Novo Receives A$11.5 Million Through Partial Sale of Marketable Securities

Novo Resources Corp. (NSRPF) has completed the sale of 38% of its shareholding in privately-owned San Cristobal Mining for A$11.5 million (C$10.5 million). The sale price exceeds the current internal fair value per share on Novo's balance sheet as of September 30, 2024. Following the transaction, Novo's remaining stake in San Cristobal is estimated at A$19 million (C$17 million).

The proceeds will fund exploration programs in Western Australia and Victoria, and A$3 million will be used to repay the first portion of deferred consideration owed to IMC Holdings. Post-sale, Novo's cash balance stands at A$16.7 million (C$15.3 million) as of December 04, 2024. The transaction will result in capital gains tax of A$1.4 million payable in Q1 2025.

Novo Resources Corp. (NSRPF) ha completato la vendita del 38% della sua partecipazione nella San Cristobal Mining, una compagnia privata, per A$11,5 milioni (C$10,5 milioni). Il prezzo di vendita supera il valore equo interno per azione attualmente presente nel bilancio di Novo al 30 settembre 2024. Dopo la transazione, si stima che la partecipazione rimanente di Novo in San Cristobal sia di A$19 milioni (C$17 milioni).

I proventi finanzieranno programmi di esplorazione in Australia Occidentale e Victoria, e A$3 milioni saranno utilizzati per rimborsare la prima parte del corrispettivo differito dovuto a IMC Holdings. Dopo la vendita, il saldo di cassa di Novo è pari a A$16,7 milioni (C$15,3 milioni) al 4 dicembre 2024. La transazione comporterà un'imposta sulle plusvalenze di A$1,4 milioni da pagare nel primo trimestre del 2025.

Novo Resources Corp. (NSRPF) ha completado la venta del 38% de su participación en la San Cristobal Mining, una empresa privada, por A$11,5 millones (C$10,5 millones). El precio de venta supera el valor justo interno por acción en el balance de Novo a fecha de 30 de septiembre de 2024. Tras la transacción, se estima que la participación restante de Novo en San Cristobal es de A$19 millones (C$17 millones).

Los ingresos financiarán programas de exploración en Australia Occidental y Victoria, y A$3 millones se utilizarán para reembolsar la primera parte de la consideración diferida adeudada a IMC Holdings. Después de la venta, el saldo de efectivo de Novo asciende a A$16,7 millones (C$15,3 millones) al 4 de diciembre de 2024. La transacción resultará en un impuesto sobre las ganancias de capital de A$1,4 millones que se pagará en el primer trimestre de 2025.

노보 리소스 Corp. (NSRPF)는 민간 소유의 산 크리스토발 마이닝에서 38%의 지분 매각을 완료했습니다. 매각 금액은 A$1150만 (C$1050만)입니다. 판매 가격은 2024년 9월 30일 기준으로 노보의 재무제표에 있는 주당 현재 내부 공정 가치보다 높습니다. 거래 후 노보의 산 크리스토발에 대한 남은 지분은 A$1900만 (C$1700만)으로 예상됩니다.

이 수익금은 서호주와 빅토리아에서의 탐사 프로그램 자금을 조달하고, A$300만은 IMC 홀딩스에 대한 유예 보상을 첫 번째 부분 상환에 사용됩니다. 매각 후 노보의 현금 잔액은 2024년 12월 4일 기준으로 A$1670만 (C$1530만)입니다. 이번 거래는 2025년 1분기에 납부할 A$140만의 자본 이득세를 초래할 것입니다.

Novo Resources Corp. (NSRPF) a finalisé la vente de 38% de sa participation dans San Cristobal Mining, une société privée, pour A$11,5 millions (C$10,5 millions). Le prix de vente dépasse la valeur équitable interne par action dans le bilan de Novo au 30 septembre 2024. Après la transaction, la participation restante de Novo dans San Cristobal est estimée à A$19 millions (C$17 millions).

Les produits financeront des programmes d'exploration en Australie-Occidentale et à Victoria, et A$3 millions seront utilisés pour rembourser la première partie de la contrepartie différée due à IMC Holdings. Après la vente, le solde de trésorerie de Novo s'élève à A$16,7 millions (C$15,3 millions) au 4 décembre 2024. La transaction entraînera un impôt sur les gains en capital de A$1,4 millions payable au premier trimestre 2025.

Novo Resources Corp. (NSRPF) hat den Verkauf von 38% seiner Beteiligung an dem privat geführten Unternehmen San Cristobal Mining für A$11,5 Millionen (C$10,5 Millionen) abgeschlossen. Der Verkaufspreis übersteigt den aktuellen internen fairen Wert pro Aktie in Novos Bilanz zum 30. September 2024. Nach der Transaktion wird Novos verbleibender Anteil an San Cristobal auf A$19 Millionen (C$17 Millionen) geschätzt.

Die Erlöse werden Forschungsprogramme in Westaustralien und Victoria finanzieren, und A$3 Millionen werden verwendet, um den ersten Teil der aufgeschobenen Vergütung, die an IMC Holdings geschuldet ist, zurückzuzahlen. Nach dem Verkauf beträgt Novos Bargeldbestand A$16,7 Millionen (C$15,3 Millionen) am 4. Dezember 2024. Die Transaktion wird zu einer Kapitalertragssteuer von A$1,4 Millionen führen, die im 1. Quartal 2025 fällig ist.

- Sale of San Cristobal shares generated A$11.5 million, exceeding internal fair value

- Cash position strengthened to A$16.7 million

- Remaining San Cristobal stake valued at approximately A$19 million

- Capital gains tax liability of A$1.4 million in Q1 2025

- Outstanding debt of A$12.6 million to IMC Holdings due by 2026

HIGHLIGHTS

- Novo has sold

38% of its shareholding in privately-owned San Cristobal Mining (San Cristobal) for gross proceeds of A$11.5 million (C$10.5 million ). The San Cristobal Share Sale exceeds the current internal fair value per San Cristobal share on Novo’s balance sheet as of September 30, 2024. - The San Cristobal Share Sale implies that Novo’s remaining shareholdings in San Cristobal would have an estimated value A

$19 million (C$17 million ). - The funds received from the San Cristobal Share Sale will support Novo’s current exploration programs across Western Australia and Victoria, enable Novo to focus on identifying additional exploration opportunities, and be used to repay the first portion of the deferred consideration owed to IMC Holdings of A

$3 million due in late December 20241. - Following the partial sale of its San Cristobal shareholding, Novo has a cash balance of A

$16.7 million (C$15.3 million ), as at December 04, 2024.

VANCOUVER, British Columbia, Dec. 04, 2024 (GLOBE NEWSWIRE) -- Novo Resources Corp. (“Novo” or the “Company”) (ASX: NVO) (TSX: NVO) (OTCQX: NSRPF) is pleased to announce the sale (the “San Cristobal Share Sale”) of ~

Commenting on this transaction, Mike Spreadborough, Executive Co-Chairman and Acting Chief Executive Officer, said: “We are very pleased to complete this sale of our investment in San Cristobal which has resulted in approximately A

With a cash balance of A

The receipt of funds from the San Cristobal Share Sale will support Novo’s current exploration programs across Western Australia and Victoria and Novo’s focus on identifying additional exploration opportunities and will also be used to repay the first portion of the deferred consideration owed to IMC Holdings (“IMC”) of A

In connection with the completion of the San Cristobal Share Sale, the Company paid finders’ fees in respect of certain San Cristobal shares sold totalling US

The San Cristobal Share Sale is expected to result in capital gains tax payable in Q1 2025 of A

Advisors

Haywood Securities Inc. acted as financial advisor to Novo in connection with the San Cristobal Share Sale. Owen Bird Law Corporation acted as legal counsel to Novo in connection with the San Cristobal Share Sale.

Authorised for release by the Board of Directors.

CONTACT

| Investors: Mike Spreadborough +61 8 6400 6100 info@novoresources.com | North American Queries: Leo Karabelas +1 416 543 3120 leo@novoresources.com | Media: Cameron Gilenko +61 466 984 953 cameron.gilenko@sodali.com |

QP STATEMENT

Dr Christopher Doyle (MAIG) and Dr Simon Dominy (FAusIMM CPGeo; FAIG RPGeo), are the qualified persons, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, responsible for, and having reviewed and approved, the technical information contained in this news release. Dr Doyle is Novo’s Exploration Manager - Victoria and Dr Dominy is a Technical Advisor to Novo.

ABOUT NOVO

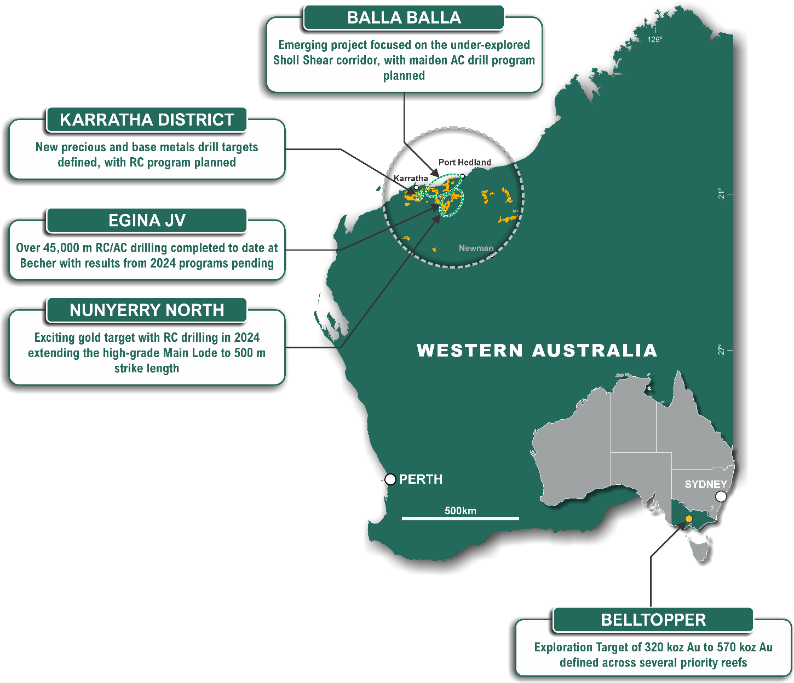

Novo is an Australian based gold explorer listed on the ASX and the TSX focused on discovering standalone gold projects with > 1 Moz development potential. Novo is an innovative gold explorer with a significant land package covering approximately 5,500 square kilometres in the Pilbara region of Western Australia, along with the 22 square kilometre Belltopper project in the Bendigo Tectonic Zone of Victoria, Australia2.

Novo’s key project area is the Egina Gold Camp, where De Grey Mining is farming-in to form a JV at the Becher Project and surrounding tenements through exploration expenditure of A

Novo has also formed A lithium joint venture with SQM Australia Pty Ltd in the Pilbara which provides shareholder exposure to battery metals.

Novo has a significant investment portfolio and a disciplined program in place to identify value accretive opportunities that will build further value for shareholders.

Please refer to Novo’s website for further information including the latest corporate presentation.

_______________

1 Refer to announcement dated 20 December 2024 – Sale of Nullagine Gold project to Calidus Resources (released to ASX on 21 December 2023).

2 An Exploration Target as defined in the JORC Code (2012) is a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. Accordingly, these figures are not Mineral Resource or Ore Reserve estimates as defined in the JORC Code (2012). The potential quantities and grades referred to above are conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. These figures are based on the interpreted continuity of mineralisation and projection into unexplored ground often around historical workings. The Exploration Target has been prepared in accordance with the JORC Code (2012). as detailed in the Company’s ASX announcement released on 25 September 2024 (available to view at www.asx.com.au). The Tonnage range for the exploration target is 1.5Mt to 2.1Mt, the Ounces range from 320Koz Au to 570Koz Au and the Grade range is 6.6g/t Au to 8.4g/t Au. The Company confirms that it is not aware of any new information that material affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the original market announcement continue to apply and have not materially changed

3 Refer to De Grey ASX Announcement, Hemi Gold Project Resource Update, dated 21 November 2023 No assurance can be given that a similar (or any) commercially viable mineral deposit will be determined at Novo’s Becher Project

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/28148873-e4f0-44ba-adc2-66d161ba0364