Legion Partners Issues Letter to OneSpan Stockholders

Legion Partners Asset Management, holding 2,790,121 shares (6.9% ownership) of OneSpan (OSPN), has nominated four independent director candidates for the 2021 Annual Meeting. The nominees—Sarika Garg, Rinki Sethi, Michael J. McConnell, and Sagar Gupta—are expected to bring substantial modern software and cybersecurity expertise to OneSpan's Board. Legion argues the current Board lacks relevant experience and has overseen underperformance. They advocate for financial transparency, improved governance, and strategic oversight to enhance shareholder value.

- Nomination of four independent candidates with significant software and cybersecurity experience.

- Focus on transitioning OneSpan to a cloud-first model, reflecting modern industry trends.

- Current Board members perceived as lacking relevant experience in modern software and hardware sectors.

- Claims of insufficient financial disclosure and governance practices.

Legion Partners Asset Management, LLC, which, together with the other participants in its solicitation (collectively, “Legion Partners” or “Legion”), beneficially owns 2,790,121 shares of common stock of OneSpan Inc. (“OneSpan” or the “Company”) (Nasdaq: OSPN), representing approximately

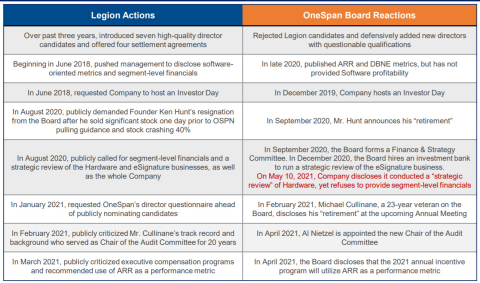

Table 1 (Graphic: Business Wire)

The full text of the letter is below:

May 26, 2021

Dear Fellow OneSpan Stockholders:

As significant long-term owners of OneSpan stock, holding more than

Despite the Company’s claims, most of the current directors lack hardware and/or modern software experience. Further, OneSpan has misleadingly portrayed its Board members’ legacy, low-growth and on-premise software company experience as relevant. That is why we have recruited and nominated a world-class group of technologists, operators, executives and investors who have overseen, led and invested in numerous successful modern public software and hardware companies. We believe our candidates are objectively better qualified to oversee the task at hand than the Company’s nominees:

- Sarika Garg, most recently Chief Strategy Officer at Tradeshift, will bring significant software operational, sales, technology and M&A leadership experience to the Board. She is widely considered a world-renowned expert on SaaS operations, sales and architectures – particularly in the fintech space – and was featured as a speaker at the World Economic Forum in Davos on leadership in the tech industry. Prior to Tradeshift, Ms. Garg spent over a decade at SAP, the world’s largest enterprise software company, including as a top executive in the Office of the CEO overseeing the firm’s transition to the cloud and its numerous multi-billion dollar cloud acquisitions.

-

Rinki Sethi, Chief Information Security Officer at Twitter, a

$46 billion market cap company, will bring significant cybersecurity software and hardware, and technical M&A leadership experience to the Board. She is an award-winning leader in security innovation who has managed and developed security infrastructure for Fortune 500 companies and brings prior product, strategy and M&A experience from Palo Alto Networks, a world-class cloud-first cybersecurity firm.

- Michael McConnell will bring extensive executive, operational, governance and investment know-how to the Board – particularly in the technology and software space. He has 20+ years of experience as a public company non-executive Board member and CEO – giving him operating and public company investor expertise – and has served on 16 public company boards, including those of cloud-first recurring revenue software companies.

- Sagar Gupta, Senior Analyst, Head of TMT Investing at Legion, would bring the perspective of a major shareholder as well as deep expertise in software public equities investing, including leading numerous successful cloud-first recurring revenue software investments at Legion Partners and prior firms. Considering the space the Company operates in, he will bring much needed age diversity to the Board.

The bottom line is that a modern public software company needs to be led by individuals with modern software experience. Our nominees would bring the right C-level operational expertise, technical, cybersecurity, capital allocation and capital markets experience and governance and investment backgrounds that are needed on the Board at this time.

In contrast, the four directors we are seeking to replace – John Fox, Jean Holley, Matthew Moog and Marc Zenner – have, for the most part, presided over long periods of underperformance and appear to lack experience at modern software and hardware public companies. They have no comparable operating experience at software or hardware companies, no Board experience at any other public software or hardware companies, no apparent investment experience in public software or hardware companies and no cybersecurity technical experience.

Disappointingly, at a time when the Company should be looking to the future, it has instead chosen to re-litigate the past. Contrary to what OneSpan recently said, Legion has not dropped any of its ideas. Legion continues to believe the following must be addressed to improve the Company’s valuation:

- Improve financial disclosures, including separating Software gross and operating margins from Hardware, to better enable a sum-of-the-parts valuation approach in the public markets;

- Form a detailed capital allocation framework and diligently oversee all capital deployment, including potential M&A, to ensure better integration of businesses and achievement of long-term accretive returns for stockholders;

- Improve strategic oversight to ensure hardware mistakes, such as failing to innovate, including by utilizing new form factors, are not repeated with software;

- Redesign executive compensation to better align with long-term stockholder value creation to avoid perverse incentives toward legacy solutions that are inconsistent with the Company’s go-forward strategy;

- Implement best practices in governance, improve Board diversity, and establish broader ESG frameworks; and

- Objectively evaluate all strategic alternatives, including the exploration of strategic partnerships and alternative paths toward monetizing assets.

The Company’s false narrative about our ideas is yet another example of OneSpan making misleading statements – some of which we detailed in our recent presentation. As the Company itself admits, we have spent years attempting to help management including by making specific suggestions that would likely not have been adopted without our pressure – as illustrated by Table 1.

And, despite hollow promises of committee leadership refreshment, the single change the Board has made this year has been to make Al Nietzel Chair of the Audit Committee.

In the face of our significant efforts to collaborate on refreshment, the Board has rejected our highly qualified nominees and instead defensively added new directors with questionable qualifications and fit, as well as prior connections to existing directors. Consider the following:

- Marianne Johnson, who was added to the Board in March of 2020, informed us that she was connected to Jean Holley through “the Atlanta tech community” and they are members of the same non-profit. Ms. Johnson also had a four-year overlap in the Strategy group at Equifax with Garry Capers, who joined the Board in April 2021. Equifax was founded in 1899 and has low-single-digit organic growth.

- Board member Al Nietzel’s experience is from CDK Global, which develops legacy software for automobile dealerships and has low-single-digit organic growth. Together with Ms. Johnson, who works at Cox Automotive, the two bring a combined six years of experience from that space.

- Further, Messrs. Nietzel and Capers bring a combined 13 years of experience working at ADP, which is a legacy payroll processor and HR company – and which, incidentally, also has low-single-digit organic growth.

-

Finally, Mr. Capers, who the Company admits was recommended by another independent member of the Board, comes from a physical check printing company where he leads a “cloud solutions” segment that accounts for less than

15% of total 2020 Deluxe revenues and offers web hosting and design, logo design, reporting, incorporation and marketing services.

Notably, there is a curious pattern of geographic overlap and concentration among the incumbent directors. Ms. Holley, Ms. Johnson and Mr. Capers all reside in the Atlanta area, with Ms. Johnson and Mr. Capers being added to the Board after Ms. Holley moved from the Chicago area to the Atlanta area. Similarly, four existing directors currently reside in the Chicago area. These sorts of boardroom connections can lead to a lack of independence and robust debate, which ultimately is not good for stockholders.

The time for real change has come. OneSpan’s legacy directors can no longer be allowed to preside over a heavily discounted valuation while occupying seats on the Board of a Company for which their own experience and backgrounds were arguably never a fit.

We urge stockholders to support all four of Legion’s nominees by voting on the White proxy card.

Sincerely,

Chris Kiper and Ted White

Legion Partners Asset Management, LLC

For more information about Legion’s case for change at OneSpan, please visit https://protectonespan.com/.

VOTE FOR LEGION’S FOUR NOMINEES ON THE WHITE PROXY CARD TODAY

About Legion Partners

Legion Partners is a value-oriented investment manager based in Los Angeles, with a satellite office in Sacramento, CA. Legion Partners seeks to invest in high-quality businesses that are temporarily trading at a discount, utilizing deep fundamental research and long-term shareholder engagement. Legion Partners manages a concentrated portfolio of North American small-cap equities on behalf of some of the world’s largest institutional and HNW investors.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210526006109/en/

FAQ

What is Legion Partners' stake in OneSpan (OSPN)?

Who are the nominees proposed by Legion Partners for OneSpan's Board?

What changes does Legion Partners propose for OneSpan?

What are the concerns regarding OneSpan's current Board?