LexisNexis Insurance Demand Meter Shows Third Consecutive Quarter of Negative Growth in U.S. Auto Insurance Shopping Rates

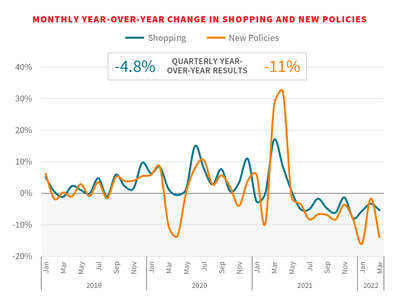

The LexisNexis Risk Solutions Insurance Demand Meter indicates a 4.8% decline in U.S. auto insurance shopping growth in Q1 2022, marking the third consecutive quarterly drop. This drop is attributed to higher claims costs and a 16% decrease in new car sales. New policy growth fell 11%, as insurers reduced marketing budgets amidst economic pressures. However, industry experts suggest that rate increases could prompt a resurgence in consumer shopping in the coming months. The report highlights the ongoing struggles due to pandemic-related challenges, including inventory shortages and inflation.

- Potential for increased insurance shopping due to expected rate hikes by carriers.

- Insights from the report can help insurers adjust strategies to meet market demands.

- Continued decline in auto insurance shopping growth for three quarters.

- Significant drop in new policy growth by 11% due to decreased marketing efforts.

- 16% decrease in new car sales affecting the overall market.

Insights

Analyzing...

Drop in Shopping Signals 'Cold' Q1, While Increasing Claims and Related Profitability Challenges Could Heat Up the Insurance Market

ATLANTA, May 25, 2022 /PRNewswire/ -- The latest edition of the LexisNexis® Risk Solutions Insurance Demand Meter reports the overall annual U.S. auto insurance shopping growth rate, which includes shopping and new policies, dropped for the third consecutive quarter for the first time since LexisNexis Risk Solutions began releasing these quarterly metrics. Shopping was down

New policy growth declined

"The auto insurance and automotive OEM industries are still facing significant headwinds related to decreased marketing spend by carriers, variables in tax refunds for consumers, and new and used vehicle shortages, but I don't think it's time to sound the alarm just yet," said Adam Pichon, vice president and general manager, auto insurance, LexisNexis Risk Solutions. "The market is still reacting to pandemic-related and macroeconomic factors such as chip shortages, inflation, and labor shortages, and carriers are responding to claims inflation challenges by raising rates. Rate taking among carriers is expected to continue through 2023, which will likely drive consumers back into the insurance shopping market."

With Claims Severity Up, Carriers' Marketing Spend is Down

As reported in last quarter's edition of the Insurance Demand Meter as well as the newly released 2022 Auto Insurance Trends Report, suppressed new vehicle sales persisted into Q1 2022 and were down

With an eye on profitability, many insurers have drastically cut their marketing spendi. This is having a significant impact, especially in the direct channel where corporate marketing is critical to creating new insurance shoppers. LexisNexis Risk Solutions analysis suggests shopping volumes are down

Uncertainty Swirls Due to Variances in Tax Return Shopping

New shopping volumes for uninsured drivers who qualify for the Earned Tax Creditii (EITC) and the Additional Child Tax Creditiii were down in Q1 2022, as they were a year ago during the same period. This marks a two-year divergence from the typical pre-pandemic pattern we typically see in our data during tax season.

While the early disbursement of the Additional Child Tax Credit in late 2021 did not appear to have a significant impact on the depressed shopping volumes among the uninsured segment, it did impact the overall shopping volumes across all demographics.

Insurers Respond – and a Look Ahead

As expected, rate filings were a priority among carriers in Q1 2022, and that should continue for at least the next 18 months.

"Upticks in claim frequency and severity have forced the hand of insurers to revisit rate adequacy," said Pichon. "We will continue to keep a close eye on the auto insurance market's rate activity and gauge whether it becomes a key catalyst for increased U.S. consumer shopping when they see their premiums are higher."

Download the latest Insurance Demand Meter.

About the LexisNexis Insurance Demand Meter

The LexisNexis Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data and advanced analytics to provide insights that help businesses and governmental entities reduce risk and improve decisions to benefit people around the globe. We provide data and technology solutions for a wide range of industries including insurance, financial services, healthcare and government. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information and analytics for professional and business customers. For more information, please visit www.risk.lexisnexis.com, and www.relx.com.

Media Contacts:

Chas Strong

LexisNexis Risk Solutions

Phone: +1.706.714.7083

Charles.Strong@lexisnexisrisk.com

Donna Armstrong

Brodeur Partners for LexisNexis Risk Solutions

Phone: +1.646.746.5611

mholman@brodeur.com

i https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/geico-progressive-break-trend-slash-advertising-expenditures-in-2021-69764365 and Q1 2022 Personal Lines Overview, Competiscan, ©2022.

ii www.eitc.irs.gov/partner-toolkit/basic-marketing-communication-materials/eitc-fast-facts/eitc-fast-facts

iii www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/earned-income-tax-credit-statistics

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lexisnexis-insurance-demand-meter-shows-third-consecutive-quarter-of-negative-growth-in-us-auto-insurance-shopping-rates-301555029.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lexisnexis-insurance-demand-meter-shows-third-consecutive-quarter-of-negative-growth-in-us-auto-insurance-shopping-rates-301555029.html

SOURCE LexisNexis Risk Solutions