Riot Announces May 2024 Production and Operations Updates

Riot Platforms announced its May 2024 production and operations updates, highlighting a significant decrease in Bitcoin (BTC) production to 215 BTC, a 43% drop from April 2024 and a 68% drop from May 2023. Despite this, the company's deployed hash rate increased to 14.7 EH/s, a 17% rise from April 2024 and a 39% increase year-over-year. Power and Demand Response Credits earned surged to $7.3 million, a 244% increase from April 2024. Operations at the Corsicana facility progressed, with the first 100 MW building fully developed and an additional 3.1 EH/s added to the self-mining capacity. However, operations were temporarily halted due to a lightning strike. Riot anticipates achieving a total self-mining hash rate capacity of 41 EH/s by 2025.

- Deployed hash rate increased to 14.7 EH/s, up 17% from April 2024.

- Power and Demand Response Credits surged to $7.3 million, a 244% increase from April 2024.

- Completion of the first 100 MW building at the Corsicana facility, adding 3.1 EH/s to self-mining capacity.

- Significant progress in miner deployments and infrastructure at the Corsicana facility.

- Anticipated self-mining hash rate capacity of 41 EH/s by 2025 is on track.

- Bitcoin production decreased to 215 BTC, a 43% drop from April 2024 and a 68% drop year-over-year.

- Temporary halt in operations at the Corsicana facility due to a lightning strike.

- Decreased hash rate at the Rockdale facility, down 7% from April 2024.

- Average Bitcoin produced per day dropped by 45% month-over-month.

Insights

The most striking aspect of Riot Platforms' update is the sharp decline in Bitcoin production in May 2024. Producing 215 BTC represents a

Despite the fall in production, Riot's hash rate increased to 14.7 EH/s, a

Riot's power strategy, generating

In summary, while the decline in BTC production is concerning, Riot’s strategic infrastructure and power management efforts present a balanced outlook. Short-term challenges due to reduced block rewards are apparent, but long-term growth seems anchored on their expanding hash rate and innovative power strategies.

The update highlights some technologically significant advancements at Riot’s facilities. The deployment of advanced MicroBT M60S miners and the immersion cooling systems significantly contribute to the increase in hash rate despite the decline in Bitcoin production. Immersion cooling, where miners are submerged in a non-conductive liquid, offers enhanced cooling efficiency, leading to improved performance and reduced downtime.

The lightning incident at the Corsicana facility serves as a testament to the robustness of Riot’s operational protocols. The fact that operations resumed without significant delay shows effective risk management and system resilience, important for maintaining operational continuity.

Additionally, Riot’s plan to achieve a total self-mining hash rate of 41 EH/s by 2025 indicates their forward-looking strategy to leverage technological advancements for scaling operations. This long-term vision underscores the company's commitment to maintaining its competitive edge in an increasingly challenging market.

From a market perspective, Riot's strategy to enhance their hash rate capacity positions them favorably in the competitive Bitcoin mining industry. The halving event, which traditionally reduces miner revenue, emphasizes the importance of maximizing operational efficiency and scaling infrastructure, both of which Riot is actively pursuing.

The increase in deployed hash rate and the operational ramp-up at the Corsicana facility indicate a forward momentum. However, the decline in Bitcoin production will likely reflect in short-term revenue dips, potentially impacting stock performance if not mitigated by other operational efficiencies.

Investors must consider external market factors as well, such as Bitcoin's price volatility and regulatory changes, which significantly influence mining profitability. Riot's ability to generate substantial power credits is a strategic advantage, providing a buffer against these market fluctuations.

Overall, Riot's operational updates suggest a mixed short-term outlook with promising long-term potential. Investors should weigh these factors when evaluating the company’s future growth trajectory.

Riot Produces 215 Bitcoin in May 2024 and Increases Deployed Hash Rate to 14.7 EH/s

CASTLE ROCK, Colo., June 04, 2024 (GLOBE NEWSWIRE) -- Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot” or “the Company”), an industry leader in vertically integrated Bitcoin (“BTC”) mining, announces unaudited production and operations updates for May 2024.

Bitcoin Production and Operations Updates for May 2024

| Comparison (%) | |||||

| Metric | May 20241,2 | April 20242 | May 2023 | Month/Month | Year/Year |

| Bitcoin Produced | 215 | 375 | 676 | - | - |

| Average Bitcoin Produced per Day | 6.9 | 12.5 | 21.8 | - | - |

| Bitcoin Held3 | 9,084 | 8,872 | 7,190 | 2% | 26% |

| Bitcoin Sold | - | - | 600 | N/A | N/A |

| Bitcoin Sales - Net Proceeds | - | - | N/A | N/A | |

| Average Net Price per Bitcoin Sold | N/A | N/A | N/A | N/A | |

| Deployed Hash Rate - Rockdale3 | 11.5 EH/s | 12.4 EH/s | 10.5 EH/s | - | 10% |

| Deployed Hash Rate - Corsicana3 | 3.1 EH/s | 0.2 EH/s | - | 1,742% | N/A |

| Deployed Hash Rate - Total3 | 14.7 EH/s | 12.6 EH/s | 10.5 EH/s | 17% | 39% |

| Avg. Operating Hash Rate - Rockdale4 | 7.4 EH/s | 8.6 EH/s | 7.3 EH/s | - | 1% |

| Avg. Operating Hash Rate - Corsicana4 | 1.4 EH/s | 0.2 EH/s | - | 744% | N/A |

| Avg. Operating Hash Rate - Total4 | 8.8 EH/s | 8.8 EH/s | 7.3 EH/s | - | 20% |

| Power Credits5 | 383% | 686% | |||

| Demand Response Credits6 | 145% | 35% | |||

| Total Power Credits | 244% | 160% | |||

- May 2024 reflects the first full month of reduced block rewards after the April 2024 Bitcoin halving.

- Unaudited, estimated.

- As of month-end.

- Average for the month.

- Estimated power curtailment credits.

- Estimated credits received from participation in ERCOT demand response programs.

“Riot made significant progress towards its 2024 hash rate growth targets during the month of May as operations ramped up at our second mining facility outside of Corsicana, Texas,” said Jason Les, CEO of Riot. “The first 100 MW building at our Corsicana Facility, Building A1, is now fully developed and miner deployment is nearing completion. A substantial portion of these miner deployments occurred towards the end of the month, and in total added 3.1 EH/s to Riot’s self-mining capacity, bringing Riot’s total self-mining capacity to 14.7 EH/s.

“We have been extremely pleased with the performance of the immersion systems and MicroBT miners at our Corsicana Facility during these first few weeks of operations, and we are seeing strong results for uptime amidst varying operating conditions. Our attention now turns to miner deployment in our second 100 MW building at Corsicana, Building A2, beginning in June.

“Riot’s unique power strategy, which we typically employ most actively in the summer months, has already started to demonstrate significant results for this year, generating approximately

Operations Update

At the Rockdale Facility, teams have begun deinstalling problematic miner models, and deployments of new MicroBT M60S miners have commenced. As a result, deployed hash rate in May at the Rockdale Facility temporarily decreased by approximately 850 PH/s month over month. Deployments of the new M60S miners are expected to continue and accelerate through the month of June.

At the Corsicana Facility, a lightning strike occurred in May which resulted in the decision to pause all operations for a period of approximately three days, out of an abundance of caution, while all systems were assessed. Once it was confirmed that lightning protection systems functioned as anticipated, mining operations resumed.

Infrastructure Update

Riot is currently developing Phase 1 of the Company’s second large-scale facility, the Corsicana Facility, which is expected to total 400 megawatts (“MW”) of developed mining capacity upon completion of this initial phase. Once fully developed, the Corsicana Facility is expected to total 1 gigawatt (1,000 MWs) in total developed mining capacity.

In May, the immersion tanks in Building A1 were fully deployed and nearly all miners in the building have been energized. Additionally, during the month, the structure for Building A2 was completed and deployment of miners and immersion tanks has commenced.

Development for the third building at Corsicana, Building B1, continued on schedule with the building structure now fully erected and concrete slab pouring in progress. Installation of immersion tanks is expected to begin during the month of June.

Estimated Hash Rate Growth

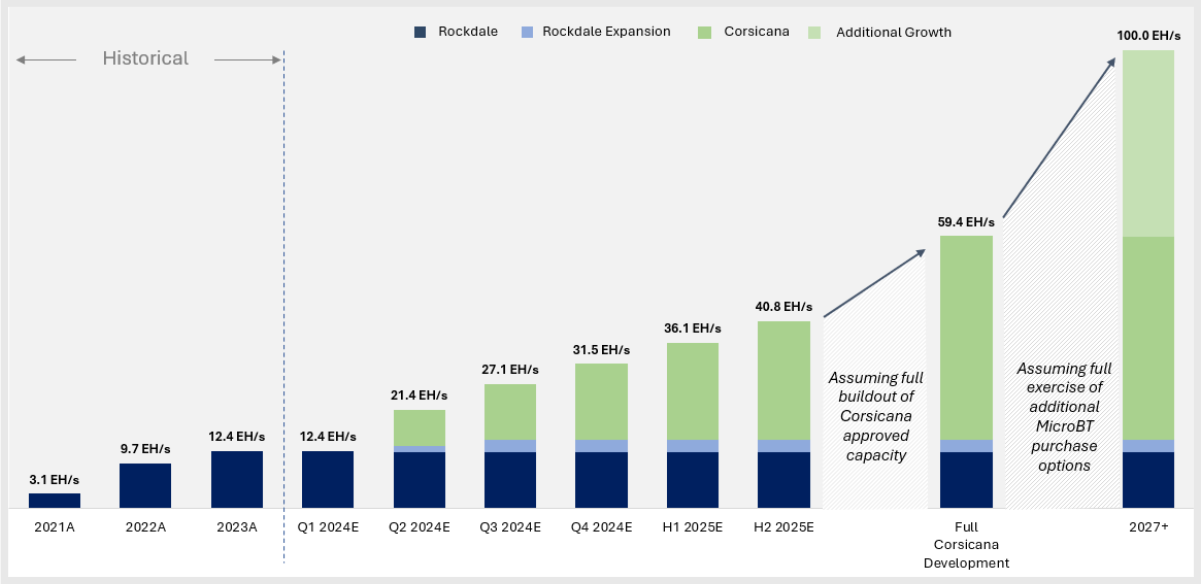

Riot anticipates achieving a total self-mining hash rate capacity of 31 EH/s by the end of 2024.

As previously disclosed, in June 2023, Riot entered into a long-term master purchase agreement with MicroBT, which included an initial order of 33,280 immersion miners for the Corsicana Facility. Effective December 1, 2023, Riot executed a second order under the MicroBT master agreement for an additional 66,560 immersion miners, primarily for the Corsicana Facility. In February 2024, Riot entered into a third order with MicroBT, for 31,500 air-cooled miners for the Rockdale Facility. Approximately 17,000 miners in the third order are expected to replace underperforming machines currently operating in the facility, and the deployment of the remaining 14,500 miners will contribute additional hash rate capacity to our self-mining operations at the Rockdale Facility.

Collectively, the three purchase orders will add an anticipated 28 EH/s to Riot’s self-mining capacity. Deployment of the miners intended for the Corsicana Facility has begun and is estimated to be completed by the second half of 2025. Deployment of the miners intended for the Rockdale Facility has begun and is expected to be completed in Q3 2024.

Upon full deployment in 2025, Riot anticipates a total self-mining hash rate capacity of 41 EH/s.

Human Resources Update

Riot is pleased to announce that CEO of ESS Metron, Stephen Howell, has been appointed Chief Operating Officer of the Company and will continue to oversee ESS Metron, Riot’s wholly owned electrical engineering and manufacturing subsidiary. Stephen brings a wealth of experience and expertise to Riot’s operations leadership with a career spanning over two decades in electrical engineering and power generation.

Riot is currently recruiting for positions across the Company. Join our team in building, expanding, and securing the Bitcoin network.

Open positions are available at: https://www.riotplatforms.com/careers.

About Riot Platforms, Inc.

Riot’s (NASDAQ: RIOT) vision is to be the world’s leading Bitcoin-driven infrastructure platform. Our mission is to positively impact the sectors, networks, and communities that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve best-in-class execution and create successful outcomes.

Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. The Company has Bitcoin mining operations in central Texas and electrical switchgear engineering and fabrication operations in Denver, Colorado.

For more information, visit www.riotplatforms.com.

Safe Harbor

Statements in this press release that are not historical facts are forward-looking statements that reflect management’s current expectations, assumptions, and estimates of future performance and economic conditions. Such statements rely on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipates,” “believes,” “plans,” “expects,” “intends,” “will,” “potential,” “hope,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements may include, but are not limited to, statements about the benefits of acquisitions, including financial and operating results, and the Company’s plans, objectives, expectations, and intentions. Among the risks and uncertainties that could cause actual results to differ from those expressed in forward-looking statements include, but are not limited to: unaudited estimates of Bitcoin production; our future hash rate growth (EH/s); the anticipated benefits, construction schedule, and costs associated with the Corsicana site expansion; our expected schedule of new miner deliveries; the impact of weather events on our operations and results; our ability to successfully deploy new miners; the variance in our mining pool rewards may negatively impact our results of Bitcoin production; megawatt (“MW”) capacity under development; we may not be able to realize the anticipated benefits from immersion cooling; the integration of acquired businesses may not be successful, or such integration may take longer or be more difficult, time-consuming or costly to accomplish than anticipated; failure to otherwise realize anticipated efficiencies and strategic and financial benefits from our acquisitions; and the impact of COVID-19 on us, our customers, or on our suppliers in connection with our estimated timelines. Detailed information regarding the factors identified by the Company’s management which they believe may cause actual results to differ materially from those expressed or implied by such forward-looking statements in this press release may be found in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including the risks, uncertainties and other factors discussed under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as amended, and the other filings the Company makes with the SEC, copies of which may be obtained from the SEC’s website, www.sec.gov. All forward-looking statements included in this press release are made only as of the date of this press release, and the Company disclaims any intention or obligation to update or revise any such forward-looking statements to reflect events or circumstances that subsequently occur, or of which the Company hereafter becomes aware, except as required by law. Persons reading this press release are cautioned not to place undue reliance on such forward-looking statements.

Investor Contact:

Phil McPherson

303-794-2000 ext. 110

IR@Riot.Inc

Media Contact:

Alexis Brock

303-794-2000 ext. 118

PR@Riot.Inc

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/053bd56f-2648-4809-8f8e-8d95700688cf

https://www.globenewswire.com/NewsRoom/AttachmentNg/455b329e-1b54-4a56-b356-a3ba5f84a689

https://www.globenewswire.com/NewsRoom/AttachmentNg/69676211-f9ff-4b0b-80a4-40d96e390c68