Orange County Bancorp, Inc. Announces Record Earnings for 2021

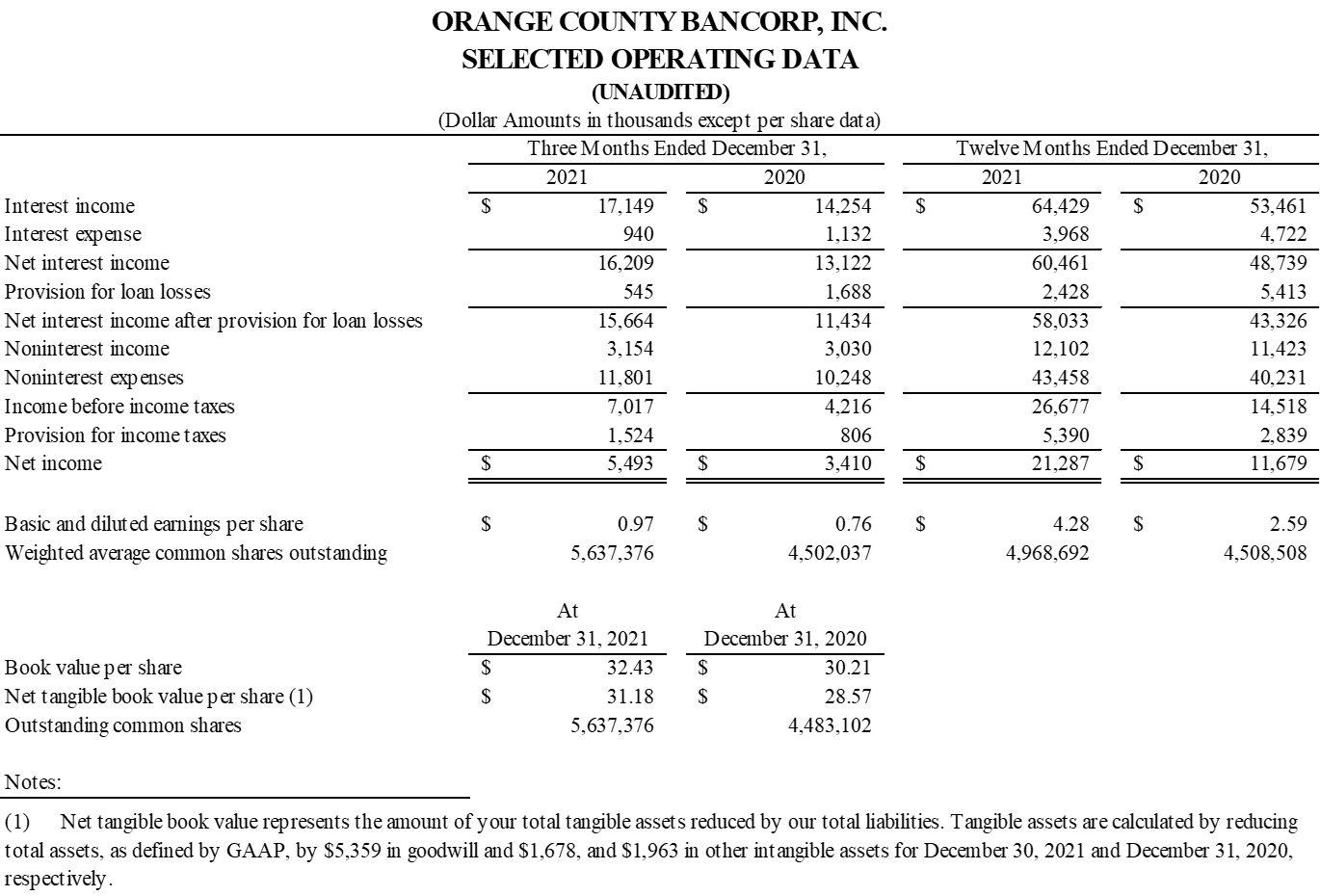

Orange County Bancorp (NASDAQ:OBT) reported a significant increase in net income for 2021, rising by $9.6 million (82.1%) to a record $21.3 million, equivalent to $4.28 per share. Q4 net income also grew by 61.8% year-over-year, reaching $5.5 million. The company's total assets surged 28.6% to $2.1 billion, with average loans increasing 20% to $1.2 billion. Additionally, the successful IPO raised $38.5 million for further growth and visibility. Key growth was evident across all business segments, including a 17.9% revenue increase from trust and asset advisory services.

- Net income increased by $9.6 million (82.1%) to a record $21.3 million.

- Q4 net income rose by $2.1 million (61.8%) year-over-year to $5.5 million.

- Total assets increased by $476.1 million (28.6%) to $2.1 billion.

- Average loans (net of PPP) grew approximately 20% year-over-year to $1.2 billion.

- Trust and asset advisory business revenue increased 17.9% year-over-year to $9.6 million.

- Successful IPO raised gross proceeds of approximately $38.5 million.

- Non-interest expense for the year increased by $3.3 million (8.2%) to $43.5 million.

Insights

Analyzing...

- Net Income for full year 2021 increased

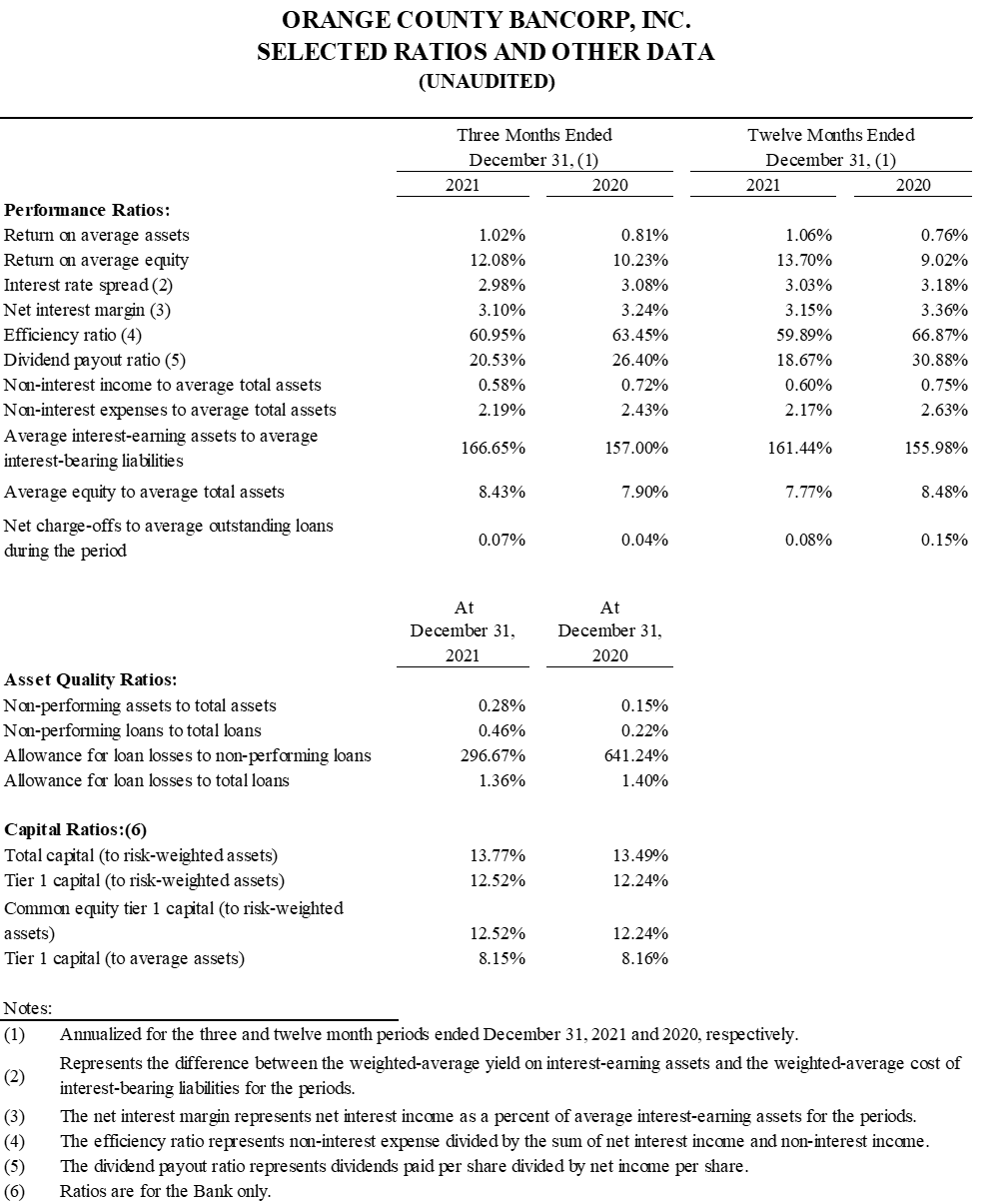

$9.6 million , or82.1% , to a record$21.3 million - Return on average assets for Q4 2021 rose 21 basis points, or

25.9% , year-over-year to1.02% - Return on average equity for Q4 2021 rose 185 basis points, or

18.1% , year-over-year to12.08% - Average Loans (net of PPP) for Q4 2021 increased approximately

20% year-over-year, to$1.2 billion - Provision for loan losses of

$545 thousand for Q4 2021 declined67.7% year-over-year due to stabilizing credit trends and characteristics within the portfolio - Average demand and money market deposits for Q4 2021 grew

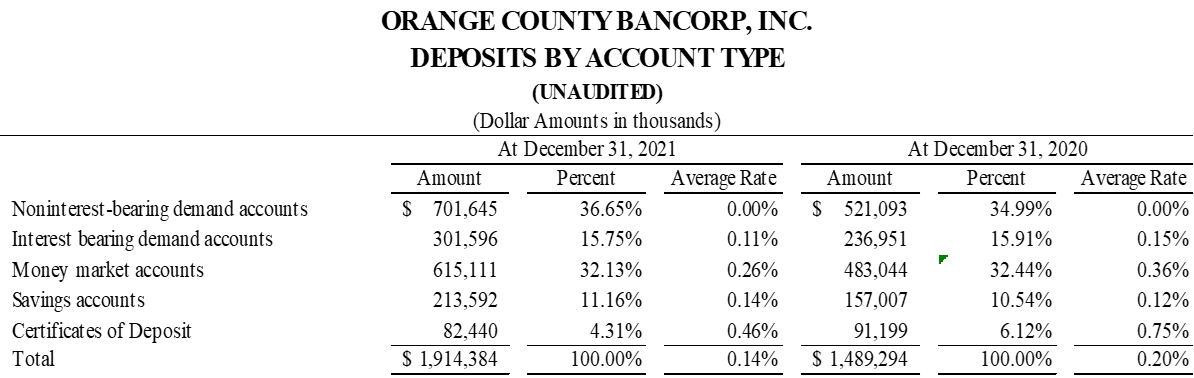

25.8% year-over-year to$949.3 million - Total Assets grew

$476.1 million , or28.6% , from year-end 2020 to$2.1 billion at December 31, 2021 - Trust and asset advisory business revenue increased

17.9% year-over-year, to$9.6 million , for year end 2021 - Book Value per Share rose

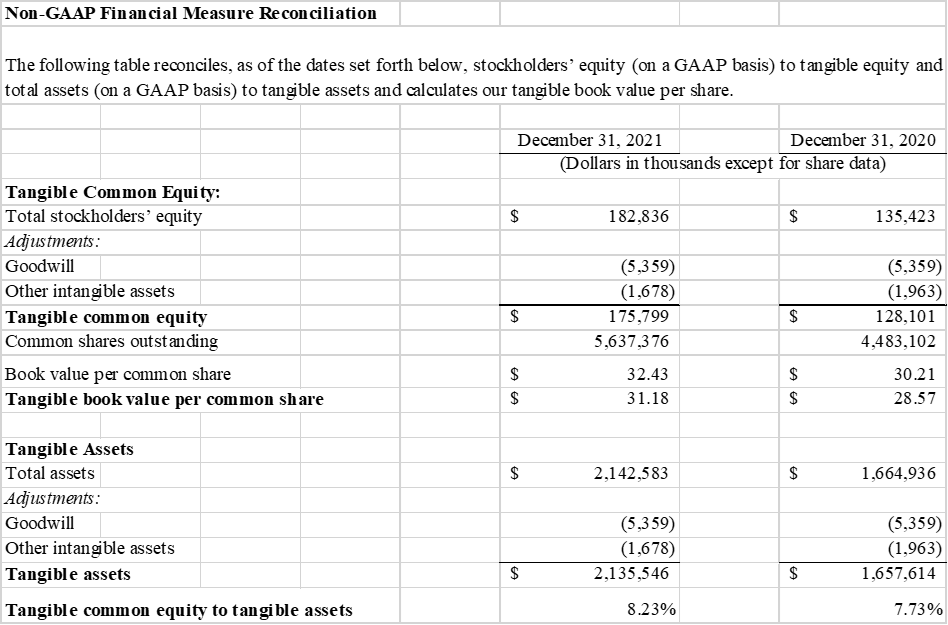

$2.22 , or7.4% , to$32.43 at December 31, 2021 compared to$30.21 at December 31, 2020 - Net Tangible Book Value per Share rose

$2.61 , or8.6% , to$31.18 at December 31, 2021 compared to$28.57 at December 31, 2020

MIDDLETOWN, NY / ACCESSWIRE / January 26, 2022 / Orange County Bancorp, Inc. (the "Company")(NASDAQ:OBT), parent company of Orange Bank & Trust Co. (the "Bank") and Hudson Valley Investment Advisors, Inc. ("HVIA"), today announced net income of

"Over the past several years Orange County Bancorp has strategically positioned itself as the premier business bank in the region," said Orange County Bancorp President & CEO, Michael Gilfeather. "We recognized early on that the decentralized banking model employed by many of our competitors left small and midsized businesses in the communities we serve without a true banking partner. We have sought to fill that void and I am pleased to announce our record results for the quarter and year just ended demonstrate the success of our strategy. Net income of

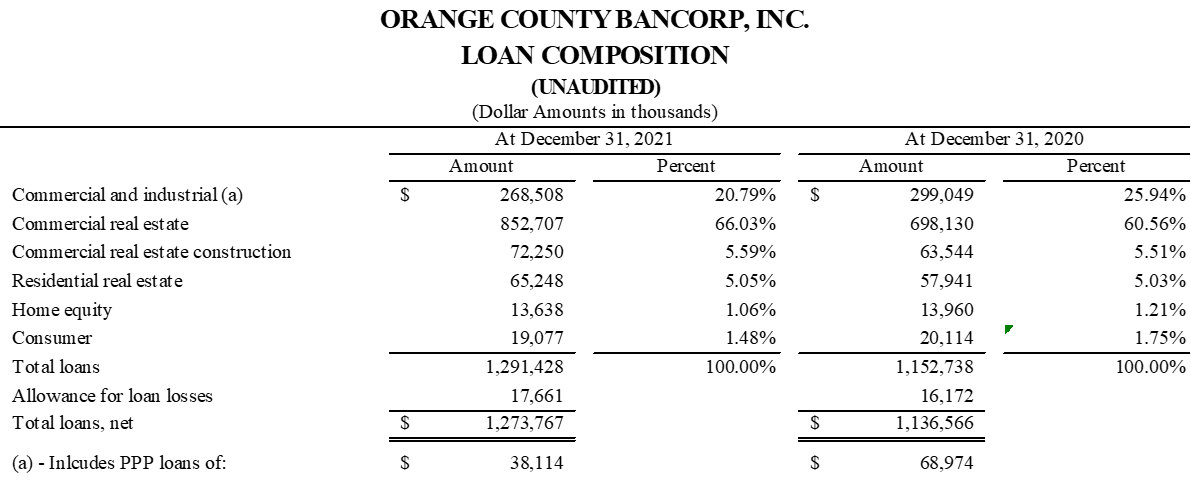

Key to delivering on our superior value proposition to business clients were contributions from all parts of the bank. I am also pleased to report that every business segment shared in our growth, with the Bank's loan portfolio increasing more than

Our loan growth was, in fact, even stronger than the headline number suggests, as a substantial portion of PPP (Paycheck Protection Program) loans originated over the past 18 months were forgiven this year. At year end, these loans totaled just

To ensure our strict underwriting and risk management standards kept pace with our growth, we upgraded our data and accounting systems during the year. We completed this project in the 4th quarter and it came in at approximately

Early last year we also launched our Wealth Management initiative, integrating the expertise of our Private Banking, Trust and Investment Advisory Service businesses to create a comprehensive offering for clients with complex business or financial and estate planning needs. In keeping with our strategic business focus, we have tailored Wealth Management to serve our new and existing business relationships. The results to date have been very encouraging, with revenues growing approximately

As we have gained experience and confidence partnering with local business communities through our expansion efforts, we have developed a better understanding of where and how to effectively grow the Bank. In July, we opened a branch in the Bronx, which in its short history has performed well above expectations. We also opened a branch in Nanuet in November, positioning us to better serve Rockland County and, given its proximity to New Jersey, gaining visibility into Bergen County. We are very excited about the prospects for these branches and continue to evaluate other areas for potential expansion.

To bolster implementation of our growth strategy, we launched and announced a successful completion of an initial public offering of common stock in early Q3 2021. The transaction was upsized due to strong institutional demand and culminated in the sale of 1.15 million shares at a price of

The success we enjoyed in 2021 was the result of years of planning and investment in facilities, technology, and personnel. None of it, however, would have been possible without the commitment and effort of every employee of the Bank. The foundation for responsibly growing our business remains strong, and I am confident our team will continue to deliver exceptional service to our clients and the communities we serve. This, in turn, should create additional opportunities to grow the Bank and generate even stronger results for our shareholders. I am incredibly fortunate to be surrounded by such a team and thank them for their hard work."

Fourth Quarter and Full-Year 2021 Financial Review

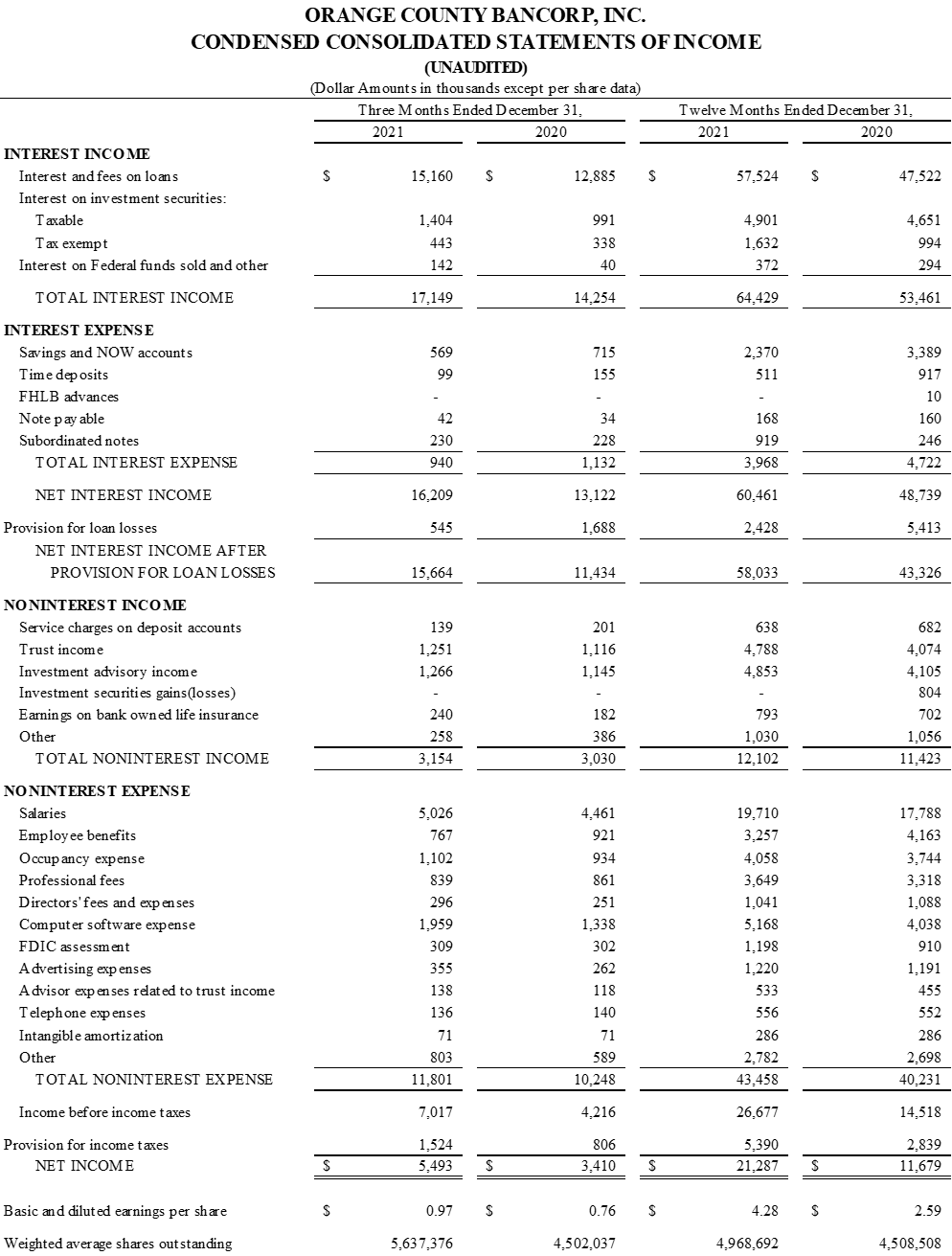

Net Income

Net income for the fourth quarter of 2021 was

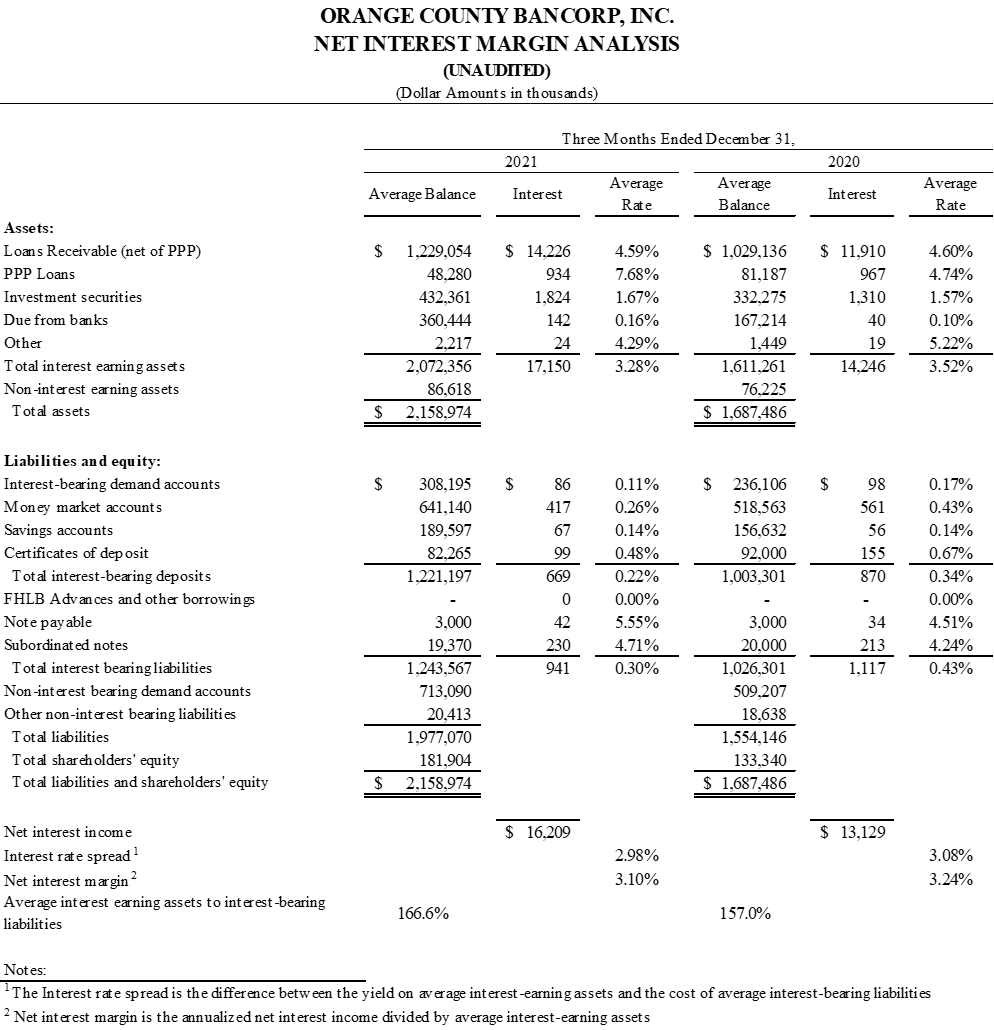

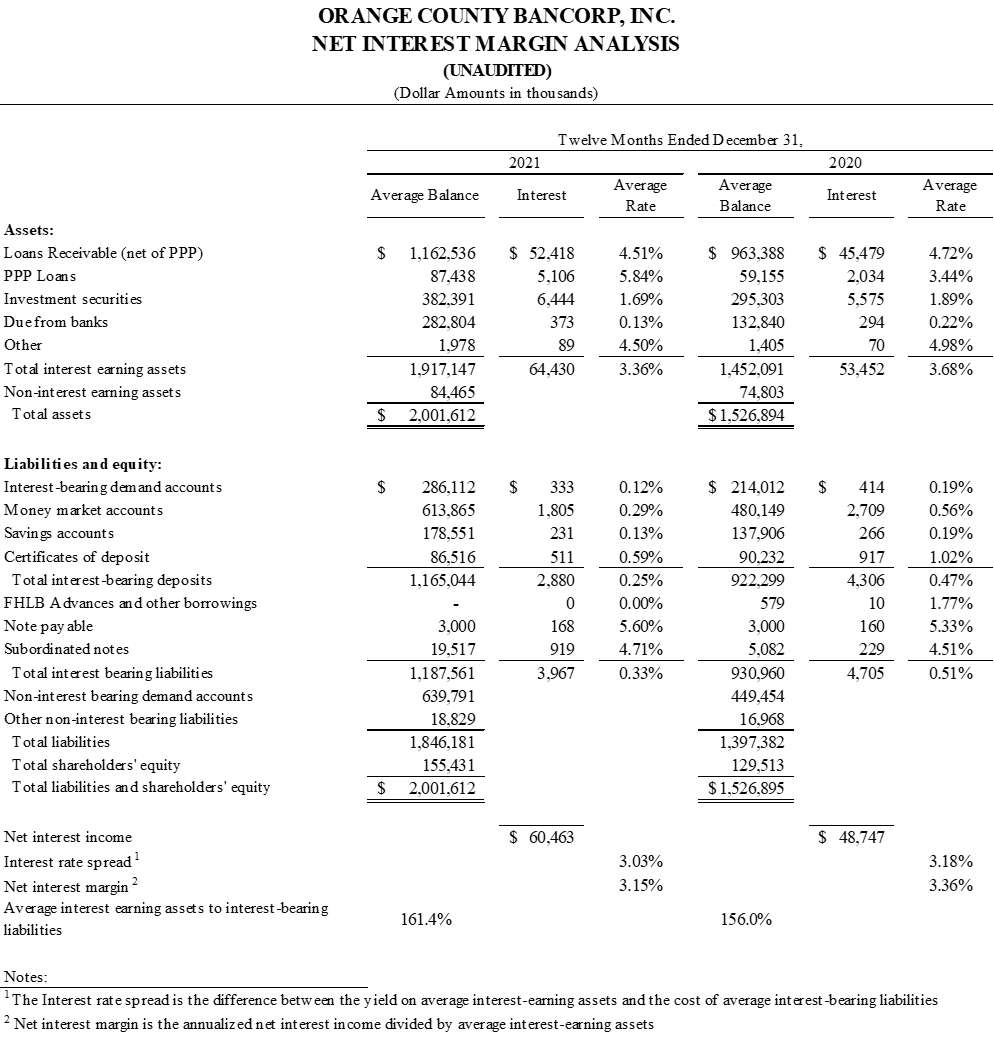

Net Interest Income

For the three months ended December 31, 2021, net interest income increased by

Total interest income increased

Total interest expense decreased

Provision for Loan Losses

The Company recognized provisions for loan losses of

Non-Interest Income

Non-interest income was

Non-Interest Expense

Non-interest expense was

Income Tax Expense

Our provision for income taxes for the three months ended December 31, 2021 was

Financial Condition

Total consolidated assets increased

Total cash and due from banks increased from

Total investment securities rose

Total loans increased

Total deposits rose

Stockholders' equity increased

At December 31, 2021, the Bank maintained capital ratios in excess of regulatory standards for well capitalized institutions. The Bank's Tier 1 capital to average assets ratio was

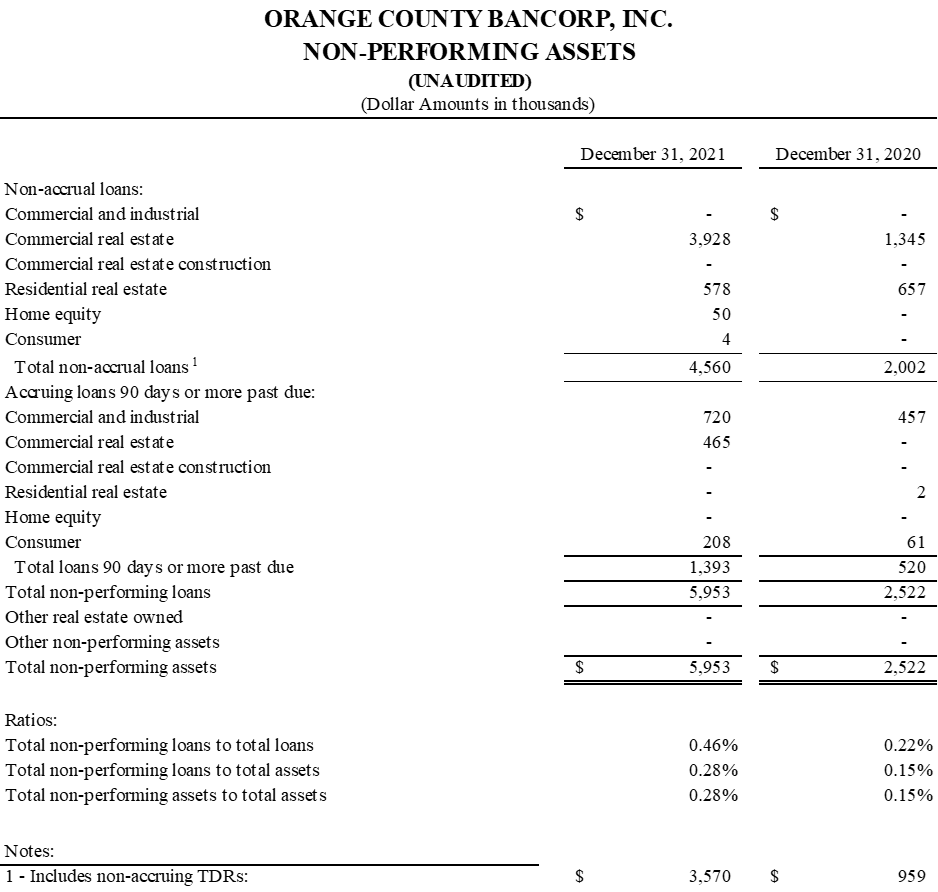

Loan Quality

At December 31, 2021, the Bank had total non-accrual loans of

About Orange County Bancorp, Inc.

Orange County Bancorp, Inc. is the parent company of Orange Bank & Trust Company and Hudson Valley Investment Advisors, Inc. Orange Bank & Trust Company is an independent bank that began with the vision of 14 founders over 125 years ago. It has grown through innovation and an unwavering commitment to its community and business clientele to more than

Forward Looking Statements

Certain statements contained herein are "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward looking statements may be identified by reference to a future period or periods, or by the use of forward looking terminology, such as "may," "will," "believe," "expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms, or the negative of those terms. Forward looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the real estate and economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. Further, given its ongoing and dynamic nature, it is difficult to predict what the continuing effects of the COVID-19 pandemic will have on our business and results of operations. The pandemic and related local and national economic disruption may, among other effects, continue to result in a material adverse change for the demand for our products and services; increased levels of loan delinquencies, problem assets and foreclosures; branch disruptions, unavailability of personnel and increased cybersecurity risks as employees work remotely.

The Company wishes to caution readers not to place undue reliance on any such forward looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions that may be made to any forward looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

For further information:

Robert L. Peacock

SEVP Chief Financial Officer

rpeacock@orangebanktrust.com

Phone: (845) 341-5005

SOURCE: Orange County Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/685703/Orange-County-Bancorp-Inc-Announces-Record-Earnings-for-2021