PowerBand Reports Second Quarter 2022 Financial Results

PowerBand Solutions (TSXV:PBX)(OTCQB:PWWBF) closed the first tranche of a $23.8M private placement, raising $18.6M. For Q2 2022, revenue decreased by 6% year-over-year and 32% from Q1 2022, with gross margins down to 43% due to competitive incentives. A net loss of $6.5M was recorded from an impairment charge. While management expects restructuring benefits in the future, the company has withdrawn guidance for 2022 in light of macroeconomic challenges in used car financing.

- None.

- None.

Insights

Analyzing...

- Closed the first tranche of its

$23.8M private placement with strategic investors for gross proceeds of$18.6M - Withdrew guidance issued on November 30, 2021, in anticipation of new strategic plan expected to be released by the end of Q3/2022

TORONTO, ON / ACCESSWIRE / August 30, 2022 / PowerBand Solutions (TSXV:PBX)(OTCQB:PWWBF) ("PowerBand", "PBX" or the "Company"), a comprehensive e-commerce solution transforming the online experience to sell, trade, lease, and finance vehicles, is announcing that it has filed its Interim Consolidated Financial Statements and Management's Discussion and Analysis report for the three-month period ended June 30, 2022. These documents may be viewed under the Company's profile at www.sedar.com. All numbers are in Canadian dollars, except otherwise noted.

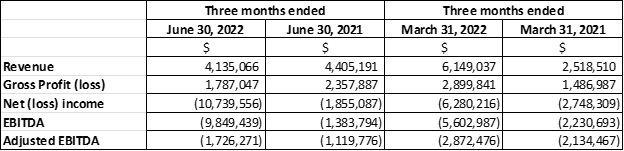

The following table sets out selected financial information for the second quarter ended June 30, 2022, and highlights described below:

- Cash on hand at June 30, 2022 was

$18,003,178 compared to$6,367,533 as at December 31, 2021. The second and final tranche of the private placement offering for$5,195,040 was closed in July 2022. The working capital position has improved with the infusion of cash from the private placement offering with strategic investors J. Bryan Hunt, Jr., Joe Poulin and Pierre Lassonde. - Revenue for the three months ended June 30, 2022, was

6% lower than the same comparable three months period last year and32% lower than Q1/2022. The new leadership team has been reviewing the lease origination operations at DrivrzFinancial and decided to reposition the sales team, restructure dealer participation fees, and implement controls to focus on higher-quality credit profiles. While these measures have resulted in business disruption in the short-term, the Company anticipates that the benefits will be realized in subsequent periods. - Gross margins for the three months ended June 30, 2022, were

43% compared to gross margin of53% for the comparable three months last year. The lower gross margin is a consequence of higher deal incentives in a competitive environment, given ongoing depressed inventory levels. - Net loss and EBITDA for the three months ended June 30, 2022, were higher compared to the three months ended last year due to a non-cash impairment charge on intangible assets and goodwill of

$6,562,088 , resulting from the comprehensive review by the new management team of the existing business units. More detailed information regarding the restructuring changes can be found in the Company's Management's Discussion and Analysis report for the three-month period ended June 30, 2022, filed on Sedar. - Adjusted EBITDA loss has improved from

$2.8M in Q1/2022 to$1.7M in Q2/2022. On June 29, 2022, Powerband announced that significant progress has been achieved in rationalizing its cost structure, thereby improving the long-term sustainability of the business model. - As described in further detail in the MD&A, PowerBand has withdrawn guidance for 2022, which was issued on November 20, 2021. A deteriorating macro environment for used car financing has persisted throughout 2022, as inventory levels continue to be challenged by supply chain constraints. The Company is conducting a comprehensive review of the business strategy, operations, and the product lines and anticipates releasing a new strategic plan before the end of Q3/2022.

Darrin Swenson, CEO and Director of PowerBand Solutions states "we had a very active second quarter with a comprehensive review of the business strategy and the implementation of cost restructuring measures that are expected to improve gross margins and lower corporate overhead expenses. While our revenue for the quarter was impacted by business disruption and a deliberate reset on origination guidelines, we expect the new strategic measures will show results in subsequent quarters, with higher quality credit originations. Our focus has shifted to sustainable growth initiatives, and we look forward to providing a comprehensive strategic plan before the end of Q3/2022".

About PowerBand Solutions, Inc.

PowerBand Solutions Inc., listed on the TSX Venture Exchange and the OTCQB markets, is a fintech provider disrupting the automotive industry. PowerBand's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, funders, and manufacturers (OEMs). It enables them to buy, sell, trade, finance, and lease new and used, electric and non-electric vehicles, on any phone, tablet or PC connected to the internet. PowerBand's transaction platform - being trademarked under DRIVRZ™ - is being made available across North American and global markets.

For further information, please contact:

Darrin Swenson

Chief Executive Officer and Director

E: Darrin.swenson@powerbandsolutions.com

P: 1-866-768-7653

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release contains non-IFRS financial measures, such as EBITDA and Adjusted EBITDA. The Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance withIFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company's operating results.

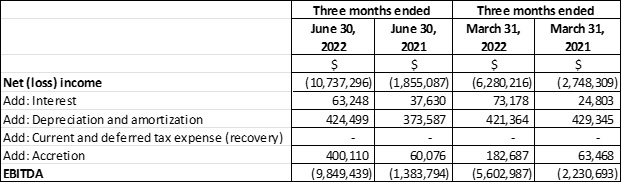

Earnings before Interest, Taxation, Depreciation and Amortization ("EBITDA")

EBITDA is a measure used by management to evaluate operational performance. It is also a common measure that is reported on and used by investors in determining a company's ability to incur and service debt as well as a valuation methodology. Management believes EBITDA enhances the information provided in the Financial Statements. EBITDA is a non-IFRS measure and should not be considered an alternative to operating income or net income (loss) in measuring the Company's performance. EBITDA should not be used as an exclusive measure of cash flows because it does not consider the impact of working capital growth, capital expenditures, debt principal reductions and other sources and uses of cash which are disclosed in the consolidated statements of cash flows.

The following chart reflects the calculation of EBITDA:

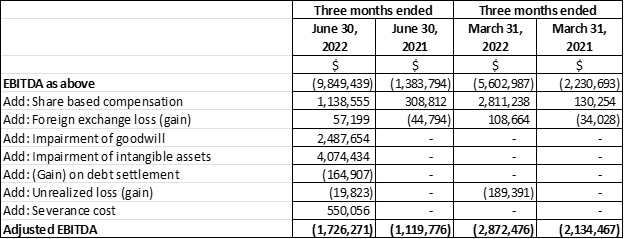

Adjusted EBITDA

Adjusted EBITDA, defined as Earnings before Interest, Taxation, Depreciation, Amortization, Share Based Compensation expense, Provision for expected credit loss, foreign exchange loss, and loss from debt settlement and shares issued and other one-time costs is an additional measure used by management to evaluate cash flows and the Company's ability to service debt. Adjusted EBITDA is a non-IFRS measure and should not be considered an alternative to operating income or net income (loss) in measuring the Company's performance.

The following chart reflects the Company's calculation of Adjusted EBITDA:

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding future plans and objectives of the Company, expected benefits and results from operations, are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

SOURCE: PowerBand Solutions Inc.

View source version on accesswire.com:

https://www.accesswire.com/713933/PowerBand-Reports-Second-Quarter-2022-Financial-Results