U.S. Auto Insurance Shopping Rebounds after an Unprecedented Drop, According to Insurance Demand Meter from LexisNexis Risk Solutions

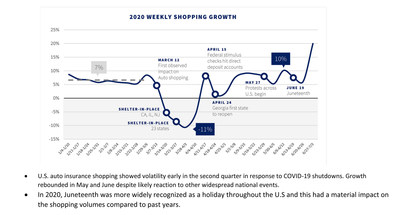

ATLANTA, Aug. 17, 2020 /PRNewswire/ -- LexisNexis® Risk Solutions released its Latest Insurance Demand Meter, which reports Q2 U.S. auto insurance shopping activity. According to the Meter, auto insurance shopping and new business growth rebounded in May and June after an out of the ordinary drop in late March and early April due to COVID-19 shutdowns and the impact from civil unrest and other widespread national events. However, there was little impact on the annual shopping rate, which remained strong for both Q1 and Q2.

"The positive growth in the Q2 numbers are a testament to the insurance industry's commitment during challenging times," said Tanner Sheehan, associate vice president of auto insurance at LexisNexis Risk Solutions. "Despite significant headwinds on multiple fronts, the industry continues to prove its stability and preparedness for the unforeseen."

Key insights from the Second Quarter

- Overall growth: Although there was a +

0.7% increase in the auto insurance shopping quarterly growth rate in Q2 2020, it was still80% below the 5-year average. New business growth dipped slightly to -1.9% for the quarter, and was seven times lower than the prior year. - Trends by age group: The 66+ age demographic shopped at the highest rate with five weeks during the quarter topping

20% growth, while the under 35 age groups returned to their anticipated pre-pandemic growth rates hovering around5% growth. - Trends by shopping channels: Insurance carriers that use exclusive agents fared the best during the COVID-19 shutdown and have subsequently seen higher growth rates than independent agents or direct channels, ending the quarter at

20% growth year-over-year. - Trends for new business: New business volume fell to -

14% in April, a low that pulled the overall growth rate for the quarter down to -2% . Similar to shopping growth, new business volumes rebounded in May and June to just above 2019 levels and ultimately reached8% growth by the end of the quarter.

Early third quarter trends

Early Q3 numbers show both shopping and new business volumes are tracking to pre-COVID-19 levels, and market conditions are developing to potentially spur increased shopping growth rates.

"Cancellation moratoria imposed by carriers at the height of the COVID crisis will be expiring, state governments are reopening and issuing more driver's licenses, and carriers are starting to file for rate decreases," said Sheehan. "These are all signs that shopping has strong potential to pick up as the quarter progresses."

About the LexisNexis Insurance Demand Meter

The LexisNexis Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly

To download the Q3 2020 report, click here.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data and advanced analytics to provide insights that help businesses and governmental entities reduce risk and improve decisions to benefit people around the globe. We provide data and technology solutions for a wide range of industries including insurance, financial services, healthcare and government. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information and analytics for professional and business customers across industries. For more information, please visit www.risk.lexisnexis.com, and www.relx.com.

Media Contacts:

Rocio Rivera

LexisNexis Risk Solutions

Phone: +1.678.694.2338

rocio.rivera@lexisnexisrisk.com

Mollie Holman

Brodeur Partners for LexisNexis Risk Solutions

Phone: +1.646.746.5611

mholman@brodeur.com

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/us-auto-insurance-shopping-rebounds-after-an-unprecedented-drop-according-to-insurance-demand-meter-from-lexisnexis-risk-solutions-301112583.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/us-auto-insurance-shopping-rebounds-after-an-unprecedented-drop-according-to-insurance-demand-meter-from-lexisnexis-risk-solutions-301112583.html

SOURCE LexisNexis Risk Solutions