Piedmont Lithium Announces Q2’24 North American Lithium Operational Results

Piedmont Lithium (Nasdaq: PLL) announced Q2'24 operational results for its jointly owned North American Lithium (NAL) mine. Key highlights include:

- Shipped approximately 14,000 dmt of spodumene concentrate in Q2'24

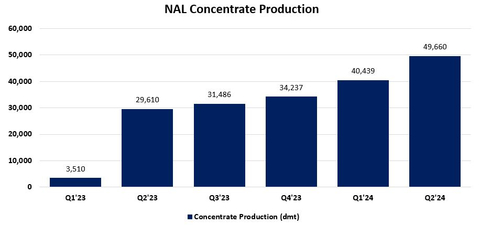

- Record quarterly production of 49,660 dmt, up 23% from Q1'24

- New quarterly highs: 68% lithium recovery and 83% process plant utilization

- Targeting 96,500 dmt shipments in H2'24

- Crushed ore dome now operational, expected to improve production and utilization

NAL achieved significant progress towards steady-state production, with June seeing 91% mill utilization and a single-day production record of 919 dmt. Piedmont aims to increase shipments to contract customers in H2'24.

Piedmont Lithium (Nasdaq: PLL) ha annunciato i risultati operativi del Q2'24 per la sua miniera di litio nordamericana (NAL) di proprietà congiunta. I punti salienti includono:

- Circa 14.000 dmt di concentato di spodumene spedite nel Q2'24

- Produzione trimestrale record di 49.660 dmt, in aumento del 23% rispetto al Q1'24

- Nuovi massimi trimestrali: 68% di recupero del litio e 83% di utilizzo dell'impianto di lavorazione

- Obiettivo di 96.500 dmt di spedizioni nel H2'24

- Dome di minerale frantumato ora operativo, si prevede un miglioramento nella produzione e nell'utilizzo

NAL ha raggiunto progressi significativi verso una produzione costante, con giugno che ha visto un 91% di utilizzo della molino e un record di produzione giornaliera di 919 dmt. Piedmont mira ad aumentare le spedizioni ai clienti contrattuali nel H2'24.

Piedmont Lithium (Nasdaq: PLL) anunció los resultados operativos del Q2'24 para su mina de litio en América del Norte (NAL), de propiedad conjunta. Los aspectos destacados incluyen:

- Se enviaron aproximadamente 14,000 dmt de concentrado de espodumena en el Q2'24

- Producción trimestral récord de 49,660 dmt, un aumento del 23% con respecto al Q1'24

- Máximos trimestrales nuevos: 68% de recuperación de litio y 83% de utilización de la planta de procesamiento

- Objetivo de 96,500 dmt de envíos para el H2'24

- La cúpula de mineral triturado ahora está operativa, se espera que mejore la producción y la utilización

NAL ha logrado un progreso significativo hacia una producción constante, con junio viendo un 91% de utilización del molino y un récord de producción diaria de 919 dmt. Piedmont aspira a aumentar los envíos a clientes contratados en el H2'24.

피에몬트 리튬 (Nasdaq: PLL)은 공동 소유하는 북미 리튬 (NAL) 광산의 Q2'24 운영 결과를 발표했습니다. 주요 하이라이트는 다음과 같습니다:

- Q2'24에 약 14,000 dmt의 스포듀미네 농축물이 출하되었습니다

- 분기 생산량 기록 경신: 49,660 dmt, Q1'24 대비 23% 증가

- 분기 최고: 리튬 회수율 68% 및 가공 공장 가동률 83%

- H2'24에 96,500 dmt 출하 목표 설정

- 파쇄된 광체 돔이 이제 가동 중이며, 생산 및 가동률 개선이 예상됩니다

NAL은 안정적인 생산을 향한 중요한 진전을 이루었으며, 6월에는 91% 밀 가동률과 하루 최대 생산량 919 dmt 기록을 달성했습니다. 피에몬트는 H2'24에 계약 고객에게의 출하량을 늘릴 계획입니다.

Piedmont Lithium (Nasdaq: PLL) a annoncé les résultats opérationnels du Q2'24 pour sa mine de lithium nord-américaine (NAL) détenue en commun. Les points clés incluent :

- Environ 14 000 dmt de concentré de spodumène expédié au Q2'24

- Production trimestrielle record de 49 660 dmt, en hausse de 23% par rapport au Q1'24

- Nouveaux records trimestriels : 68 % de récupération de lithium et 83 % d'utilisation de l'usine de traitement

- Objectif de 96 500 dmt d'expéditions pour le H2'24

- Dôme de minerai broyé désormais opérationnel, ce qui devrait améliorer la production et l'utilisation

NAL a réalisé des progrès significatifs vers une production à l'état stable, avec un taux d'utilisation du moulin de 91 % en juin et un record de production d'une journée de 919 dmt. Piedmont vise à augmenter les expéditions vers ses clients contractuels au H2'24.

Piedmont Lithium (Nasdaq: PLL) hat die Betriebsergebnisse des Q2'24 für seine gemeinsam betriebene Nordamerikanische Lithiummine (NAL) bekannt gegeben. Die wichtigsten Highlights sind:

- Ungefähr 14.000 dmt Spodumenkonzentrat im Q2'24 versandt

- Quartalsproduktion Rekord von 49.660 dmt, ein Anstieg von 23% im Vergleich zu Q1'24

- Neue Quartalsrekorde: 68% Lithium-Rückgewinnung und 83% Anlagenauslastung

- Ziel von 96.500 dmt Versand im H2'24

- Zerkleinerte Erzkuppel nun in Betrieb, Verbesserung der Produktion und Auslastung erwartet

NAL hat erhebliche Fortschritte in Richtung einer stabilen Produktion erzielt, mit einem 91% Mühlenauslastung im Juni und einem Rekord von 919 dmt an einem einzelnen Produktionstag. Piedmont strebt an, die Lieferungen an Vertragsanpassungskunden im H2'24 zu erhöhen.

- Record quarterly production of 49,660 dmt, up 23% from Q1'24

- New quarterly highs: 68% lithium recovery and 83% process plant utilization

- Targeting 96,500 dmt shipments in H2'24

- June saw 91% mill utilization and a single-day production record of 919 dmt

- Unit operating costs decreased by 2% quarter over quarter on a tons sold basis

- Crushed ore dome commissioning completed, expected to further improve production and utilization

- Shipped 14,000 dmt in Q2'24, down 10% from 15,500 dmt in Q1'24

- One shipment of approximately 14,000 dmt delayed from late Q2'24 to early Q3'24 due to port logistical issues

- Ore mined decreased by 33% compared to Q1'24

Insights

Piedmont Lithium's Q2'24 operational results for North American Lithium (NAL) demonstrate significant progress in production ramp-up, albeit with some logistical challenges. The record quarterly production of 49,660 dmt, up

Key positives include:

- Improved lithium recovery rate of

68% - Increased process plant utilization at

83% - Commissioning of the crushed ore dome, expected to further boost production

Challenges to note:

10% quarter-over-quarter decrease in concentrate shipped- Delayed shipment of 14,000 dmt due to port logistical issues

33% decrease in ore mined compared to Q1'24

The

The lithium market context is important for interpreting Piedmont's results. As one of the few active spodumene mines globally, NAL's strategic importance cannot be overstated. The production ramp-up comes at a time when the lithium market is experiencing volatility, with prices having declined from 2023 peaks but still remaining historically high.

Key market considerations:

- Growing demand from EV manufacturers and energy storage sectors

- Geopolitical push for domestic lithium production in North America

- Potential supply constraints as new projects face delays

Piedmont's position as a North American supplier aligns well with the U.S. government's efforts to secure critical minerals domestically. The company's multi-asset strategy, including projects in Quebec and Ghana, provides geographical diversification, potentially mitigating risks associated with any single operation.

However, investors should be aware of the competitive landscape. As more lithium projects come online globally, Piedmont will need to maintain cost competitiveness and production efficiency. The

The appointment of Lucas Dow as the new Managing Director and CEO of Sayona Mining could bring fresh perspectives to the joint venture, potentially influencing future strategic decisions and operational improvements at NAL.

-

Piedmont shipped approximately 14,000 dmt of spodumene concentrate in Q2’24; targets 96,500 dmt in H2’24 -

Record quarterly production of 49,660 dmt, up

23% from Q1’24 as NAL nears H2’24 steady-state production target -

New quarterly highs achieved for lithium recovery at

68% and process plant utilization at83% - Crushed ore dome now operational and expected to further improve production levels and utilization rates

Figure 1: North American Lithium Concentrate Production (Graphic: Business Wire)

Q2’24 Operational Results Summary

Piedmont Lithium |

Unit |

Q2’24 |

Q1’24 |

QoQ

|

2024

|

2023

|

YoY

|

Concentrate Shipped |

kt dmt |

14.0 |

15.5 |

( |

29.5 |

- |

n/m2 |

Average Grade |

% Li2O |

~ |

~ |

- |

~ |

- |

n/m |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAL1 |

Unit |

Q2’24 |

Q1’24 |

QoQ

|

2024

|

2023

|

YoY

|

Ore Mined |

kt wmt |

233.7 |

351.1 |

( |

584.8 |

338.4 |

|

Concentrate Produced |

kt dmt |

49.7 |

40.4 |

|

90.1 |

33.1 |

|

Plant (Mill) Utilization |

% |

|

|

|

|

|

|

Lithium Recovery |

% |

|

|

|

|

|

|

Concentrate Shipped |

kt dmt |

27.7 |

58.1 |

( |

85.8 |

- |

n/m |

|

|

|

|

|

|

|

|

In Q2’24, NAL produced 49,660 dmt and shipped 27,729 dmt, of which approximately 14,000 dmt of spodumene concentrate were sold to

NAL increased quarterly production by nearly

“As one of only a handful of active spodumene mines globally, NAL is a highly strategic asset with excellent operational performance as the ramp-up to steady-state production continues. With ongoing quarterly production records and the recent high-grade drill results of the 2023-2024 drill campaign, NAL has demonstrated significant progress and future potential,” said Keith Phillips, President and CEO of Piedmont Lithium. “As we enter the second half of the year, we look forward to increasing our shipments to contract customers. We welcome Mr. Lucas Dow as the newly appointed Managing Director and CEO of our partner, Sayona Mining, and we thank Mr. James Brown for his prior leadership.”

___________________

1 All references to information about or related to NAL are from the Quarterly Activities Report June 2024, filed with the ASX by Sayona Mining Limited on 25 July 2024.

About Piedmont Lithium

Piedmont Lithium Inc. (Nasdaq: PLL; ASX: PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in

Cautionary Note to U.S. Investors

Piedmont’s public disclosures are governed by the

The statements in the link below were prepared by, and made by, NAL. The following disclosures are not statements of

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of or as described in securities legislation in

View source version on businesswire.com: https://www.businesswire.com/news/home/20240725187668/en/

Erin Sanders

SVP, Corporate Communications & Investor Relations

T: +1 704 575 2549

E: esanders@piedmontlithium.com

Source: Piedmont Lithium