NMG Secures Multiyear Offtakes and total US$87.5 Million Investment from Anchor Customers and Strategic Investors to Underpin its Phase 2 Ore-to-Battery-Material Graphite Operations

- NMG secures multiyear offtake agreements with Panasonic Energy and GM, covering 85% of Phase-2 production.

- Investments totaling US$87.5 million from Mitsui and Pallinghurst advance NMG's development.

- NMG aims to become the first fully integrated natural graphite active anode material producer in North America.

- The agreements and investments pave the way for future funding of up to US$275 million from Anchor Customers.

- Current market dynamics favor NMG's local production due to Chinese graphite export limitations and U.S. sourcing requirements.

- Strategic partner Mitsui and investor Pallinghurst inject funds to support NMG's commercial vision and operations.

- NMG's acquisition of the Uatnan Mining Project provides additional supply opportunities for Western EV and battery manufacturers.

- The company engages in financing efforts with convertible noteholders, export credit agencies, governments, and strategic investors.

- Anchor Customers and potential co-investors plan to participate in future funding, subject to certain conditions and ownership thresholds.

- The transactions involve related party disclosures and compliance with regulatory requirements.

- Accrued interest owed to Holders under the Notes will be settled through the issuance of Common Shares.

- Shareholders, analysts, and media are invited to attend an Investor Briefing hosted by NMG's Management Team.

- None.

Insights

The strategic investments and offtake agreements between Nouveau Monde Graphite Inc. (NMG), Panasonic Energy, General Motors (GM), Mitsui and Pallinghurst signal a robust commitment to the North American electric vehicle (EV) and lithium-ion battery market. The significance of this development lies in the establishment of a carbon-neutral, reliable and sizeable source of Canadian natural graphite, which is a critical component in the production of EV batteries.

Current market dynamics, including Chinese export restrictions and strict U.S. sourcing standards, have created a favorable environment for local production. NMG's strategic positioning to meet these demands, coupled with its Phase-3 expansion plans, indicates a potential shift in the graphite supply chain towards North America. This could reduce dependence on foreign sources and align with broader geopolitical and environmental agendas, such as energy autonomy and decarbonization.

For investors, the long-term offtake agreements and pricing formula linked to market prices provide a level of predictability and bankability for NMG's operations. However, the heavy reliance on a few major customers could pose risks if market conditions or customer requirements change. The phased investment strategy, with the initial Tranche 1 Investment followed by potential future funding, suggests a cautious yet optimistic approach to scaling operations.

The financial structure of the agreements, including the US$87.5 million investment and the potential future funding of up to US$275 million, underscores the confidence of major industry players in NMG's business model and its strategic importance in the EV supply chain. The equity investments by Panasonic and GM, along with the investments by Mitsui and Pallinghurst, not only provide necessary capital for the advancement of NMG's Phase-2 operations but also embed these stakeholders into the company's growth trajectory.

From a financial perspective, the repurchase of convertible notes using the proceeds from these investments simplifies NMG's capital structure and potentially reduces future interest obligations. The issuance of warrants as part of the investment terms offers additional upside potential for the investors, while also introducing potential dilution for existing shareholders. The lock-up period and standstill limitation for Mitsui, as well as the anti-dilution rights, indicate measures to prevent hostile takeovers and maintain stability in ownership.

Investors should note that the investments and future funding are subject to certain conditions, including regulatory approvals, which could impact the timeline and certainty of the capital inflow. The related party transactions and the subsequent ownership stakes of Mitsui and Pallinghurst also necessitate careful consideration of minority shareholder interests and potential conflicts of interest.

Legal complexities arise from the related party transactions involving Mitsui and Pallinghurst, categorized as 'interested parties.' Compliance with Regulation 61-101 and the TSX Venture Exchange Policy 5.9 is critical to protect minority shareholders and ensure transparency in these transactions. The agreements include provisions for formal valuation and minority approval, which safeguard against unfair practices and provide an additional layer of scrutiny.

The lock-up agreement and standstill provisions with Mitsui demonstrate a strategic approach to manage shareholder dynamics and prevent any single entity from gaining disproportionate control. The registration rights agreement facilitates future liquidity of the securities acquired through the investment, which could be beneficial for the investors while also impacting the market dynamics of NMG's shares.

Investors and stakeholders should pay close attention to the material change reports and the detailed terms of the subscription, offtake and investor rights agreements, which will be made available on regulatory platforms. These documents will provide critical insights into the legal framework governing the transactions and any potential implications for the company's governance and shareholder rights.

-

Panasonic Energy and GM (together, the “Anchor Customers”) concurrently commit to multiyear offtake agreements for NMG’s active anode material, covering approximately

85% of NMG’s planned Phase-2 fully integrated production, from ore to battery materials. -

Offtake agreements are complemented by an aggregate

US Tranche 1 Investment from Panasonic and GM to advance the development of NMG’s Phase-2 Matawinie Mine and Bécancour Battery Material Plant as per their respective specifications.$50 million -

Strategic partner Mitsui and long-time investor Pallinghurst inject a total of

US into NMG’s development, the aggregate proceeds of which will be used to repurchase their previously announced convertible notes.$37.5 million -

Offtake agreements and investments support NMG’s execution plan for its Phase-2 Matawinie Mine and Bécancour Battery Material Plan, marking a significant milestone toward future funding by Anchor Customers of up to

US , subject to certain conditions and a maximum ownership threshold agreed between the relevant parties.$275 million - Shareholders, analysts, and media are invited to attend an Investor Briefing today at 10:30 a.m. ET hosted by NMG’s Management Team via webcast.

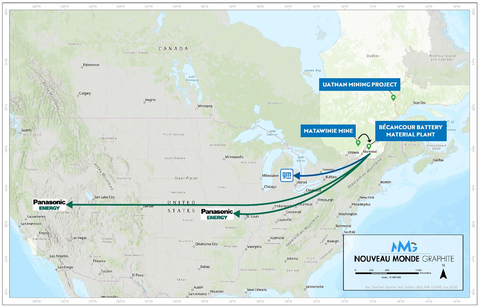

Map of NMG’s integrated extraction and advanced manufacturing routes to supply Panasonic Energy and GM.

Arne H Frandsen, Chair of NMG, declared: “Today, influential actors in strategic minerals, modern commodities, batteries, and EVs are coming together to drive the establishment of a Canadian source of graphite to support energy autonomy, national security, and global decarbonization. I am confident that such commercial and investment levers will constitute the bedrock on which NMG can build its Phase 2 operations and more. Congrats to colleagues at Panasonic Energy, GM, Mitsui and Pallinghurst for this multifaceted transaction; together we will support the world’s transitions towards a cleaner future.”

Eric Desaulniers, Founder, President, and CEO of NMG, reacted: “In our journey to position NMG as the North American leader of responsible mining and advanced manufacturing, we had been looking for top-tier EV and battery manufacturers to bolster our commercial vision. Thanks to visionary customers and investors, we are now moving toward establishing a fully local and traceable value chain. From the Matawinie ore, to the

A Solid Commercial Backing

The multiyear offtake agreements cover the supply of a committed combined annual volume of 36,000 tonnes of active anode material by NMG to the Anchor Customers, representing approximately

In parallel, the Company maintains intensive commercial discussions and continued product qualification with other tier-1 battery manufacturers for the balance of its Phase-2 production. Current market dynamics in

Strategic Participation into NMG’s Business Plan

The Anchor Customers, directly or through an affiliate, have each agreed to make an initial

In line with the previously announced framework agreement between NMG, Panasonic Energy and Mitsui, the Company’s strategic partner Mitsui supports the attainment of this milestone and further development efforts towards a final investment decision (“FID”) by investing

Long-time strategic investor Pallinghurst has also agreed to participate via a

Such warrants are generally exercisable in connection with the Tranche 2 Investment at FID in accordance with their terms. Each warrant will entitle the holder thereof to acquire one Common Share (a “Warrant Share”) at a price per Warrant Share equal to the lower of (i) the amount in

Upon a positive FID, the parties’ commercial relationship is also intended to expand through further investments into NMG as part of the construction financing. The Anchor Customers, directly or through an affiliate, together with potential co-investors, intend to participate in future funding of a total amount valued at approximately

Related Party Disclosure

Currently, Mitsui may have beneficial ownership of, or control or direction over, directly or indirectly, the Mitsui Convertible Note that can be converted into units comprising an aggregate of 5,000,000 Common Shares and 5,000,000 Common Share purchase warrants (the “Mitsui Warrants”), as well as 1,052,695 Common Shares issuable in connection with accrued interest under the Mitsui Convertible Note, which in the aggregate represent approximately

Currently, Pallinghurst may have beneficial ownership of, or control or direction over, directly or indirectly, 11,541,013 Common Shares and the Pallinghurst Convertible Note that can be converted into units comprising an aggregate of 2,500,000 Common Shares and 2,500,000 Common Share purchase warrants (the “Pallinghurst Warrants”), as well as 526,348 Common Shares issuable in connection with accrued interest under the Pallinghurst Convertible Note, which in the aggregate represent approximately

Mitsui and Pallinghurst are “interested parties” in respect of the transactions described herein, and their investment as well as the repayment of the Notes each constitutes a “related party transaction” (collectively, the “Related Party Transactions”) within the meaning of Regulation 61-101 respecting Protection of Minority Security Holders in Special Transactions (“MI 61-101”) and the TSX Venture Exchange Policy 5.9 - Protection of Minority Security Holders in Special Transactions.

The independent directors of the Company, determined in accordance with MI 61-101, are responsible for (i) evaluating the applicability of MI 61-101 to the Related Party Transactions; (ii) considering whether any exemptions from any formal valuation and/or minority approval requirements of MI 61-101 determined to be applicable would be available to NMG in connection with the Related Party Transactions or whether to seek regulatory exemptive relief in respect thereof; and (iii) if required or advisable, determining and confirming whether a formal valuation pursuant to MI 61-101 is required in connection with the Related Party Transactions and, if required or advisable, determining the terms of such valuator’s engagement (including the fees to be paid to such valuator) and supervising the preparation of such valuation.

The Related Party Transactions are conditional on compliance with the requirements of MI 61-101 or NMG receiving exemptive relief from the requirements of MI 61-101. A material change report in respect of the Related Party Transactions will be filed by NMG.

Settlement of Accrued Interests

Upon the approval of the TSX Venture Exchange and the New York Stock Exchange (the “Exchanges”), the accrued interest owed to Pallinghurst and Mitsui (together, the “Holders”) under the Notes for the period from January 1, 2024, until the date of their respective subscription agreements, will satisfy as follows. 232,191 Common Shares at a price of

Complementary Information

Shareholders and analysts are invited to attend a webcast Investor Briefing this morning, Thursday, February 15, 2024, at 10:30 a.m. ET. Hosted by President and CEO Eric Desaulniers with the participation of NMG’s Management Team, the briefing will entail a technical presentation followed by a question-and-answer session. Registration should be completed prior to the start of the briefing at: https://us06web.zoom.us/webinar/register/WN_VmhZvajOQJ2yICWrk9ySzQ.

Members of the media may download high-resolution files of the brief interview with Eric Desaulniers on this announcement at https://we.tl/t-t9Nwt9RiQR and make additional interview or information requests to Julie Paquet, Vice President, Communications & ESG Strategy at NMG.

Completion of the transactions described herein remains subject to customary regulatory approvals, including approval of the TSX Venture Exchange and NYSE, and other customary closing conditions. Copies of the referenced subscription, offtake, investor rights and registration rights agreements will be available on the Company’s page on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, and the summary of the such agreements contained herein is qualified in its entirety by the reference to such documents.

About Nouveau Monde Graphite

Nouveau Monde Graphite is striving to become a key contributor to the sustainable energy revolution. The Company is working towards developing a fully integrated source of carbon-neutral battery anode material in

About Panasonic Energy

Panasonic Energy established in April 2022 as part of the Panasonic Group's switch to an operating company system, provides innovative battery technology-based products and solutions globally. Through its automotive lithium-ion batteries, storage battery systems and dry batteries, the company brings safe, reliable, and convenient power to a broad range of business areas, from mobility and social infrastructure to medical and consumer products. Panasonic Energy is committed to contributing to a society that realizes happiness and environmental sustainability, and through its business activities the company aims to address societal issues while taking the lead on environmental initiatives. For more details, please visit www.Panasonic.com/global/energy

About GM

General Motors (NYSE:GM) is a global company focused on advancing an all-electric future that is inclusive and accessible to all. At the heart of this strategy is the Ultium battery platform, which will power everything from mass-market to high-performance vehicles. General Motors, its subsidiaries and its joint venture entities sell vehicles under the Chevrolet,

About Mitsui

Mitsui & Co., Ltd. (TYO: 8031.JP) is a global trading and investment company with a diversified business portfolio that spans approximately 63 countries in

Mitsui has about 5,500 employees and deploys talent around the globe to identify, develop, and grow businesses in collaboration with a global network of trusted partners. Mitsui has built a strong and diverse core business portfolio covering the Mineral and Metal Resources, Energy, Machinery and Infrastructure, and Chemicals industries.

Leveraging its strengths, Mitsui has further diversified beyond its core profit pillars to create multifaceted value in new areas, including innovative Energy Solutions, Healthcare & Nutrition and through a strategic focus on high-growth Asian markets. This strategy aims to derive growth opportunities by harnessing some of the world’s main mega-trends: sustainability, health & wellness, digitalization and the growing power of the consumer.

Mitsui has a long heritage in

For more information on Mitsui & Co’s businesses visit, www.Mitsui.com

About Pallinghurst

For almost 20 years, The Pallinghurst Group has been a world-leading investor in the metals and natural resources sector with a key focus on battery materials – facilitating the vital, global shift towards sustainable energy storage. www.pallinghurst.com

Subscribe to our news feed: https://bit.ly/3UDrY3X

Cautionary Note

All statements, other than statements of historical fact, contained in this press release including, but not limited to those describing the closing transactions described in this press release, closing of the Tranche 1 Investment, the anticipated benefits of the transactions described herein, the satisfaction of the conditions to closing the transactions and the timing thereof, receipt of any regulatory approvals in respect of the transactions described herein, receipt of exemptive relief in respect of the requirements of MI 61-101, use of proceeds from the private placement, the impact of the transactions on a related party’s ownership amount, a positive final investment decision and closing of project financing, closing of the potential total equity investments of

Forward-looking statements are subject to known or unknown risks and uncertainties that may cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Risk factors that could cause actual results or events to differ materially from current expectations include, among others, those risks, delays in the scheduled delivery times of the equipment, the ability of the Company to successfully implement its strategic initiatives and whether such strategic initiatives will yield the expected benefits, the availability of financing or financing on favorable terms for the Company, the dependence on commodity prices, the impact of inflation on costs, the risks of obtaining the necessary permits, the operating performance of the Company’s assets and businesses, competitive factors in the graphite mining and production industry, changes in laws and regulations affecting the Company’s businesses, political and social acceptability risk, environmental regulation risk, currency and exchange rate risk, technological developments, the impacts of the global COVID-19 pandemic and the governments’ responses thereto, and general economic conditions, as well as earnings, capital expenditure, cash flow and capital structure risks and general business risks. A further description of risks and uncertainties can be found in NMG’s Annual Information Form dated March 23, 2023, including in the section thereof captioned “Risk Factors”, which is available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Unpredictable or unknown factors not discussed in this Cautionary Note could also have material adverse effects on forward-looking statements.

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. The Company disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

The market and industry data contained in this press release is based upon information from independent industry publications, market research, analyst reports and surveys and other publicly available sources. Although the Company believes these sources to be generally reliable, market and industry data is subject to interpretation and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data-gathering process and other limitations and uncertainties inherent in any survey. The Company has not independently verified any of the data from third-party sources referred to in this press release and accordingly, the accuracy and completeness of such data is not guaranteed.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information regarding the Company is available in the SEDAR+ database (www.sedarplus.ca), and for

View source version on businesswire.com: https://www.businesswire.com/news/home/20240214714914/en/

MEDIA

Julie Paquet

VP Communications & ESG Strategy

+1-450-757-8905 #140

jpaquet@nmg.com

INVESTORS

Marc Jasmin

Director, Investor Relations

+1-450-757-8905 #993

mjasmin@nmg.com

Source: Nouveau Monde Graphite Inc.