LexisNexis Insurance Demand Meter Registers "Hot" For New Policies and "Cool" for Overall U.S. Auto Insurance Shopping

- Record volumes of new policies in August and September despite a decline in shopping growth

- Electric and hybrid vehicles are comprising a growing share of new auto insurance policies

- Tightening budgets and ongoing rate increases are impacting consumers, leading to near-record shopping volumes

- Claims severity continues to drive profitability challenges for insurers

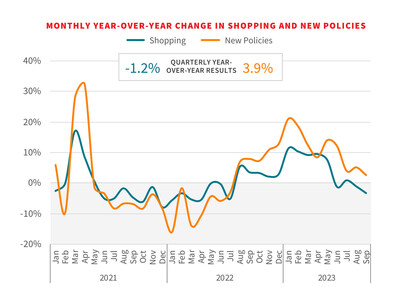

- Quarterly year-over-year U.S. auto insurance shopping growth rate declined to -1.2% in Q3 2023

- New policy growth was down from last quarter

- New vehicle policies and shopping linked to new and used vehicle purchases are at four-year lows

Continued downshift in shopping growth parallels low point seen in Q2 of 2022, while new policies see record volumes in August and September in response to continued rate increases

"This quarter's Demand Meter reminds us that the industry is still reconciling with significant macro trends that have shifted the auto insurance market significantly," said Adam Pichon, senior vice president of Auto Insurance and Claims at LexisNexis® Risk Solutions. "Ongoing rate increases and changing demographics continue to contribute to near-record shopping volumes, while claims severity continues to drive profitability challenges for insurers. The combination of these trends has created a challenging environment that has been the theme for insurers in 2023."

Insurance shopping slows but remains elevated, with demographic shifts at play as consumers seek cost savings

For the first time since Q2 2022, shopping growth registered as 'Cool' on the Insurance Demand Meter, continuing a downshifting trend that began in June. This trend does not come as a surprise, as the industry begins to overcome the elevated market activity that began in Q3 2022. While efforts by insurers to scale back new business have helped suppress shopping rates, consumers are still shopping at high volumes in response to ongoing rate increases, which are projected to net out at over

A deeper dive into shopping trends uncovers continuing shifts in demographics, with growth in the 65+ age group and declines in younger age groups – specifically those under 35 years old. Those 65 and over now make up

Key to explaining this demographic shift has been the larger trend of household consolidation, which we first saw influencing insurance shopping trends in Q2 of this year. The average number of drivers per policy continues to grow, as parents add their adult children to their policies or adult children add their retired parents.

Electric Vehicles (EVs) comprise a growing share of new auto insurance policies, even as new vehicle policies drop

As EV sales continue to rise, their proportion of new auto insurance policies does, too. This quarter, Electric (battery/plug-in hybrid/fuel cell electric vehicles) and Hybrid vehicles rose to

The growing EV trend is taking place despite the overall drop in new policy volumes and shopping linked to new and used vehicle purchases, which are at four-year lows despite the auto industry's rebound from the 2022 microchip shortage and supply chain crisis.

A Look Ahead

A constant theme from previous LexisNexis Insurance Demand Meters has been the significant rise in claims severities over recent years, and that trend looks like it should continue into 2024. Profitability challenges persist even after the implementation of significant rate increases and strict underwriting restrictions, so much so that insurers' financial ratings have started to be downgraded. But these same rate increases and strict underwriting restrictions are driving consumers to shop their policies, and that now includes even long-term customers who may have been out of the market for 10 or more years.

"Changing shopping demographics and behaviors are likely to be the norm thanks to tightening consumer budgets and ever-increasing auto insurance premiums," said Pichon. "Claims frequencies continue to hold steady, but with severity levels still well above historical averages – largely fueled by high vehicle repair costs – insurers remain focused on making key strategic decisions on whether to implement additional restrictions or conversely look to gain market share as they move toward profitability."

"As we enter the holiday season, insurance shopping activity traditionally tends to slow," continued Pichon. "But ever-increasing premiums, combined with tightening consumer budgets, could lead to a change in traditional shopping behaviors."

Download the latest Insurance Demand Meter.

About the LexisNexis Insurance Demand Meter

The LexisNexis Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data and advanced analytics to provide insights that help businesses and governmental entities reduce risk and improve decisions to benefit people around the globe. We provide data and technology solutions for a wide range of industries including insurance, financial services, healthcare and government. Headquartered in metro Atlanta,

Media Contacts:

Chas Strong

LexisNexis Risk Solutions

Phone: +1.706.202.5813

Charles.Strong@lexisnexisrisk.com

Alex Jafarzadeh

Brodeur Partners

Phone: +1.617.587.2846

ajafarzadeh@brodeur.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lexisnexis-insurance-demand-meter-registers-hot-for-new-policies-and-cool-for-overall-us-auto-insurance-shopping-301998053.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lexisnexis-insurance-demand-meter-registers-hot-for-new-policies-and-cool-for-overall-us-auto-insurance-shopping-301998053.html

SOURCE LexisNexis Risk Solutions

FAQ

What is the latest edition of the LexisNexis Insurance Demand Meter reporting for Q3 2023?

What are the key factors contributing to the decline in shopping growth?

What are the positive trends in the report?

What are the negative trends in the report?