Bannerman Energy Announces Agreement To Acquire Strategic Stake in Namibia Critical Metals Inc.

Namibia Critical Metals Inc. (OTC PINK:NMREF) announced that Bannerman Energy Limited has entered into an agreement to acquire 82,290,680 common shares, equating to 41.8% of NMI. This acquisition is expected to enhance strategic alignment and synergies with Bannerman's Etango Uranium Project in Namibia, completing within 30 days. Additionally, NMI's CEO Darrin Campbell expressed optimism about the partnership’s potential to leverage Bannerman's expertise to enhance the Lofdal Project, anticipated to supply crucial dysprosium and terbium metals for emerging markets.

- Bannerman's acquisition of a 41.8% stake provides strategic alignment with the Etango Uranium Project.

- Partnership expected to leverage Bannerman's ESG expertise, enhancing community relations and project development.

- Potential for the Lofdal Project to supply dysprosium and terbium, key components for the permanent magnets sector.

- None.

Insights

Analyzing...

HALIFAX, NS / ACCESSWIRE / May 19, 2022 / Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NMI") (TSXV:NMI)(OTC PINK:NMREF) announced that Bannerman Energy Limited ("Bannerman"), an Australian listed uranium development company, has issued a news release on May 18, 2022 announcing it has entered into an agreement to acquire 82,290,680 common shares (

The NMI Share Acquisition by Bannerman offers significant strategic alignment and development synergies with Bannerman's flagship Etango Uranium Project in Namibia.

The Company also announced today that Steve Kapp will not be standing for re-election at the Company's Annual and Special Meeting to be held on May 19, 2022. The Company intends to identify a replacement for Mr. Kapp in due course.

Bannerman's Managing Director and CEO, Brandon Munro, commented:

"The Lofdal Project is on a path to produce dysprosium and terbium, two of the most strategically important metals on the planet. Our exposure to this future production, through a strategic shareholding in Namibia Critical Metals, is therefore a strong fit with Bannerman's Etango Project, a near-term supplier of uranium at a globally significant scale. I have followed the Lofdal Project and worked with its management since living in Namibia in 2010, and am personally delighted to formalise these strong in-country working relationships. I am also pleased that long standing relationships with NMI's major shareholders have enabled a direct, efficient transaction at this point in time.

"As Lofdal moves closer to production, our partnership offers strong potential to leverage Bannerman's extensive in-country expertise and credentials, in particular in the ESG (Environment, Social and Governance) sphere. After meeting at Lofdal with NMI President Darrin Campbell, and key JOGMEC representatives, I am confident that there is a strong alignment of intent and values between Bannerman and NMI, which has strong community and government relationships built during their 15-year presence in Namibia."

Namibia Critical Metals Inc. President and CEO, Darrin Campbell, commented:

"I am delighted that Bannerman Energy is set to become a supportive major shareholder in Namibia Critical Metals Inc. I look forward to working with the Bannerman team and our project partner JOGMEC to add significant further value to the Lofdal Project. I expect that Bannerman's development experience, plus downstream industry and broader marketing experience, will be highly advantageous as we progress Lofdal towards being a globally significant supplier of dysprosium and terbium to the burgeoning permanent magnets sector."

About Bannerman Energy Limited

Bannerman is a uranium development company listed on the Australian, OTC Markets and Namibian stock exchanges. Its flagship asset is the advanced Etango Uranium Project located in the Erongo Region of Namibia.

Etango has undertaken extensive exploration and feasibility activity over the past 15 years. The Etango tenements possess a globally large-scale uranium mineral resource1. A 20 Mtpa development at Etango was the subject of a Definitive Feasibility Study ("DFS") completed in 2012 and a DFS Optimisation Study completed in 20152. Bannerman constructed and operated a Heap Leach Demonstration Plant at Etango, which comprehensively de-risked the acid heap leach process to be utilised on the Etango ore.

Etango has environmental approvals for the proposed mine and external mine infrastructure, based on a 12-year environmental baseline. Bannerman is a CSR leader within Namibia and exercises best-practice governance in all aspects of its business.

In August 2021, a Pre-Feasibility Study ("PFS") was completed on Etango-8. The PFS confirmed that this accelerated, streamlined project is strongly amenable to development - both technically and economically. A DFS on Etango-8 has commenced with expected completion in 3Q CY2022.

About Namibia Critical Metals Inc.

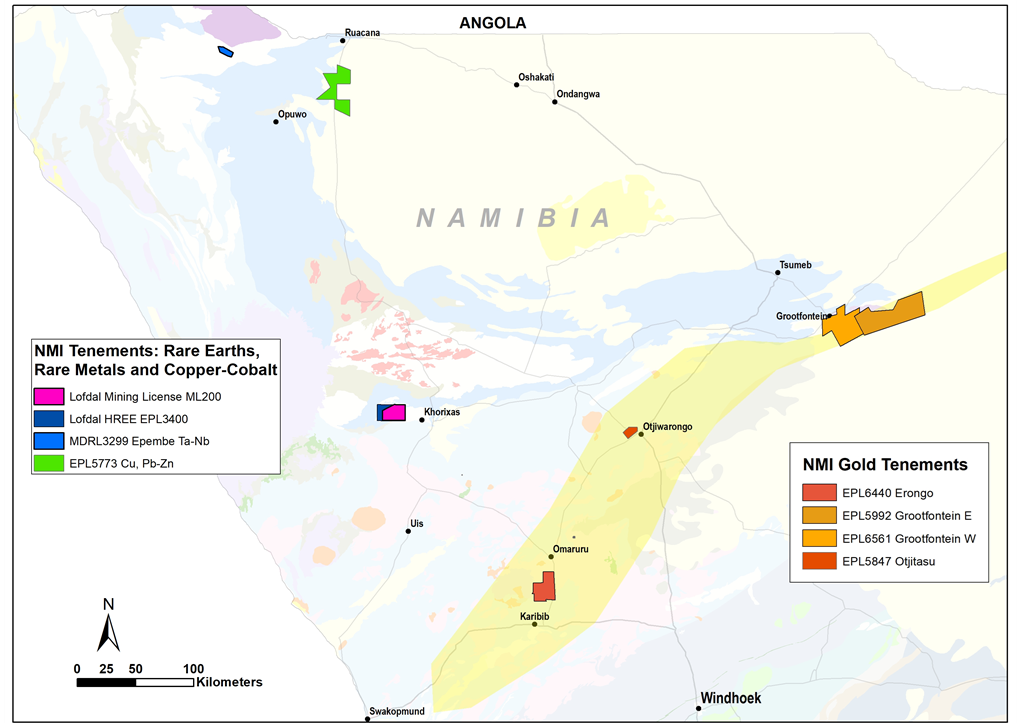

Namibia Critical Metals Inc. holds a diversified portfolio of exploration and advanced stage projects in Namibia focused on the development of sustainable and ethical sources of metals for the battery, electric vehicle and associated industries. The most advanced stage project in the portfolio is Lofdal. The Company also holds significant land positions in areas favourable for gold mineralization.

Heavy Rare Earths: The Lofdal Dysprosium-Terbium Project is the Company's most advanced project being fully permitted with a Mining Licence (ML 200) issued in 2021. The project is being developed in joint venture with Japan Oil, Gas and Metals National Corporation ("JOGMEC").

Gold: The Company's Exclusive Prospecting Licenses ("EPLs") prospective for gold are located in the Central Namibian Gold Belt which hosts a number of significant orogenic gold deposits including the Navachab Gold Mine, the Otjikoto Gold Mine and more recently the discovery of the Twin Hills deposit. At the Erongo Gold Project, stratigraphic equivalents to the meta-sediments hosting the recent Osino gold discovery at Twin Hills have been identified and exploration is progressing over this highly prospective area. The Grootfontein Base Metal and Gold Project has potential for magmatic copper-nickel mineralization, Mississippi Valley-type zinc-lead-vanadium mineralization and Otjikoto-style gold mineralization. Interpretation of geophysical data and regional geochemical soil sampling have identified first gold targets.

Tantalum-Niobium: The Epembe Tantalum-Niobium-Uranium Project is at an advanced stage with a well-defined, 10 km long carbonatite dyke that has been delineated by detailed mapping and radiometric surveys and over 11,000 meters of drilling. Preliminary mineralogical and metallurgical studies including sorting tests (XRT), indicate the potential for significant physical upgrading. Further work will be undertaken to advance the project to a preliminary economic assessment stage.

Figure 1: Location of Namibia Critical Metals' projects

Qualified Person's Statement

Rainer Ellmies, PhD, MScGeol, EurGeol, AusIMM is Vice President Exploration of Namibia Critical Metals Inc. and the Company's Qualified Person. He has reviewed and approved the scientific and technical information in this press release.

About Japan Oil, Gas and Metals National Corporation (JOGMEC) and the Joint Venture

JOGMEC is a Japanese government independent administrative agency which among other things seeks to secure stable resource supplies for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. The mandated areas of responsibilities within JOGMEC relate to oil and natural gas, metals, coal and geothermal energy. JOGMEC facilitates opportunities with Japanese private companies to secure supplies of natural resources for the benefit of the country's economic development.

Rare earths are of critical importance to Japanese industrial interests and JOGMEC has extensive experience with all aspects of the sector. JOGMEC provided Lynas with US

Namibia Critical Metals currently owns a

The common shares of Namibia Critical Metals Inc. trade on the TSX Venture Exchange under the symbol "NMI" and the OTCQ under "NMREF".

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Souce: Section 3 of Bannerman's ASX release dated 2 August 2021, Etango-8 Project Pre-Feasibility Study.

2 Source: Bannerman's ASX release dated 11 November 2015, Outstanding DFS Optimisation Study Results.

For more information please contact:

Namibia Critical Metals Inc.

Darrin Campbell, President

Tel: +01 (902) 835-8760

Fax: +01 (902) 835-8761

Email: Info@NamibiaCMI.com

Website: www.NamibiaCriticalMetals.com

The foregoing information may contain forward-looking information relating to the future performance of Namibia Critical Metals Inc. Forward-looking information, specifically, that concerning future performance, is subject to certain risks and uncertainties, and actual results may differ materially. These risks and uncertainties are detailed from time to time in the Company's filings with the appropriate securities commissions.

SOURCE: Namibia Critical Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/701941/Bannerman-Energy-Announces-Agreement-To-Acquire-Strategic-Stake-in-Namibia-Critical-Metals-Inc