127th Common Stock Monthly Dividend Increase Declared by Realty Income

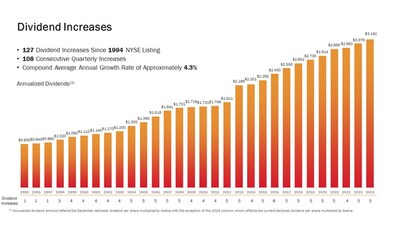

Realty Income (NYSE: O), known as The Monthly Dividend Company®, has announced its 127th dividend increase since its 1994 NYSE listing. The company has declared a monthly cash dividend increase from $0.2630 to $0.2635 per share, payable on October 15, 2024, to stockholders of record as of October 1, 2024. This raise brings the annualized dividend to $3.162 per share, up from $3.156. Realty Income has maintained a 651-consecutive monthly dividend streak throughout its 55-year history, with 108 consecutive quarterly increases since its NYSE listing. The company, an S&P 500 member, boasts a diverse portfolio of 15,450 properties across the U.S. and Europe.

Realty Income (NYSE: O), conosciuta come The Monthly Dividend Company®, ha annunciato il suo 127° aumento di dividendo dalla sua quotazione in borsa nel 1994. L'azienda ha dichiarato un aumento del dividendo in contanti mensile da $0.2630 a $0.2635 per azione, che sarà pagato il 15 ottobre 2024, agli azionisti registrati al 1° ottobre 2024. Questo aumento porta il dividendo annualizzato a $3.162 per azione, rispetto a $3.156. Realty Income ha mantenuto una striscia di dividendi mensili consecutivi di 651 mesi nella sua storia di 55 anni, con 108 aumenti trimestrali consecutivi dalla sua quotazione in borsa. L'azienda, membro dell'S&P 500, vanta un portafoglio diversificato di 15.450 proprietà negli Stati Uniti e in Europa.

Realty Income (NYSE: O), conocida como The Monthly Dividend Company®, ha anunciado su incremento de dividendo número 127 desde su entrada en la NYSE en 1994. La compañía ha declarado un aumento del dividendo en efectivo mensual de $0.2630 a $0.2635 por acción, pagadero el 15 de octubre de 2024, a los accionistas registrados al 1 de octubre de 2024. Este incremento lleva el dividendo anualizado a $3.162 por acción, subiendo de $3.156. Realty Income ha mantenido una racha de 651 meses consecutivos de dividendos a lo largo de su historia de 55 años, con 108 incrementos trimestrales consecutivos desde su cotización en la NYSE. La compañía, miembro del S&P 500, cuenta con un diverso portfolio de 15,450 propiedades en Estados Unidos y Europa.

Realty Income (NYSE: O), 일명 The Monthly Dividend Company®,는 1994년 NYSE 상장 이후 127번째 배당금 인상을 발표했습니다. 회사는 $0.2630에서 $0.2635로 월간 현금 배당을 인상한다고 발표했으며, 이 배당금은 2024년 10월 15일에 2024년 10월 1일 기준 주주에게 지급됩니다. 이 인상으로 연간 배당금이 주당 $3.162로 증가하였으며, 이전에는 $3.156였습니다. Realty Income은 55년의 역사 동안 651개월 연속 배당금 지급 기록을 유지해 왔으며, NYSE 상장 이후 108개월 연속 분기 배당금 인상을 기록했습니다. 이 회사는 S&P 500의 회원으로, 미국과 유럽에 걸쳐 15,450개의 다양한 부동산 포트폴리오를 보유하고 있습니다.

Realty Income (NYSE: O), connue sous le nom de The Monthly Dividend Company®, a annoncé sa 127ème augmentation de dividende depuis son introduction en bourse en 1994. L'entreprise a déclaré une augmentation de son dividende en espèces mensuel de $0.2630 à $0.2635 par action, payable le 15 octobre 2024, aux actionnaires enregistrés au 1er octobre 2024. Cette augmentation porte le dividende annualisé à $3.162 par action, contre $3.156 auparavant. Realty Income a maintenu une série ininterrompue de 651 mois de paiements de dividende tout au long de ses 55 ans d'histoire, avec 108 augmentations trimestrielles consécutives depuis son introduction en bourse. L'entreprise, membre du S&P 500, possède un portefeuille diversifié de 15 450 propriétés à travers les États-Unis et l'Europe.

Realty Income (NYSE: O), bekannt als The Monthly Dividend Company®, hat seine 127. Dividendensteigerung seit der Börsennotierung 1994 bekannt gegeben. Das Unternehmen hat eine Erhöhung der monatlichen Bargelddividende von $0.2630 auf $0.2635 pro Aktie erklärt, die am 15. Oktober 2024 an die Aktionäre gezahlt wird, die am 1. Oktober 2024 registriert sind. Diese Erhöhung bringt die annualisierte Dividende auf $3.162 pro Aktie, im Vergleich zu $3.156. Realty Income hat über seine 55-jährige Geschichte eine ununterbrochene Serie von 651 monatlichen Dividendenzahlungen aufrechterhalten, mit 108 aufeinanderfolgenden vierteljährlichen Erhöhungen seit der Notierung an der NYSE. Das Unternehmen, Mitglied des S&P 500, verfügt über ein vielfältiges Portfolio von 15.450 Immobilien in den USA und Europa.

- Declared 127th dividend increase since 1994 NYSE listing

- Monthly dividend increased to $0.2635 per share

- Annualized dividend raised to $3.162 per share

- 651 consecutive monthly dividends paid over 55-year history

- 108 consecutive quarters of dividend increases

- Diverse portfolio of 15,450 properties across multiple countries

- None.

"The dividend remains core to Realty Income's mission," said Sumit Roy, Realty Income's President and Chief Executive Officer. "This is the 108th consecutive quarter that we have declared a dividend increase since our 1994 NYSE listing and today's declaration represents the 651st consecutive monthly dividend throughout our 55-year operating history."

About Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies. Founded in 1969, we invest in diversified commercial real estate and have a portfolio of 15,450 properties in all 50 U.S. states, the

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this press release, the words "estimated," "anticipated," "expect," "believe," "intend," "continue," "should," "may," "likely," "plans," and similar expressions are intended to identify forward-looking statements. Forward-looking statements include discussions of our business and portfolio; cash flows; the intentions of management; and dividends, including the amount, timing and payment of dividends. Forward-looking statements are subject to risks, uncertainties, and assumptions about us, which may cause our actual future results to differ materially from expected results. Some of the factors that could cause actual results to differ materially are, among others, our continued qualification as a real estate investment trust; general domestic and foreign business, economic, or financial conditions; competition; fluctuating interest and currency rates; inflation and its impact on our clients and us; access to debt and equity capital markets and other sources of funding (including the terms and partners of such funding); continued volatility and uncertainty in the credit markets and broader financial markets; other risks inherent in the real estate business including our clients' solvency, client defaults under leases, increased client bankruptcies, potential liability relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; impairments in the value of our real estate assets; changes in domestic and foreign income tax laws and rates; property ownership through joint ventures, partnerships and other arrangements which may limit control of the underlying investments; epidemics or pandemics, including measures taken to limit their spread, the impacts on us, our business, our clients, and the economy generally; the loss of key personnel; the outcome of any legal proceedings to which we are a party or which may occur in the future; acts of terrorism and war; the anticipated benefits from mergers and acquisitions including from the merger with Spirit Realty Capital, Inc.; and those additional risks and factors discussed in our reports filed with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are not guarantees of future plans and performance and speak only as of the date of this press release. Actual plans and operating results may differ materially from what is expressed or forecasted in this press release. We do not undertake any obligation to update forward-looking statements or publicly release the results of any forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/127th-common-stock-monthly-dividend-increase-declared-by-realty-income-302244143.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/127th-common-stock-monthly-dividend-increase-declared-by-realty-income-302244143.html

SOURCE Realty Income Corporation