Osisko Development Reports Third Quarter 2024 Results

Osisko Development (NYSE: ODV) reports Q3 2024 results with $40.8 million in cash and equivalents. The company sold 47 ounces of gold from Cariboo Gold Project, generating $0.2 million in revenues. A mandatory prepayment of US$4.6 million was completed following a private placement. The company completed two significant private placements: a non-brokered placement raising US$34.5 million and a brokered placement raising US$57.5 million. At Cariboo Gold Project, permitting progress continues with final decisions expected in Q4 2024. The company is advancing an optimized feasibility study anticipated for Q2 2025. The Tintic Project completed drilling programs targeting copper-gold-molybdenum porphyry mineralization.

Osisko Development (NYSE: ODV) riporta i risultati del terzo trimestre 2024 con 40,8 milioni di dollari in contante e equivalenti. L'azienda ha venduto 47 once d'oro dal Cariboo Gold Project, generando 0,2 milioni di dollari di entrate. Un pagamento anticipato obbligatorio di 4,6 milioni di dollari americani è stato completato a seguito di un collocamento privato. L'azienda ha concluso due importanti collocamenti privati: un collocamento non mediato che ha raccolto 34,5 milioni di dollari americani e un collocamento mediato che ha raccolto 57,5 milioni di dollari americani. Al Cariboo Gold Project, i progressi nelle autorizzazioni continuano con decisioni finali attese nel quarto trimestre del 2024. L'azienda sta portando avanti uno studio di fattibilità ottimizzato previsto per il secondo trimestre del 2025. Il Tintic Project ha completato programmi di perforazione mirati alla mineralizzazione di porfiria di rame-oro-molibdeno.

Osisko Development (NYSE: ODV) informa los resultados del tercer trimestre de 2024 con 40.8 millones de dólares en efectivo y equivalentes. La empresa vendió 47 onzas de oro del Cariboo Gold Project, generando 0.2 millones de dólares en ingresos. Se completó un prepago obligatorio de 4.6 millones de dólares estadounidenses tras una colocación privada. La empresa llevó a cabo dos colocaciones privadas significativas: una colocación no mediada que recaudó 34.5 millones de dólares estadounidenses y una colocación mediada que recaudó 57.5 millones de dólares estadounidenses. En el Cariboo Gold Project, continúa el progreso en la obtención de permisos con decisiones finales esperadas para el cuarto trimestre de 2024. La empresa está avanzando en un estudio de viabilidad optimizado, previsto para el segundo trimestre de 2025. El Tintic Project completó programas de perforación orientados a la mineralización de pórfido de cobre-oro-molibdeno.

오시스코 개발 (NYSE: ODV)는 2024년 3분기 결과를 보고하며 현금 및 현금성 자산이 4080만 달러라고 밝혔습니다. 이 회사는 카리부 골드 프로젝트에서 47온스의 금을 판매하여 20만 달러의 수익을 올렸습니다. 사모 배치 후 460만 달러의 의무 선불이 완료되었습니다. 이 회사는 3450만 달러를 모금한 비중개 방식과 5750만 달러를 모금한 중개 방식을 포함하여 두 차례의 중요한 사모 배치를 완료했습니다. 카리부 골드 프로젝트에서 허가 진행이 계속되고 있으며, 최종 결정은 2024년 4분기에 예상됩니다. 이 회사는 2025년 2분기에 예상되는 최적화된 타당성 연구를 추진하고 있습니다. 틴틱 프로젝트는 구리-금-몰리브데늄 포르피리 미네랄화를 목표로 하는 드릴링 프로그램을 완료했습니다.

Osisko Development (NYSE: ODV) publie les résultats du troisième trimestre 2024, avec 40,8 millions de dollars en liquidités et équivalents. L'entreprise a vendu 47 onces d'or provenant du Cariboo Gold Project, générant 0,2 million de dollars de revenus. Un prépaiement obligatoire de 4,6 millions de dollars a été effectué à la suite d'un placement privé. L'entreprise a réalisé deux placements privés significatifs : un placement non médié par lequel 34,5 millions de dollars ont été levés et un placement médié par lequel 57,5 millions de dollars ont été levés. Pour le Cariboo Gold Project, l'avancement des permis se poursuit, avec des décisions finales attendues au quatrième trimestre 2024. L'entreprise avance dans une étude de faisabilité optimisée prévue pour le deuxième trimestre 2025. Le projet Tintic a complété des programmes de forage ciblant la minéralisation porphyrique de cuivre-or-molybdène.

Osisko Development (NYSE: ODV) berichtet über die Ergebnisse des dritten Quartals 2024 mit 40,8 Millionen US-Dollar in Barmitteln und Äquivalenten. Das Unternehmen verkaufte 47 Unzen Gold aus dem Cariboo Gold Project und erzielte damit Einnahmen von 0,2 Millionen US-Dollar. Eine obligatorische Vorauszahlung von 4,6 Millionen US-Dollar wurde nach einer Privatplatzierung abgeschlossen. Das Unternehmen hat zwei bedeutende Privatplatzierungen abgeschlossen: eine nicht vermittelte Platzierung, die 34,5 Millionen US-Dollar raised hat, und eine vermittelte Platzierung, die 57,5 Millionen US-Dollar raised hat. Im Cariboo Gold Project geht der Genehmigungsprozess weiter, mit finalen Entscheidungen, die im vierten Quartal 2024 erwartet werden. Das Unternehmen arbeitet an einer optimierten Machbarkeitsstudie, die für das zweite Quartal 2025 erwartet wird. Das Tintic-Projekt hat Bohrprogramme zur Zielmineralisierung von Kupfer-Gold-Molybdän-Porphyr abgeschlossen.

- Successful completion of private placements raising approximately US$92 million

- Strong cash position of $40.8 million

- Permitting process for Cariboo Gold Project nearing completion

- 90% completion of bulk sample development at Cariboo Gold Project

- Significant revenue decline to $0.2 million in Q3 2024 from $10.4 million in Q3 2023

- Fully drawn term loan of US$50.0 million

- San Antonio Gold Project remains under care and maintenance

- No agreement reached with Xatśūll First Nation for Cariboo Project

Insights

The Q3 2024 results reveal significant financial developments for Osisko Development. With

The successful completion of both non-brokered and brokered private placements, including strategic investment from Condire Investors, demonstrates strong market confidence. The company's focus on the Cariboo Gold Project's development, with anticipated permit decisions in Q4 2024 and an optimized feasibility study in Q2 2025, positions it for potential growth, though execution risks remain.

The Cariboo Gold Project shows promising advancement with 90% completion of the bulk sample development drift and all major permits pending final decisions. The project's optimization plans to accelerate throughput to 4,900 tonnes per day could enhance its economic potential. The strategic review of the San Antonio project and exploration progress at Tintic, particularly the identification of new porphyry targets, demonstrates portfolio diversification.

Key technical milestones, including the bulk sample completion in Q1 2025 and upcoming feasibility study, will be important valuation catalysts. The company's ability to secure significant funding while advancing multiple projects indicates strong project management, though operational execution and permitting timelines remain critical factors.

(All monetary references are expressed in Canadian dollars, unless otherwise indicated)

MONTREAL, Nov. 13, 2024 (GLOBE NEWSWIRE) -- Osisko Development Corp. (NYSE: ODV, TSXV: ODV) ("Osisko Development" or the "Company") reports its financial and operating results for the three months ended September 30, 2024 ("Q3 2024").

Q3 2024 HIGHLIGHTS

Operating, Financial and Corporate Updates:

- As at September 30, 2024, the Company had approximately

$40.8 million in cash and cash equivalents. An amount of approximately$67.7 million (US$50.0 million ) was fully drawn as at September 30, 2024 under the delayed draw term loan with National Bank of Canada maturing October 31, 2025.- Following the completion of the non-brokered private placement on October 14, 2024 (see Subsequent to Q3 2024) and pursuant to the credit facility agreement, the Company completed a mandatory prepayment of US

$4.6 million on October 29, 2024.

- Following the completion of the non-brokered private placement on October 14, 2024 (see Subsequent to Q3 2024) and pursuant to the credit facility agreement, the Company completed a mandatory prepayment of US

- 47 ounces of gold sold by the Company from operating activities in the third quarter from the Cariboo Gold Project ("Cariboo Gold Project") by processing stockpiles at a third-party facility.

$0.2 million in revenues ($10.4 million in Q3 2023) and$0.1 million in cost of sales ($10.1 million in Q3 2023) generated from operating activities.- Effective July 4, 2024, as part of its annual compensation review, the Board of Directors approved the grant of an aggregate of 2,797,400 incentive stock options and an aggregate of 371,800 restricted share units to certain senior officers of the Company in accordance with the terms of the Company's Option and RSU plans.

Cariboo Gold Project – British Columbia, Canada (

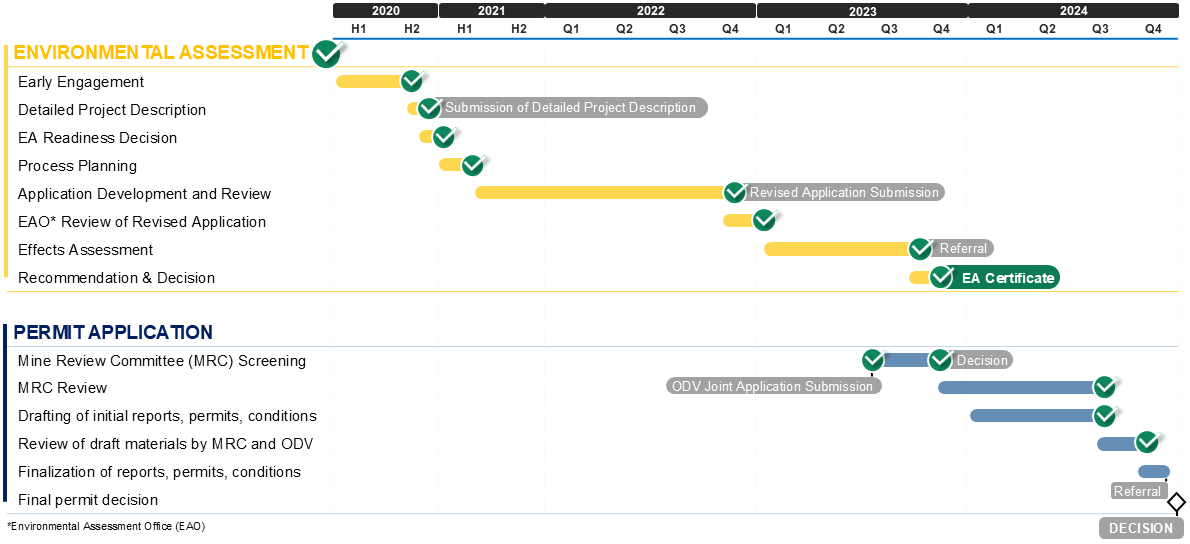

- Permitting Progress. Receipt of the EA Certificate in October 2023 successfully concluded the EA process for the Cariboo Gold Project (see Figure 1).

- The BC Mines Act permit has been referred for decision to the statutory decision maker in the BC Ministry of Energy, Mines and Low Carbon Innovation. The review of the Environmental Management Act permits has been completed, as well, and the Company is awaiting referral thereof to the statutory decision maker in the immediate future. The Company anticipates receiving final decisions in Q4 2024.

- On November 7, 2024, the Company announced that while it had yet to reach an agreement with the Xatśūll First Nation, it would continue to engage and consult with Xatśūll First Nation, including after any decision on the permits.

- The Company continues to explore project funding options, including fully-funded solutions for the Cariboo Gold Project.

- Pre-Construction Activities. During Q1 2024, under an existing provincial permit, the Company commenced an underground development drift from the existing Cow Portal into the Cariboo Gold Project's mineral deposit at the Lowhee Zone. The objective of the bulk sample work program is to reach the ore body and extract a 10,000 tonne bulk sample of mineralized material for ore sorter, heavy equipment and mining testing.

- To date, approximately 1,050 meters of development has been completed or approximately

90% , with another 122 meters remaining to reach the target area. - The Company anticipates completing the bulk sample program and the results thereof in Q1 2025.

- To date, approximately 1,050 meters of development has been completed or approximately

- Optimized Feasibility Study. The Company is advancing work on an optimized feasibility study ("OFS") for the Cariboo Gold Project, which is anticipated to be completed in Q2 2025. The scope of the OFS will take into account and include, among other things, certain mining and processing flowsheet optimizations including an accelerated development timeline to 4,900 tonnes per day throughput, updated metal price and foreign exchange assumptions, and updated operating and capital cost estimates to reflect the current environment. The OFS will follow the framework set out in the existing ongoing permitting process.

Figure 1: Cariboo Gold Project – Permitting Timeline Summary

- Wildfire Response. On July 22, 2024, the Company temporarily paused non-essential activities at its Cariboo Gold Project following a wildfire evacuation order that included the Project. The wildfire evacuation order was lifted on July 25, 2024, and normal course operations and site activities at the Cariboo Gold Project resumed on July 26, 2024. The mine site infrastructure was unaffected by the wildfires.

Tintic Project – Utah, U.S.A. (

- Porphyry Target Drilling. Two surface diamond drill holes totalling approximately 2,920 meters ("m") (9,581 feet ("ft")) have been completed at the Big Hill target area testing for copper-gold-molybdenum porphyry mineralization potential. One diamond drill hole was completed from underground testing porphyry-style mineralization down plunge of the mineralized structures below Trixie to a depth of 759.6 m (2,492 ft) (Trixie West). Based on the geological information from these drill holes, the Company has identified several high-priority targets for the next phase of the porphyry exploration program, including:

- Big Hill West Porphyry Target. The results of the recent and historical drill holes suggest that the early and potentially better mineralized intrusive phase could be in an untested area immediately west and southwest of the area drilled at Big Hill.

- Zuma High-Potential Porphyry Target. The Zuma area has been identified as a good porphyry target that merits initial drill testing and may represent one of the causative porphyry centres of the East Tintic district.

- Lower Quartzite CRD Target. Based on the compilation of geological, drilling, and historical data, a potential large scale carbonate replacement deposit ("CRD") may be located below the footwall of the East Tintic thrust fault. A recommended drill program has been proposed that targets downdip extensions of known mineralization at Burgin.

- As part of a Phase II regional drilling program, the Company intends to proceed with two drill holes on the Big Hill West and Zuma porphyry targets in the coming months.

San Antonio Gold Project – Sonora State, Mexico (

- The San Antonio Gold Project has been under care and maintenance since Q3 2023.

- The Company awaits next steps from the government of Mexico with respect to the permitting process and the status of open pit mining in the country.

- Strategic Review. The Company is conducting a strategic review of the project and has engaged a financial advisor in connection thereof. The strategic review includes, among others, exploring the potential for a financial or strategic partner in the asset or for a full or partial sale of the asset.

SUBSEQUENT TO Q3 2024

- The Company completed a non-brokered private placement of units pursuant to which the Company issued an aggregate of 19,163,410 units at a price of US

$1.80 per unit for gross proceeds of approximately US$34.5 million , comprising (i) 13,426,589 units at a price of US$1.80 per unit for gross proceeds of approximately US$24.2 million , which closed on October 1, 2024 and (ii) 5,736,821 units at a price of US$1.80 per unit for gross proceeds of approximately US$10.3 million , which closed on October 11, 2024. Each unit consists of one common share of the Company and one common share purchase warrants of the Company entitling the holder of each common share purchase warrant to purchase one additional common share at a price of US$3.00 on or prior to October 1, 2029. - On November 12, 2024, the Company completed a brokered private placement pursuant to which the Company issued an aggregate of 31,946,366 units of the Company at a price of US

$1.80 per unit for aggregate gross proceeds of approximately US$57.5 million , including the exercise in full of the option granted to the agents of the private placement (the "Offering"). Each unit consists of one common share of the Company and one common share purchase warrant of the Company entitling the holder thereof to purchase one additional common share at a price of US$3.00 on or prior to October 1, 2029. In connection with the brokered private placement, the agents were paid a cash commission equal to4.5% of the aggregate gross proceeds.- The Offering included a lead order from Condire Investors, LLC ("Condire"), an investment firm based in Dallas, Texas, resulting in an approximate

8.8% holding in the Company's issued and outstanding common shares immediately following the closing of the Offering (on a non-diluted basis). Concurrently with the Offering, the Company and Condire have agreed to find a mutually agreeable addition to the Company’s Board of Directors or, alternatively, a Board observer.

- The Offering included a lead order from Condire Investors, LLC ("Condire"), an investment firm based in Dallas, Texas, resulting in an approximate

KEY UPCOMING MILESTONES

| Key Project Milestones | Expected Timing of Completion | Anticipated Remaining Costs* | ||

| Cariboo Gold Project(1) | ||||

| Bulk Sample | Q1 2025 | |||

| Water and Waste Management | Q4 2024 | |||

| Electrical and Communication | Q4 2024 | |||

| Management, environmental, and other pre-permitting work | Q4 2024 | |||

| Permitting | Completed – Q3 2024 | $nil | ||

| Tintic Project | ||||

| Regional Drilling – Phase II | Q2 2025 |

*as at September 30, 2024

Notes:

| (1) | The expenditures disclosed in this table include amounts approved by the Board of Directors up until the end of December 2024. Additional expenditures will be required to complete certain of the milestones and are subject to approval by the Board of Directors. |

Consolidated Financial Statements

The Company's unaudited interim consolidated financial statements (the "Financial Statements") and management's discussion and analysis ("MD&A") for the three months ended September 30, 2024 are available on the Company's website at www.osiskodev.com, on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Daniel Downton P.Geo., Chief Resource Geologist of Osisko Development, a "qualified person" within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Technical Reports

Information relating to the Cariboo Gold Project and the current feasibility on the Cariboo Gold Project and the assumptions, qualifications and limitations thereof is supported by the technical report titled "Feasibility Study for the Cariboo Gold Project, District of Well, British Columbia, Canada", dated January 10, 2023 (amended January 12, 2023) with an effective date of December 30, 2022 prepared for the Company by independent representatives BBA Engineering Ltd. and supported by independent consulting firms, including InnovExplo Inc., SRK Consulting (Canada) Inc., Golder Associates Ltd. (amalgamated with WSP Canada Inc. on January 1, 2023, to form WSP Canada Inc.), WSP USA Inc., Falkirk Environmental Consultants Ltd., Klohn Crippen Berger Ltd., KCC Geoconsulting Inc., and JDS Energy & Mining Inc. (the "Cariboo Technical Report"). Reference should be made to the full text of the Cariboo Technical Report, which was prepared in accordance with NI 43-101 and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile and on the Company's website at www.osiskodev.com.

Information relating to the Tintic Project and the current mineral resource estimate for the Trixie deposit (the "2024 Trixie MRE") and the assumptions, qualifications and limitations thereof, is supported by the technical report titled "NI 43-101 Technical Report, Mineral Resource Estimate for the Trixie Deposit, Tintic Project, Utah, United States of America" dated April 25, 2024 (with an effective date of March 14, 2024), prepared for the Company by independent representatives of Micon International Limited, being William Lewis, P. Geo, and Alan J. San Martin, MAusIMM(CP) (the "Tintic Technical Report"). Reference should be made to the full text of the Tintic Technical Report, which was prepared in accordance with NI 43-101 and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile and on the Company's website at www.osiskodev.com.

Information relating to San Antonio is supported by the technical report titled "NI 43-101 Technical Report for the 2022 Mineral Resource Estimate on the San Antonio Project, Sonora, Mexico", dated July 12, 2022 (with an effective date of June 24, 2022) prepared for the Company by independent representatives of Micon International Limited (the "San Antonio Technical Report", collectively with the Tintic Technical Report and Cariboo Technical Report, the "Technical Reports"). Reference should be made to the full text of the San Antonio Technical Report, which was prepared in accordance with NI 43-101 and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile and on the Company's website at www.osiskodev.com.

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a North American gold development company focused on past-producing mining camps located in mining friendly jurisdictions with district scale potential. The Company's objective is to become an intermediate gold producer by advancing its

For further information, visit our website at www.osiskodev.com or contact:

| Sean Roosen | Philip Rabenok |

| Chairman and CEO | Director, Investor Relations |

| Email: sroosen@osiskodev.com | Email: prabenok@osiskodev.com |

| Tel: +1 (514) 940-0685 | Tel: +1 (437) 423-3644 |

CAUTIONARY STATEMENTS

Cautionary Statement Regarding Estimates of Mineral Resources

This news release uses the terms measured, indicated and inferred mineral resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that mineral resources are not mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. The mineral resource estimate disclosed in this news release may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. The mineral resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum's "CIM Definition Standards on Mineral Resources and Mineral Reserves" incorporated by reference into NI 43-101. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for preliminary economic assessments. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically.

Cautionary Statement Regarding Financing Risks

The Company's development and exploration activities are subject to financing risks. At the present time, the Company has exploration and development assets which may generate periodic revenues through test mining, but has no mines in the commercial production stage that generate positive cash flows. The Company cautions that test mining at its operations could be suspended at any time. The Company's ability to explore for and discover potential economic projects, and then to bring them into production, is highly dependent upon its ability to raise equity and debt capital in the financial markets. Any projects that the Company develops will require significant capital expenditures. To obtain such funds, the Company may sell additional securities including, but not limited to, the Company's shares or some form of convertible security, the effect of which may result in a substantial dilution of the equity interests of the Company's Shareholders. Alternatively, the Company may also sell a part of its interest in an asset in order to raise capital. There is no assurance that the Company will be able to raise the funds required to continue its exploration programs and finance the development of any potentially economic deposit that is identified on acceptable terms or at all. The failure to obtain the necessary financing(s) could have a material adverse effect on the Company's growth strategy, results of operations, financial condition and project scheduling.

Cautionary Statement Regarding Test Mining Without Feasibility Study

The Company cautions that its prior decision to commence small-scale underground mining activities and batch vat leaching at the Trixie test mine was made without the benefit of a feasibility study, or reported mineral resources or mineral reserves, demonstrating economic and technical viability, and, as a result there may be increased uncertainty of achieving any particular level of recovery of material or the cost of such recovery. The Company cautions that historically, such projects have a much higher risk of economic and technical failure. Small scale test-mining at Trixie was suspended in December 2022, resumed in the second quarter of 2023, and suspended once again in December 2023. If and when small-scale test-mining recommences at Trixie, there is no guarantee that production will continue as anticipated or at all or that anticipated production costs will be achieved. The failure to continue production may have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations. Failure to achieve the anticipated production costs may have a material adverse impact on the Company's cash flow and potential profitability. In continuing operations at Trixie after closing, the Company has not based its decision to continue such operations on a feasibility study, or reported mineral resources or mineral reserves demonstrating economic and technical viability.

Cautionary Statement to U.S. Investors

The Company is subject to the reporting requirements of the applicable Canadian securities laws and as a result reports information regarding mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements, MD&A and this news release, in accordance with Canadian reporting requirements, which are governed by NI 43-101. As such, such information concerning mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements, MD&A and this news release, is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the U.S. Securities and Exchange Commission ("SEC").

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this news release may be deemed "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (together, "forward-looking statements"). These forward-looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Forward-looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including the assumptions, qualifications and limitations relating to the significance of the high-priority target drilling; the utility of modern exploration techniques; the potential for parallel high-grade gold fissure zones; the potential of Tintic to host a copper-gold porphyry center; the significance of regional exploration potential; the ability of the Company to complete the OFS and the scope, results and timing of thereof; progress in respect of pre-construction activities at Cariboo; the potential for unknown mineralized structures to extend existing zones of mineralization; category conversion; the timing and status of permitting; the results of ongoing stakeholder engagement; the capital resources available to Osisko Development; the ability of the Company to execute its planned activities, including as a result of its ability to seek additional funding or to reduce planned expenditures; the ability of the Company to obtain future financing and the terms of such financing; management's perceptions of historical trends, current conditions and expected future developments; the utility and significance of historic data, including the significance of the district hosting past producing mines; future mining activities; the potential of high grade gold mineralization on Trixie and Cariboo; the results (if any) of further exploration work to define and expand mineral resources; the ability of exploration work (including drilling) to accurately predict mineralization; the ability to generate additional drill targets; the ability of management to understand the geology and potential of the Company's properties; the ability of the Company to expand mineral resources beyond current mineral resource estimates; the timing and ability of the Company to complete upgrades to the mining and mill infrastructure at Trixie (if at all); continuation of test mining activities at Trixie (if at all); the timing and ability of the Company to ramp up processing capacity at Trixie (if at all); the ability of the Company to complete its exploration and development objectives for its projects in the timing contemplated and within expected costs (if at all); the ongoing advancement of the deposits on the Company's properties; the deposit remaining open for expansion at depth and down plunge; the ability to realize upon any mineralization in a manner that is economic; the Cariboo project design and ability and timing to complete infrastructure at Cariboo (if at all); the ability and timing for Cariboo to reach commercial production (if at all); the ability to adapt to changes in gold prices, estimates of costs, estimates of planned exploration and development expenditures; the ability of the Company to obtain further capital on reasonable terms; the profitability (if at all) of the Company's operations; the Company being a well-positioned gold development company in Canada, USA and Mexico; the ability and timing for the permitting at San Antonio; the impact of permitting delays at San Antonio; the outcome of the strategic review of the San Antonio Project; sustainability and environmental impacts of operations at the Company's properties; the ability and timing of the Company to mutually agree with Condire to a board nominee or observer and impact of same; as well as other considerations that are believed to be appropriate in the circumstances, and any other information herein that is not a historical fact may be "forward looking information". Material assumptions also include, management's perceptions of historical trends, the ability of exploration (including drilling and chip sampling assays, and face sampling) to accurately predict mineralization, budget constraints and access to capital on terms acceptable to the Company, current conditions and expected future developments, regulatory framework remaining defined and understood, results of further exploration work to define or expand any mineral resources, as well as other considerations that are believed to be appropriate in the circumstances. Osisko Development considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko Development, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to capital market conditions and the Company's ability to access capital on terms acceptable to the Company for the contemplated exploration and development at the Company's properties; the ability to continue current operations and exploration; regulatory framework and presence of laws and regulations that may impose restrictions on mining; the ability of exploration activities (including drill results and chip sampling, and face sampling results) to accurately predict mineralization; errors in management's geological modelling; the ability to expand operations or complete further exploration activities; the timing and ability of the Company to obtain required approvals and permits; the results of exploration activities; risks relating to exploration, development and mining activities; the global economic climate; metal and commodity prices; fluctuations in the currency markets; dilution; environmental risks; and community, non-governmental and governmental actions and the impact of stakeholder actions. Readers are urged to consult the disclosure provided under the heading "Risk Factors" in the Company's annual information form for the year ended December 31, 2023 as well as the financial statements and MD&A for the year ended December 31, 2023, which have been filed on SEDAR+ (www.sedarplus.ca) under Osisko Development's issuer profile and on the SEC's EDGAR website (www.sec.gov), for further information regarding the risks and other factors facing the Company, its business and operations. Although the Company's believes the expectations conveyed by the forward-looking statements are reasonable based on information available as of the date hereof, no assurances can be given as to future results, levels of activity and achievements. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. Forward-looking statements are not guarantees of performance and there can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f35949e1-e049-4178-b5c7-8fe0069c3fab

FAQ

What was ODV's revenue in Q3 2024?

How much did ODV raise in their recent private placements?

When is the Cariboo Gold Project optimized feasibility study expected?