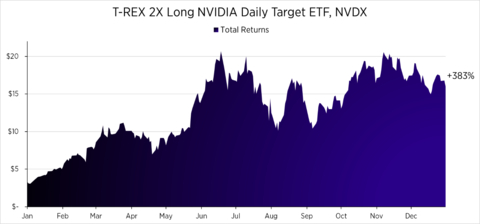

NVDX Is The Best Performing ETF of 2024!

The first 2x NVDA ETF in USA (Ticker: NVDX) led the ETF market with a

(Graphic: Business Wire)

Launched on October 19, 2023, NVDX was the first ever 2X daily target NVIDIA ETF available in the

T-REX ETFs introduced the first-ever 2x and -2x ETFs in the

This ETF is not intended to be a buy and hold investment. Instead, it is intended to be a daily trading tool for sophisticated investors. This ETF is designed to achieve its stated investment objective on a daily basis and the performance over different periods of time can differ significantly from the ETF’s stated daily objective. Any decision to hold this ETF for more than one day should be made with great care and only as the result of a series of daily (or more frequent) investment decisions to remain invested in the ETF for the next one-day period.

Standardized performance can be found on rexshares.com/nvdx. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 844-802-4004. Short term performance, in particular, is not a good indication of the fund's future performance, and an investment should not be made based solely on returns.

About REX Financial

REX Financial is an innovative provider of exchange-traded products specializing in alternative-strategy ETFs and ETNs, with over

About Tuttle Capital Management

Tuttle Capital Management is a leader in thematic and actively managed ETFs, leveraging an agile investment approach to align with market trends. For details, visit tuttlecap.com.

Important Information

The T-REX 2X Long NVIDIA Daily Target ETF (the “Fund”) seeks daily leveraged investment results and is very different from most other exchange-traded funds. As a result, the Fund may be riskier than alternatives that do not use leverage because the Fund’s objective is to magnify (

Investors should consider the investment objectives, risk, charges, and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the T-REX ETFs please call 1-844-802-4004 or visit our website at rexshares.com. Read the prospectus and summary prospectus carefully before investing.

There is no guarantee that the Funds will achieve their investment objectives. Investing involves risk, including possible loss of principal.

NVDX and NVDQ are not suitable for all investors. The Funds are designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leverage (2X/-2X) investment results, understand the risks associated with the use of leverage and are willing to monitor their portfolios frequently. Investing in the funds is not equivalent to investing directly in NVDA as the fund will generally hold

Because of daily rebalancing and the compounding of each day’s return over time, the return of the Fund for periods longer than a single day will be the result of each day’s returns compounded over the period, which will very likely differ from

The Funds’ investment adviser will not attempt to position each Fund’s portfolio to ensure that a Fund does not gain or lose more than a maximum percentage of its net asset value on a given trading day. As a consequence, if a Fund’s underlying security moves more than

Important Risks

Investing in the Funds involves a high degree of risk. As with any investment, there is a risk that you could lose all or a portion of your investment in the Funds.

Fixed Income Securities Risk. When the Fund invests in fixed income securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned by the Fund.

Effects of Compounding and Market Volatility Risk. The Fund has a daily leveraged investment objective and the Fund’s performance for periods greater than a trading day will be the result of each day’s returns compounded over the period, which is very likely to differ from +/-

Leverage Risk. The Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage. An investment in the Fund is exposed to the risk that a decline in the daily performance of NVDA will be magnified. This means that an investment in the Fund will be reduced by an amount equal to

Indirect Investment Risk. NVIDIA Corp. is not affiliated with the Trust, the Adviser or any affiliates thereof and is not involved with this offering in any way, and has no obligation to consider the Fund in taking any corporate actions that might affect the value of the Fund. The Trust, the Fund and any affiliate are not responsible for the performance of NVIDIA Corp. and make no representation as to the performance of NVDA. Investing in the Fund is not equivalent to investing in NVDA. Fund shareholders will not have voting rights or rights to receive dividends or other distributions or any other rights with respect to NVDA.

Industry Concentration Risk. The Fund will be concentrated in the industry to which NVIDIA Corp. is assigned (i.e., hold more than

Liquidity Risk. Holdings of the Fund may be difficult to buy or sell or may be illiquid, particularly during times of market turmoil. Illiquid securities may be difficult to value, especially in changing or volatile markets.

New Fund Risk. As of the date of this prospectus, the Fund has no operating history and currently has fewer assets than larger funds. Like other new funds, large inflows and outflows may impact the Fund’s market exposure for limited periods of time.

Information Technology Sector Risk. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation, and competition, both domestically and internationally, including competition from competitors with lower production costs.

The T-REX Strategies ETFs are sponsored by REX Advisers LLC and are distributed by Foreside Fund Services, LLC, member FINRA. Foreside Fund Services is not affiliated with REX Advisers, REX Shares or Tuttle Capital Management LLC.

© Copyright 2025 REX Shares. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250115412925/en/

Media

Gregory FCA for REX Shares

rexshares@gregoryfca.com

Matthew Tuttle for Tuttle Capital Management

mtuttle@tuttlecap.com

Source: REX Financial