Strategic Joint Venture With Global Lithium Producer SQM

- None.

- None.

HIGHLIGHTS

|

Novo Executive Co-Chairman and Acting CEO Mike Spreadborough said, “To be participating in a JV with a global lithium leader like SQM is an excellent outcome for Novo and will see us receive an immediate payment of A

“Meanwhile, SQM can focus on the battery metals prospectivity of the West Pilbara area and our shareholders can benefit from future exploration success with a free-carried interest until a decision to mine.

“SQM has been very active in the Western Australian lithium sector with a ~

“This joint venture expands Novo’s lithium exploration exposure given the existing lithium Quartz Hill JV with Liatam Mining.”

VANCOUVER, British Columbia, Dec. 18, 2023 (GLOBE NEWSWIRE) -- Novo Resources Corp. (Novo or the Company) (ASX: NVO) (TSX: NVO & NVO.WT.A) (OTCQX: NSRPF) is pleased to announce that (though its Australian subsidiaries) it has entered into a tenement sale agreement, joint venture agreement, and coordination agreement with SQM Australia Pty Ltd (SQM), a wholly owned subsidiary of Sociedad Química y Minera de Chile S.A., in relation to five of Novo’s prospective lithium and nickel exploration tenements (Priority Tenements) in the West Pilbara (Harding Battery Metals JV, HBMJV). The joint venture name reflects the importance of the Harding River to the West Pilbara region.

SQM will pay Novo A

Novo will also be entitled to a contingent success payment based on the lithium contained in a JORC compliant ore reserve upon completion of a feasibility study.

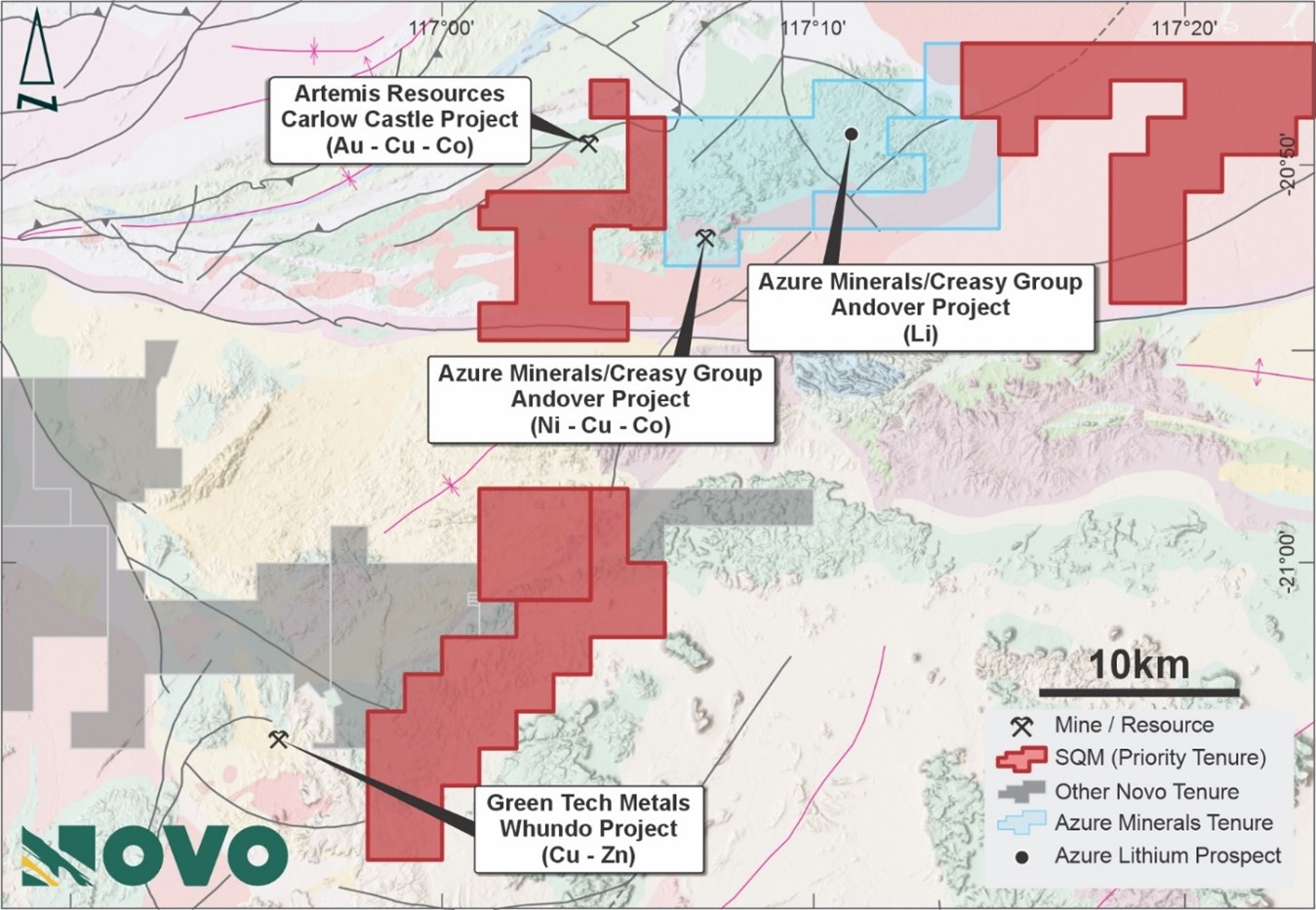

The HBMJV with SQM is a significant milestone for Novo, providing leverage to battery metals discoveries across a package of tenements adjacent to or in the vicinity of Azure Minerals’ Andover Lithium - Nickel Project and Artemis Resources’ Carlow Castle Gold – Copper – Cobalt Project.

Harding Battery Metals Joint Venture (HBMJV) Details

Novo and SQM have entered into a joint venture agreement relating to Novo’s West Pilbara battery metals portfolio where SQM will be the manager HBMJV.

Key transaction details of the joint venture include

- SQM will obtain a

75% interest in the Priority Tenements (refer Appendix), and the option referred to below, upon payment of A$10 million , following which the parties will form an unincorporated joint venture in respect of their respective75% and25% interests. - SQM will have a 12-month option to acquire a

75% interest in additional Novo West Pilbara tenements (Option Tenements) (refer Appendix). Any tenements over which the option is exercised will be held by the HBMJV in the same proportions as the existing HBMJV tenements (75% SQM and25% Novo).

Price and structure terms

- SQM will acquire a

75% interest in the Priority Tenements for a purchase price comprising of the following payments.- A

$10,000,000 upfront payment. - A contingent success payment calculated on the tonnes of lithium contained in a JORC compliant ore reserve on which a feasibility study is based.

- A

Additional key terms of the Joint-Venture

- Novo will be free carried by SQM until a decision to mine has been approved by the HBMJV.

- Novo will retain

100% of the gold, silver, PGE, copper, lead and zinc mineral rights and will continue to explore for these minerals across these tenements. - If SQM exercises the option to acquire an interest in any of the Option Tenements, then SQM must reimburse Novo for reasonable costs incurred by Novo to keep the relevant tenements in good standing during the option period.

- Each party will have a pre-emptive right in respect of any disposal of the other party's interest in the HBMJV.

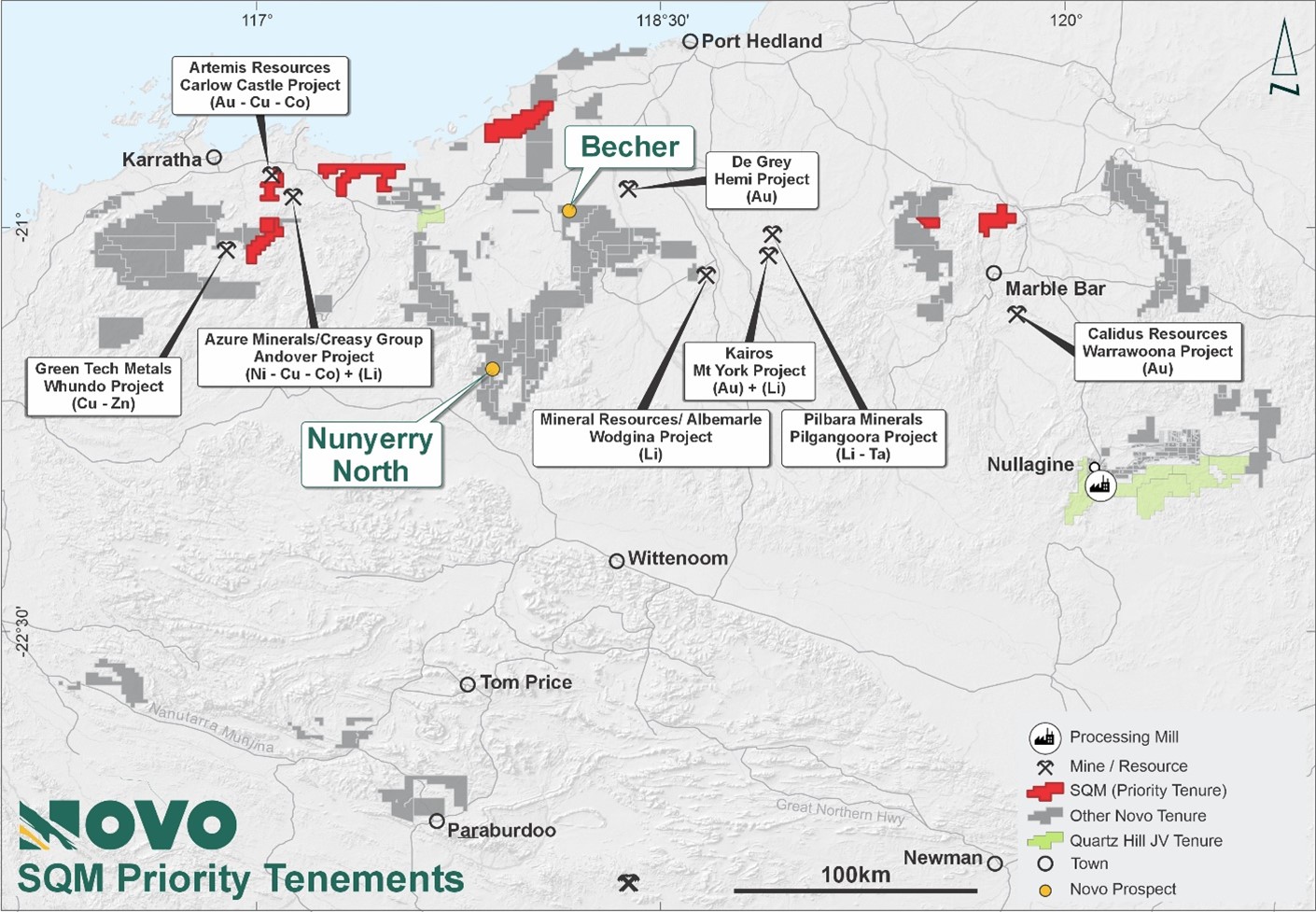

Figure 1: Harding Battery Metals JV Priority Tenements

Figure 2: Location of Priority Tenement adjacent to Azure Minerals’

Andover Lithium – Nickel Project2

ABOUT NOVO

Novo explores and develops its prospective land package covering approximately 9,000 square kilometres in the Pilbara region of Western Australia, along with the 22 square kilometre Belltopper project in the Bendigo Tectonic Zone of Victoria, Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its stakeholders.

Authorised for release by the Board of Directors.

CONTACT

| Investors: Mike Spreadborough +61 8 6400 6100 info@novoresources.com | North American Queries: Leo Karabelas +1 416 543 3120 leo@novoresources.com | Media: Cameron Gilenko +61 466 984 953 cgilenko@citadelmagnus.com |

FORWARD-LOOKING INFORMATION

Some statements in this news release contain forward-looking information (including within the meaning of Canadian securities legislation) including, without limitation, that the SQM JV described in this news release will expand Novo’s exposure to lithium exploration. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the resource industry and the risk factors identified in Novo’s annual information form for the year ended December 31, 2022, which is available under Novo’s profile on SEDAR+ at www.sedarplus.ca and at www.asx.com.au. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Novo assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Novo updates any forward-looking statement(s), no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements.

Priority Tenements

| Tenement | Holder |

| E47/4703 (application only) | Meentheena Gold Pty Ltd |

| E47/1745 | Karratha Gold Pty Ltd |

| E47/3677 | Grant’s Hill Gold Pty |

| E45/3675 | Whim Creek Pty Ltd – beneficially owned by and in process of transfer to Nullagine Gold Pty Ltd |

| E47/3608 | Grant’s Hill Gold Pty Ltd |

Option Tenements

| Tenement | Holder |

| E47/3443 | Karratha Gold Pty Ltd |

| P47/1845 | Grant’s Hill Gold Pty Ltd |

| P47/1846 | Grant’s Hill Gold Pty Ltd |

| P47/1847 | Grant’s Hill Gold Pty Ltd |

| E47/3700 | Grant’s Hill Gold Pty Ltd |

| E47/3713 | Grant’s Hill Gold Pty Ltd |

| E47/4090 (application only) | Karratha Gold Pty Ltd |

| E47/4091 | Karratha Gold Pty Ltd |

| E47/4092 (application only) | Karratha Gold Pty Ltd |

| E47/4116 | Rocklea Gold Pty Ltd |

| E47/3659 | Grant’s Hill Gold Pty Ltd |

| E47/3660 | Grant’s Hill Gold Pty Ltd |

| E45/3724 | Whim Creek Pty Ltd – beneficially owned by and in process of transfer to Nullagine Gold Pty Ltd |

| E45/3952 | Witx Pty Ltd– beneficially owned by and in process of transfer to Nullagine Gold Pty Ltd |

| E45/5282 | Meentheena Gold Pty Ltd |

| E45/4921 | Bamboozler Pty Ltd |

| E45/5281 (application only) | Meentheena Gold Pty Ltd |

| E45/5868 | Grant’s Hill Gold Pty Ltd |

| E45/5329 (application only) | Grant’s Hill Gold Pty Ltd |

| E47/3701 | Grant’s Hill Gold Pty Ltd |

| E47/4041 | Karratha Gold Pty Ltd |

| E47/4012 | Karratha Gold Pty Ltd |

| E47/3779 | Meentheena Gold Pty Ltd |

| E47/3818 | Meentheena Gold Pty Ltd |

| E47/3826 | Karratha Gold Pty Ltd |

| E47/4353 (application only) | Meentheena Gold Pty Ltd |

| E47/4347 | Grant’s Hill Gold Pty Ltd |

| E47/3622 | Grant’s Hill Gold Pty Ltd |

| E47/3778 | Meentheena Gold Pty Ltd |

| E47/3611 | Grant’s Hill Gold Pty Ltd |

| E47/3817 | Meentheena Gold Pty Ltd |

| E47/3615 | Grant’s Hill Gold Pty Ltd |

| E47/3821 | Meentheena Gold Pty ltd |

| E47/3822 | Meentheena Gold Pty Ltd |

__________________________

1 Refer to Azure Minerals Limited ASX announcement dated 10 October 2023. Results referred to in Azure Minerals’ news release are not necessarily representative of mineralisation on Novo’s tenements in the West Pilbara, near Roebourne, Western Australia.

2 No assurance can be given that a similar or any commercially mineable deposit will be determined on Novo’s adjacent tenements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/17cd2a80-c4e1-4764-b332-67df72927e7f

https://www.globenewswire.com/NewsRoom/AttachmentNg/b9f7c76f-014a-42e9-aa32-9f492bd3bf9b

FAQ

What is the joint venture agreement between Novo Resources Corp. and SQM Australia Pty Ltd?

What are the details of the joint venture agreement?

What are the key transaction details of the joint venture?

What is Novo's role in the joint venture?

What is the impact of the joint venture on Novo's cash reserves?