Osisko Development Provides Exploration Update at Tintic Project

Rhea-AI Summary

Osisko Development Corp. (NYSE: ODV, TSXV: ODV) has provided an update on exploration activities at its 100%-owned Tintic Project in Utah, U.S.A. The company has completed surface and underground diamond drilling targeting potential copper-gold-molybdenum porphyry centers and conducted underground chip sampling at the Trixie test mine. Key highlights include:

1. Two surface drill holes at the Big Hill target intersected porphyry systems over a vertical depth of approximately 1,500 m.

2. Underground drilling at the Trixie West Porphyry target completed to a depth of 759.6 m.

3. Identification of high-potential porphyry and carbonate replacement deposit (CRD) targets at Zuma and Lower Quartzite.

4. Underground chip samples at Trixie yielded promising results, including 11.07 g/t Au and 25.45 g/t Ag over 6.10 m.

Positive

- Identification of porphyry systems at Big Hill target, indicating potential for mineralization

- Discovery of high-potential porphyry and CRD targets at Zuma and Lower Quartzite

- Promising underground chip sample results at Trixie, with high-grade gold and silver intercepts

Negative

- No significant copper, gold, or molybdenum intercepts in the Big Hill and Trixie West Porphyry target drilling

- Porphyries encountered at Big Hill lack evidence for major fluid paths required to be the source of mineralization in the Tintic District

News Market Reaction

On the day this news was published, ODV declined 1.60%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

MONTREAL, Aug. 07, 2024 (GLOBE NEWSWIRE) -- Osisko Development Corp. (NYSE: ODV, TSXV: ODV) ("Osisko Development" or the "Company") is pleased to provide an update on exploration activities at its

Chris Lodder, President, stated, "Early results from our systematic exploration approach are yielding valuable information in assisting with vectoring toward potential mineralized porphyry sources and large undiscovered polymetallic carbonate replacement deposits. We are seeing encouraging porphyry style mineralization in drill holes that are providing us with better understanding of the geometry, ore controls and zoning of mineralization at East Tintic. With this knowledge, we are well positioned to continue to vector towards more copper-rich areas believed to be the source of known mineralization at Tintic. Utah was most recently ranked by the Fraser Institute as the top mining jurisdiction globally, and we are excited at the future prospect of building on our presence there."

BIG HILL PORPHYRY TARGET DRILLING

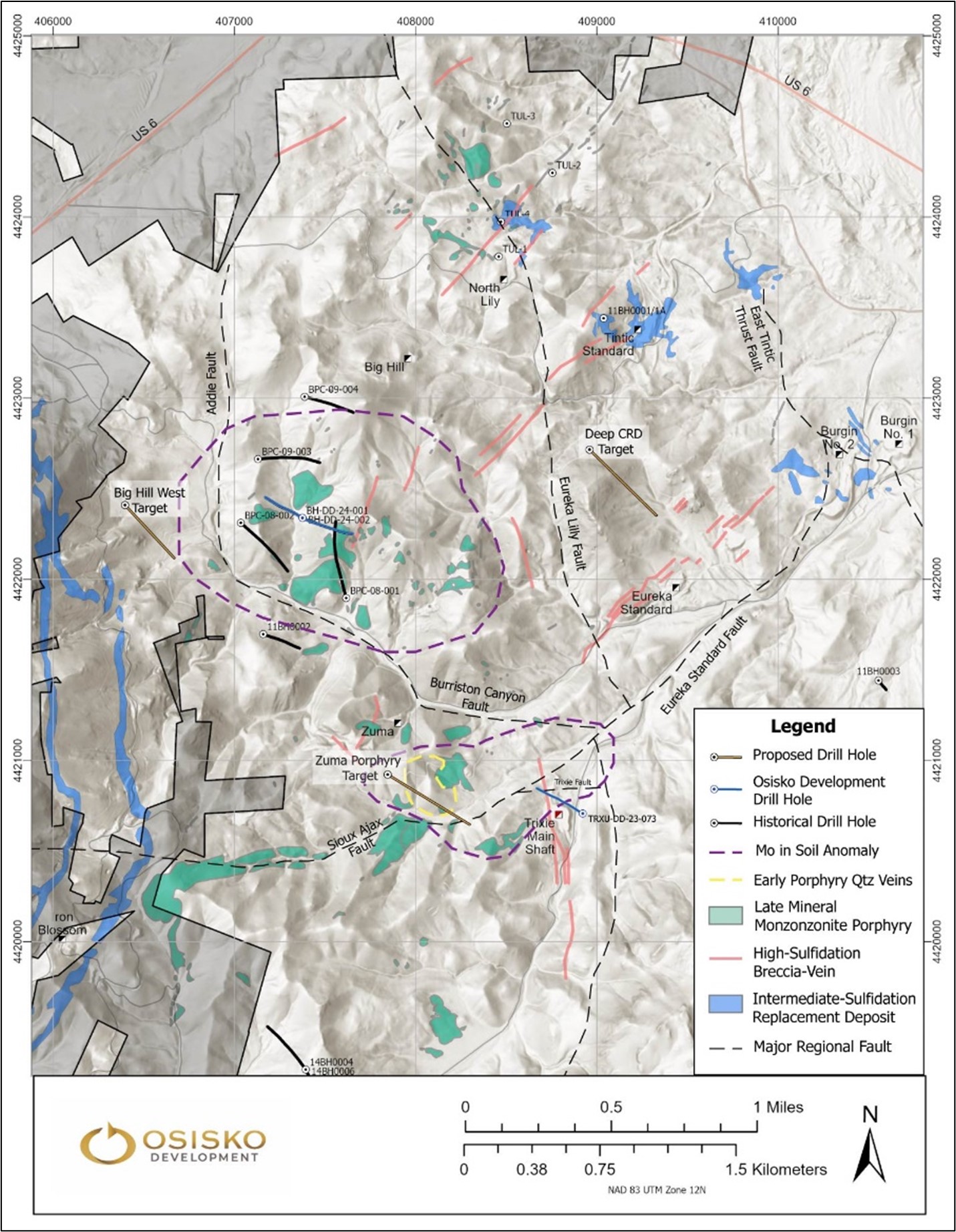

- Drilling Results. Two surface diamond drill holes, BH-DD-24-001 and BH-DD-24-002, have been completed at the Big Hill target Area in early May 2024 (see Figure 2).

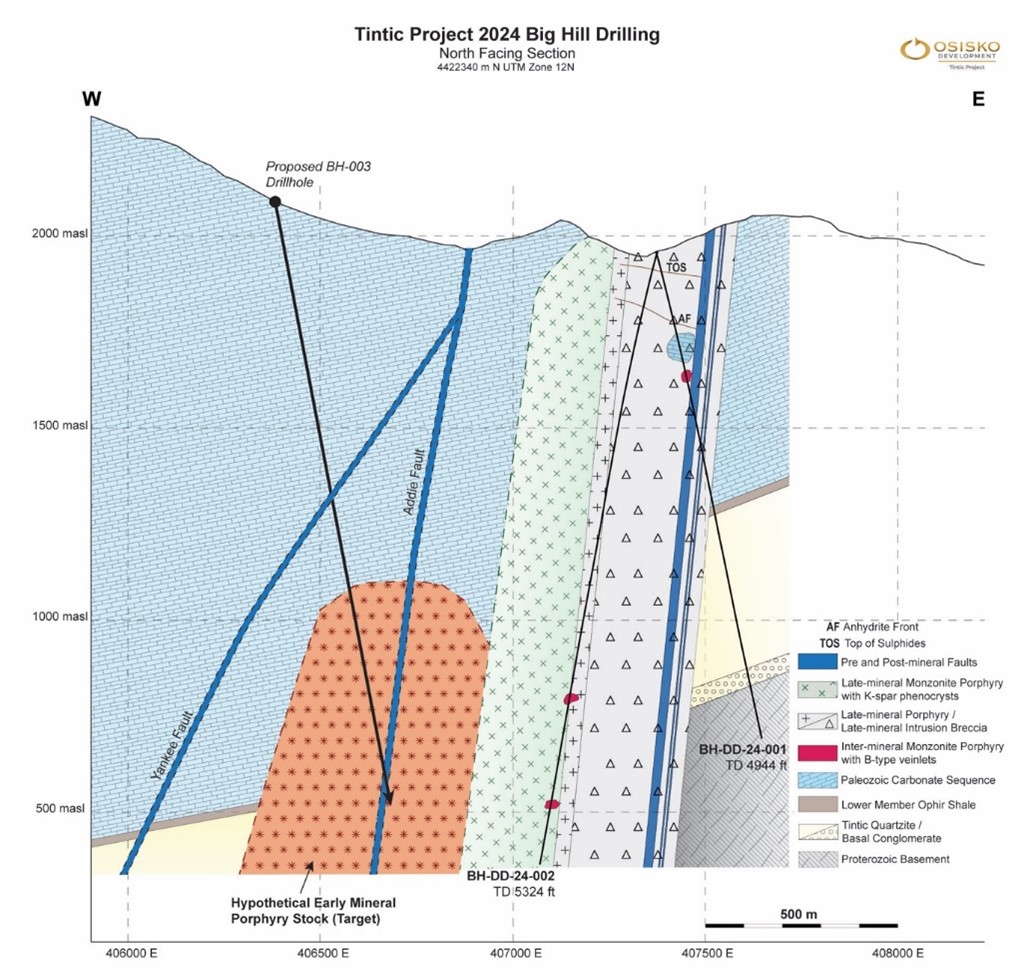

- The first drill hole was completed to a depth of 1,297 meters ("m") (4,257 feet ("ft")) when it transitioned out of the prospective alteration zone. The second drill hole was repositioned at a modified angle and completed to a depth of 1,623 m (5,324 ft).

- Both drill holes intersected porphyry systems defined by at least three late-mineral monzonite porphyritic intrusive phases and an intrusion breccia over a vertical depth of approximately 1,500 m (see Figure 3).

- Although anomalous copper and molybdenum mineralization was encountered, including low visible presence of chalcopyrite, tennantite, and molybdenite, this was primarily localized along structures, and hydrothermal breccias, and the transition from calcareous rocks into quartzites. No significant intercepts of copper, gold or molybdenum were observed. The porphyries encountered to date are considered to lack evidence for the major fluid paths required to be the source of mineralization in the Tintic District.

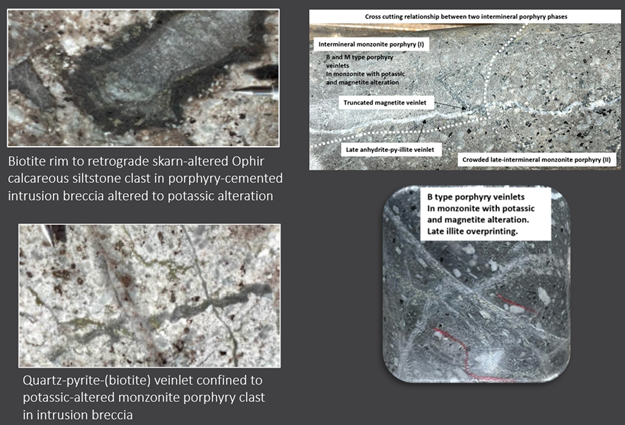

- Results to date have shown that the porphyries and intrusion breccia display potassic alteration with anhydrite and pyrite veinlets, which have undergone variable retrograde alteration to illite-chlorite and have been overprinted by pyrophyllite, dickite, and kaolinite along fault zones. This combination of intrusive rocks and alteration are clear evidence of the presence of a porphyry style mineralization at Big Hill. However, they are weakly mineralized, late inter-mineral phases that often post-date the better mineralized early-porphyry intrusive phases in well known porphyry deposits.

- Big Hill West Target. The results of the recent and historical drill holes suggest that the early and potentially better mineralized intrusive phase could be in an untested area immediately west and southwest of the area drilled at Big Hill (see Figure 3).

- Early porphyry intrusions, with more intense veinlets and alteration, are thought to be required to explain the metal inventory of the Tintic District.

- Drill core to date has shown that carbonate rocks in the intrusion breccia are marbleized and, in places, altered to retrograde skarn. Some discrete intervals comprise a finer-grained monzonite porphyry which is cut by porphyry-style quartz and magnetite veinlets, some containing pyrite and molybdenite with clear B-type affinity (see Figure 1). These inter-mineral intercepts, only approximated in Figure 3, are considered as blocks or screens 'floating' in the late-mineral phases, indicating that there are early and likely better mineralized inter-mineral intrusive phases to be found at Big Hill.

Figure 1: Core photos from Big Hill drill holes showing texture of intrusive rocks and associated alteration, veinlets, and breccia-clasts characteristic of porphyries.

- The potassically altered late-mineral porphyries are chilled against the quartz-veined porphyry intervals, defining them as inter-mineral in timing. These inter-mineral intercepts (approximated in Figure 3) are considered as blocks or screens 'floating' in the late-mineral phases. A similar quartz-veined porphyry is more abundant in the core from BPC-08-002 drilled by Anglo American at Big Hill (see Figure 2) in 2008. This drillhole also included appreciable thicknesses of the same intrusion breccia.

Figure 2: Tintic Project plan map showing the Big Hill, Zuma, and Lower Quartzite CRD targets.

Figure 3: Big Hill geological section, presenting geology logged in drill holes BH-DD-24-001 and BH-DD-24-002 and the Big Hill West target.

TRIXIE WEST PORPHYRY TARGET DRILLING

- One diamond drill hole, TRXU-DD-23-073, was completed from underground testing porphyry-style mineralization down plunge of the mineralized structures below Trixie (see Figure 2).

- The drill hole was completed to a depth of 759.6 m (2,492 ft) when it crossed the Eureka Lily Fault to the east and out of the prospective alteration zone.

- After collaring into the lower portion of the Ophir shale the drillhole remained in the Tintic Quartzite formation without intersecting porphyritic intrusions. Favorable geochemical and alteration mineral indicators were observed in the upper sections of the drillhole. However, at approximately 390 m (1,278 ft) downhole, the regional scale Eureka Lilly fault was crossed, beyond which these indicators significantly diminished.

- These results suggest that the western hanging wall block of the Eureka Lilly fault is more conducive for porphyry-style mineralization. Therefore, future drilling efforts will be more effective from the Zuma area, located west of Trixie (see Figure 2).

- Anomalous mineralization was encountered in the drill hole, primarily attributed to localized small structures in the Tintic Quartzite and appear to be of a similar mineralization style as found at the main Trixie deposit. However, no significant intercepts of gold, copper or molybdenum were encountered in TRX-DD-23-073.

HIGH-POTENTIAL PORPHYRY AND CRD TARGETS

The Zuma Target

- The Zuma area is considered a good porphyry target that merits initial drill testing and may represent one of the causative porphyry centres of the East Tintic district (see Figures 2 and 4).

- It is defined by overlapping geochemical and geophysical anomalies: the confluence of several regional scale structures linked to known high-sulfidation mineralization, the presence of early quartz veinlets on surface, and indications of multiple phases of magmatism (Figure 2).

- Drill testing of the anomalies identified at Zuma is considered a high-priority porphyry target.

Lower Quartzite CRD Target

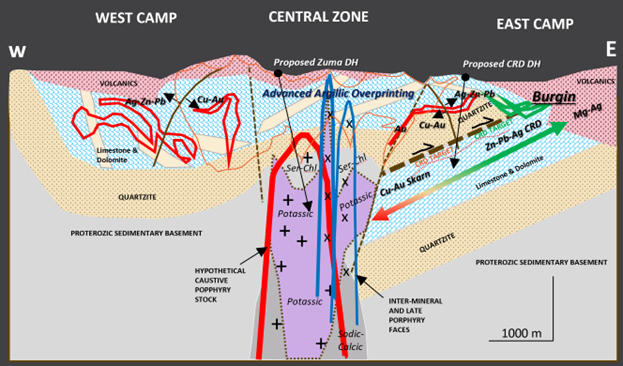

- Based on the compilation of geological, drilling, and historical data, a potential large scale carbonate replacement deposit ("CRD") may be located below the footwall of the East Tintic thrust fault (see Figure 4).

- A recommended drill target follows downdip extensions of known mineralization at Burgin, along the traces of the NE faults below where they intersect the west dipping thrust fault that defines the base of the quartzite. Of note, historic production and most known metal inventory in the Burgin area represents close to

45% of the total mineralization discovered and mined in the East Tintic district. Meaning, these ore deposits are typically larger than those in veins and narrow mantos at the top of the quartzite (see Figure 4).

Figure 4: Interpreted West-East cross section, looking North, from the Main (West Camp, Ivanhoe Electric's land) passing east into the central valley zone and the East Camp of Tintic (ODV's land).

- CRD mineralization mined in the East Tintic district, except for the Burgin deposit, has all been localized at the upper contact or close to the upper contact of the Tintic Quartzite and the calcareous strata of the Ophir formation (see Figure 4), structurally confined along the intersection of NE trending faults (see Figure 2).

- Figure 4 shows main lithological units, high angle faults and folds, a main low angle thrust fault putting in contact older quartzites over younger calcareous rocks in East Tintic. It also includes an approximate location of known main ore bodies, potential location of the proposed causative porphyry center of Zuma (drill target) and a potential connection of proximal Cu-Au CRD-Skarn mineralization below the thrust fault-plain starting at the limits of the causative porphyry and changing toward the east into Zn-Pb-Ag-Mn distal mineralization at Burgin. The proposed CRD drill hole is located between Burgin and Trixie.

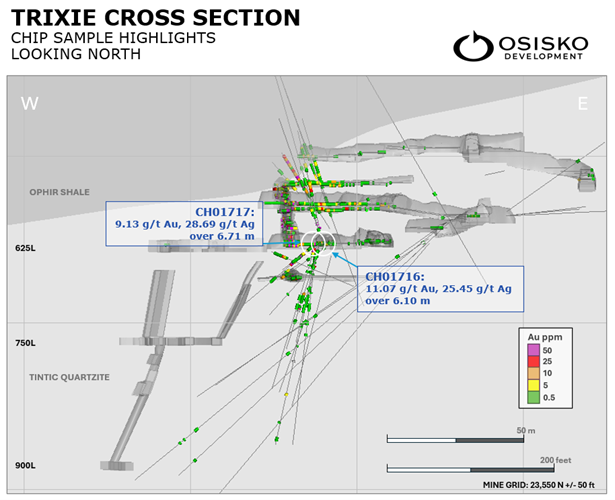

TRIXIE UNDERGROUND CHIP SAMPLE ASSAY HIGHLIGHTS

Chip samples were collected from new development areas in the walls of an exploration crosscut to explore along the Wild Cat, T2 and T4 domains of the Trixie deposit on the 625 Level (see Figure 5). Assay highlights include underground chip samples from four new development faces. All four faces had samples with greater than 1.0 gram per tonne ("g/t") gold ("Au") or greater than 50.0 g/t silver ("Ag") values (see Table 1). The remaining chip samples returned no significant assays. Selected assay highlights include:

- 11.07 g/t Au and 25.45 g/t Ag over 6.10 m in CH01716 (0.32 ounce per ton ("oz/t") Au and 0.74 oz/t Ag over 20 ft) including

- 90.20 g/t Au and 226.33 g/t Ag over 0.30 m (2.63 oz/t Au and 6.60 oz/t Ag over 1 ft)

- 9.13 g/t Au and 28.69 g/t Ag over 6.71 m in CH01717 (0.27 oz/t Au and 0.84 oz/t Ag over 22 ft) including

- 21.77 g/t Au and 52.31 g/t Ag over 1.52 m (0.63 oz/t Au and 1.53 oz/t Ag over 5 ft)

Figure 5: Trixie Cross Section with Chip Highlights

Table 1: Chip Sample Length Weighted Assay Composites at Trixie

| Site ID | Depth From (m) | Depth To (m) | Length (m) | Au (g/t) | Ag (g/t) | Depth From (ft.) | Depth To (ft.) | Length (ft.) | Au (oz/t) | Ag (oz/t) | |

| CH01714 | 1.52 | 2.44 | 0.91 | 1.23 | 18.07 | 5.00 | 8.00 | 3.00 | 0.04 | 0.53 | |

| CH01714 | 4.11 | 4.57 | 0.46 | 2.30 | 111.42 | 13.50 | 15.00 | 1.50 | 0.07 | 3.25 | |

| CH01714 | 7.01 | 7.62 | 0.61 | 1.10 | 8.09 | 23.00 | 25.00 | 2.00 | 0.03 | 0.24 | |

| CH01715 | 0.91 | 2.13 | 1.22 | 5.83 | 15.56 | 3.00 | 7.00 | 4.00 | 0.17 | 0.45 | |

| CH01715 | 16.15 | 16.46 | 0.30 | 53.07 | 162.32 | 53.00 | 54.00 | 1.00 | 1.55 | 4.73 | |

| CH01716 | 1.52 | 4.57 | 3.05 | 2.97 | 9.62 | 5.00 | 15.00 | 10.00 | 0.09 | 0.28 | |

| CH01716 | Including | 1.52 | 3.05 | 1.52 | 3.09 | 9.15 | 5.00 | 10.00 | 5.00 | 0.09 | 0.27 |

| CH01716 | and | 3.05 | 4.57 | 1.52 | 2.85 | 10.08 | 10.00 | 15.00 | 5.00 | 0.08 | 0.29 |

| CH01716 | 7.62 | 13.72 | 6.10 | 11.07 | 25.45 | 25.00 | 45.00 | 20.00 | 0.32 | 0.74 | |

| CH01716 | Including | 7.62 | 8.38 | 0.76 | 25.09 | 38.60 | 25.00 | 27.50 | 2.50 | 0.73 | 1.13 |

| CH01716 | and | 8.38 | 9.45 | 1.07 | 4.53 | 7.75 | 27.50 | 31.00 | 3.50 | 0.13 | 0.23 |

| CH01716 | and | 9.45 | 9.75 | 0.30 | 90.20 | 226.33 | 31.00 | 32.00 | 1.00 | 2.63 | 6.60 |

| CH01716 | and | 9.75 | 10.67 | 0.91 | 6.27 | 19.03 | 32.00 | 35.00 | 3.00 | 0.18 | 0.55 |

| CH01716 | and | 10.67 | 12.19 | 1.52 | 1.61 | 5.45 | 35.00 | 40.00 | 5.00 | 0.05 | 0.16 |

| CH01716 | and | 12.19 | 13.72 | 1.52 | 5.14 | 14.95 | 40.00 | 45.00 | 5.00 | 0.15 | 0.44 |

| CH01716 | 15.24 | 16.76 | 1.52 | 1.17 | 11.35 | 50.00 | 55.00 | 5.00 | 0.03 | 0.33 | |

| CH01717 | 0.00 | 1.52 | 1.52 | 3.46 | 0.00 | 0.00 | 5.00 | 5.00 | 0.10 | 0.00 | |

| CH01717 | 3.05 | 4.57 | 1.52 | 5.38 | 13.61 | 10.00 | 15.00 | 5.00 | 0.16 | 0.40 | |

| CH01717 | 10.06 | 16.76 | 6.71 | 9.13 | 28.69 | 33.00 | 55.00 | 22.00 | 0.27 | 0.84 | |

| CH01717 | Including | 10.06 | 10.21 | 0.15 | 23.04 | 63.32 | 33.00 | 33.50 | 0.50 | 0.67 | 1.85 |

| CH01717 | and | 10.21 | 10.67 | 0.46 | 2.02 | 14.12 | 33.50 | 35.00 | 1.50 | 0.06 | 0.41 |

| CH01717 | and | 10.67 | 12.19 | 1.52 | 3.19 | 18.07 | 35.00 | 40.00 | 5.00 | 0.09 | 0.53 |

| CH01717 | and | 12.19 | 13.72 | 1.52 | 21.77 | 52.31 | 40.00 | 45.00 | 5.00 | 0.63 | 1.53 |

| CH01717 | and | 13.72 | 14.94 | 1.22 | 8.13 | 22.22 | 45.00 | 49.00 | 4.00 | 0.24 | 0.65 |

| CH01717 | and | 14.94 | 15.70 | 0.76 | 7.92 | 32.53 | 49.00 | 51.50 | 2.50 | 0.23 | 0.95 |

| CH01717 | and | 15.70 | 16.76 | 1.07 | 2.64 | 16.08 | 51.50 | 55.00 | 3.50 | 0.08 | 0.47 |

About Trixie

The Trixie test mine is one of several gold and base metal targets within the larger Tintic Project consisting of >20,500 acres of mining claims (18,783 acres of patented mining claims and a further approximately 1,807 acres of unpatented mining claims) within the historic East Tintic Mining District of Central Utah, U.S.A. The T2 and T4 zones at Trixie show multi-ounce gold grades associated with high sulphidation epithermal mineralization, structurally controlled and hosted within quartzites. The T2 structure mineralization consists of native Au, and rare Au-Ag rich telluride minerals with quartz. The T4 is a broad enveloping zone, encompassing multiple discrete quartz-barite stockwork and fissure veining structures and structural zones developed around and similar to the discrete T2 structure and is located in the foot wall of the 75-85 zone.

A 3D model and virtual site tour of Trixie and the wider Tintic Project is accessible on the Company's VRIFY page at: https://vrify.com/decks/15815.

Technical Report

Information relating to the Tintic Project and the current MRE for the Trixie deposit (the "2024 Trixie MRE") is supported by the technical report titled "NI 43-101 Technical Report, Mineral Resource Estimate for the Trixie Deposit, Tintic Project, Utah, United States of America", dated April 25, 2024 (with an effective date of March 14, 2024) prepared for the Company by independent representatives of Micon International Limited (the "Tintic Technical Report"). Reference should be made to the full text of the Tintic Technical Report, which was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and is available electronically on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under Osisko Development's issuer profile and on the Company's website at www.osiskodev.com.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Daniel Downton, P.Geo., Chief Resource Geologist of Osisko Development, and a "qualified person" within the meaning of NI 43-101.

Face Sampling Methodology

As most structures at Trixie are steeply dipping to the east or west, current sampling procedures are designed to sample the structure. Chip samples are collected and do not exceed 1.5 m (5 ft.) in length. The face is washed for safety, and for better identification of mineralization, alteration and structures. The hanging wall and footwall of the structures are marked up on the face and back, samples intervals are marked up and follow lithological contacts.

Samples are collected in feet and assays are reported in grams per tonne and troy ounce per short ton gold and silver. Conversions to metric and imperial measurements are rounded to two decimal places.

Quality Assurance (QA) – Quality Control (QC)

All drill core and exploration samples are dispatched to ALS Geochemistry in Elko, Nevada or Reno, Nevada for offsite sample preparation and analysis. ALS Geochemistry is ISO/IEC 17025 and ISO 9001 certified. Samples are assigned a unique sample ID. All geological and sampling information is entered into Datamine Fusion database. Core is sawn in half and half is sampled. Certified standards and blanks are inserted into all sample dispatches. Samples are collected by Old Dominion Transportation and dispatched to ALS Geochehistry's laboratories in Elko, Nevada or Reno, Nevada. Sample submission forms accompany the samples, and digital copies are emailed to ALS Geochemistry.

All core sample preparation is completed by ALS Geochemistry, including drying, crushing, and pulverizing of samples. Analytical assays include gold by 30-gram fire assay with AAS finish , and gold overlimits by fire assay with gravimetric finish. Screen metallic and hyperspectral analyses are performed on selected samples. Multielement analysis (including silver) is by four-acid digest with ICP-AES/ICP-MS finish. The pulps are returned to Osisko Development and coarse rejects are disposed after 90 days. Assays are reported to Osisko Development and then loaded into Datamine Fusion. Quality Assurance-Quality Control samples are checked, and assays are merged with sample information for future reporting.

Underground face samples are collected by Company geologists from each of the active test mining faces, with samples transported by the geologists from Trixie to the on-site Company laboratory located at the Burgin administrative complex. Underground samples are dried, crushed to <10 mm and a 250 g split is taken. The split is pulverized, and a 30 g Fire Assay with gravimetric finish is completed to determine gold and silver grades, reported in oz/short ton and g/t.

The Company's Burgin laboratory is not a certified analytical laboratory, but the facility is managed by a qualified laboratory manager with annual auditing by technical staff. Inter-laboratory check assays using ALS Laboratory as a third-party independent analysis of samples is routinely carried out as part of ongoing QA/QC work. Certified OREAS QC standards and blanks are inserted at regular intervals in the sample stream to monitor laboratory performance.

Within the Trixie deposit, true width is estimated to be approximately 0.5 m – 3.0 m (1.6 – 10.0 ft) for all fissure veins and discrete structures (T2, T3, 75-85, Wildcat and 40 Fault) and the T4 zone is modelled at an average width of 90 m (300 ft) and encompasses disseminated mineralization and discontinuous veins ranging from several cm to 1 m (3 ft).

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a North American gold development company focused on past-producing mining camps located in mining friendly jurisdictions with district scale potential. The Company's objective is to become an intermediate gold producer by advancing its

For further information, visit our website at www.osiskodev.com or contact:

| Sean Roosen | Philip Rabenok |

| Chairman and CEO | Director, Investor Relations |

| Email: sroosen@osiskodev.com | Email: prabenok@osiskodev.com |

| Tel: +1 (514) 940-0685 | Tel: +1 (437) 423-3644 |

CAUTION STATEMENTS

Cautionary Statement Regarding Test Mining Without Feasibility Study

The Company cautions that its prior decision to commence small-scale underground mining activities and batch vat leaching at the Trixie test mine was made without the benefit of a feasibility study, or reported mineral resources or mineral reserves, demonstrating economic and technical viability, and, as a result there may be increased uncertainty of achieving any particular level of recovery of material or the cost of such recovery. The Company cautions that historically, such projects have a much higher risk of economic and technical failure. Small scale test-mining at Trixie was suspended in December 2022, resumed in the second quarter of 2023, and suspended once again in December 2023. If and when small-scale test-mining recommences at Trixie, there is no guarantee that production will continue as anticipated or at all or that anticipated production costs will be achieved. The failure to continue production may have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations. Failure to achieve the anticipated production costs may have a material adverse impact on the Company's cash flow and potential profitability. In continuing operations at Trixie after closing, the Company has not based its decision to continue such operations on a feasibility study, or reported mineral resources or mineral reserves demonstrating economic and technical viability.

Cautionary Statement to U.S. Investors

The Company is subject to the reporting requirements of the applicable Canadian securities laws and as a result reports information regarding mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements, MD&A and this news release, in accordance with Canadian reporting requirements, which are governed by NI 43-101. As such, such information concerning mineral properties, mineralization and estimates of mineral reserves and mineral resources, including the information in its technical reports, financial statements, MD&A and this news release, is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the U.S. Securities and Exchange Commission ("SEC").

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this news release may be deemed "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (together, "forward-looking statements"). These forward-looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Forward-looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including the assumptions, qualifications and limitations relating to the significance of the high-priority target drilling; the utility of modern exploration techniques; the potential for parallel high-grade gold fissure zones; the potential of Tintic to host a copper-gold porphyry center; the significance of regional exploration potential; the results of the 2024 Trixie MRE; the potential for unknown mineralized structures to extend existing zones of mineralization; category conversion; the timing and status of permitting; the capital resources available to Osisko Development; the ability of the Company to execute its planned activities, including as a result of its ability to seek additional funding or to reduce planned expenditures; the ability of the Company to obtain future financing and the terms of such financing; management's perceptions of historical trends, current conditions and expected future developments; the utility and significance of historic data, including the significance of the district hosting past producing mines; future mining activities; the potential of high grade gold mineralization on Trixie and Cariboo; the results (if any) of further exploration work to define and expand mineral resources; the ability of exploration work (including drilling) to accurately predict mineralization; the ability to generate additional drill targets; the ability of management to understand the geology and potential of the Company's properties; the ability of the Company to expand mineral resources beyond current mineral resource estimates; the timing and ability of the Company to complete upgrades to the mining and mill infrastructure at Trixie (if at all); continuation of test mining activities at Trixie (if at all); the timing and ability of the Company to ramp up processing capacity at Trixie (if at all); the ability of the Company to complete its exploration and development objectives for its projects in 2024 in the timing contemplated and within expected costs (if at all); the ongoing advancement of the deposits on the Company's properties; the deposit remaining open for expansion at depth and down plunge; the ability to realize upon any mineralization in a manner that is economic; the Cariboo project design and ability and timing to complete infrastructure at Cariboo (if at all); the ability and timing for Cariboo to reach commercial production (if at all); the ability to adapt to changes in gold prices, estimates of costs, estimates of planned exploration and development expenditures; the ability of the Company to obtain further capital on reasonable terms; the profitability (if at all) of the Company's operations; the Company being a well-positioned gold development company in Canada, USA and Mexico; the ability and timing for the permitting at San Antonio; the impact of permitting delays at San Antonio; the outcome of the strategic review of the San Antonio Project; sustainability and environmental impacts of operations at the Company's properties; as well as other considerations that are believed to be appropriate in the circumstances, and any other information herein that is not a historical fact may be "forward looking information". Material assumptions also include, management's perceptions of historical trends, the ability of exploration (including drilling and chip sampling assays, and face sampling) to accurately predict mineralization, budget constraints and access to capital on terms acceptable to the Company, current conditions and expected future developments, regulatory framework remaining defined and understood, results of further exploration work to define or expand any mineral resources, as well as other considerations that are believed to be appropriate in the circumstances. Osisko Development considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko Development, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to capital market conditions and the Company's ability to access capital on terms acceptable to the Company for the contemplated exploration and development at the Company's properties; the ability to continue current operations and exploration; regulatory framework and presence of laws and regulations that may impose restrictions on mining; the ability of exploration activities (including drill results and chip sampling, and face sampling results) to accurately predict mineralization; errors in management's geological modelling; the ability to expand operations or complete further exploration activities; the timing and ability of the Company to obtain required approvals and permits; the results of exploration activities; risks relating to exploration, development and mining activities; the global economic climate; metal and commodity prices; fluctuations in the currency markets; dilution; environmental risks; and community, non-governmental and governmental actions and the impact of stakeholder actions. Readers are urged to consult the disclosure provided under the heading "Risk Factors" in the Company's annual information form for the year ended December 31, 2023 as well as the financial statements and MD&A for the year ended December 31, 2023, which have been filed on SEDAR+ (www.sedarplus.ca) under Osisko Development's issuer profile and on the SEC's EDGAR website (www.sec.gov), for further information regarding the risks and other factors facing the Company, its business and operations. Although the Company's believes the expectations conveyed by the forward-looking statements are reasonable based on information available as of the date hereof, no assurances can be given as to future results, levels of activity and achievements. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. Forward-looking statements are not guarantees of performance and there can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/97aa758e-1f87-4944-8a6f-ab39633f9298

https://www.globenewswire.com/NewsRoom/AttachmentNg/a5b65c66-bbe6-4620-8d03-bd8edc9ac20c

https://www.globenewswire.com/NewsRoom/AttachmentNg/2b762c0b-512e-4a75-8f79-a7f52e23bbab

https://www.globenewswire.com/NewsRoom/AttachmentNg/6a1309d6-851f-4d1d-8293-e61f7bbdabd1

https://www.globenewswire.com/NewsRoom/AttachmentNg/8886e6a5-622d-40a6-b5c6-f271d3f0543d