Pampa Metals to Start Drilling at its Redondo-Veronica and Cerro Buenos Aires Copper Projects in Chile

VANCOUVER, BC / ACCESSWIRE / June 2, 2021 / Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIRA)(OTCQB:PMMCF) is pleased to announce that its first drilling campaign will start in mid-June 2021 in the context of strong and robust copper and precious metals markets. The Company plans to drill test prioritized targets at its

Julian Bavin, CEO of Pampa Metals commented: "We are pleased to have progressed to an advanced stage of planning for our initial drill test after a little more than 6 months from inception of the company, despite current Covid-related restrictions. Pampa Metals has

Drilling at Redondo-Verónica & Cerro Buenos Aires

Planning for an initial drill program at Redondo-Veronica and Cerro Buenos Aires is well advanced and a drill contract has been signed with an experienced contractor in Chile for a minimum of 3,000m of RC drilling, with an overall objective to drill about 4,000m. The campaign will be completed without installing camps at either project, which is highly advantageous in terms of planning, permitting and cost. Engagement and deployment of ancillary services is well advanced.

Both Redondo-Veronica and Cerro Buenos Aires show a variety of geological, hydrothermal alteration, geochemical and geophysical anomalies that have led to the definition of several potential porphyry copper (± moly ± gold) -style targets at both projects. These targets have necessarily been prioritised for the purposes of this initial drill test. Further technical information will be released in due course, but the projects can be summarised as follows:

- Redondo-Veronica (6,600 hectares): Located along the Domeyko (Eocene-Oligocene) mineral belt of northern Chile, and with five separate target areas of hydrothermal alteration characteristic of porphyry copper deposits identified and mapped. Recently completed 3D Vector IP, Magnetotelluric, and airborne drone magnetic geophysical surveys have revealed a series of geophysical features related to the hydrothermal alteration zones that support the geological interpretations. At least two of the target areas will be drilled in this initial drilling campaign.

- Cerro Buenos Aires (7,600 hectares): Located along the Central Depression (Paleocene) mineral belt of northern Chile, with three outcropping areas showing intense hydrothermal alteration characteristic of the upper and intermediate portions of porphyry copper-style systems, separated by extensive post-mineral covered "pampas". Historic magnetic, resistivity, and CSAMT* geophysical data, together with multi-element geochemical soil data, show a series of important anomalies. These, combined with detailed geological mapping that has revealed porphyry-style quartz veining and a tourmaline breccia at surface, have resulted in the current prioritisation of two areas within the property for drill testing, one of which is characterised by extensive post-mineral cover. Gradient Array IP surveying is currently in progress over one of these selected anomalous target areas.

* Controlled-Source Audio-Frequency Magnetotellurics

Strong Copper Industry Dynamics to Benefit Junior Explorers

The copper industry is currently experiencing a very strong upswing in the commodity cycle, driven mainly by global demand and supply dynamics, with global infrastructure spending and the drive towards greener technologies forecast to drive a massive increase in demand for copper in future years. With precious metals also experiencing a strong upswing, market conditions are highly supportive of the search for new supply and the exploration efforts of companies like Pampa Metals.

Copper markets are driven by industrial demand for its unique properties as a metal. Many industry commentators suggest that supply growth from current mines and advanced projects will not be able to keep up with predicted demand growth - particularly over the next 10 years or so - a combination that will be very supportive of prices.

Factors contributing to this unprecedented demand for the red metal include the global push to adopt low carbon technologies to mitigate climate change risks, including renewable forms of energy, the battery storage industry, and the electrification of transportation and vehicles (EVs) in general. No suitable cost-effective replacement for copper currently exists, and on the supply side, there are challenges for existing mines around the world to meet this demand, providing a support for copper prices and generating a clear need for new mineral discoveries.

The most important source of copper today is from a type of mineral deposit known as a porphyry copper deposit, which provide around

Chile is located around the Pacific Ocean "ring of fire" that provides the geology conducive to the formation of large porphyry copper deposits, and is the world's single largest copper producer, providing more than

With a healthy treasury, no debt and a strong management and board team, the company is well positioned to pursue and make a new discovery in Chile. Discovery is the biggest value driver in the mining industry.

Qualified Person

Technical information in this news release has been approved by Mario Orrego G, Geologist and a Registered Member of the Chilean Mining Commission and a Qualified Person as defined by National Instrument 43-101. Mr. Orrego is a consultant to the Company.

COVID-19

The global outbreak of COVID-19 has led governments worldwide to enact emergency measures to combat the spread of the virus. Such measures may result in a period of business disruption including reduced operations, which could have a material adverse impact on the Company's results of operations, financial condition and the market and trading price of the Company's securities.

As of the date of this news release, the duration and immediate and eventual impact of the COVID-19 pandemic remains unknown. It is not possible to reliably estimate the length and severity of these developments and the impact on the financial results and condition of the Company. The outbreak of COVID-19 has not caused significant disruptions to the Company's business to date, with field activities being conducted by Chile-based specialists and consultants, although international travel to Chile for management is currently not practical. Important business communication is largely reliant on digital media. However, the COVID-19 outbreak may yet cause disruptions to the Company's business and operational plans.

ABOUT PAMPA METALS

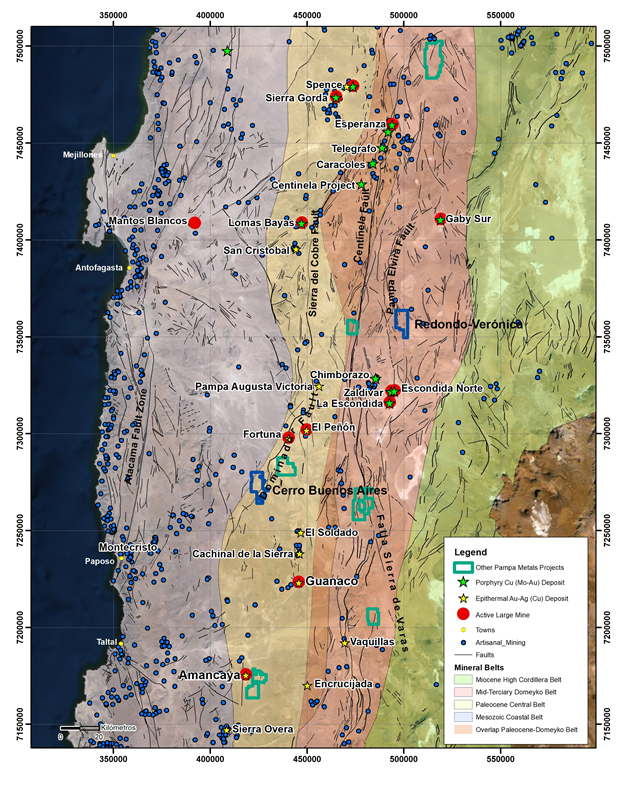

Pampa Metals is a Canadian company listed on the Canadian Stock Exchange (CSE: PM) as well as the Frankfurt (FSE: FIRA) and OTC (OTCPK: PMMCF) exchanges. Pampa Metals owns a highly prospective 59,000-hectare portfolio of eight projects for copper and gold located along proven mineral belts in Chile, one of the world's top mining jurisdictions. The Company has a vision to create value for shareholders and all other stakeholders by making a major copper discovery along the prime mineral belts of Chile, using the best geological and technological methods. For more information, please visit Pampa Metals' website www.pampametals.com.

ON BEHALF OF THE BOARD

Julian Bavin | Chief Executive Officer

INVESTOR CONTACT

Ioannis (Yannis) Tsitos | Director

investors@pampametals.com

www.pampametals.com

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential", "indicate" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance and actual results may differ materially from those in forward-looking statements.

Location of Redondo-Veronica and Cerro Buenos Aires Projects

SOURCE: Pampa Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/649999/Pampa-Metals-to-Start-Drilling-at-its-Redondo-Veronica-and-Cerro-Buenos-Aires-Copper-Projects-in-Chile