PowerBand Reports First Quarter 2022 Financial Results

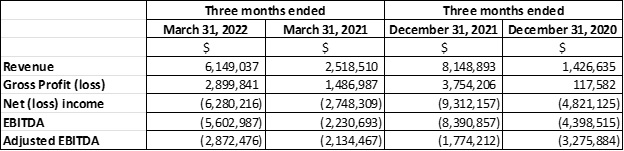

PowerBand Solutions (OTCQB:PWWBF) reported Q1 2022 revenue of $6.1 million, a remarkable 144% increase from $2.5 million in Q1 2021. However, gross margin declined to 47% from 59% due to competitive dealer incentives. The company's revenue decreased compared to Q4 2021, impacted by low inventory and rising used vehicle prices. To enhance operations, PowerBand has initiated cost restructuring and plans to close a CAD $25 million private placement to ensure liquidity. Positive outlooks are anticipated as macro conditions stabilize over the next 12-18 months.

- Revenue increased by 144% year-over-year to $6.1 million in Q1 2022.

- Private placement offering of approximately CAD $25 million expected to enhance liquidity.

- Gross margin declined from 59% in Q1 2021 to 47% in Q1 2022.

- Revenue decreased compared to Q4 2021 due to ongoing low inventory and high used vehicle prices.

Insights

Analyzing...

- Revenue of

$6.1M in Q1 2022, an increase of144% from revenue of$2.5M in Q1 2021 - Cost restructuring initiatives have commenced with further savings being identified

TORONTO, ON / ACCESSWIRE / May 31, 2022 / PowerBand Solutions (TSXV:PBX) (OTCQB:PWWBF) ("PowerBand" "PBX" or the "Company"), a comprehensive e-commerce solution transforming the online experience to sell, trade, lease, and finance vehicles, is announcing that it has filed its Interim Consolidated Financial Statements and Management's Discussion and Analysis report for the three-month period ended March 31, 2022. These documents may be viewed under the Company's profile at www.sedar.com. All numbers are in Canadian dollars, except otherwise noted.

Revenue for the three-month period ended March 31, 2022, when compared to the same period in 2021, increased by

The Company is expected to close on the previously announced private placement offering of approximately CAD

Under the direction of Interim CEO Darrin Swenson, PowerBand has initiated a comprehensive review of its cost structure to identify opportunities for rationalizing expenses and will provide further updates when appropriate.

Darrin Swenson commented "the recently announced strategic partners will focus on repositioning the Company for efficiency and ultimately, profitability. There are tremendous value generative opportunities for the Company as macro conditions normalize over the next 12-18 months. We look forward to unveiling our new strategic plan prior to the end of Q3 2022."

About PowerBand Solutions, Inc.

PowerBand Solutions Inc., listed on the TSX Venture Exchange and the OTCQB markets, is a fintech provider disrupting the automotive industry. PowerBand's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, funders, and manufacturers (OEMs). It enables them to buy, sell, trade, finance, and lease new and used, electric and non-electric vehicles, on any phone, tablet or PC connected to the internet. PowerBand's transaction platform - being trademarked under DRIVRZ™ - is being made available across North American and global markets.

For further information, please contact:

Darrin Swenson

Interim Chief Executive Officer

E: darrin.swenson@powerbandsolutions.com

P: 1-866-768-7653

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release contains non-IFRS financial measures; the Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance withIFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company's operating results.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding future plans and objectives of the Company, are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available.

SOURCE: PowerBand Solutions Inc.

View source version on accesswire.com:

https://www.accesswire.com/703304/PowerBand-Reports-First-Quarter-2022-Financial-Results