O3 Mining Expands Mineralization at Alpha on its Bulldog Deposit and Kappa Zone

O3 Mining (TSXV: OIII | OTCQX: OIIIF) has reported significant progress in its 250,000 metre drilling program at the Alpha property in Val-d'Or, Québec. The latest findings from 16 holes at the Bulldog deposit show an average gold grade of 5.3 g/t over 6.0 metres. Notable intercepts include 2.8 g/t Au over 14.1 metres and 9.5 g/t Au over 4.8 metres. The ongoing drilling aims to convert existing resources and discover new deposits, supported by a fully-funded program, enhancing the potential for future resource upgrades.

- 16 successful drill holes at Bulldog deposit indicating substantial gold presence.

- Average gold grade of 5.3 g/t over significant intervals suggests solid mineralization.

- Ongoing drilling program fully funded and strategically aimed at resource expansion and new discoveries.

- None.

Insights

Analyzing...

TSXV:OIII | OTCQX:OIIIF - O3 Mining

TORONTO, Aug. 5, 2021 /PRNewswire/ - O3 Mining Inc. (TSXV: OIII) (OTCQX: OIIIF) ("O3 Mining" or the "Corporation") is pleased to provide an update on its fully-funded 250,000 metre drilling program at its Marban and Alpha properties in Val-d'Or, Québec, Canada which seeks to convert, expand, and discover new gold resources. The Company is reporting 16 holes drilled on the Alpha property.

Alpha

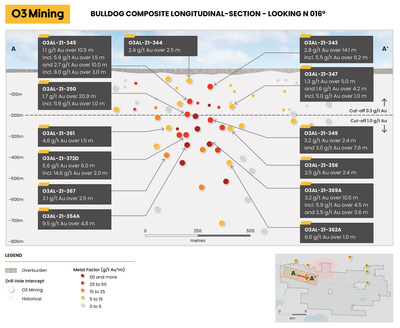

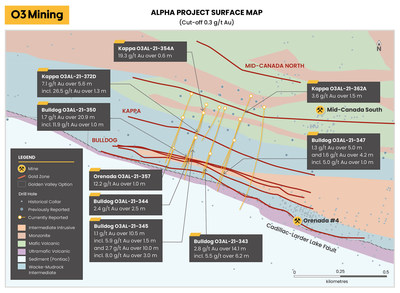

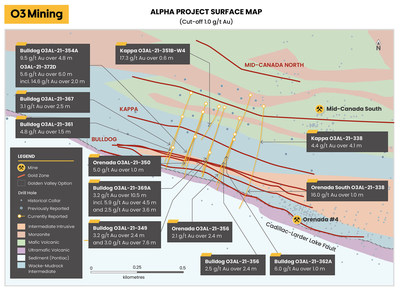

The core of the Bulldog deposit now counts a total of 16 intercepts with a grade-thickness above 15 g/t Au * metre within an area covering 200 metres along strike and 400 metres down dip at an average of 5.3 g/t Au over 6.0 metres. The deposit remains open at depth and toward the west.

Drilling Highlights:

- 2.8 g/t Au over 14.1 metres including 5.5 g/t Au over 6.2 metres in hole O3AL-21-343 only 65 metres below surface on the Bulldog deposit;

- 9.5 g/t Au over 4.8 metres in hole O3AL-21-354A at a vertical depth of 340 metres on the Bulldog deposit;

- 7.1 g/t Au over 5.6 metres including 26.5 g/t Au over 1.3 metres in hole O3AL-21-372D at a vertical depth of 150 metres on the Kappa zone which remains open at depth.

A 3D-model of the Alpha project is available on the Company's website at: https://o3mining.com/presentations/drill-results

The Corporation continues to extend gold mineralization with the potential to increase resources within trucking distance of the 1,600 tpd Aurbel Mill ("Aurbel"). On May 14, 2020, O3 Mining signed an option agreement with QMX Gold Corporation (acquired by Eldorado Gold on January 2021) to acquire a

O3 Mining's President and Chief Executive Officer, Mr. Jose Vizquerra commented, "I am very excited about today's results at Bulldog which give us confidence in the robustness of the deposit in terms of grade, thickness and continuity, and will also allow us to better design the upcoming 2022 winter drilling program to extend the Bulldog deposit toward the west and at depth where it remains open. Also, the potential of the Alpha property is encouraging as we continue to drill on the Kappa zone which extends at depth and remains completely open in all directions."

Table 1: Drill Hole Intercepts (only intercepts above 5 g/t Au * m are reported, cut-off 0.3 g/t Au and above 200 vertical metres)

Drill Hole | From | To | Interval | Au (g/t) | Zone |

O3AL-21-343 | 79.0 | 93.1 | 14.1 | 2.8 | Bulldog |

including | 86.9 | 93.1 | 6.2 | 5.5 | |

O3AL-21-344 | 80.5 | 83.0 | 2.5 | 2.4 | |

O3AL-21-345 | 87.0 | 97.5 | 10.5 | 1.1 | |

including | 94.5 | 96.0 | 1.5 | 5.9 | |

and | 179.5 | 189.5 | 10.0 | 2.7 | |

including | 184.0 | 187.0 | 3.0 | 8.0 | |

O3AL-21-347 | 241.5 | 246.5 | 5.0 | 1.3 | |

and | 286.8 | 291.0 | 4.2 | 1.6 | |

including | 288.0 | 289.0 | 1.0 | 5.0 | |

O3AL-21-350 | 312.5 | 333.4 | 20.9 | 1.7 | |

including | 318.0 | 319.0 | 1.0 | 11.9 | |

O3AL-21-354A | 95.2 | 95.8 | 0.6 | 19.3 | Kappa

|

O3AL-21-362A | 175.5 | 177.0 | 1.5 | 3.6 | |

O3AL-21-372D | 179.4 | 185.0 | 5.6 | 7.1 | |

including | 180.9 | 182.2 | 1.3 | 26.5 | |

O3AL-21-357 | 140.6 | 141.6 | 1.0 | 12.2 | Orenada |

Table 2: Drill Hole Intercepts (only intercepts above 5 g/t Au * m are reported, cut-off 1.0 g/t Au and under 200 vertical metres)

Drill Hole | From | To | Interval | Au (g/t) | Zone |

O3AL-21-349 | 300.0 | 302.4 | 2.4 | 3.2 | Bulldog |

and | 314.6 | 322.2 | 7.6 | 3.0 | |

O3AL-21-354A | 452.7 | 457.5 | 4.8 | 9.5 | |

O3AL-21-356 | 377.9 | 380.3 | 2.4 | 2.5 | |

O3AL-21-361 | 331.4 | 332.9 | 1.5 | 4.8 | |

O3AL-21-362A | 552.5 | 553.5 | 1.0 | 6.0 | |

O3AL-21-367 | 500.9 | 503.4 | 2.5 | 3.1 | |

O3AL-21-369A | 437.5 | 448.0 | 10.5 | 3.2 | |

including | 440.5 | 445.0 | 4.5 | 5.9 | |

and | 456.6 | 460.2 | 3.6 | 2.5 | |

O3AL-21-372D | 385.0 | 391.0 | 6.0 | 5.6 | |

including | 389.0 | 391.0 | 2.0 | 14.6 | |

O3AL-21-338 | 568.4 | 572.5 | 4.1 | 4.4 | Kappa

|

O3AL-21-351B-W4 | 694.0 | 694.6 | 0.6 | 17.3 | |

O3AL-21-350 | 376.0 | 377.0 | 1.0 | 5.0 | Orenada |

O3AL-21-356 | 457.2 | 459.6 | 2.4 | 2.1 | |

O3AL-21-338 | 1057.0 | 1058.0 | 1.0 | 16.0 | Orenada South |

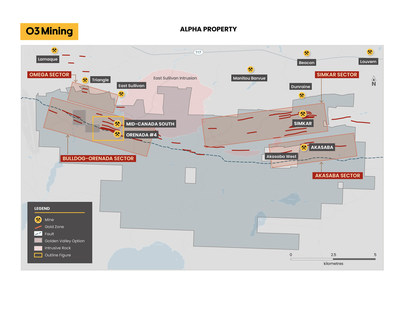

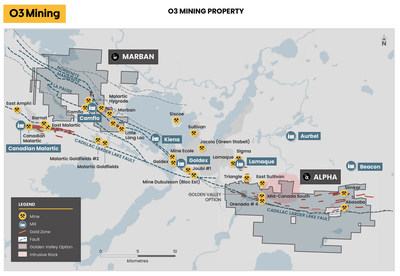

Figure 1: Alpha Project Drilling Map

Figure 2: Bulldog Composite Longitudinal-Section – Looking N016O

Figure 3: Alpha Property Surface Map (Cut-off 0.3 g/t Au and above 200 vertical metres)

Figure 4: Alpha Property Surface Map (Cut-off 1.0 g/t Au and under 200 vertical metres)

Drilling Update

The Corporation drilled 86,000 metres during 2019 and 2020 on its Val-d'Or properties testing for Potential Economic Material ("PEM") with 100-metre step-outs aiming to expand current resources of 2.4 million ounces measured and indicated (62.0 Mt @ 1.22 g/t Au)1 and 1.5 million ounces inferred (20.2 Mt @ 2.27 g/t Au)1 and make new discoveries. All intercepts listed in todays news release from Bulldog will be used to convert PEM to inferred resources and will be included in a updated resource for Alpha which is expected to be released during the second half of 2022.

Figure 5: Marban and Alpha Properties Overview

Marban – Project Development

The Marban project is in the heart of the Malartic gold mining camp. It covers 7,525 hectares, and is located 12 kilometres from the Canadian Malartic Mine. The Marban PEA outlined production of an average 115,000 ounces of gold per year over the 15.2 year mine life.

Drilling at Marban has focused on expanding mineralization in and outside of the proposed PEA pit areas, as well as discovering new mineralization for an underground mining scenario. An 80,000 metre drill program is being executed this year, with 27,000 metres drilled so far. There will be up to eight drill rigs testing for PEM, as well as, aiming to convert resources from Inferred to Measured and Indicated, to ultimately become part of Marban's maiden mineral reserve.

A PEA was completed on the project in 2020, and a Pre-Feasibility Study ("PFS") is currently underway and due to be completed in 2022 as the next step to advance the project to production. O3 Mining aims to become a leading gold producer and put the Marban project into production by 2026.

Alpha – Advanced Exploration

The Alpha property is located 8 kilometres east of Val-d'Or, Québec, and 3 kilometres south of the El Dorado Lamaque Mine. The property covers more than 7,754 hectares and includes 20 kilometres of the prolific Cadillac Break. O3 Mining has an option agreement that grants the right to acquire 100 per cent interest in the Aurbel Mill located only 10 kilometres from the Alpha property for C

Drilling at Alpha is at an earlier stage than at Marban and has focused on grassroots exploration, deposit delineation, and resource expansion. A 56,000 metre program is being executed this year with 38,000 metres completed year to date. O3 Mining will have up to three drill rigs testing for new discoveries using its PEM drilling strategy as well as focusing on deposit delineation and expansion of the current resource.

1/ Mineral Inventory: i) Marban Technical Report 2020, ii) Orenada Technical Report 2018, iii) Akasaba Technical Report 2014, iv) Simkar Gold Technical Report 2015, v) East Cadillac Technical Report 2017, vi) Sleepy Technical Report 2014

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved by Mr. Louis Gariepy. (OIQ #107538), VP Exploration, who is a "qualified person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Quality Control and Reporting Protocols

True width determination is currently unknown but is estimated at 65

About O3 Mining Inc.

O3 Mining Inc., an Osisko Group company, is a gold explorer and mine developer on the road to produce from its highly prospective gold camps in Québec, Canada. O3 Mining benefits from the support, previous mine-building success, and expertise of the Osisko team as it grows towards being a gold producer with several multi-million ounce deposits in Québec.

O3 Mining is well-capitalized and owns a

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. The information in this news release about the transaction; and any other information herein that is not a historical fact may be "forward-looking information". Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "interpreted", "management's view", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the restart of operations; further steps that might be taken to mitigate the spread of COVID-19; the impact of COVID-19 related disruptions in relation to the Corporation's business operations including upon its employees, suppliers, facilities and other stakeholders; uncertainties and risk that have arisen and may arise in relation to travel, and other financial market and social impacts from COVID-19 and responses to COVID 19. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Corporation nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Corporation does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/o3-mining-expands-mineralization-at-alpha-on-its-bulldog-deposit-and-kappa-zone-301349009.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/o3-mining-expands-mineralization-at-alpha-on-its-bulldog-deposit-and-kappa-zone-301349009.html

SOURCE O3 Mining Inc.