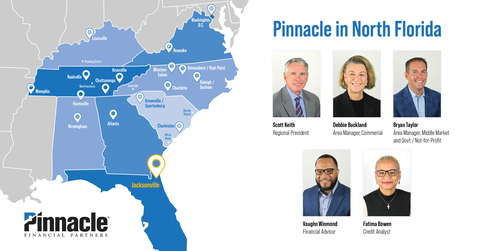

Pinnacle Financial Partners Recruits High-Performing Team for Expansion Into North Florida

Former Truist Regional President Scott Keith leads the team from

(Photo: Business Wire)

“This is a dream team of financial professionals with deep local roots who will build Pinnacle as a new bank offering something brand new to the market,” said M. Terry Turner, Pinnacle’s president, CEO and co-founder. “Our model of an unbeatable workplace culture and unmatched client service has proven successful across the Southeast. That’s the kind of bank

Keith comes to Pinnacle with more than 34 years of local experience in financial services. He was most recently the regional president of

“This feels like the culmination of my career to this point,” Keith said. “Jacksonville is where I started and where I fell in love with local banking. We need a financial institution focused exclusively on service and advice and with a commitment to doing so consistently. That’s what Pinnacle is famous for throughout the Southeast. To be one of the teammates who can bring that to

Buckland and Taylor were both part of Keith’s leadership team at Truist, and the three are now working together to build Pinnacle in the region.

Buckland has a 27-year banking history in

Taylor spent 21 years with BB&T/Truist, serving in various roles in

“The chance to once again work with highly respected professionals like Scott and Debbie is exciting by itself,” Taylor said. “Coupled with Pinnacle’s intense focus on the client and associate experience, it’s a dream scenario.”

Together, they are recruiting a team of experience financial professionals to join them. This includes bankers, treasury consultants, wealth advisors, mortgage brokers and support staff so they can deploy the full suite of Pinnacle solutions to meet the needs of businesses and individuals in

“We’ve already heard excitement around the community about Pinnacle and the chance to build a new bank for our region,” Buckland said. “Pinnacle’s reputation as a great place to work and do business preceded our entry into

Winmond is Pinnacle’s first financial advisor in

Bowen joins as a credit analyst, working side-by-side with Winmond and the rest of the team to bring Pinnacle’s credit culture to bear in service of clients’ needs. She also has 15 years of financial services experience, much of it at Truist where she most recently served as a commercial lending portfolio manager.

The team are working to secure space near downtown

Pinnacle has a proven track record as a powerful recruiter of top banking talent, which has powered its organic growth and de novo expansions throughout its history. The firm’s work environment and internal culture have earned dozens of national, regional and local awards, including these 2023 honors:

- No. 4 Best Bank to Work For – American Banker

- No. 24 Best Company to Work For – FORTUNE and Great Place to Work®

- No. 6 Best Workplace for Women – FORTUNE and Great Place to Work

- No. 7 Best Workplace in Financial Services and Insurance – FORTUNE and Great Place to Work

- No. 14 Companies That Care – PEOPLE

- No. 28 Best Workplace for Parents – FORTUNE and Great Place to Work, 2023

This is the latest market expansion for Pinnacle after very successful de novo starts in

-

Atlanta :$642.6 million $1.4 billion -

Washington, D.C. and the National Capital Region:$914.5 million $388.4 million -

Birmingham :$299.2 million $628.2 million -

Huntsville :$319.0 million $69.5

“We expect similar success here as we continue to seize a once-in-a-generation opportunity to build a new kind of regional community bank throughout the Southeast,” Turner said. “The chance to bring one of America’s best banks to the nation’s second fastest growing state is almost unprecedented. The

Pinnacle Financial Partners provides a full range of banking, investment, trust, mortgage and insurance products and services designed for businesses and their owners and individuals interested in a comprehensive relationship with their financial institution. The firm is the No. 1 and fastest growing bank in the

Pinnacle began operations in a single location in downtown

Additional information concerning Pinnacle, which is included in the Nasdaq Financial-100 Index, can be accessed at www.pnfp.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240117734557/en/

Joe Bass

(615) 743-8219

joe.bass@pnfp.com

Faith Seifuddin

(615) 743-8437

faith.seifuddin@pnfp.com

Source: Pinnacle Financial Partners, Inc.