Kin Insurance Continues Rapid Growth Trajectory in Third Quarter 2021

Omnichannel Acquisition Corp. (NYSE: OCA) and Kin Insurance reported significant growth in their third quarter 2021 results. Gross Written Premium surged

- Gross Written Premium increased 534% year-over-year to $26.7 million.

- Total Managed Premium rose 420% year-over-year to $27.8 million.

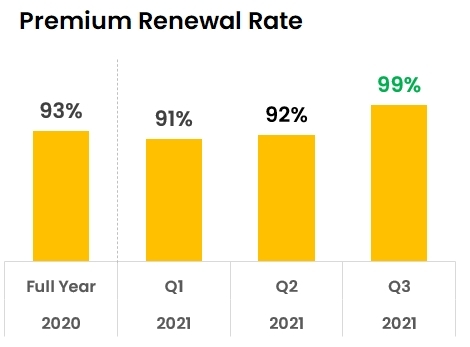

- Record Premium Renewal Rate of 99%, up from 92% in Q2 2021.

- Gross Profit from management operations increased by 487% to $8.0 million.

- Adjusted Operating Income remains negative at -$9.3 million for Q3 2021.

- Operating Expenses increased substantially from $4.1 million to $17.3 million year-over-year.

– Third Quarter 2021 Gross Written Premium increases

– Third Quarter 2021 Total Managed Premium increases

– Premium Renewal Rate on Carrier increases to record

Premium Renewal Rate for

-

Total Managed Premium quintupled to

$27.8 million $5.4 million 13% sequentially from the second quarter of 2021. Growth was entirely organic and directly written without the use of independent agents. -

$26.7 million 96% ) of third quarter 2021 Total Managed Premium was Gross Written Premium on the Kin Interinsurance Network (the “Carrier”), a reciprocal exchange managed byKin Insurance, Inc. -

Premium Renewal Rate on the Carrier increased to

99% compared to92% in the second quarter 2021. -

Gross Profit from Kin’s Management Operations grew

487% to$8.0 million $1.4 million

| Summary Financials | ||||||||||||||||||||||

| Results are for Shareholder Interest ( |

||||||||||||||||||||||

2020 |

2021 |

|||||||||||||||||||||

| ($mm) | Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

|||||||||||||||

| Total Managed Premium* | 4.8 |

6.4 |

5.4 |

8.5 |

16.4 |

24.7 |

27.8 |

|||||||||||||||

| % growth (YoY) |

|

|

|

|

|

|

|

|||||||||||||||

| Revenue | 1.1 |

1.5 |

1.4 |

2.2 |

4.4 |

6.8 |

8.0 |

|||||||||||||||

| % growth (YoY) |

|

|

|

|

|

|

|

|||||||||||||||

| % of total managed premium |

|

|

|

|

|

|

|

|||||||||||||||

| Gross Profit | 1.1 |

1.5 |

1.4 |

2.2 |

4.4 |

6.8 |

8.0 |

|||||||||||||||

| % growth (YoY) |

|

|

|

|

|

|

|

|||||||||||||||

| Operating Expenses | 4.1 |

4.8 |

5.4 |

9.1 |

11.3 |

13.9 |

17.3 |

|||||||||||||||

| Adjusted Operating Income** | -3.1 |

-3.3 |

-4.1 |

-6.9 |

-6.9 |

-7.0 |

-9.3 |

|||||||||||||||

| * Total Managed Premium, formerly reported as Total Written Premium, includes all premiums originated and serviced by Kin, including on |

||||||||||||||||||||||

| **Adjusted Operating Income, a non-GAAP financial measure, as net loss attributable to |

||||||||||||||||||||||

“While the third quarter is typically the seasonally slowest quarter, our direct-to-consumer value proposition enabled us to still grow our Total Managed Premium by double digits sequentially,” said

Kin’s premium renewal rate increased to

Kin’s operating leverage improved meaningfully in the third quarter, as Gross Profit grew two times faster than Operating Expenses on a year over year basis.

“Our operating leverage continues to improve year over year, even in a quarter where we invested considerably in new initiatives, in particular a significant brand campaign, ‘Florida, Man,’ which generated more than a million social views,” added Kin Chief Financial Officer

The preliminary results for the third quarter ended

Business Combination Transaction

On

About Kin

Kin is the home insurance company for every new normal. By leveraging proprietary technology, Kin delivers fully digital homeowners insurance with an elegant user experience, accurate pricing, and fast, high-quality claims service. Kin offers homeowners, landlord, condo, and mobile home insurance through the Kin Interinsurance Network (KIN), a reciprocal exchange owned by its customers who share in the underwriting profit. Because of its efficient technology and direct-to-consumer model, Kin provides affordable pricing without compromising coverage. To learn more, visit https://www.kin.com.

About

Important Information for Investors and Stockholders

This communication relates to a proposed business combination (the “Business Combination”) between

Investors and security holders will be able to obtain free copies of the registration statement, proxy statement/prospectus and all other relevant documents filed or that will be filed with the

Forward-Looking Statements

This communication includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the business of Kin or the combined company after completion of the Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement and the proposed Business Combination contemplated thereby; (2) the inability to complete the transactions contemplated by the transaction agreement due to the failure to obtain approval of the stockholders of Omnichannel or other conditions to closing in the transaction agreement; (3) the ability to meet the NYSE’s listing standards following the consummation of the transactions contemplated by the transaction agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Kin as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed Business Combination; (7) changes in applicable laws or regulations; and (8) the possibility that Kin may be adversely affected by other economic, business, and/or competitive factors. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Omnichannel’s Annual Report on Form 10-K, and other documents filed by Omnichannel from time to time with the

Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved.

Participants in the Solicitation

Omnichannel, Kin and their respective directors and executive officers may be deemed participants in the solicitation of proxies of Omnichannel stockholders with respect to the proposed Business Combination. Omnichannel stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and executive officers of

Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement / prospectus that Omnichannel intends to file with the

No Offer or Solicitation

This communication does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act, or an exemption therefrom.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211020005371/en/

Kin

Investor Relations

investors@kin.com

Media Relations

press@kin.com

Omnichannel

Investor Relations

oacir@icrinc.com

Media Relations

oacpr@icrinc.com

Source:

FAQ

What were the Q3 2021 financial results for Omnichannel Acquisition Corp. (OCA)?

What is the Premium Renewal Rate for Kin Insurance as of Q3 2021?

What is the expected timeline for Kin Insurance's business combination with Omnichannel Acquisition Corp?

What was the Gross Profit reported by Kin Insurance in Q3 2021?