Refined Metals Corp. and Eagle Plains Resources Enter into an Option Agreement for the Dufferin Project in the Athabasca Basin

- None.

- None.

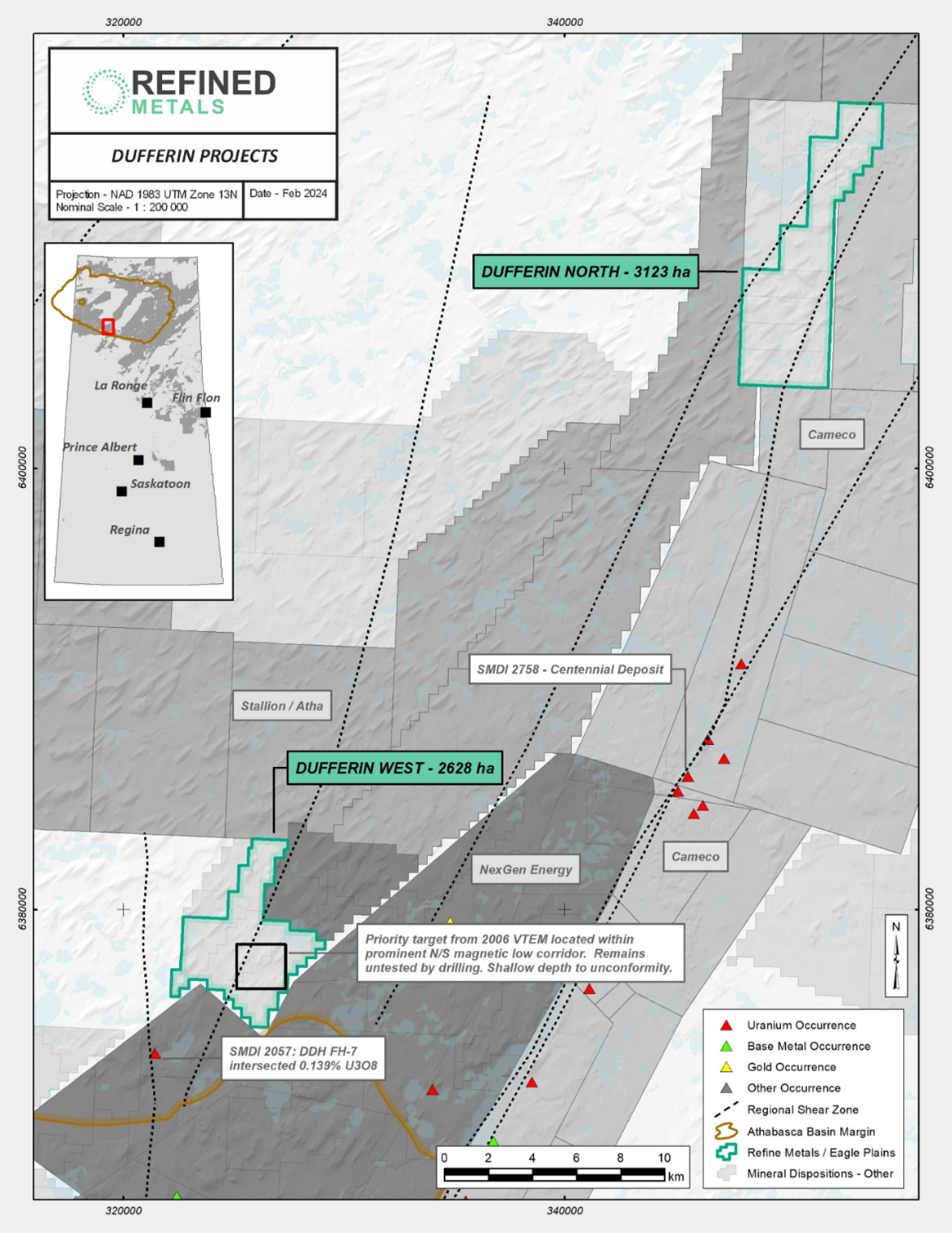

6,424 hectare Dufferin Project located approximately 130km northwest of the Key Lake Mines, Saskatchewan

VANCOUVER, British Columbia, Feb. 27, 2024 (GLOBE NEWSWIRE) -- Refined Metals Corp. (CSE: RMC; OTC: RFMCF; FRA: CWA0) (the “Company”) is pleased to announce that it has entered into an option agreement (the “Option Agreement”) with Eagle Plains Resources Ltd. (the “Vendor”) dated February 26, 2024 (the “Effective Date”), pursuant to which the Company has been granted the right, at its option, to acquire up to a

Mark Fields, Chief Executive Officer of the Company stated, “We are excited to add the Dufferin Project to our project portfolio and for the exposure to uranium it provides. Positioned in the Athabasca Basin region, which is renowned for its high-grade uranium deposits and storied history of exploration, discovery, and development, we believe that the Project is a terrific exploration opportunity for the Company.”

C.C. (Chuck) Downie, P.Geo. President and CEO of Eagle Plains commented on the transaction: “We are pleased to be able to partner with Refined on the Project. Over the past 18 months, there has been a tremendous focus on the Athabasca Basin in terms of tenure acquisition, mergers and acquisitions, and exploration spending by both junior and senior companies. We look forward to advancing this underexplored, uranium-prospective project with Refined.”

The Dufferin Project

The Project is made up of the North and West properties, both of which are located approximately 18km from Cameco’s Centennial Deposit (historic drill hole VR-031W3 intersected

These properties are prospective for unconformity- and basement-hosted uranium mineralization in proximity to NE-SW trending faults. Faulted basement contacts and brittlely reactivated structures are the primary locations for mineralization in the area covered by the Dufferin Project. The relatively high concentration of secondary uranium bearing minerals at the Project demonstrated by prior exploration work on the Project may also indicate uranium mineralization remobilization may play an important role in this region of the Athabasca Basin. Geophysical electromagnetic (“EM”) and magnetic anomalies demonstrated by prior exploration work on the Project are supported by previous uranium and boron soil and lake sediment anomalies along the inferred fault zones, which are expected to aid in focusing future exploration programs.

The Vendor and the Company plan to undertake further detailed data compilation with a view to deploying the most effective geophysical exploration methods from a variety that have proven effective in the Athabasca Basin. These include EM, magnetic, resistivity and gravity surveys to delineate prospective conductors and alteration signatures. Geochemical sampling will also be considered over specific structures and conductors. The results of the geophysical exploration are expected to be used to identify disrupted faults delineated by EM conductors and other geophysical anomalies for drill targeting.

Figure 1: Project Map reflecting the results of certain historic exploration work on the Project and in the Project area. This information was gathered from historic exploration work conducted on the Project, including from SMDI descriptions and assessment reports filed with the Saskatchewan Governments. The Company has not had a qualified person independently verify this information. Information regarding exploration work in the Project area is not necessarily indicative of the mineralization (if any) present at the Project.

Option Agreement

As noted above, pursuant to the terms of the Option Agreement, the Company has the option to acquire a

| Deadline | Cash Payment | Share Issuance | Exploration Expenditures | |

| Execution of Option Agreement | 125,000 Shares | N/A | ||

| December 31, 2024 | 125,000 Shares | CA | ||

| December 31, 2025 | 250,000 Shares | CA | ||

| December 31, 2026 | 500,000 Shares | CA | ||

Following the Company’s exercise of the First Option, the Company has the option to acquire an additional

| Deadline | Cash Payment | Share Issuance | Exploration Expenditures | |

| December 31, 2027 | 250,000 Shares | CA | ||

| December 31, 2028 | 250,000 Shares | CA | ||

The Vendor will serve as operator of the Project during the First Option period, following which, in the event that the Company exercises the First Option, the Company will become the operator of the Project. Pursuant to the Option Agreement, the Company has the right to accelerate all cash payments, Share issuances and exploration expenditures in order to accelerate its exercise of the Option.

If the First Option or the Second Option is exercised, a

All Shares issued to the Vendor pursuant to the Option Agreement will be subject to a statutory four month hold period pursuant to applicable Canadian securities laws. The number of Shares issuable to the Vendor pursuant to the Option Agreement will be adjusted in the event that the Company undertakes certain capital reorganization or corporate transactions.

Qualified Persons

C. C. (Chuck) Downie, P.Geo., a “qualified person” for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects and a director of the Vendor, has reviewed and approved the scientific and technical disclosure in this news release.

About Refined Metals Corp.

Refined Metals Corp. is a junior mining company dedicated to identifying, evaluating and acquiring interests in mineral properties in North America. In addition to the Dufferin Project, Refined is also exploring a lithium property, the Simard Property, located in the Lac Simard region of Quebec. The Simard Property covers 5,551 hectares and has over 96 claim blocks. The Company is also party to an option agreement in respect of the Horizon South Property, a prospective, exploration-stage lithium property located in Tonopah Nevada. The Company continues to review other mineral properties in North America for possible acquisition in the future.

For further information, please contact:

Phone: (604) 398-3378

Email: Info@refinedmetalscorp.com

Forward-Looking Statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company’s current beliefs or assumptions as to the outcome and timing of such future events. In particular, this press release contains forward-looking information relating to, among other things, the Company’s exploration plans and objectives at the Project; the exploration potential of the Project, including the potential of the Project to host unconformity- and basement-hosted uranium mineralization; and the utility of prior historic exploration work in focusing future exploration programs.

Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information, including, in respect of the forward-looking information included in this press release, the assumption that: the Company will successfully complete its planned exploration programs in accordance with current expectations and that such programs will yield the results anticipated by the Company, including identifying disrupted faults delineated by EM conductors and other geophysical anomalies for drill targeting.

Although forward-looking information is based on the reasonable assumptions of the Company’s management, there can be no assurance that any forward-looking information will prove to be accurate. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral projects, including risks relating to changes in project parameters as plans continue to be redefined, that mineral exploration is inherently uncertain and that the results of mineral exploration may not be indicative of the actual geology or mineralization of a project and that mineral exploration may be unsuccessful or fail to achieve the results anticipated by the Company, including identifying disrupted faults delineated by EM conductors and other geophysical anomalies for drill targeting and discovering unconformity- and basement-hosted uranium mineralization. The forward-looking information contained in this release is made as of the date hereof, and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

The CSE has neither approved nor disapproved the information contained herein.

1 This result was taken from Saskatchewan Industry and Resources Assessment Work File: 74G12-0061, Cameco Corp., 2009, DDH VR-031W3. The Company has not had a qualified person verify this information, and this information is not necessarily indicative of the mineralization (if any) present at the Project.

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e694380e-ac9d-4742-a5fc-dfab4a106ef5