Demand Rises as Sellers List their Homes and Buy New Ones

According to Realtor.com's October Monthly Housing Report, home sellers who listed properties in September contributed to increased market demand in October, with significant pending home sales increases in key markets like Seattle (+50.5%), Boston (+25.7%), and San Diego (+22.1%). Active inventory rose 29.2% compared to October 2023, reaching its highest level since December 2019. New listings increased by 9.9% year-over-year, with the West leading regional growth at 7%. The median listing price remained stable at $424,950, while the median list price per square foot increased by 2.1% year-over-year and 50.5% compared to October 2019.

Secondo il Rapporto Mensile sul Mercato Immobiliare di Realtor.com di ottobre, i venditori di case che hanno messo in vendita le proprietà a settembre hanno contribuito ad aumentare la domanda di mercato in ottobre, con significativi aumenti delle vendite di case in attesa in mercati chiave come Seattle (+50,5%), Boston (+25,7%) e San Diego (+22,1%). Le scorte attive sono aumentate del 29,2% rispetto a ottobre 2023, raggiungendo il livello più alto dal dicembre 2019. Le nuove inserzioni sono aumentate del 9,9% rispetto all'anno precedente, con l'ovest che guida la crescita regionale con un +7%. Il prezzo medio di richiesta è rimasto stabile a $424.950, mentre il prezzo medio per piede quadrato è aumentato del 2,1% rispetto all'anno precedente e del 50,5% rispetto a ottobre 2019.

Según el Informe Mensual del Mercado de Viviendas de Realtor.com de octubre, los vendedores de casas que listaron propiedades en septiembre contribuyeron a un aumento en la demanda del mercado en octubre, con incrementos significativos en las ventas pendientes de viviendas en mercados clave como Seattle (+50.5%), Boston (+25.7%) y San Diego (+22.1%). El inventario activo aumentó un 29.2% en comparación con octubre de 2023, alcanzando su nivel más alto desde diciembre de 2019. Las nuevas listados aumentaron un 9.9% interanual, liderando el crecimiento regional el oeste con un 7%. El precio medio de lista se mantuvo estable en $424,950, mientras que el precio medio por pie cuadrado aumentó un 2.1% interanual y un 50.5% en comparación con octubre de 2019.

Realtor.com의 10월 월간 주택 보고서에 따르면, 9월에 매물로 나온 집주인들이 10월의 시장 수요 증가에 기여했으며, 시애틀 (+50.5%), 보스턴 (+25.7%), 샌디에이고 (+22.1%)와 같은 주요 시장에서 보류 중인 주택 판매가 크게 증가했습니다. 활성 재고는 2023년 10월과 비교하여 29.2% 증가하여 2019년 12월 이후 가장 높은 수준에 도달했습니다. 신규 목록은 전년 대비 9.9% 증가했으며, 서부 지역이 7%로 지역 성장률을 선도했습니다. 중간 등록 가격은 $424,950로 안정세를 유지했으며, 평방 피트당 중간 가격은 전년 대비 2.1% 증가하고 2019년 10월과 비교하여 50.5% 증가했습니다.

Selon le Rapport Mensuel sur l'Habitat de Realtor.com d'octobre, les vendeurs de maisons ayant listé leurs propriétés en septembre ont contribué à une augmentation de la demande sur le marché en octobre, avec des augmentations significatives des ventes en attente dans des marchés clés comme Seattle (+50,5%), Boston (+25,7%) et San Diego (+22,1%). Les stocks actifs ont augmenté de 29,2% par rapport à octobre 2023, atteignant leur niveau le plus élevé depuis décembre 2019. Les nouvelles annonces ont augmenté de 9,9% par rapport à l'année précédente, l'ouest menant la croissance régionale avec une hausse de 7%. Le prix médian de liste est resté stable à 424 950 $, tandis que le prix médian par pied carré a augmenté de 2,1% par rapport à l'année précédente et de 50,5% par rapport à octobre 2019.

Laut dem monatlichen Immobilienbericht von Realtor.com für Oktober trugen Hausverkäufer, die im September Immobilien anboten, zur erhöhten Marktnachfrage im Oktober bei, mit signifikanten Zuwächsen bei den laufenden Hausverkäufen in Schlüsselmärkten wie Seattle (+50,5%), Boston (+25,7%) und San Diego (+22,1%). Der aktive Bestand stieg um 29,2% im Vergleich zu Oktober 2023 und erreichte den höchsten Stand seit Dezember 2019. Neue Angebote stiegen im Jahresvergleich um 9,9%, wobei der Westen das regionale Wachstum mit 7% anführte. Der durchschnittliche Listenpreis blieb stabil bei 424.950 $, während der durchschnittliche Preis pro Quadratfuß um 2,1% im Jahresvergleich und um 50,5% im Vergleich zu Oktober 2019 anstieg.

- Active inventory increased 29.2% YoY, reaching highest level since December 2019

- New listings grew 9.9% YoY across all regions

- Strong pending sales growth in major markets (Seattle +50.5%, Boston +25.7%, San Diego +22.1%)

- Median listing prices remain elevated at $424,950, showing no improvement in affordability

- Properties spending longer time on market (+8 days to 58 days YoY)

- New listings still 14.3% below pre-pandemic levels

Insights

The housing market shows meaningful signs of recovery with active listings up

The correlation between September's new listings and October's pending sales indicates many sellers are simultaneously buying, creating a self-sustaining market momentum. However, regional disparities persist - the South is closest to pre-pandemic levels at just

The emerging price dynamics in swing states present intriguing political implications. These markets are positioned

Regional inventory recovery shows uneven progress, with the West leading new listings at

- September's rate drop and increase in new listings led to October's increase in pending sales, but could rising rates in October hinder momentum?

- Affordability issues in swing states may have these voters more interested in Federal housing policies

"Existing home sales have been disappointingly low so far in 2024 as mortgage rates remained stubbornly high, but the data show that sellers--many of whom are also buyers--responded as mortgage rates volleyed in the low- to mid

October 2024 Housing Metrics – National

Metric | Change over Oct. 2023 | Change over Oct. 2019 |

Median listing price | | +37.1 % |

Active listings | +29.2 % | -21.1 % |

New listings | +9.9 % | -14.3 % |

Median days on market | +8 days (to 58 days) | -7 days |

Share of active listings with price reductions | +0.0 percentage points (to | +1.1 percentage points |

Median List Price Per Sq.Ft. | +2.1 % | +50.5 % |

Sellers Offload and Scoop up Homes

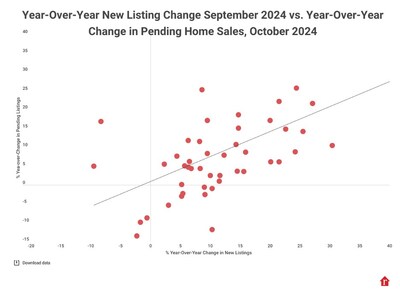

When sellers list their homes on the market it could point to a number of likely scenarios. On the one hand, the seller could be listing a primary residence with the intention to buy another home, they could be selling to move into a rental, or they could be selling a secondary home. This month, the data suggests that many sellers are selling primary residences and buying new homes through the very strong correlation between increased new listings in September 2024 and the increase in pending listings this month across the largest 50 markets.

In fact, a few of the largest markets including

Mirror Mirror on the Wall, Show Me Where the Swing States May Fall

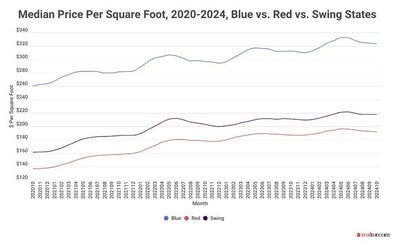

Home affordability is top of mind for many people especially in the current real estate market. As the median listing price per square foot increased by

"When it comes to home prices, swing states have mirrored red states much more than blue states over the past four years. If rising home prices since the last election matter for voters next week, it implies that swing state voters may have federal housing policy on their minds much less than voters in blue states but perhaps a little more than voters in red states" said Ralph McLaughlin, Sr. Economist, Realtor.com®.

Inventory Hits A High

On a typical day in October, there were

While active inventory hit its highest level since December 2019, it's important to note the gap in newly listed homes compared with pre-pandemic 2017 to 2019 levels is still apparent, though dwindling. The South continues to close the gap as newly listed homes sat just

October 2024 Housing Overview of the 50 Largest Metros

Metro Area | Median Listing Price | Median Listing Price YoY | Median Listing Price per Sq. Ft. YoY | Median Listing Price vs October 2019 | Median Listing Price per Sq. Ft. vs October 2019 |

-3.5 % | 0.5 % | 29.0 % | 50.1 % | ||

-5.4 % | -4.0 % | 44.7 % | 54.8 % | ||

0.7 % | 1.5 % | 14.0 % | 28.8 % | ||

1.7 % | 1.3 % | 13.2 % | 27.3 % | ||

0.0 % | 2.3 % | 42.5 % | 60.3 % | ||

5.9 % | 5.4 % | 35.0 % | 46.2 % | ||

2.1 % | 1.4 % | 28.1 % | 57.1 % | ||

-0.3 % | 1.9 % | 17.4 % | 32.6 % | ||

-7.0 % | 3.5 % | 25.0 % | 51.0 % | ||

5.0 % | 12.0 % | 29.2 % | 51.5 % | ||

0.7 % | 4.1 % | 31.8 % | 54.6 % | ||

-3.2 % | 0.0 % | 26.3 % | 43.2 % | ||

-5.5 % | -0.3 % | 21.2 % | 40.9 % | ||

7.5 % | 4.9 % | 14.4 % | 32.1 % | ||

0.0 % | 13.0 % | 34.0 % | 63.2 % | ||

0.1 % | 0.2 % | 19.4 % | 37.0 % | ||

0.6 % | 3.6 % | 23.5 % | 52.3 % | ||

-6.4 % | -2.7 % | 32.6 % | 49.9 % | ||

-8.6 % | -1.7 % | 20.8 % | 41.7 % | ||

0.0 % | 4.3 % | 48.4 % | 54.6 % | ||

-0.8 % | 1.9 % | 37.4 % | 46.7 % | ||

3.9 % | 3.8 % | 24.7 % | 41.8 % | ||

5.1 % | 0.0 % | 45.5 % | 59.7 % | ||

-12.3 % | -8.8 % | 31.5 % | 42.1 % | ||

11.0 % | 9.8 % | 42.5 % | 46.7 % | ||

-1.5 % | 1.0 % | 25.0 % | 31.0 % | ||

-5.4 % | 0.7 % | 46.6 % | 60.8 % | ||

-2.8 % | -1.9 % | 14.3 % | 24.7 % | ||

4.5 % | 7.4 % | 31.9 % | 72.3 % | ||

-5.9 % | -0.5 % | 24.5 % | 39.9 % | ||

-5.0 % | -1.8 % | 33.7 % | 51.5 % | ||

7.6 % | 5.2 % | 26.2 % | 50.0 % | ||

-1.9 % | -0.2 % | 35.4 % | 52.2 % | ||

-1.1 % | 5.0 % | 22.6 % | 31.1 % | ||

-2.8 % | 0.1 % | 29.4 % | 38.1 % | ||

2.4 % | 6.2 % | 45.6 % | 46.8 % | ||

-1.6 % | 1.4 % | 23.6 % | 50.4 % | ||

1.8 % | 4.6 % | 38.5 % | 57.1 % | ||

3.3 % | 1.7 % | 46.1 % | 57.8 % | ||

11.0 % | 7.0 % | 38.8 % | 44.4 % | ||

-3.4 % | 0.3 % | 29.2 % | 37.3 % | ||

-3.5 % | -2.2 % | 18.3 % | 36.4 % | ||

-2.0 % | 0.8 % | 38.8 % | 57.4 % | ||

-9.2 % | -7.0 % | 4.9 % | 19.4 % | ||

1.0 % | 1.5 % | 25.3 % | 25.5 % | ||

-4.1 % | -0.5 % | 29.8 % | 46.8 % | ||

8.1 % | 3.0 % | 36.1 % | 27.1 % | ||

-7.0 % | -6.1 % | 42.9 % | 58.8 % | ||

5.0 % | 5.5 % | 35.6 % | 45.6 % | ||

0.0 % | 3.6 % | 26.3 % | 51.9 % |

Metro Area | Active Listing Count YoY | New Listing Count YoY | Median Days on Market | Median Days on Market Y-Y (Days) | Price– Reduced Share | Price- Reduced Share Y-Y (Percentage Points) |

47.2 % | 7.7 % | 51 | 8 | 22.4 % | 1.7 pp | |

18.6 % | -8.4 % | 73 | 13 | 24.2 % | -10.0 pp | |

31.1 % | 24.9 % | 36 | -1 | 15.9 % | -2.7 pp | |

24.6 % | 11.5 % | 57 | 6 | 17.0 % | -0.6 pp | |

23.8 % | 8.8 % | 34 | 3 | 18.2 % | -0.4 pp | |

10.1 % | -5.0 % | 42 | 3 | 10.4 % | 0.9 pp | |

46.0 % | -3.2 % | 53 | 13 | 22.8 % | 3.4 pp | |

13.0 % | 11.2 % | 37 | 1 | 15.9 % | 0.4 pp | |

25.7 % | 5.0 % | 37 | 5 | 20.7 % | 3.2 pp | |

10.6 % | 0.7 % | 42 | 2 | 19.4 % | 1.8 pp | |

33.2 % | -1.1 % | 39 | 8 | 23.5 % | -1.1 pp | |

39.3 % | 6.1 % | 56 | 11 | 25.9 % | -0.7 pp | |

59.5 % | 13.5 % | 51 | 11 | 30.2 % | 1.0 pp | |

12.8 % | -1.3 % | 40 | 0 | 17.2 % | ||

12.9 % | 14.3 % | 33 | -5 | 10.8 % | 2.3 pp | |

26.2 % | 11.9 % | 50 | 4 | 16.9 % | -3.8 pp | |

15.5 % | 5.9 % | 46 | 5 | 27.5 % | -1.4 pp | |

50.6 % | 13.8 % | 70 | 19 | 26.1 % | 1.5 pp | |

18.2 % | 7.8 % | 51 | 2 | 18.1 % | -1.3 pp | |

49.3 % | 16.3 % | 49 | 6 | 22.6 % | 3.3 pp | |

39.2 % | 9.7 % | 48 | 4 | 14.0 % | ||

18.8 % | 2.2 % | 39 | 7 | 23.4 % | 1.3 pp | |

30.6 % | -9.0 % | 64 | 14 | 24.0 % | 0.6 pp | |

57.2 % | 2.5 % | 74 | 18 | 17.3 % | 0.8 pp | |

7.9 % | 4.3 % | 32 | 0 | 17.1 % | -4.6 pp | |

16.5 % | 6.3 % | 41 | 3 | 18.2 % | -1.0 pp | |

29.5 % | 16.8 % | 54 | 17 | 18.8 % | -6.4 pp | |

15.1 % | 0.5 % | 79 | 12 | 18.4 % | -3.3 pp | |

4.2 % | 12.5 % | 54 | -3 | 8.9 % | -1.2 pp | |

37.1 % | 14.6 % | 48 | 3 | 25.3 % | 2.5 pp | |

57.1 % | 10.6 % | 69 | 19 | 23.1 % | 0.6 pp | |

13.4 % | 6.8 % | 43 | -1 | 16.0 % | -0.3 pp | |

41.7 % | 8.2 % | 50 | 13 | 28.6 % | -0.8 pp | |

19.3 % | -1.7 % | 52 | 1 | 19.9 % | -0.8 pp | |

23.1 % | 14.9 % | 62 | 14 | 28.2 % | 6.9 pp | |

22.5 % | 6.3 % | 36 | 3 | 19.1 % | 7.6 pp | |

39.9 % | 3.2 % | 51 | 8 | 17.8 % | -0.9 pp | |

15.8 % | 6.5 % | 41 | 0 | 15.5 % | 2.9 pp | |

37.5 % | 14.1 % | 54 | 5 | 17.1 % | 0.9 pp | |

17.6 % | -0.6 % | 38 | 20 | 5.5 % | -6.2 pp | |

43.1 % | 17.0 % | 47 | 6 | 19.4 % | -0.8 pp | |

17.6 % | -0.1 % | 68 | 12 | 24.4 % | -4.3 pp | |

63.3 % | 8.3 % | 42 | 8 | 17.7 % | 2.6 pp | |

21.5 % | 5.6 % | 38 | 4 | 14.7 % | -0.6 pp | |

32.7 % | 10.6 % | 34 | 3 | 13.1 % | 0.4 pp | |

60.5 % | 17.5 % | 44 | 6 | 18.2 % | 0.8 pp | |

9.6 % | -3.2 % | 46 | 4 | 17.5 % | -3.2 pp | |

40.6 % | -12.5 % | 73 | 29 | 22.6 % | -4.5 pp | |

30.0 % | 15.3 % | 43 | 5 | 20.4 % | -1.0 pp | |

26.2 % | 19.4 % | 34 | -1 | 14.8 % | -0.7 pp |

Methodology

Realtor.com housing data as of October 2024. Listings include the active inventory of existing single-family homes and condos/townhomes/row homes/co-ops for the given level of geography on Realtor.com; new construction is excluded unless listed via an MLS that provides listing data to Realtor.com. Realtor.com data history goes back to July 2016. The 50 largest

About Realtor.com®

Realtor.com® is an open real estate marketplace built for everyone. Realtor.com® pioneered the world of digital real estate more than 25 years ago. Today, through its website and mobile apps, Realtor.com® is a trusted guide for consumers, empowering more people to find their way home by breaking down barriers, helping them make the right connections, and creating confidence through expert insights and guidance. For professionals, Realtor.com® is a trusted partner for business growth, offering consumer connections and branding solutions that help them succeed in today's on-demand world. Realtor.com® is operated by News Corp [Nasdaq: NWS, NWSA] [ASX: NWS, NWSLV] subsidiary Move, Inc. For more information, visit Realtor.com®.

Media Contact

Asees Singh, press@realtor.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/demand-rises-as-sellers-list-their-homes-and-buy-new-ones-302292229.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/demand-rises-as-sellers-list-their-homes-and-buy-new-ones-302292229.html

SOURCE Realtor.com