Pampa Metals Closes Non-Brokered Private Placement and Finalises Preparations for Maiden Drill Testing of the Buenavista Target and the Block 4 Project

Pampa Metals Corp. has successfully completed a non-brokered private placement, issuing 14,644,334 units at $0.15 per unit, raising a total of $2,196,650. Each unit consists of a common share and a warrant to purchase an additional share at $0.21 for three years. The company will allocate residual proceeds towards due diligence on potential acquisition targets and general corporate purposes. Furthermore, the VP of Exploration is finalizing preparations for a 2,100m drilling program at the Buenavista target, supported by promising geochemical data indicating anomalies of copper and molybdenum.

- Raised $2,196,650 through private placement.

- Planned 2,100m diamond drilling program at Buenavista based on favorable geochemical data.

- Potential acquisition targets identified to complement existing projects.

- Cash commissions of $94,724 and issuance of finder's warrants and shares indicate high costs associated with the fundraising.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / March 3, 2023 / Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIRA)(OTCQX®:PMMCF) is pleased to advise that it has issued 14,644,334 units ("Units") at a price of

Each Unit consists of one fully paid common share and one purchase warrant entitling the holder to acquire an additional common share at a price of

In connection with the Offering, the Company paid total cash commissions of

The Company's Vice President of Exploration was recently in Chile, finalising preparations for the maiden drill testing of the Buenavista target and the Block 4 Project more broadly, where an initial ~2,100m diamond drill program has been designed to test coincident geological, geochemical, and geophysical anomalies.

Residual proceeds from the Offering will be directed towards due diligence on the identification and possible acquisition of large porphyry copper-molybdenum targets capable of complementing the Company's existing portfolio, as well as general corporate purposes.

Block 4 / Buenavista - Principal Findings & Conclusions from Technical Data

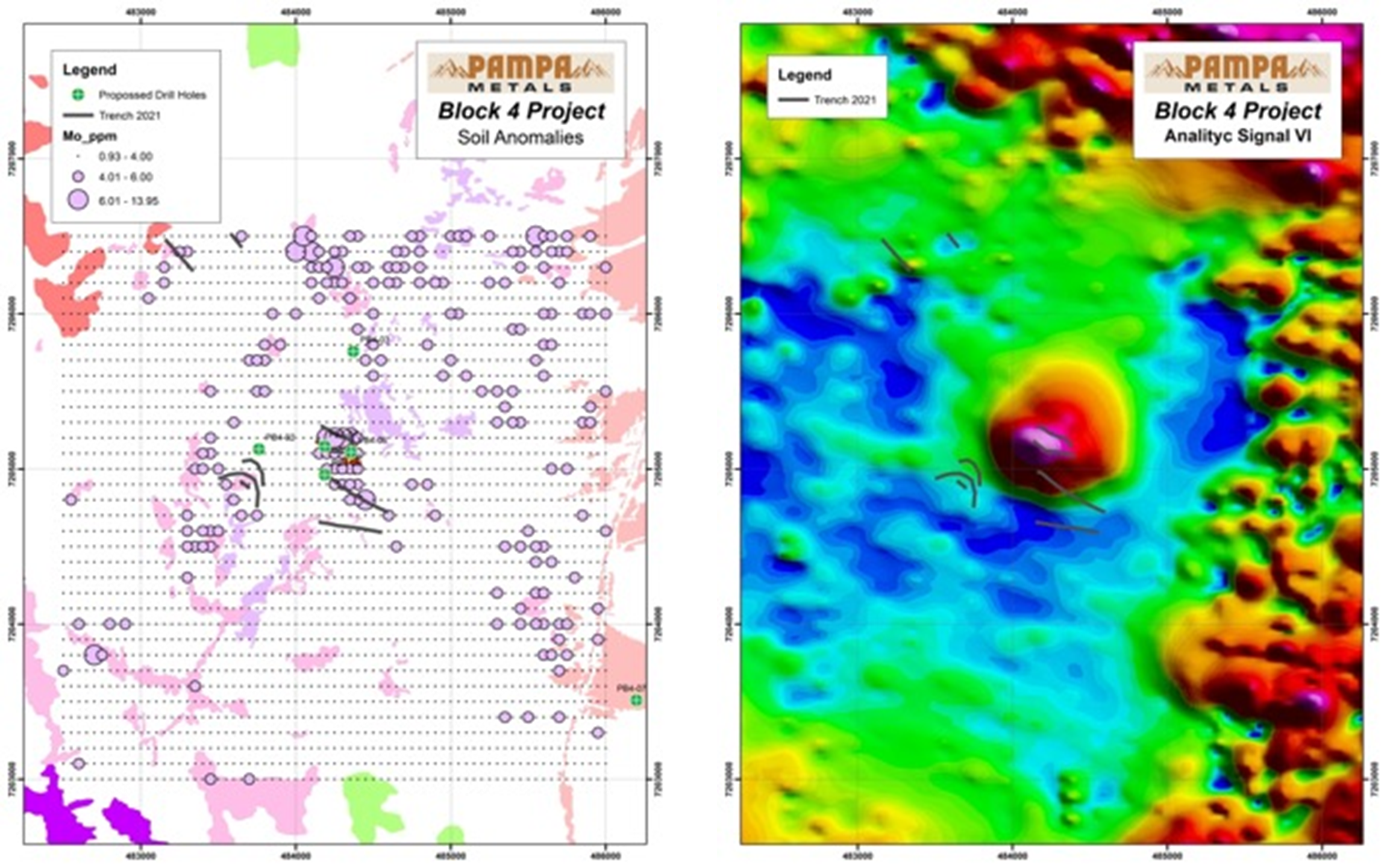

Preliminary results from a soil geochemical survey were previously reported (see news release dated November 10, 2022) and subsequently the following key findings (see news release dated January 19, 2023):

- The soil geochemical data are consistent with key findings identified by surface geology, Induced Polarisation (IP) geophysics, and magnetometry, and other complementary data including 3D modeling.

- Clearly anomalous values of Mo (up to 14 ppm Mo) and Cu (up to 1,560 ppm Cu) in soils, in a heavily supergene leached desert environment, coincide with mapped hydrothermal alteration at the key central quartz-stockwork zone and the neighbouring quartz-sulphide breccia zone (previously reported).

- Additional sporadic gold anomalies (up to 175 ppb Au), together with the distributions of copper, molybdenum, and pathfinder elements including Zn, Pb, As, and others, suggest Buenavista represents a fertile Tertiary porphyry copper-molybdenum system located along the world's preeminent porphyry copper belt.

- Buenavista has a footprint of about 1.5 km E-W by 1 km N-S according to the exploration results to date, and is located on a significant NE-SW trending geological structure revealed by the geochemical dataset and supported by surface mapping.

- The geochemical data is also suggestive of a further potential target to the SW of Buenavista, and gives encouragement to the likely existence of a further target under cover to the east of Buenavista, currently defined by geophysical data.

Mo in Soils Compared to Buenavista Magnetic Anomaly

The combination of geological, geochemical, and geophysical anomalies is suggestive of a potential "cluster" of porphyry copper-molybdenum systems on the Block 4 property, an aspect typical of some major porphyry copper-molybdenum districts in Chile and worldwide.

A diamond drilling program to test Buenavista, and likely an additional covered target under cover to the east or southeast, is well supported by the various surface datasets, where three to four diamond drill holes totalling around 2,100m have been planned.

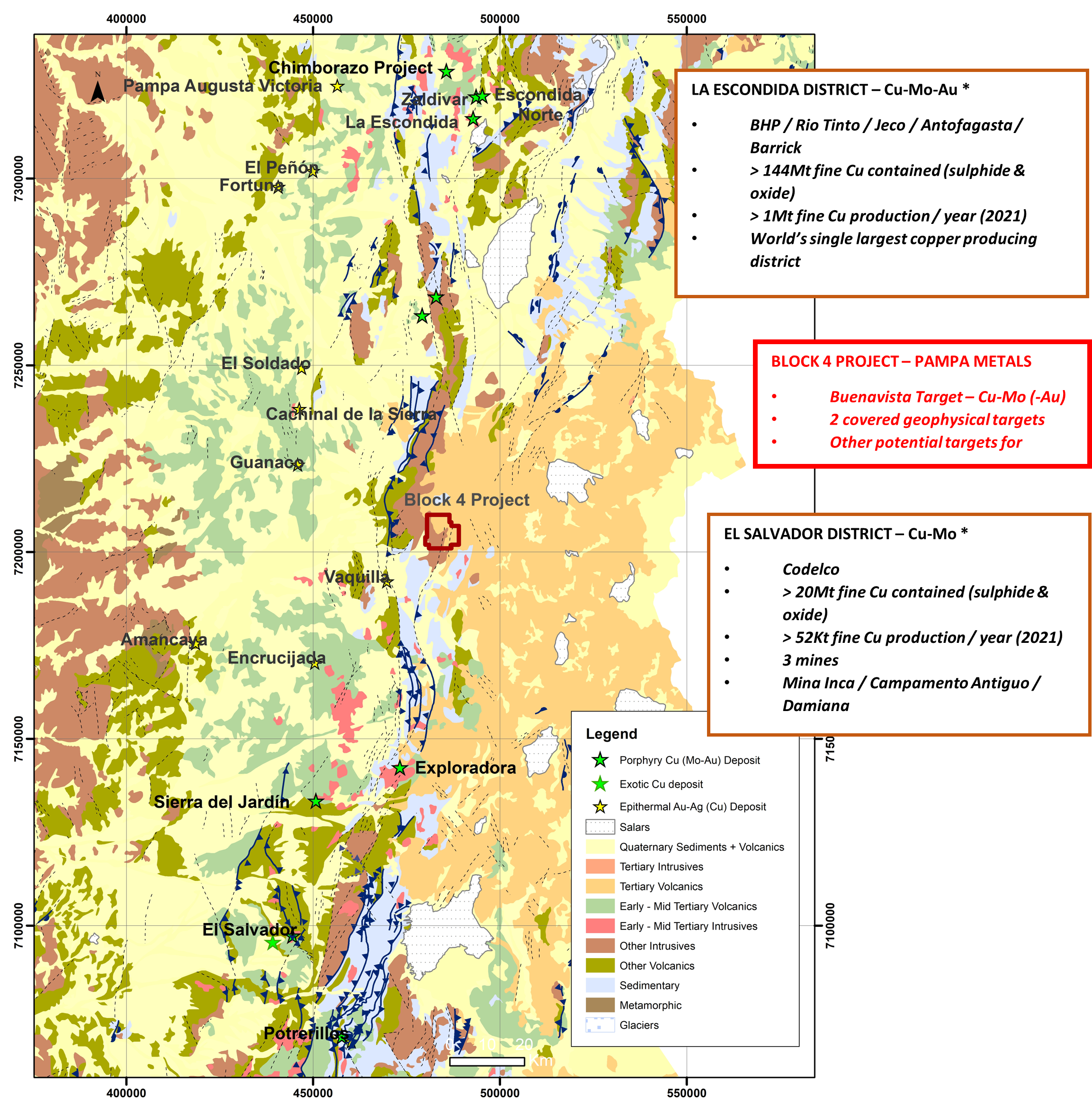

Block 4 - Regional Location Along Domeyko Belt

Debt Settlement

The Company further announces that it has entered into debt settlement agreements to settle outstanding indebtedness to two arm's length service providers in the aggregate amount of

ABOUT PAMPA METALS

Pampa Metals is a Canadian company listed on the Canadian Stock Exchange (CSE:PM) as well as the Frankfurt (FSE:FIRA) and OTC (OTCQB®:PMMCF) exchanges. Pampa Metals owns a highly prospective, wholly owned, 47,400-hectare portfolio of seven projects for copper, molybdenum and gold located along proven mineral belts in Chile, one of the world's top mining jurisdictions. The Company is actively progressing four of its projects, including completed and planned drill tests, and has two additional projects optioned to Austral Gold Ltd.

The Company has a vision to create value for shareholders and all other stakeholders by making a major copper discovery along the prime mineral belts of Chile, using the best geological and technological methods. For more information, please visit Pampa Metals' website www.pampametals.com.

The latest Company Presentation can be accessed at https://pampametals.com/investor/.

ON BEHALF OF THE BOARD

Joseph van den Elsen | President & CEO

INVESTORS CONTACT

Joseph van den Elsen | President & CEO

joseph@pampametals.com

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENT

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects" and similar expressions, or that events or conditions "will" or "may" occur. These statements are subject to various risks. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance and actual results may differ materially from those in forward-looking statements.

SOURCE: Pampa Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/741953/Pampa-Metals-Closes-Non-Brokered-Private-Placement-and-Finalises-Preparations-for-Maiden-Drill-Testing-of-the-Buenavista-Target-and-the-Block-4-Project