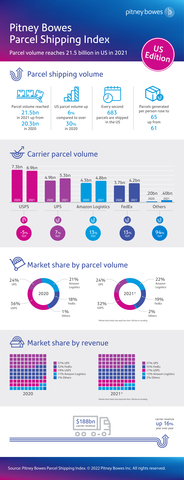

Pitney Bowes Parcel Shipping Index Finds US Parcel Volume Reached Record High of 21.5 Billion in 2021

Pitney Bowes reported a record US parcel volume increase of 6% in 2021, totaling 21.5 billion parcels. Carrier revenues surged by 16% year-over-year, reaching $188 billion. Notably, UPS held the highest share with 37% of carrier revenue. The report indicates continued growth in parcel volume, projected to hit between 25-40 billion by 2027, with a 5%-10% CAGR from 2022-2027. The resilience of the shipping industry amid pandemic challenges underscores the growing consumer reliance on online shopping.

- Record US parcel volume reached 21.5 billion in 2021, marking a 6% increase.

- Carrier revenues hit $188 billion, a 16% year-over-year growth.

- Growth forecast for US parcel volume predicts 25-40 billion by 2027 with a 5%-10% CAGR.

- USPS saw a decline in parcel volume from 7.3 billion in 2020 to 6.9 billion in 2021.

US data reveals continued parcel volume growth during second year of pandemic as carrier revenues increase 16 percent year-over-year

Pitney Bowes Parcel Shipping Index US data 2021 (Graphic: Business Wire)

The latest Index shows 59 million parcels were generated in the US each day in 2021 – totaling around 683 parcels per second - compared to 56 million shipped daily in 2020. Per capita parcel volume for the US rose from 62 to 65. For the first time the Parcel Shipping Index includes a ‘per household’ figure, revealing an average of 166 parcels shipped per US household during 2021.

“Last year saw the industry rocked by outside influences as carriers continued to manage the impact of the pandemic,” said

Key takeaways from the latest Index include:

-

Carrier Volume

- Parcel volume reached 21.5 billion in 2021, up from 20.3 billion in 2020, an increase of 6 percent

-

By volume,

USPS shipped 6.9 billion parcels in 2021 down from 7.3 billion in 2020;UPS shipped 5.3 billion parcels in 2021, up from 4.9 billion; and FedEx shipped 4.2 billion, up from 3.7 billion - The combined parcel volume from smaller carriers outside the top four, included in the 'Others' category, grew by 94 percent

-

Carrier revenue

-

Carriers collectively generated

$188 billion $163 billion -

UPS generated the highest carrier revenue with$70 billion $62 billion USPS ($31.5 billion $22 billion $3 billion - 'Others' grew revenue by 95 percent

-

UPS generated a 16 percent increase in revenue year-over-year, FedEx 21 percent growth andUSPS revenue was flat

-

Carriers collectively generated

-

Carrier market share

-

By revenue,

UPS generated the highest parcel market share of 37 percent followed by FedEx (33 percent),USPS (17 percent) and Amazon Logistics (12 percent) -

By volume,

USPS had the highest market share (32 percent, down from 36 percent in 2020), followed byUPS (24 percent, the same as in 2020), Amazon Logistics (22 percent, up from 21 percent) and FedEx (19 percent, up from 18 percent)

-

By revenue,

-

Amazon Logistics

-

Grew revenue to

$22 billion - Parcel volume growth slowed to 13 percent from 4.2 billion to 4.8 billion. In 2020, growth was 112 percent

- Parcels generated by Amazon reached 8.4 billion in 2021, of which 57 percent or 4.8 billion parcels were delivered by Amazon Logistics and 43 percent or 3.6 billion parcels were passed to carriers for last mile delivery. In 2020, Amazon passed 2.8 billion parcels to carriers for last mile delivery

-

Grew revenue to

Consumers’ online shopping behaviors continue to impact parcel volumes and carrier revenues, as some buying habits and preferences established during the pandemic remain firmly in place. BOXpoll™ by

Now in its seventh year, the Index has built a reputation as one of the industry’s most reliable sources of shipping and logistics intelligence. The global Pitney Bowes Shipping Index, which includes data from 13 countries, will be launched later this year, with data for the remaining 12 countries in the Index -

About the Pitney Bowes Parcel Shipping Index

The Pitney Bowes Parcel Shipping Index measures parcel volume and spend for business-to-business, business-to-consumer, consumer-to-business and consumer consigned shipments with weight up to 31.5kg (70 pounds) across

About

View source version on businesswire.com: https://www.businesswire.com/news/home/20220523005364/en/

M +1 518 708 3466

John.spadafora@pb.com

Marifer Rodriguez

M +1 203 940 3718

Marifer.rodriguez@pb.com

Source:

FAQ

What was the total parcel volume for Pitney Bowes in 2021?

How much did carrier revenues increase in 2021?

What is the projected growth of US parcel volume by 2027?

Which carrier generated the highest revenue in 2021?