Orange County Bancorp, Inc. Announces First Quarter Results

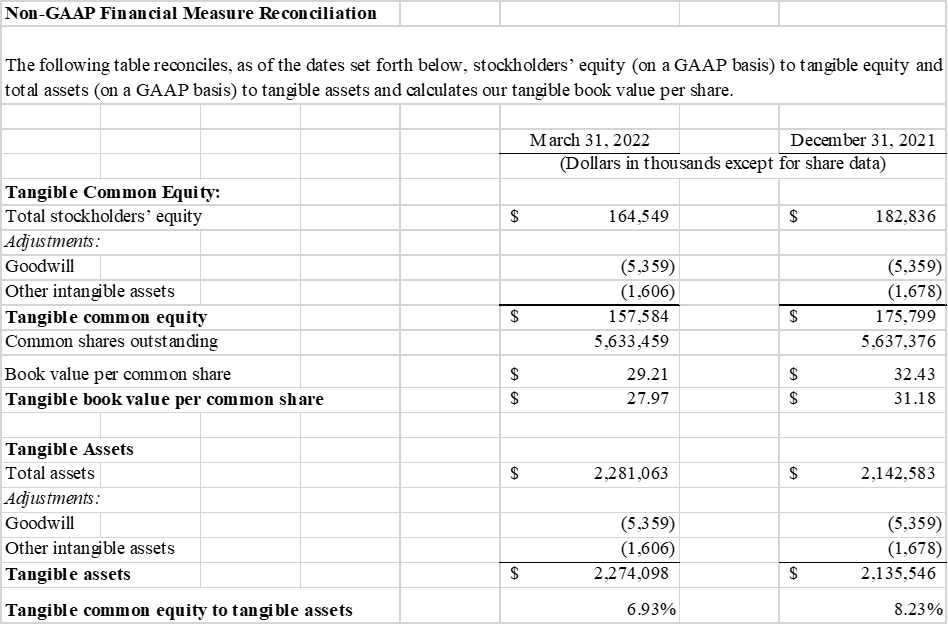

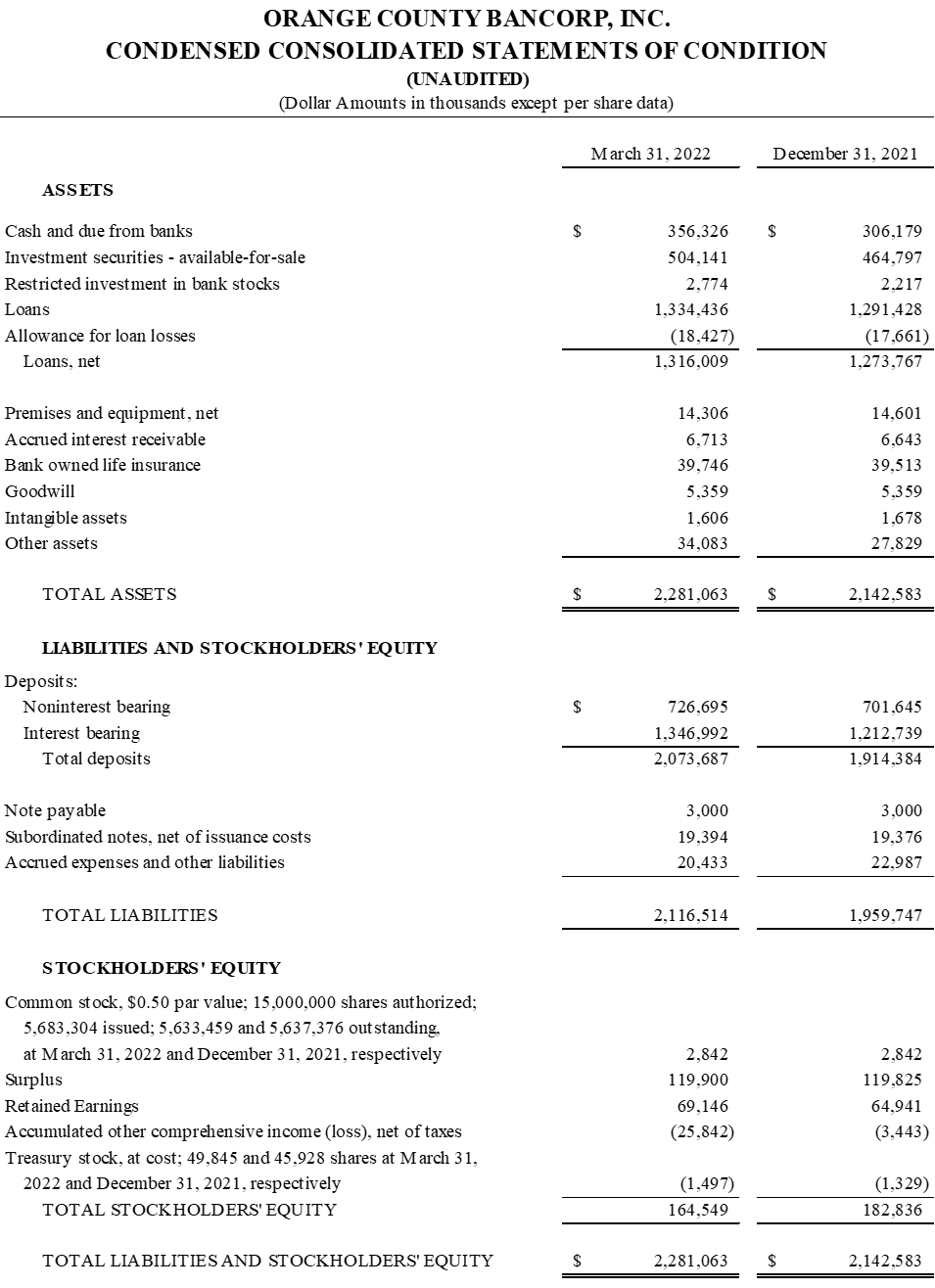

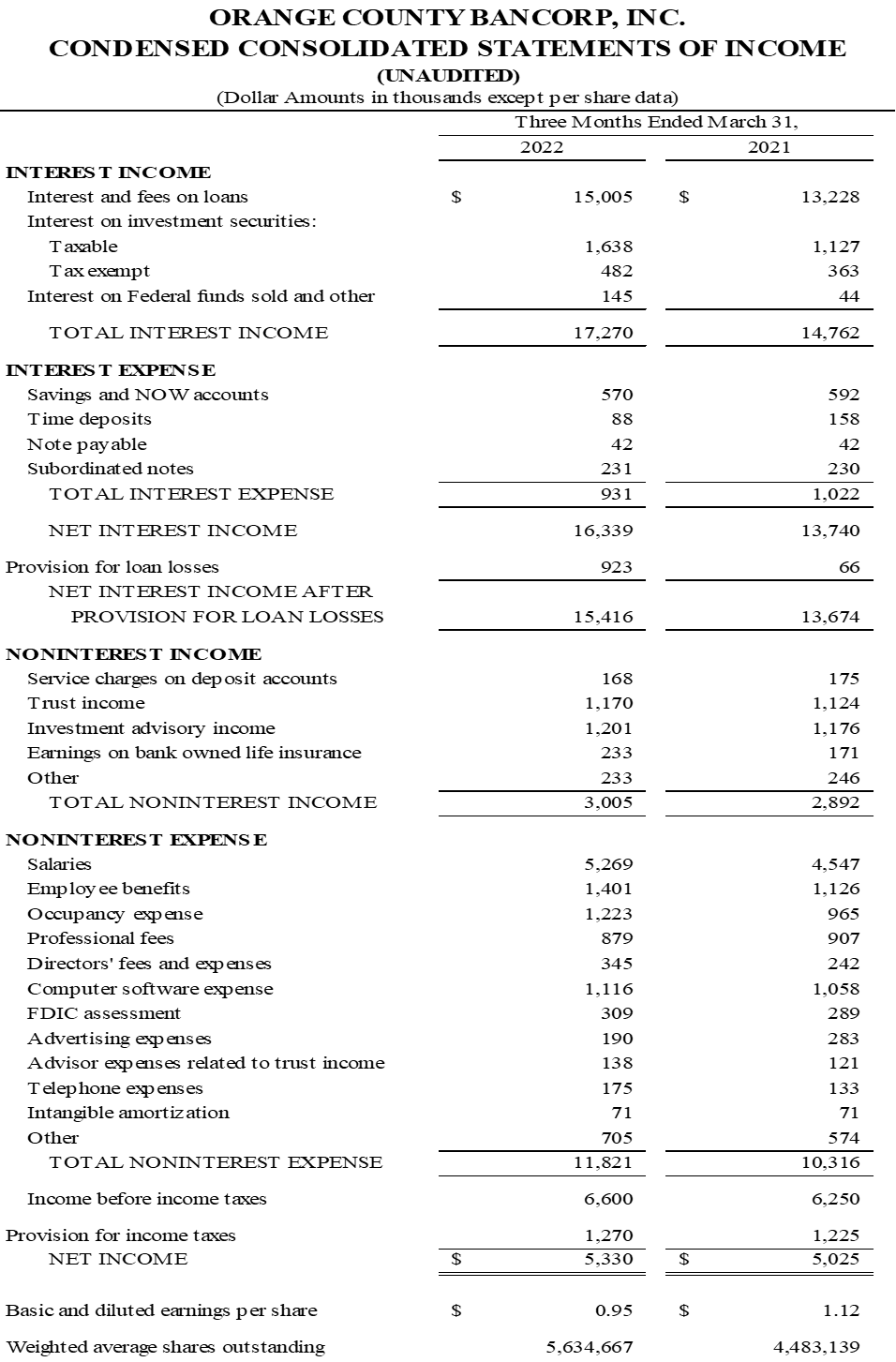

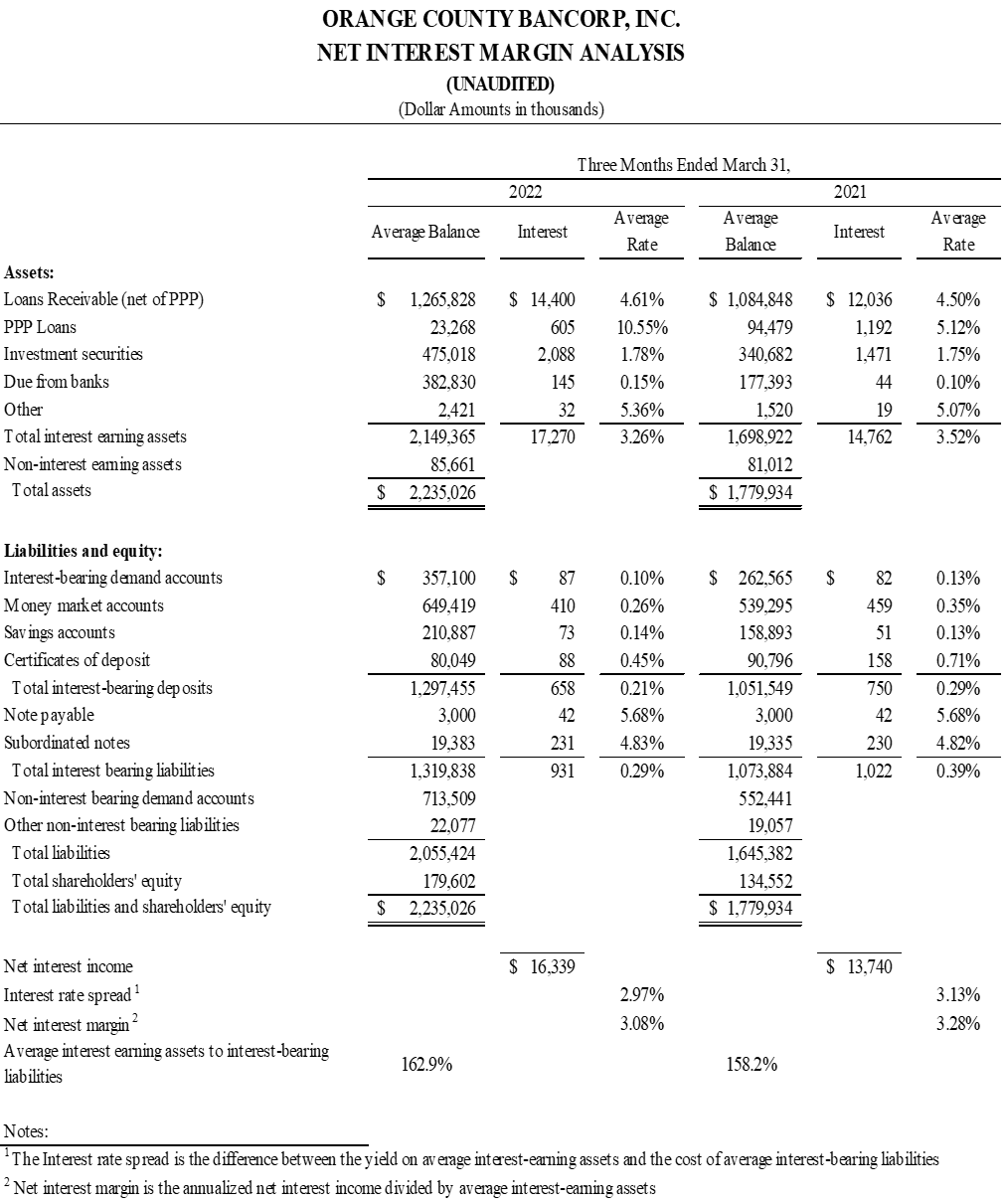

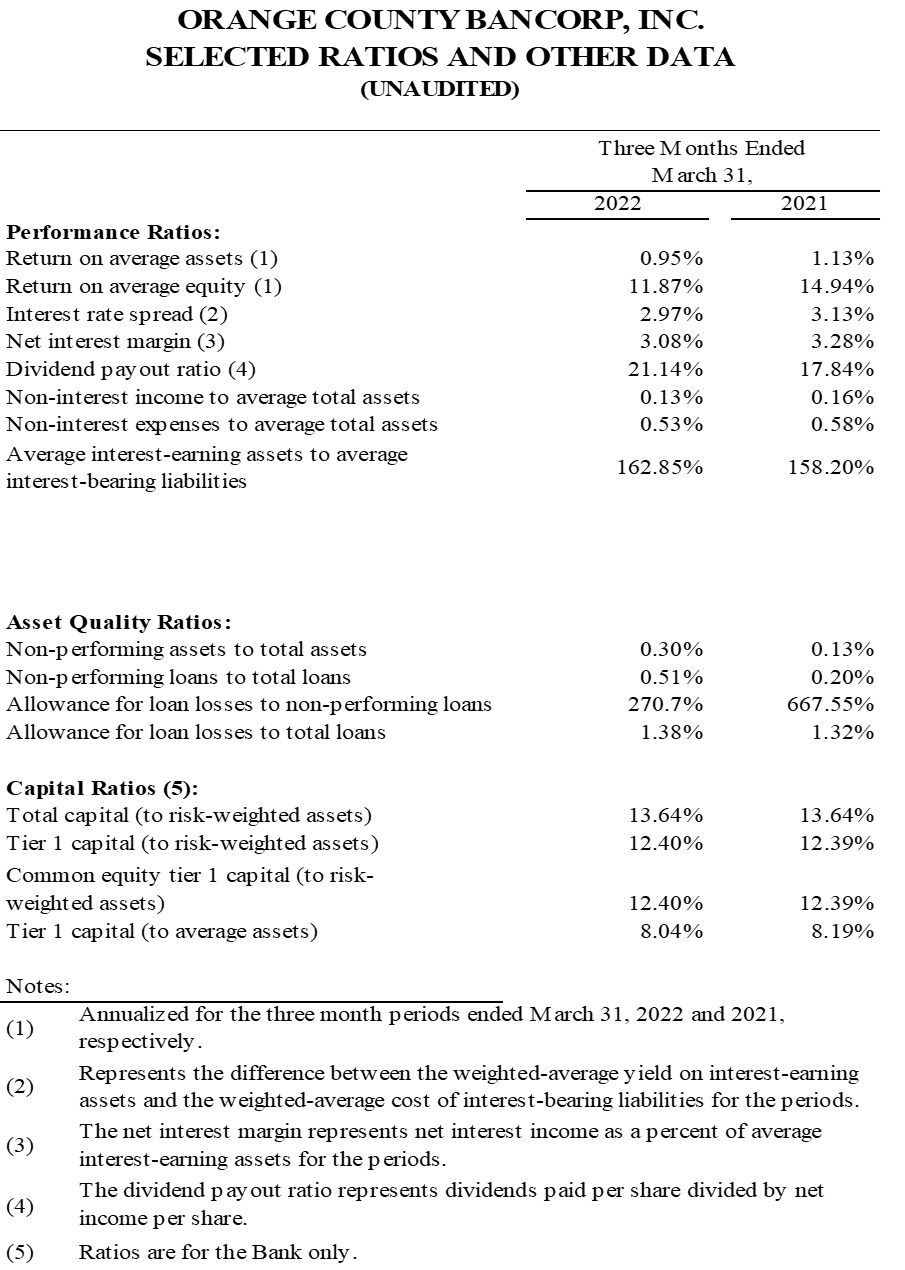

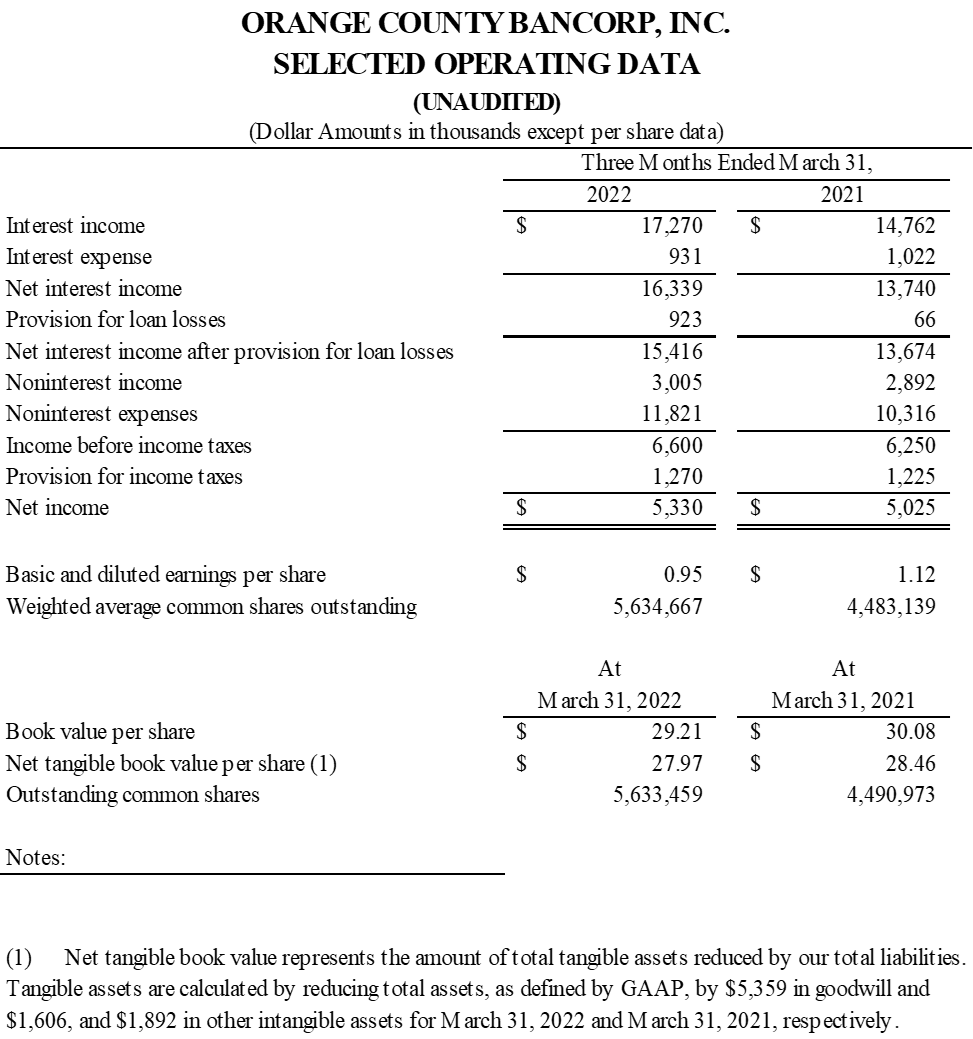

Orange County Bancorp reported a net income of $5.3 million for Q1 2022, representing a 6.1% increase from Q1 2021. However, return on average assets declined to 0.95%, and return on average equity fell to 11.87%, primarily due to an increase in shares post-IPO. Total assets grew by 6.5% to nearly $2.3 billion, driven by significant loan growth of 16.7%. Despite increased provisions for loan losses, non-interest income rose to $3.0 million. The tangible book value per share decreased by 10.3% amid rising interest rates, reflecting challenges in the current market.

- Net income increased 6.1% to $5.3 million for Q1 2022.

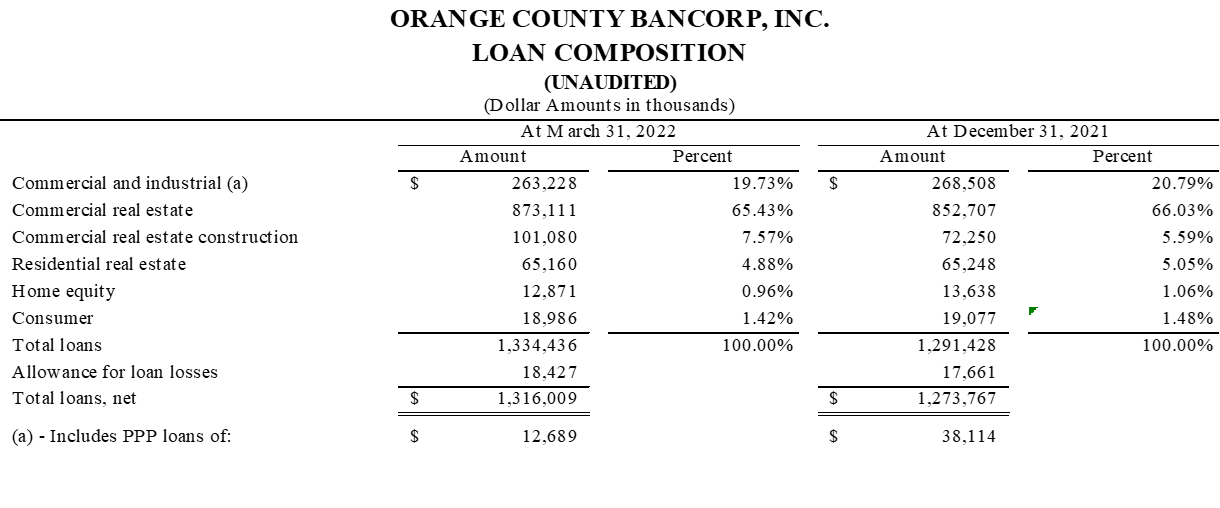

- Average loans grew by 16.7% year-over-year, reaching over $1.3 billion.

- Total assets increased by 6.5% to almost $2.3 billion.

- Non-interest income rose to $3.0 million, supported by trust operations.

- Return on average assets declined 18 basis points to 0.95%.

- Return on average equity fell 307 basis points to 11.87% due to IPO share issuance.

- Tangible book value per share decreased by 10.3% from Q4 2021.

- Provision for loan losses increased significantly to $923 thousand from $66 thousand.

Insights

Analyzing...

Orange County Bancorp, Inc. Announces First Quarter Results:

- Net Income for Q1 2022 increased

$305 thousand , or6.1% , over Q1 2021 to$5.3 million - Annualized return on average assets for Q1 2022 declined 18 basis points to

0.95% as compared to1.13% for the same quarter in 2021 as a result of the strong deposit growth during the period - Annualized return on average equity for Q1 2022 declined 307 basis points to

11.87% as compared to14.94% for the same quarter in 2021 due mainly to the effect of the initial public offering during the second half of 2021 - Average loans (net of PPP) for Q1 2022 increased approximately

16.7% , to over$1.3 billion from$1.1 billion for Q1 2021 - Provision for loan losses of

$923 thousand for Q1 2022 increased from$66 thousand in Q1 2021 due to overall loan growth of CRE and Construction loans as well as new loans within the C&I portfolio - Average demand and money market deposits for Q1 2022 rose

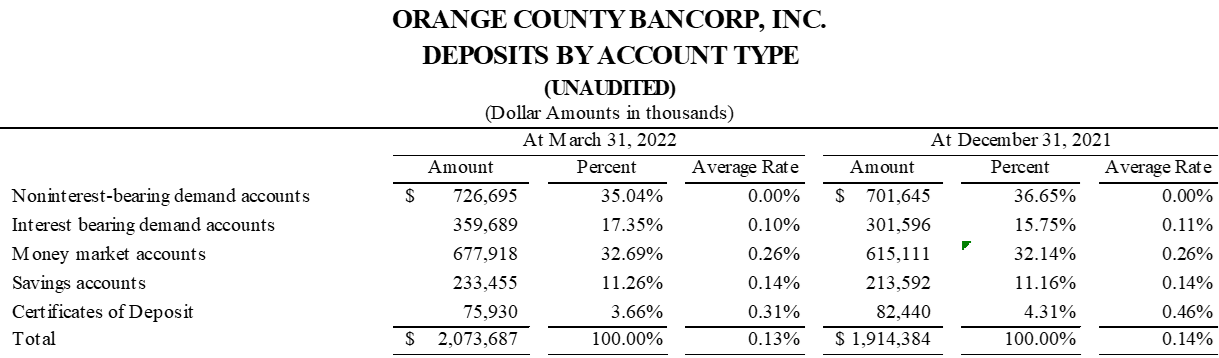

25.5% , to$1.0 billion , from$801 million for Q1 2021 - Total Assets grew

$138.5 million , or6.5% , from year-end 2021 to almost$2.3 billion at March 31, 2022 - Trust and asset advisory business revenue increased

3.1% , to almost$2.4 million , for Q1 2022 as compared to the same quarter in 2021

MIDDLETOWN, NY / ACCESSWIRE / April 27, 2022 / Orange County Bancorp, Inc. (the "Company") (NASDAQ:OBT), parent company of Orange Bank & Trust Co. (the "Bank") and Hudson Valley Investment Advisors, Inc. ("HVIA"), today announced net income of

Tangible book value per share experienced a decrease of

"Economic data in the first quarter further confirmed the reemergence of inflation," said Company President and CEO Michael Gilfeather. "The Federal Reserve responded with a 25 basis points increase in rates and indicated additional hikes to come. This resulted in a sell off in stock and bond markets, broadly impacting the financial services sector. While our business isn't immune to such changes, our strategic focus on business banking served to blunt, and in some cases capitalize on, the challenges presented by these shifting policy dynamics."

"I am pleased to announce the operational momentum we enjoyed in 2021 continued into 2022," Gilfeather added, "with net income increasing

Our Wealth Management division revenues, which include our Trust and Asset Management businesses grew

While a shift toward higher interest rates is disruptive to any bank's business plan, we made a conscious decision early last year to keep over

The economy of the lower Hudson Valley region we serve remains robust and continued growth in our loan portfolio reflects the attractive opportunities our business partners are seeing. An ancillary benefit of a strong economy is consolidation, which the banking industry in our area has recently experienced. Orange Bank has consistently benefitted from the acquisition of competitors by larger banks, who often reduce their regional focus, as well as the inevitable downsizing that follows, giving us an opportunity to add quality professionals, which further support our growth. We have been highly opportunistic in this regard.

While 2022 began with a challenging shift in Fed policy, our business model proved its adaptability and resilience - both directly, through strategic, purposeful management and planning, and indirectly, by pursuing opportunity in the face of adversity. It also demonstrated our resolve and ability to grow in a disciplined and conservative manner. There is no guarantee we can repeat such results in the face of ongoing rate increases or an economic slowdown. None of this would be possible without the commitment of our dedicated employees, the understanding of our investors, and ongoing support and satisfaction of our business clients."

First Quarter 2022 Financial Review

Net Income

Net income for the first quarter of 2022 was

Net Interest Income

For the three months ended March 31, 2022, net interest income increased

Total interest income rose

Total interest expense decreased

Furthermore, the increase in Cash during the quarters presented had a negative effect on the calculation of the Net Interest Margin. Within the current interest rate environment, these excess cash balances represent an attractive reinvestment opportunity for the Bank.

Provision for Loan Losses

The Company recognized a provision for loan losses of

Non-Interest Income

Non-interest income was

Non-Interest Expense

Non-interest expense was

Income Tax Expense

Our provision for income taxes for the three months ended March 31, 2022 was approximately

Financial Condition

Total consolidated assets increased

Total cash and due from banks increased from

Total investment securities rose

Total loans increased

Total deposits grew

Stockholders' equity experienced a decrease of approximately

At March 31, 2022, the Bank maintained capital ratios in excess of regulatory standards for well capitalized institutions. The Bank's Tier 1 capital to average assets ratio was

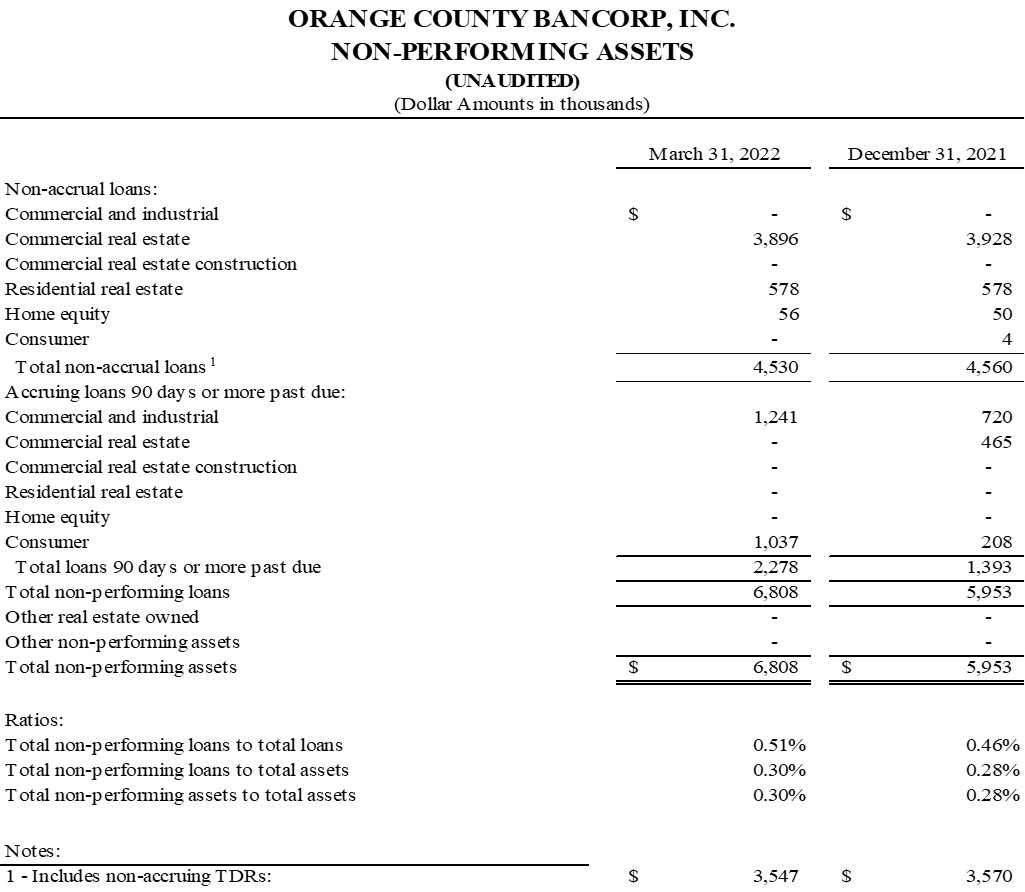

Loan Quality

At March 31, 2022, the Bank had total non-performing loans of

About Orange County Bancorp, Inc.

Orange County Bancorp, Inc. is the parent company of Orange Bank & Trust Company and Hudson Valley Investment Advisors, Inc. Orange Bank & Trust Company is an independent bank that began with the vision of 14 founders over 125 years ago. It has grown through innovation and an unwavering commitment to its community and business clientele to more than

Forward Looking Statements

Certain statements contained herein are "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward looking statements may be identified by reference to a future period or periods, or by the use of forward looking terminology, such as "may," "will," "believe," "expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms, or the negative of those terms. Forward looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the real estate and economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, inflation, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. Further, given its ongoing and dynamic nature, it is difficult to predict what the continuing effects of the COVID-19 pandemic will have on our business and results of operations. The pandemic and related local and national economic disruption may, among other effects, continue to result in a material adverse change for the demand for our products and services; increased levels of loan delinquencies, problem assets and foreclosures; branch disruptions, unavailability of personnel and increased cybersecurity risks as employees work remotely.

The Company wishes to caution readers not to place undue reliance on any such forward looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions that may be made to any forward looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

For further information:

Robert L. Peacock

SEVP Chief Financial Officer

rpeacock@orangebanktrust.com

Phone: (845) 341-5005

SOURCE: Orange County Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/699116/Orange-County-Bancorp-Inc-Announces-First-Quarter-Results