Oxbridge Re Reports Update on its RWA Tokenized Security, its Business and Third Quarter 2024 Results

Oxbridge Re Holdings reported Q3 2024 results with a net loss of $540,000 ($0.09 per share), compared to a $7.3 million loss in Q3 2023. Net premiums earned increased to $595,000 from $549,000 year-over-year. The company's Web3/RWA subsidiary, SurancePlus, plans to issue two tranches of tokenized securities: a high-yield token targeting 42% return and a balanced yield token targeting 22% return. Total expenses decreased to $498,000 from $688,000 in Q3 2023. Cash and equivalents stood at $4.8 million as of September 30, 2024, up from $3.7 million at end-2023.

Oxbridge Re Holdings ha riportato i risultati del terzo trimestre 2024 con una perdita netta di $540.000 ($0,09 per azione), rispetto a una perdita di $7,3 milioni nel terzo trimestre 2023. I premi netti guadagnati sono aumentati a $595.000 rispetto a $549.000 rispetto all'anno precedente. La sussidiaria dell'azienda Web3/RWA, SurancePlus, prevede di emettere due tranche di titoli tokenizzati: un token ad alto rendimento che mira a un ritorno del 42% e un token a rendimento bilanciato che punta a un ritorno del 22%. Le spese totali sono diminuite a $498.000 rispetto a $688.000 nel terzo trimestre 2023. La liquidità e gli equivalenti ammontavano a $4,8 milioni al 30 settembre 2024, rispetto a $3,7 milioni alla fine del 2023.

Oxbridge Re Holdings reportó resultados del tercer trimestre de 2024 con una pérdida neta de $540,000 ($0.09 por acción), en comparación con una pérdida de $7.3 millones en el tercer trimestre de 2023. Las primas netas ganadas aumentaron a $595,000 desde $549,000 interanualmente. La subsidiaria Web3/RWA de la compañía, SurancePlus, planea emitir dos tramos de valores tokenizados: un token de alto rendimiento que apunta a un retorno del 42% y un token de rendimiento equilibrado que apunta a un retorno del 22%. Los gastos totales disminuyeron a $498,000 desde $688,000 en el tercer trimestre de 2023. El efectivo y equivalentes se situaron en $4.8 millones al 30 de septiembre de 2024, aumentando desde $3.7 millones a finales de 2023.

옥스브리지 리 홀딩스는 2024년 3분기 결과를 발표하며 54만 달러($0.09 주당)의 순손실을 기록했으며, 이는 2023년 3분기의 730만 달러 손실과 비교됩니다. 순수익 보험료는 전년 대비 54만9천 달러에서 59만5천 달러로 증가했습니다. 회사의 Web3/RWA 자회사인 SurancePlus는 두 개의 토큰화된 증권 트랜치를 발행할 계획입니다: 42% 수익을 목표로 하는 고수익 토큰과 22% 수익을 목표로 하는 균형 수익 토큰이 있습니다. 총 비용은 2023년 3분기의 68만8천 달러에서 49만8천 달러로 감소했습니다. 2024년 9월 30일 기준으로 현금 및 현금성 자산은 480만 달러로, 2023년 말의 370만 달러에서 증가했습니다.

Oxbridge Re Holdings a annoncé les résultats du troisième trimestre 2024 avec une perte nette de 540 000 $ (0,09 $ par action), contre une perte de 7,3 millions $ au troisième trimestre 2023. Les primes nettes gagnées ont augmenté à 595 000 $, contre 549 000 $ d'une année sur l'autre. La filiale Web3/RWA de l'entreprise, SurancePlus, prévoit d'émettre deux tranches de titres tokenisés : un token à haut rendement visant un retour de 42 % et un token à rendement équilibré visant un retour de 22 %. Les dépenses totales ont diminué à 498 000 $, contre 688 000 $ au troisième trimestre 2023. La trésorerie et les équivalents s'élevaient à 4,8 millions $ au 30 septembre 2024, en hausse par rapport à 3,7 millions $ à la fin de 2023.

Oxbridge Re Holdings berichtete über die Ergebnisse des dritten Quartals 2024 mit einem Nett Verlust von 540.000 $ (0,09 $ pro Aktie), verglichen mit einem Verlust von 7,3 Millionen $ im dritten Quartal 2023. Die verdienten Netto-Prämien stiegen von 549.000 $ im Jahr zuvor auf 595.000 $. Die Web3/RWA-Tochtergesellschaft des Unternehmens, SurancePlus, plant die Emission von zwei Tranchen tokenisierter Wertpapiere: ein Hochzins-Token mit einer Zielrendite von 42 % und ein ausgewogenes Rendite-Token mit einer Zielrendite von 22 %. Die Gesamtausgaben sanken im dritten Quartal 2023 von 688.000 $ auf 498.000 $. Der Bestand an Bargeld und Äquivalenten betrug zum 30. September 2024 4,8 Millionen $, im Vergleich zu 3,7 Millionen $ Ende 2023.

- Net premiums earned increased to $595,000 from $549,000 YoY

- Cash position improved to $4.8M from $3.7M at year-end 2023

- Total expenses decreased to $498,000 from $688,000 YoY

- Combined ratio improved to 83.7% from 125.3% YoY

- Zero loss ratio maintained in Q3 2024

- Q3 2024 net loss of $540,000 ($0.09 per share)

- Nine-month net loss of $2.27M ($0.37 per share)

- Expense ratio remains high at 83.7% despite improvement

Insights

The Q3 2024 results show mixed signals. While the company reduced its net loss to

The company's pivot towards tokenized reinsurance securities through SurancePlus is notable, targeting ambitious returns of

The integration of reinsurance with blockchain technology through SurancePlus represents an innovative approach to RWA tokenization. The partnership with Zoniqx, which has processed

However, the success will largely depend on market adoption and the ability to maintain compliance while delivering promised yields. The extensive conference participation suggests a strong focus on building industry connections and visibility, though tangible results from these marketing efforts are yet to be seen.

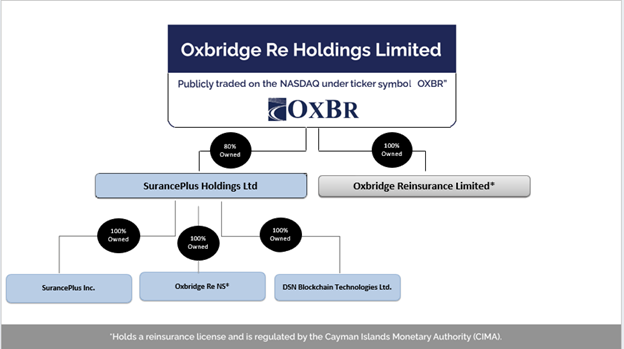

GRAND CAYMAN, Cayman Islands, Nov. 13, 2024 (GLOBE NEWSWIRE) -- Oxbridge Re Holdings Limited (NASDAQ: OXBR), (the “Company”), together with its subsidiaries which is engaged in the business of tokenized Real-World Assets (“RWAs”) initially in the form of tokenized reinsurance securities, and reinsurance solutions to property and casualty insurers in the Gulf Coast region of the United States, reported its results for the three and nine months ended September 30, 2024.

“We are energized by the progress of our Web3/RWA subsidiary, SurancePlus, which issues tokenized securities backed by reinsurance contracts as the underlying asset and currently launched on the Avalanche blockchain. SurancePlus seamlessly integrates SEC regulatory standards with blockchain technology, ensuring full transparency and compliance,” said Jay Madhu, Chairman and Chief Executive Officer. “By opening access to an asset class historically limited to a select few due to high financial barriers to entry, SurancePlus is breaking new ground. Leveraging RegD and RegS frameworks, investors can now enter this unique asset class within minutes, efficiently completing AML, KYC, and document signing requirements.”

Mr. Madhu continued, “Going forward, we intend to issue two tranches of tokenized securities, one high yield token targeting a

Marketing Strategy

As part of our comprehensive marketing strategy, we are actively participating in a series of prestigious global tech talks, conferences, and fintech events to further promote our brand and engage with industry leaders. Recent notable events that we have attended include RWA Day in Salt Lake City, Utah (October 8, 2024), Token 2049 in Singapore (September 18-19, 2024), Ripple Swell in Miami (October 15-16, 2024), Digital Assets Week in Singapore (November 4-5, 2024) and FinTech Festival in Singapore (November 6-8, 2024) for which our Chairman and CEO Jay Madhu participated as a speaker at some of above events.

In addition to these events, we are pleased to announce our upcoming participation in the following key industry conferences:

| ● | Abu Dhabi Business Week in Abu Dhabi (December 4-6, 2024) | |

| ● | Abu Dhabi Finance Week in Abu Dhabi (December 9-12, 2024) | |

| ● | Global Blockchain Congress in Dubai (December 12-13, 2024) |

We will continue to share updates on our participation in these events through press releases and look forward to connecting with key stakeholders across the digital assets, blockchain, and fintech sectors.

Financial Performance

For the three months ended September 30, 2024, the Company generated a net loss of

Net premiums earned for the three months ended September 30, 2024 were

There were no losses incurred for the three and nine months ended September 30, 2024 or 2023.

Total expenses were

At September 30, 2024, cash and cash equivalents, and restricted cash and cash equivalents were

Financial Ratios

Loss Ratio.

The loss ratio is the ratio of losses and loss adjustment expenses incurred to premiums earned and measures the underwriting profitability of our reinsurance business. The loss ratio remained consistent at

Acquisition Cost Ratio. The acquisition cost ratio is the ratio of policy acquisition costs and other underwriting expenses to net premiums earned. The acquisition cost ratio measures our operational efficiency in producing, underwriting and administering our reinsurance business.

The acquisition cost ratio increased marginally to

Expense Ratio.

The expense ratio is the ratio of policy acquisition costs and general and administrative expenses to net premiums earned. We use the expense ratio to measure our operating performance. The expense ratio decreased from

The expense ratio decreased from

Combined ratio.

We use the combined ratio to measure our underwriting performance. The combined ratio is the sum of the loss ratio and the expense ratio. The combined ratio decreased from

The combined ratio decreased from

Conference Call

Management will host a conference call later today to discuss these financial results, followed by a question and-answer session. President and Chief Executive Officer Jay Madhu and Chief Financial Officer Wrendon Timothy will host the call starting at 4:30 p.m. Eastern time. The live presentation can be accessed by dialing the number below or by clicking the webcast link available on the Investor Information section of the company’s website at www.oxbridgere.com.

Date: November 13, 2024

Time: 4.30 p.m. Eastern time

Toll-free number: 877 524-8416

International number: +1 412 902-1028

Passcode (required): 13746519

Please call the conference telephone number 10 minutes before the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact InComm Conferencing at 201 493-6280 or 877 804-2066

A replay of the call will be available by telephone after 4:30 p.m. Eastern time on the same day of the call and via the Investor Information section of Oxbridge’s website at www.oxbridgere.com until November 26th, 2024.

Toll-free replay number: 877-660-6853

International replay number: +1-201-612-7415

Conference ID: 13746519

About Oxbridge Re Holdings Limited

Oxbridge Re Holdings Limited (NASDAQ: OXBR, OXBRW) (“Oxbridge Re”) is headquartered in the Cayman Islands. The company offers tokenized Real-World Assets (“RWAs”) as tokenized reinsurance securities and reinsurance business solutions to property and casualty insurers, through its active subsidiaries SurancePlus Inc, Oxbridge Re NS, and Oxbridge Reinsurance Limited.

Insurance businesses in the Gulf Coast region of the United States purchase property and casualty reinsurance through our licensed reinsurers Oxbridge Reinsurance Limited and Oxbridge Re NS.

Our new Web3-focused subsidiary, SurancePlus Inc. (“SurancePlus”), has developed the first “on-chain” reinsurance RWA of its kind to be sponsored by a subsidiary of a publicly traded company. By digitizing interests in reinsurance contracts as on-chain RWAs, SurancePlus has democratized the availability of reinsurance as an alternative investment to both U.S. and non-U.S. investors.

Forward-Looking Statements

This press release may contain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “estimate,” “expect,” “intend,” “plan,” “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” contained in our Form 10-K filed with the Securities and Exchange Commission (“SEC”) on 26th March 2024. The occurrence of any of these risks and uncertainties could have a material adverse effect on the Company’s business, financial condition and results of operations. Any forward-looking statements made in this press release speak only as of the date of this press release and, except as required by law, the Company undertakes no obligation to update any forward-looking statement contained in this press release, even if the Company’s expectations or any related events, conditions or circumstances change.

Company Contact:

Oxbridge Re Holdings Limited

Jay Madhu, CEO

345-749-7570

jmadhu@oxbridgere.com

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Balance Sheets

(expressed in thousands of U.S. Dollars, except per share and share amounts)

| At September 30, 2024 | At December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Investments: | ||||||||

| Equity securities, at fair value (cost: | $ | 185 | $ | 680 | ||||

| Cash and cash equivalents | 1,409 | 495 | ||||||

| Restricted cash and cash equivalents | 3,412 | 3,250 | ||||||

| Premiums receivable | 1,365 | 977 | ||||||

| Other Investments | 541 | 2,478 | ||||||

| Loan Receivable | - | 100 | ||||||

| Due from Related Party | 63 | 63 | ||||||

| Deferred policy acquisition costs | 175 | 101 | ||||||

| Operating lease right-of-use assets | 100 | 9 | ||||||

| Prepayment and other assets | 72 | 96 | ||||||

| Property and equipment, net | 1 | 4 | ||||||

| Total assets | $ | 7,323 | $ | 8,253 | ||||

| Liabilities and Shareholders’ Equity | ||||||||

| Notes payable to noteholders | $ | 118 | $ | 118 | ||||

| Notes payable to Epsilon / DeltaCat Re Tokenholders | 1,485 | 1,523 | ||||||

| Unearned Premium Reserve | 1,586 | 915 | ||||||

| Operating lease liabilities | 100 | 9 | ||||||

| Accounts payable and other liabilities | 383 | 356 | ||||||

| Total liabilities | 3,672 | 2,921 | ||||||

| Shareholders’ equity: | ||||||||

| Ordinary share capital, (par value | $ | 6 | $ | 6 | ||||

| Additional paid-in capital | 33,325 | 32,740 | ||||||

| Accumulated Deficit | (29,680 | ) | (27,414 | ) | ||||

| Total shareholders’ equity | 3,651 | 5,332 | ||||||

| Total liabilities and shareholders’ equity | $ | 7,323 | $ | 8,253 | ||||

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARY

Consolidated Statements of Income (unaudited)

(expressed in thousands of U.S. Dollars, except per share and share amounts)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | ||||||||||||||||

| Assumed premiums | $ | - | $ | - | $ | 2,379 | $ | 2,195 | ||||||||

| Change in unearned premiums reserve | 595 | 549 | (671 | ) | (1,463 | ) | ||||||||||

| Net premiums earned | 595 | 549 | 1,708 | 732 | ||||||||||||

| SurancePlus management fee income | - | - | 312 | 300 | ||||||||||||

| Net investment and other income | 62 | 74 | 188 | 242 | ||||||||||||

| Interest and gain on redemption of loan receivable | - | - | 41 | - | ||||||||||||

| Unrealized loss gain on other investments | (424 | ) | (6,889 | ) | (1,937 | ) | (6,384 | ) | ||||||||

| Change in fair value of equity securities | (28 | ) | (115 | ) | (188 | ) | (34 | ) | ||||||||

| Total revenue | 205 | (6,381 | ) | 124 | (5,144 | ) | ||||||||||

| Expenses | ||||||||||||||||

| Policy acquisition costs and underwriting expenses | 66 | 60 | 188 | 80 | ||||||||||||

| General and administrative expenses | 432 | 628 | 1,486 | 1,708 | ||||||||||||

| Total expenses | 498 | 688 | 1,674 | 1,788 | ||||||||||||

| Loss before income attributable to noteholders and tokenholders | (293 | ) | (7,069 | ) | (1,550 | ) | (6,932 | ) | ||||||||

| Income attributable to noteholders and tokenholders | $ | (247 | ) | $ | (231 | ) | $ | (716 | ) | $ | (311 | ) | ||||

| Net loss | $ | (540 | ) | $ | (7,300 | ) | $ | (2,266 | ) | $ | (7,243 | ) | ||||

| Loss earnings per share | ||||||||||||||||

| Basic and Diluted | $ | (0.09 | ) | $ | (1.24 | ) | $ | (0.37 | ) | $ | (1.23 | ) | ||||

| Weighted-average shares outstanding | ||||||||||||||||

| Basic and Diluted | 6,121,020 | 5,870,234 | 6,045,542 | 5,866,083 | ||||||||||||

| Performance ratios to net premiums earned: | ||||||||||||||||

| Loss ratio | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | ||||||||

| Acquisition cost ratio | 11.1 | % | 10.9 | % | 11.0 | % | 10.9 | % | ||||||||

| Expense ratio | 83.7 | % | 125.3 | % | 98.0 | % | 244.3 | % | ||||||||

| Combined ratio | 83.7 | % | 125.3 | % | 98.0 | % | 244.3 | % | ||||||||

Attachment