124th Common Stock Monthly Dividend Increase Declared by Realty Income

- None.

- None.

Insights

The marginal increase in Realty Income's monthly dividend, from $0.2565 to $0.2570 per share, reflects a conservative approach to capital distribution. While the increment is minimal, it upholds the company's reputation as a reliable dividend-paying entity. This strategy could be perceived as a signal of financial stability and a commitment to returning value to shareholders, potentially attracting income-focused investors.

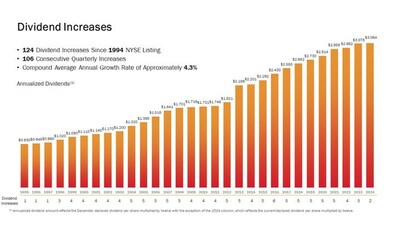

From a financial analysis standpoint, the annualized dividend amount's slight rise from $3.078 to $3.084 per share may not significantly affect the company's stock price in the short-term. However, the consistency in dividend growth, marking the 124th increase, underpins investor confidence and could contribute to stock resilience during market volatility. The commitment to a dependable dividend could also be a factor in the stock's risk profile, possibly lowering the perceived risk among conservative investors.

Realty Income's dividend increase aligns with its long-standing branding as 'The Monthly Dividend Company', reinforcing its market position among real estate investment trusts (REITs) that prioritize regular income distributions. This incremental dividend increase strategy may not be aggressive, but it serves to differentiate Realty Income from other players in the market that may offer less frequent or less predictable dividends.

Considering the broader market context, where investors may be wary of economic uncertainties or interest rate hikes, Realty Income's announcement could be seen as a move to maintain investor loyalty and attract those seeking stable, income-generating investments. The company's historical performance, with 645 consecutive monthly dividends, is likely to be highlighted in marketing efforts to strengthen its appeal to a specific investor demographic.

The decision to increase dividends, even marginally, can be reflective of broader economic conditions. In a low-interest-rate environment, companies like Realty Income might capitalize on cheaper borrowing costs to finance distributions. Conversely, in a rising interest rate scenario, such a move could indicate strong operational cash flows and a robust financial position that allows the company to maintain or increase dividends without overly leveraging.

Long-term implications of consistent dividend increases can have a stabilizing effect on the company's stock, particularly during economic downturns when investors might seek refuge in assets that provide regular income. The company's ability to sustain its dividend policy through various economic cycles could be indicative of its resilience and strategic financial management.

"We remain dedicated to Realty Income's mission of providing stockholders with a dependable monthly dividend that increases over time," said Sumit Roy, President and Chief Executive Officer of Realty Income. "This is the 106th consecutive quarter that we have declared a dividend increase since our 1994 NYSE listing and today's declaration represents the 645th consecutive monthly dividend throughout our 55-year operating history."

About Realty Income

Realty Income, The Monthly Dividend Company®, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats® index. We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a REIT, and its monthly dividends are supported by the cash flow from over 15,450 real estate properties (including properties acquired in the Spirit merger in January 2024) primarily owned under long-term net lease agreements with commercial clients. To date, the company has declared 645 consecutive monthly dividends on its shares of common stock throughout its 55-year operating history and increased the dividend 124 times since Realty Income's public listing in 1994 (NYSE: O). Additional information about the company can be obtained from the corporate website at www.realtyincome.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this press release, the words "estimated," "anticipated," "expect," "believe," "intend," "continue," "should," "may," "likely," "plans," and similar expressions are intended to identify forward-looking statements. Forward-looking statements include discussions of our business and portfolio and the intentions of management including the amount, timing and payment of dividends. Forward-looking statements are subject to risks, uncertainties, and assumptions about us, which may cause our actual future results to differ materially from expected results. Some of the factors that could cause actual results to differ materially are, among others, our continued qualification as a REIT; general domestic and foreign business, economic, or financial conditions; competition; fluctuating interest and currency rates; inflation and its impact on our clients and us; access to debt and equity capital markets and other sources of funding; continued volatility and uncertainty in the credit markets and broader financial markets; other risks inherent in the real estate business including our clients' defaults under leases, increased client bankruptcies, potential liability relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; impairments in the value of our real estate assets; changes in domestic and foreign income tax laws and rates; our clients' solvency; property ownership through joint ventures and partnerships which may limit control of the underlying investments; current or future epidemics or pandemics, measures taken to limit their spread, the impacts on us, our business, our clients, and the economy generally; the loss of key personnel; the outcome of any legal proceedings to which we are a party or which may occur in the future; acts of terrorism and war; the anticipated benefits from the merger with Spirit Realty Capital, Inc.; and those additional risks and factors discussed in our reports filed with the

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/124th-common-stock-monthly-dividend-increase-declared-by-realty-income-302088355.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/124th-common-stock-monthly-dividend-increase-declared-by-realty-income-302088355.html

SOURCE Realty Income Corporation

FAQ

What is the new monthly dividend amount declared by Realty Income Corporation (NYSE: O)?

When is the dividend payable to stockholders of Realty Income Corporation (NYSE: O)?

How many consecutive quarters has Realty Income Corporation (NYSE: O) declared dividend increases?