VANCOUVER, BC, Dec. 28, 2023 /PRNewswire/ - Nevada King Gold Corp. (TSXV: NKG) (OTCQX: NKGFF) ("Nevada King" or the "Company") is pleased to review the significant advancements at its 100%-owned Atlanta Gold Mine Project achieved during its 2023 exploration campaign. The 2023 drilling program both advanced resource definition drilling in established zones and leveraged off new geologic modeling to discover several significant new high-grade zones.

2023 Corporate Highlights:

- Drilled seven diamond drill holes and 202 reverse circulation holes at Atlanta accounting for over 50,000 metres during the 2023 calendar year. Over 30,000m from 109 drill holes are currently pending assay and release.

- Solidified its strategic land holdings in the Atlanta district by staking an additional 469 claims (39.8km2) to fully surround and build a geological buffer around the Atlanta caldera.

- Raised $16.25-million at a price of $0.45 per share. Founder & CEO Collin Kettell and all of the management team participated in the financing for over $2 million with much of the balance subscribed for by insiders and significant shareholders. Over 55% of the shares of the Company are held by insiders and large shareholders who continue to be strong supporters of the Company.

- Expanded Phase II drill program from 20,000m to 60,000m following a series of exploration successes that leveraged off new geological modeling. The Company has now drilled over 70,000m and is planning to provide guidance on a further increase in January.

Atlanta Exploration & Drilling Highlights:

One year ago today, Nevada King released an updated geologic model that represented a significant departure from the historical interpretation of the Atlanta Au-Ag epithermal system. The prior model constrained the distribution and tenor of gold mineralization to a single fault structure. Nevada King's new geologic model projected a series of high-angle faults through the Atlanta system that were each interpreted as potential conduits for channeling gold-bearing hydrothermal fluids into the Atlanta deposit. The 2023 drilling was successful in confirming new high-grade discoveries in areas within and proximate to these projected feeder structures and allowed the Company to track high-grade mineralization along a multitude of structures throughout the Atlanta deposit.

The 2023 program generated a significant amount of drill results which, along with ongoing updated interpretation, was disclosed in 24 news releases. The Atlanta drill results and accompanying cross sections and plan maps provided a developing narrative over an expanding mineralized footprint including numerous thick and high-grade mineralized drill intercepts.

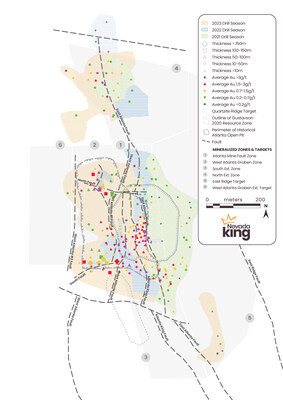

Today, the Company is pleased to release a new map of Atlanta presenting the progressive success of its exploration and definition drilling that began in 2021 as part of its Phase I drill program (shown in green), followed by its Phase II program in 2022 (blue) and expanded Phase II program in 2023 (orange). Results from drill holes reported to date are color and shape coded to illustrate gold grade and thickness, respectively. Primary fault structures are overlayed in black dashed lines. Following Figure 1 is a brief description of the 2021, 2022, and 2023 results and a look at what is to come in 2024.

2021 Phase I Drilling:

The Company's inaugural Phase I, 2021 drill program consisted of 68 drill holes totaling 5,544m and was focused on exploring three areas that were historically underexplored or never tested. This included testing for mineralization from within the Atlanta pit, to the east of the pit, and along trend, 500m north of the pit. In each of these areas, the Company's drilling successfully intercepted significant oxide gold mineralization.

At the bottom of the Atlanta pit, a fence of five holes interesected high-grade gold mineralization including 54.9m averaging 5.34 g/t Au in AT21-62 and 64m averaging 3.35 g/t Au in AT21-64 (released January 12, 2022 and January 20, 2022).

At 560m north-northwest of the Atlanta pit, the Company encountered 9.1m averaging 8.26 g/t Au within an overall intercept of 18.3m grading 4.64 g/t Au in AT21-003 (released November 22, 2021). This hole was drilled 240m north of the Gustavson 2020 pit-constrained resource zone and clearly demonstrated the high-grade potential along the northern extension of the East Atlanta Fault.

Drilling to the east of the pit also encountered gold mineralization starting at surface, including 37m of 0.65 g/t Au in AT21-38A and 32m of 0.59 g/t Au in AT21-38, highlighting the potential for an eastern expansion of the resource area (released January 12, 2022).

In summation, initial 2021 drilling demonstrated the existence of fault offsets within the mineralized zone and intersected a number of shallow, high-grade mineralized zones both at the bottom of the historical Atlanta pit and well north of the resource area that were not identified in historical drilling.

2022 Phase II Drilling:

Phase II drilling commenced in June of 2022 and was designed to further test mineralization at the bottom of the pit together with better defining the westward extension of gold mineralization across a 100m to 150m-wide shear zone termed the Atlanta Mine Fault Zone ("AMFZ"). Mineralization in the AMFZ is almost exclusively confined to a dense, sub-horizontal silica-breccia horizon that formed along the erosional unconformity separating younger volcanics from underlying older dolomite and quartzite. This breccia horizon tends to be higher-grade and thicker along the eastern side of the shear zone where hole intercepts typically average 1-3 g/t Au over 30-50m thicknesses. The AMFZ was drilled by prior operators and the easternmost fault strand (East Atlanta Fault) was historically mined, but historical operators failed to recognize the presence and significance of the multiple feeder structures and geometrically complex west-dipping mineralized blocks comprising this broad structure zone, and consequently had no effective geological model with which to interpret their widely-spaced drill results.

The Company focused on drilling the AMFZ with a series of vertical hole fences and successfully identified high-grade gold mineralization. Intercepts included 3.41 g/t Au over 54.9m in AT22NS-46 and 2.65 g/t Au over 50.3m in AT22NS-59 (released October 18, 2022), as well as 3.19 g/t Au over 32m in AT22NS-83T and 2.9 g/t Au over 28.1m in AT22NS-81T (released December 5, 2022). Drilling south of the pit intercepted 77.7m of 0.62 g/t Au in AT22-RC9 and 41.2m of 1.05 g/t Au in AT22-RC10, showing that gold mineralization continues along the southward extension of the AMFZ. These areas, which were largely ignored by previous explorers, returned higher-grades over thicker intercepts than seen in past drilling in the vicinity, thus demonstrating good potential for encountering additional mineralization further southward.

2023 Drilling:

In early 2023, the Company stepped further westward from the AMFZ into the Atlanta caldera, revealing the existence of a 150m-wide graben hosting gold mineralization both within Tertiary volcanics and along the unconformity separating volcanics from underlying Paleozoic sediments. Termed the West Atlanta Graben Zone ("WAGZ"), this area is characterized by long drill intercepts that can exceed 150m in thickness and range in average grade from 0.5 g/t to 1.5 g/t Au. Examples include 2.31 g/t Au over 71.7m in AT22WS-2 (released February 13, 2023), 1.03 g/t Au over 181.4m in AT22SE-4 and 0.98 g/t Au over 163.1m in AT22SE-42 (released March 20, 2023), and 2.74 g/t Au over 89m in AT22HG-8T (released April 3, 2023). Once the WAGZ's structural setting was drill-defined, Nevada King was quick to recognize the strong potential within this this down-dropped volcanic basin for significantly adding tonnage to the Atlanta system.

Drilling throughout 2023 continued to test mineralization along the AMFZ and within the WAGZ while concurrently discovering and testing major feeder structures controlling both mineralized zones. The boundary between these zones coincides with the West Atlanta Fault ("WAF") and adjacent West Atlanta Fault #1 ("WAF1"), both of which appear to be major controlling structures for the Atlanta deposit with respect to localizing shallow intrusive activity and serving as the main hydrothermal feeders for the epithermal system. Drilling along the WAF and WAF1 encountered several instances of high-grade gold and silver mineralization including 1084 g/t Ag and 5.27 g/t Au over 10.7m in AT22HG-18 (released April 20, 2023).

Figure 1 above shows the distribution of gold grade and thickness reported to date in relation to the areas drilled during the past three years. The westward increase in intercept thickness is apparent due to the influence of the WAGZ, whereas higher gold grades are scattered around the deposit but generally occur proximal to major structures. Nevada King's closer spaced drilling along these major structures has connected the higher-grade intercepts together along strike, forming a grid-like pattern of high-grade along structures and lower-grade between the structures. The net effect has been to reveal higher-grade portions of the deposit that were not apparent from the more widely-spaced historical drill holes.

In addition, following these main structures has allowed for significant expansion well outside the existing resource zone to the south, the west, and to the north. In October, the Company released results from an area immediately south of the resource zone in a blind discovery that included 2.15 g/t Au over 96m in AT23HG-34 and 1.89 g/t Au over 114.3m in AT23HG-37 (released October 17, 2023). Meanwhile, drilling in the North Extension target 600m north of the Atlanta Pit continued to encounter high-grade gold mineralization including 4.01 g/t Au over 21.3m and 3.69 g/t Au over 13.7m (released September 27, 2023).

2024 Drilling:

Looking to 2024, Nevada King's Atlanta resource expansion and definition program will focus on closely spaced drilling along major structures to test and expand the very high-grade zones (or "jewelry boxes") recently discovered towards the end of 2023. These are best exemplified by the October 2023 release of the most gold rich hole ever recorded at Atlanta with 11.64 g/t Au over 108.3m, including 37.16 g/t Au over 29m, intercepted in the northwest portion of the resource area within the WAGZ (released October 2, 2023). This was followed by another record intercept of 6.55 g/t Au and 100.8 g/t Ag over 82.3m, intersected along a different structure within the AMFZ, (released November 14, 2023). These bonanza-grade zones, although relatively restricted in size, are very high-grade and could lead to a boost in the overall grade at Atlanta.

As the 2024 year progresses, exploration drilling will continue southward from the resource zone along the South Quartzite Ridge Target and eastward up onto the East Ridge Target. Reconnaissance drilling will commence in early summer to follow-up on the many geophysical and geochemical anomalies identified in 2023 throughout the Atlanta District. With a far better geological/geochemical/geophysical model for the Atlanta deposit in hand, the Company is now much better equipped to cost-effectively look for other Atlanta-type targets within a 31 km2 prospective region that is almost completely covered by post-mineral volcanics, caldera moat sediments, and thick alluvium.

The strong, high-grade mineralization encountered within the Atlanta deposit is connected to a large and relatively long-lived hydrothermal system formed along the caldera's margin, boding well for identifying similar deposits around or adjacent to the caldera margin.

QA/QC Protocols

All Reverse Circulation samples from the Atlanta Project are split at the drill site and placed in cloth and plastic bags utilizing a nominal 2kg sample weight. CRF standards, blanks, and duplicates are inserted into the sample stream on-site on a one-in-twenty sample basis, meaning all three inserts are included in each 20-sample group. Samples are shipped by a local contractor in large sample shipping crates directly to American Assay Lab in Reno, Nevada, with full custody being maintained at all times. At American Assay Lab, samples were weighted then crushed to 75% passing 2mm and pulverized to 85% passing 75 microns in order to produce a 300g pulverized split. Prepared samples are initially run using a four acid + boric acid digestion process and conventional mutli-element ICP-OES analysis. Gold assays are initially run using 30-gram samples by lead fire assay with an OES finish to a 0.003 ppm detection limit, with samples greater than 10 ppm finished gravimetrically. Every sample is also run through a cyanide leach for gold with an ICP-OES finish. The QA/QC procedure involves regular submission of Certified Analytical Standards and property-specific duplicates.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101 ("NI 43-101").

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016, the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King's portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines' large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled "Atlanta Property, Lincoln County, NV" with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company's profile on SEDAR+ (www.sedarplus.ca).

Resource Category

| Tonnes

(000s)

| Au

Grade

(ppm)

| Contained Au

Oz

| Ag Grade

(ppm)

| Contained Ag

Oz

|

Measured

| 4,130

| 1.51

| 200,000

| 14.0

| 1,860,000

|

Indicated

| 6,910

| 1.17

| 260,000

| 10.6

| 2,360,000

|

Measured + Indicated

| 11,000

| 1.30

| 460,000

| 11.9

| 4,220,000

|

Inferred

| 5,310

| 0.83

| 142,000

| 7.3

| 1,240,000

|

Table 1. NI 43-101 Mineral Resources at the Atlanta Mine

Please see the Company's website at www.nevadaking.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of Nevada King, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. Forward-looking statements in this news release relate to, among other things, the Company's exploration plans and the Company's ability to potentially expand mineral resources and the impact thereon. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.

View original content to download multimedia:https://www.prnewswire.com/news-releases/nevada-king-reviews-2023-achievements-at-its-atlanta-gold-mine-project---drills-50-000m-increases-land-package-and-confirms-new-geological-model-302023161.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/nevada-king-reviews-2023-achievements-at-its-atlanta-gold-mine-project---drills-50-000m-increases-land-package-and-confirms-new-geological-model-302023161.html

SOURCE Nevada King Gold Corp.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/nevada-king-reviews-2023-achievements-at-its-atlanta-gold-mine-project---drills-50-000m-increases-land-package-and-confirms-new-geological-model-302023161.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/nevada-king-reviews-2023-achievements-at-its-atlanta-gold-mine-project---drills-50-000m-increases-land-package-and-confirms-new-geological-model-302023161.html