Pampa Metals to Acquire Rugby Resources and Pursue ASX Listing, Creating a Leading South American Porphyry Copper Explorer

Pampa Metals (PMMCF) has executed a binding letter agreement to acquire 100% of Rugby Resources shares, creating a leading South American copper explorer. The all-share transaction values Rugby shares at a 1:6.4 ratio, with Rugby shareholders holding approximately 38% of Pampa post-transaction.

The combined entity will focus on three main projects: Piuquenes copper-gold porphyry in Argentina (featuring significant drill results including 801m @ 0.40% Cu, 0.51 g/t Au), Cobrasco copper-moly porphyry in Colombia (with drill results including 808m @ 0.42% Cu, 79 ppm Mo), and the Mantau IOCG copper project in Chile.

The company plans to pursue a dual listing on the Australian Stock Exchange and TSX Venture Exchange. Prior to closing, Rugby shareholders will receive interest in a newly-formed company (Rugby Spinco) containing certain separated assets. The transaction is subject to due diligence, regulatory approvals, and definitive agreement within a 45-day exclusivity period.

Pampa Metals (PMMCF) ha firmato un accordo vincolante per acquisire il 100% delle azioni di Rugby Resources, creando un importante esploratore di rame in Sud America. La transazione interamente azionaria valuta le azioni di Rugby con un rapporto di 1:6,4, con gli azionisti di Rugby che detengono circa il 38% di Pampa dopo la transazione.

L'entità combinata si concentrerà su tre progetti principali: porfido di rame-oro Piuquenes in Argentina (che presenta risultati di perforazione significativi tra cui 801m @ 0,40% Cu, 0,51 g/t Au), porfido di rame-molibdeno Cobrasco in Colombia (con risultati di perforazione tra cui 808m @ 0,42% Cu, 79 ppm Mo), e il progetto di rame Mantau IOCG in Cile.

L'azienda prevede di perseguire una doppia quotazione sulla Borsa australiana e sul TSX Venture Exchange. Prima della chiusura, gli azionisti di Rugby riceveranno un interesse in una nuova società (Rugby Spinco) contenente determinati beni separati. La transazione è soggetta a due diligence, approvazioni normative e un accordo definitivo entro un periodo di esclusività di 45 giorni.

Pampa Metals (PMMCF) ha ejecutado un acuerdo vinculante para adquirir el 100% de las acciones de Rugby Resources, creando un líder en exploración de cobre en Sudamérica. La transacción completamente en acciones valora las acciones de Rugby en una proporción de 1:6,4, con los accionistas de Rugby poseyendo aproximadamente el 38% de Pampa después de la transacción.

La entidad combinada se centrará en tres proyectos principales: porfido de cobre-oro Piuquenes en Argentina (con resultados de perforación significativos, incluyendo 801m @ 0,40% Cu, 0,51 g/t Au), porfido de cobre-molibdeno Cobrasco en Colombia (con resultados de perforación que incluyen 808m @ 0,42% Cu, 79 ppm Mo), y el proyecto de cobre Mantau IOCG en Chile.

La empresa planea buscar una doble cotización en la Bolsa de Valores de Australia y en el TSX Venture Exchange. Antes del cierre, los accionistas de Rugby recibirán un interés en una nueva empresa (Rugby Spinco) que contendrá ciertos activos separados. La transacción está sujeta a la debida diligencia, aprobaciones regulatorias y un acuerdo definitivo dentro de un período de exclusividad de 45 días.

Pampa Metals (PMMCF)는 Rugby Resources의 100% 주식을 인수하기 위한 구속력 있는 계약을 체결하여 남미의 주요 구리 탐사 기업을 만들었습니다. 이 전액 주식 거래는 Rugby 주식을 1:6.4 비율로 평가하며, Rugby 주주들은 거래 후 Pampa의 약 38%를 보유하게 됩니다.

결합된 회사는 세 가지 주요 프로젝트에 집중할 예정입니다: 아르헨티나의 Piuquenes 구리-금 포르피리 (801m @ 0.40% Cu, 0.51 g/t Au를 포함한 중요한 시추 결과 포함), 콜롬비아의 Cobrasco 구리-몰리브덴 포르피리 (808m @ 0.42% Cu, 79 ppm Mo를 포함한 시추 결과), 그리고 칠레의 Mantau IOCG 구리 프로젝트입니다.

회사는 호주 증권 거래소와 TSX 벤처 거래소에 이중 상장을 추진할 계획입니다. 거래 완료 전에 Rugby 주주들은 특정 분리된 자산을 포함하는 신설 회사(Rugby Spinco)에 대한 지분을 받게 됩니다. 이 거래는 실사, 규제 승인 및 45일 독점 기간 내에 최종 계약을 조건으로 합니다.

Pampa Metals (PMMCF) a signé un accord contraignant pour acquérir 100 % des actions de Rugby Resources, créant ainsi un leader de l'exploration du cuivre en Amérique du Sud. La transaction entièrement en actions valorise les actions de Rugby à un ratio de 1:6,4, les actionnaires de Rugby détenant environ 38 % de Pampa après la transaction.

L'entité combinée se concentrera sur trois projets principaux : porphyre de cuivre-or Piuquenes en Argentine (avec des résultats de forage significatifs, y compris 801m @ 0,40 % Cu, 0,51 g/t Au), porphyre de cuivre-molybdène Cobrasco en Colombie (avec des résultats de forage incluant 808m @ 0,42 % Cu, 79 ppm Mo), et le projet de cuivre Mantau IOCG au Chili.

L'entreprise prévoit de poursuivre une double cotation à la Bourse australienne et au TSX Venture Exchange. Avant la clôture, les actionnaires de Rugby recevront un intérêt dans une nouvelle société (Rugby Spinco) contenant certains actifs séparés. La transaction est soumise à une diligence raisonnable, à des approbations réglementaires et à un accord définitif dans un délai d'exclusivité de 45 jours.

Pampa Metals (PMMCF) hat eine verbindliche Vereinbarung zur Übernahme von 100% der Anteile an Rugby Resources unterzeichnet und damit einen führenden Kupferexplorer in Südamerika geschaffen. Die Transaktion in Form eines Aktientauschs bewertet die Rugby-Aktien im Verhältnis 1:6,4, wobei die Rugby-Aktionäre nach der Transaktion etwa 38% von Pampa halten werden.

Das kombinierte Unternehmen wird sich auf drei Hauptprojekte konzentrieren: Piuquenes Kupfer-Gold-Porphyr in Argentinien (mit signifikanten Bohrergebnissen, darunter 801m @ 0,40% Cu, 0,51 g/t Au), Cobrasco Kupfer-Molybdän-Porphyr in Kolumbien (mit Bohrergebnissen, darunter 808m @ 0,42% Cu, 79 ppm Mo) und das Mantau IOCG Kupferprojekt in Chile.

Das Unternehmen plant, eine doppelte Notierung an der australischen Börse und der TSX Venture Exchange anzustreben. Vor dem Abschluss werden die Rugby-Aktionäre Anteile an einem neu gegründeten Unternehmen (Rugby Spinco) erhalten, das bestimmte getrennte Vermögenswerte enthält. Die Transaktion unterliegt einer Due Diligence, regulatorischen Genehmigungen und einem endgültigen Vertrag innerhalb eines 45-tägigen Exklusivitätszeitraums.

- Significant drill results from Piuquenes project showing high-grade copper-gold mineralization

- Strong drill results from Cobrasco project with extensive copper-molybdenum mineralization

- Portfolio diversification across three advanced copper projects in different jurisdictions

- Planned dual listing on ASX and TSX-V potentially increasing market visibility and liquidity

- Transaction subject to multiple conditions and approvals with no certainty of completion

- Potential shareholder dilution with Rugby shareholders receiving 38% of combined entity

VANCOUVER, BC / ACCESS Newswire / February 19, 2025 / Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIR)(OTCQB:PMMCF) and Rugby Resources Ltd. ("Rugby") (TSXV:RUG) are pleased to advise they have executed a binding letter agreement contemplating the acquisition by Pampa Metals of

Highlights

◦ Rapid exploration and advancement of Pampa Metals' flagship Piuquenes copper-gold porphyry project in Argentinawhere significant drill results to date include (refer to December 5, 2023, and March 18, May 6 and May 23, 2024 news releases - CSE:PM): |

PIU01-2024DDH

422m @

incl. 132m @

Incl. 80m @

PIU02-2024DDH

448m @

incl. 188m @

incl. 126m @

PIU03-2024DDH

801m @

incl. 518m @

incl. 176m @

PIU16-01DDH

558m @

incl. 130m @

◦ Recommencing drilling at Rugby's Cobrasco copper-moly porphyry discovery in Colombia (the "Cobrasco Project"), where the only three holes ever drilled reported wide intercepts of highly significant mineralization ( refer to January 17, 2023 and February 9,2023 news releases - RUG:TSXV ): |

CDH001

808m @

Incl. 138m @

Incl. 82 m @

CDH002

754m @

Incl. 172m @

CDH003

144.6m @

◦ Initial assessment f the prospective Mantau IOCG copper project in Chile.

|

Proposed Transaction Terms

Pursuant to the binding letter agreement dated February 17, 2025, Pampa Metals is proposing to acquire all the issued and outstanding common shares of Rugby in exchange for common shares of Pampa Metals by way of a statutory plan of arrangement, under the Business Corporations Act (British Columbia) on the basis of 1 Pampa Metals share for every 6.4 Rugby shares. Upon Closing of the Transaction the Rugby Shareholders will hold approximately

On Closing, Bryce Roxburgh, the President and Chief Executive Officer of Rugby, will be appointed to the board of directors of Pampa and the current board of Rugby will resign.

Prior to the Closing, Rugby will transfer to Rugby Spinco the following assets:

a. A b. The El Zanjon and Venidero gold-silver projects in Argentina; c. A joint venture interest in the Georgetown Project, a copper gold exploration project in Australia; and d. A |

Subject to regulatory and shareholder approval, Rugby intends to distribute all of the shares of Rugby Spinco to the existing Rugby shareholders on Closing and Rugby Spinco will cease to be a subsidiary of Rugby (the "Spinout Transaction"). There is no current intention to list the shares of Rugby Spinco on a stock exchange.

The proposed Transaction is and will be subject to a range of conditions, including, but not limited to, Pampa Metals and Rugby entering into a definitive agreement relating to the Transaction (the "Definitive Agreement") containing terms and conditions outlined in the Letter Agreement, as well as representations and warranties, conditions, and other provisions all customary for transactions of this nature. The Letter Agreement creates a binding obligation of Rugby and Pampa Metals to take reasonable best efforts to complete due diligence and enter into the Definitive Agreement during a 45-day exclusivity period (the "Exclusivity Period"). The entering into of the Definitive Agreement is subject to, among other things, completion of the parties' respective due diligence, the receipt by Rugby of a favourable opinion as to the fairness, from a financial point of view, of the Transaction to the Rugby shareholders and approval of the Boards of Pampa Metals and Rugby (the "Agreement Conditions"). In the event the Definitive Agreement is entered into, the Closing of the proposed Transaction will be subject to additional conditions precedent including, but not limited to, the receipt of all regulatory, court and shareholder approvals. There is no certainty that the parties will enter into the Definitive Agreement or conclude the proposed Transaction.

During the Exclusivity Period, both parties are subject to certain non-solicitation covenants subject to standard fiduciary duty exceptions.

Prior to execution of the Definitive Agreement, all directors of Rugby will be required to enter into voting and support agreements with Pampa Metals pursuant to which they will agree to vote Rugby shares held by them in favour of the Transaction.

Board and Management Changes

Upon Closing, Mr. Bryce Roxburgh, a current director, President and Chief Executive Officer of Rugby, will join the board of Pampa Metals. Joseph van den Elsen will remain as Executive Chairman and Chief Executive Officer of Pampa Metals.

Bryce Roxburgh

Bryce Roxburgh, a founding shareholder of Rugby, graduated with a Bachelor of Science degree in geology and geophysics from Sydney University in 1971 and has 50 years' experience in the exploration and mining industry.

Between 1971 and 1989, he worked for Amoco Minerals Australia Company and Cyprus Mines Corporation as Regional Manager for Eastern Australia & South East Asia, responsible for the exploration teams which discovered the Selwyn, Red Dome and Junction Reef ore-bodies. Between 1989 and 1998, he was Exploration Manager for Arimco N.L. and Climax Mining Limited in Eastern Australia, South East Asia and South America where he was responsible for the teams which discovered the Didipio gold-copper ore-body in the Philippines, and the Don Sixto gold deposit in Argentina. In 2003 he established Exeter Resource Corporation from which Extorre Gold Mines Ltd was spun-out. Extorre held the Cerro Moro gold deposit discovery in Argentina until it was acquired by Yamana Gold in 2012, and Exeter Resource Corp. held the Caspiche copper gold porphyry discovery in Chile until it was acquired by Goldcorp in 2017.

Pampa Metals' Flagship Project

Piuquenes Copper - Gold Porphyry Project San Juan, Argentina

In 2024 Pampa Metals successfully transitioned from early-stage copper and gold exploration to the assessment and acquisition of more advanced stage copper project(s). The acquisition of an interest in the company making, high-grade Piuquenes copper-gold porphyry project in San Juan, Argentina has laid a strong foundation for significant shareholder value creation through the discovery and delineation of an economic copper-gold deposit(s).

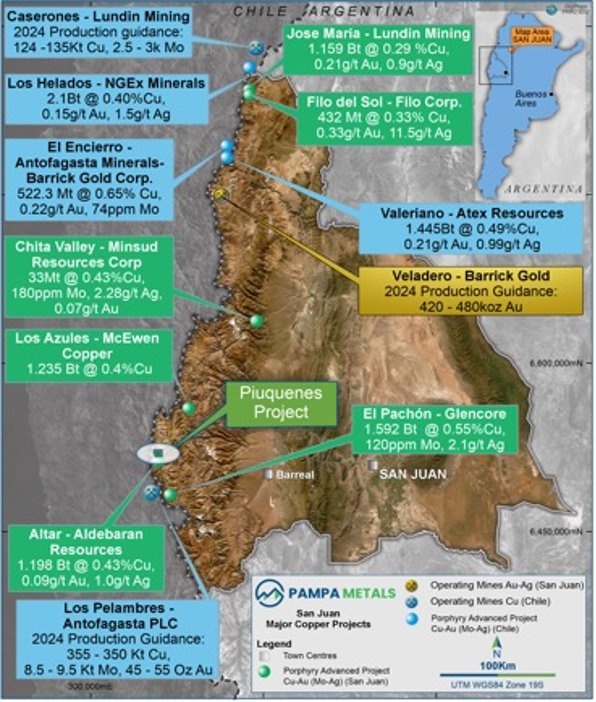

Piuquenes is a newly discovered, gold rich copper porphyry deposit located immediately adjacent to the north of Aldebaran Resources' (ALDE:TSX-V) giant Altar porphyry copper system. Other large porphyry copper projects in the San Juan Miocene porphyry belt include El Pachón (Glencore), approximately 30 kilometers ("km") to the south, the operating Los Pelambres copper mine (

Figure 1. Piuquenes Project: San Juan Major Copper Projects

In 2024 Pampa Metals completed a maiden 3-hole drill program for 2,592m.Each of the three drillholes from Pampa Metals' initial drill program intersected significant intervals of copper, gold and silver mineralization as follows:

PIU01-2024DDH

422 m @

incl. 132 m @

Incl. 80 m @

PIU02-2024DDH

448 m @

incl. 188m @

incl. 126 m @

PIU03-2024DDH

801 m @

incl. 518 m @

incl. 176 m @

incl. 64 m @

incl. 32m @

Key technical findings from this program include:

|

Figure 2 . PIU-03-2024DDH Disseminated copper oxides in porphyry A-type quartz veinlets overprinting early biotite-magnetite altered quartz-diorite porphyry

Pampa Metals continues to make excellent progress on its 2024-25 follow-up drill program ( refer to January 21, 2025 and February 3, 2025 news releases ).

Figure 3 . PIU-03-2024DDH Intense porphyry A type quartz vein stockwork with disseminated chalcopyrite and late veins associated with intermineral potassic (Kfeldspar-quartz) alteration

Rugby Projects

Cobrasco Copper-Molybdenum Project, Colombia

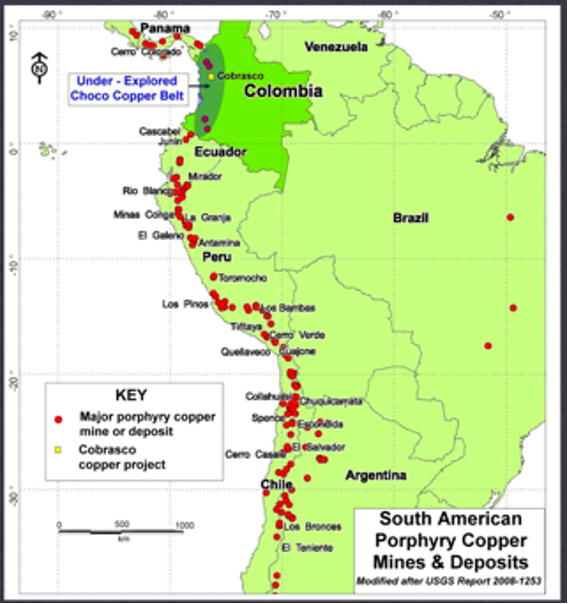

The Cobrasco Project is located along the underexplored Chocó Copper Belt of the Western Cordillera, a continuation of the prolific Andean porphyry belt that extends through Chile, Peru and Ecuador to the south, and Panama to the north (Figure 4). The Project extends across 30 km2 and is defined by strong rock, stream sediment and soil geochemical anomalies supported by strong geophysical evidence. Drilling to date has only tested a small portion of the large system outlined by surface exploration work.

Figure 4. Cobrasco Project: Chocó Porphyry Belt (Colombia)

Rugby completed a drilling program in 2022 which included two holes, CDH001 and CDH002, and the upper portion of a third hole, CDH003. All holes intersected significant copper and molybdenum mineralization:

CDH001

808 m @

incl. 138 m @

Incl. 82 m @

CDH002

754 m @

incl. 172 m @

CDH003

144.6 m @

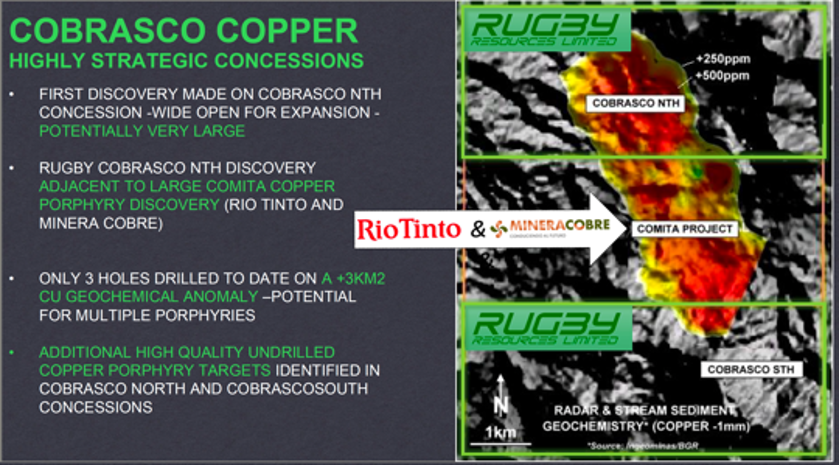

Figure 5 . Cobrasco Project Location and Summary

Hole CDH001 drilled beneath the central part of a strong coherent copper soil geochemical target, intersected strong porphyry copper-molybdenum mineralization. Drill hole CDH002 was collared approximately 250 meters diagonally south of the section drilled by CDH001 and was terminated in a fault zone before hitting target depth. CDH003 was drilled at approximately 90 degrees to CDH002 from the same drill site. The hole was suspended at 300.6 meters due to mechanical problems, well short of the target depth of +1000 meters.

Hole CDH001 intersected 82m at

Figure 6. CDH001: Quartz diorite with siliceous-phyllic alteration overprinted on potassic alteration, brecciation and considerable disseminated bornite in a dark gray silica matrix

Hole CDH002 collared 250m south of the section tested by hole CDH001intersected 172m of

Hole CDH003 was suspended at 300.6m in strong porphyry mineralization and intersected 144.6m of

Figure 7. CDH003: mineralized quartz diorite porphyry with dominant bornite and lesser chalcopyrite

Cobrasco mineralization is bornite dominant with lesser chalcopyrite and molybdenite. Penalty elements (particularly arsenic) are low in drillhole assays. Such mineralization would be expected to be amenable to the production of a high-grade copper concentrate using traditional mineral processing.

Initial drilling results, combined with mapping, geochemical and geophysical data reinforce interpretation that Rugby has identified a very significant copper-molybdenum porphyry system at Cobrasco. Evidence to date strongly suggests a cluster of porphyry centres aligned within a north-westerly trending structural corridor, a characteristic commonly observed in other porphyry systems in the Western Andean Cordillera.

Approximately 1km north of the currently drilled porphyry mineralization, bornite-molybdenite veining within porphyritic rocks was mapped and sampled in an area of highly elevated molybdenum in soil geochemistry, indicating proximity to the core of a porphyry system.

Additionally, a large magnetic low geophysical anomaly (indicative of magnetite destruction from a mineralizing porphyry system) was identified approximately two kilometers east of the drilled porphyry. Streams draining this feature contain copper-gold-rich breccia boulders, suggesting the potential for another substantial porphyry body.

Mantau Copper-Gold Project Chile

The Mantau Project covers an area of 45 sq.km and is located 70km northeast of Antofagasta city and 40km east of the port of Mejillones in northern Chile. The project benefits from a highly favorable location, offering excellent year-round access and low elevation.

Figure 8. Mantau Project Summary

Mantau is situated in the Coastal Belt of Northern Chile which hosts several large copper deposits genetically and spatially related to the Atacama Fault System. This metallogenic belt includes manto-type Cu-Ag, porphyry copper and iron oxide copper gold (IOCG) orebodies. Mantos Blancos and Antucoya are the largest mines with annual production of some 70,000t of copper. Marimaca Copper Corp has also outlined a significant copper oxide resource nearby with recent drilling extending high grade copper mineralization in the underlying sulphide zone.

No environmental or community issues are known to exist within this historical mining area. There is no record of recent previous systematic exploration within the project area although there has been previous small-scale mining of oxide copper mineralization. Most of the project is covered by regolith with only limited outcrops.

Early work by Rugby geologists has identified mineralized hydrothermal breccias, widespread alteration and area of veining. Sampling of old workings returned values up to

Next Steps

Subject to satisfaction of the Agreement Conditions, the Parties will act reasonably to finalize and enter into the Definitive Agreement as soon as practicable, but in any event no later than the end of the Exclusivity Period.

In parallel, Pampa Metals will continue to advance exploration at the Piuquenes project.

The entering into of the Definitive Agreement is subject to the Agreement Conditions. There is no certainty that the parties will enter into the Definitive Agreement or conclude the proposed Transaction.

Rugby and Pampa Metals will issue further information about the proposed transaction in the near future.

Joseph van den Elsen, Pampa Metals President and CEO commented: "This is an exciting time to be a Pampa Metals shareholder, as we rapidly advance the Piuquenes project and pursue significant value through the discovery and delineation of an economic deposit(s) on the property. This season we have significantly expanded the footprint of the Piuquenes Central porphyry system and intersected bornite-rich mineralization indicative of a high-grade core. Drilling at Piuquenes East has intersected porphyry mineralization and quartz vein stockwork on the first hole and we continue to advance several other targets at Piuquenes through surface exploration. Securing the Cobrasco and Mantau projects via the acquisition of Rugby adds an exciting pipeline of high-quality, advanced stage South American copper exploration projects to our portfolio. Rugby has already demonstrated Cobrasco to be an exceptional exploration opportunity based on the potential size and grade of the porphyry system outlined to date, and we look forward to continuing to explore this potential for a world class copper deposit discovery on the property".

ON BEHALF OF THE PAMPA BOARD

Joseph van den Elsen | President & CEO

joseph@pampametals.com

Tel: 604.669.0660

INVESTOR CONTACT

Jordan Webster | Jordan@pampametals.com

ON BEHALF OF THE RUGBY BOARD

Bryce Roxburgh | President & CEO

Tel: 61.405.428.605

INVESTOR CONTACT

Bryce Roxburgh | rox@rugbyresourcesltd.com

ABOUT PAMPA METALS

Pampa Metals is a copper-gold exploration company listed on the Canadian Stock Exchange (CSE:PM), Frankfurt (FSE:FIR), and OTC (OTCQB:PMMCF) exchanges.

In November 2023, Pampa Metals announced it had entered into an Option and Joint Venture Agreement for the acquisition of an

ABOUT RUGBY RESOURCES

Rugby is an exploration company conducting "discovery stage" exploration on a portfolio of copper, gold and silver targets in Colombia, Argentina and Chile. The Colombian Cobrasco Project is located along the western cordillera belt which hosts large scale copper molybdenum mines in Chile, Peru, and Panama (and more recent significant projects discovered in Ecuador). This belt has not been subjected to modern exploration in Colombia. Rugby looks to advance the Cobrasco Project to demonstrate the economic potential of a major discovery for Colombia. The discovery of significant new copper opportunities is essential for the mining industry to supply the copper necessary to transition from fossil fuels to advanced electrification.

Rugby benefits from the experience of its directors and management, a team that has either been directly responsible for world-class mineral discoveries or has been part of the management teams responsible for such discoveries. Prior companies under their management included Exeter Resource Corporation and Extorre Gold Mines Limited, which held significant projects in South America. These companies were taken over by Goldcorp (Newmont) and Yamana respectively.

QUALIFIED PERSON

Technical information in this news release pertaining to the Piuquenes Project has been approved by Mario Orrego G. Mr. Orrego G. is a Geologist, a Registered Member of the Chilean Mining Commission and a Qualified Person as defined by National Instrument 43-101. Mr. Orrego G. is a consultant to the Company.

Technical information in this news release pertaining to the Cobrasco and other Rugby projects has been approved by Paul Joyce, Rugby's Chief Operating Officer, Director and a "qualified person" ("QP") within the definition of that term in National Instrument 43-101, Standards of Disclosure for Mineral Projects, has verified the scientific and technical information that forms the basis for this news release. Paul Joyce is a Fellow of the Australian Institute of Geoscientists (registered member # 1908).

FORWARD-LOOKING STATEMENT

PAMPA METALS

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects" and similar expressions, or that events or conditions "will" or "may" occur. These statements are subject to various risks. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance, and actual results may differ materially from those in forward-looking statements.

RUGBY RESOURCES

Certain of the statements made and information contained herein is "forward-looking information" within the meaning of the Canadian securities laws. This includes statements concerning whether the proposed Transaction or Spinout Transaction will be consummated or the Definitive Agreement entered into, the Company's proposed exploration plans for the Cobrasco Project in Colombia and the El Zanjon and Venidero projects in Argentina, the expected timing of drilling and/or geophysics programs, budgeted costs to conduct exploration programs including drilling, high grade potential and potential for mineral discoveries at its projects and the style or occurrence of the mineralization which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Rugby holds certain of its projects under option agreements, which require annual cash payments, expenditure and/ or drilling requirements in order to maintain its interest. Should the Company not be able to meet its obligations or renegotiate the agreements it will lose its rights under the option agreement. Forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the effect on prices of major mineral commodities such as copper and gold by factors beyond the control of the Company; events which cannot be accurately predicted such as political and economic instability, terrorism, environmental factors and changes in government regulations and taxes; the shortage of personnel with the requisite knowledge and skills to design and execute exploration programs; difficulties in arranging contracts for drilling and other exploration services; the Company's dependency on equity market financings to fund its exploration programs and maintain its mineral exploration properties in good standing; political risk that a government will change, environmental regulations, taxes or mineral royalties in a manner that could have an adverse effect on the Company's assets or financial condition and impair its ability to advance its mineral exploration projects or raise further funds for exploration; risks associated with title to resource properties due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the interpretation of laws regarding ownership or exploration of mineral properties in Argentina, Chile and Colombia and in the sometimes ambiguous conveyancing characteristic of many resource properties, currency risks associated with foreign operations, the timing of obtaining permits to conduct exploration activities, the ability to conclude agreements with local communities and other risks and uncertainties; risks related to geopolitical conflicts; and including those described in each of the Company's management discussion and analysis and those contained in its financial statements for the year ended February 29, 2024 filed with the Canadian Securities Administrators and available at www.sedarplus.ca . In addition, forward-looking information is based on various assumptions including, without limitation, assumptions associated with exploration results and costs and the availability of materials and skilled labour. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new information, future events or otherwise.

Neither the CSE, the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Pampa Metals Corp.

View the original press release on ACCESS Newswire