Newmont Reports 2021 Mineral Reserves of 93 million Gold Ounces and 65 million Gold Equivalent Ounces

Newmont Corporation (NYSE: NEM) reported a slight decrease in gold Mineral Reserves for 2021, totaling 92.8 million ounces, down from 94.2 million at the end of 2020. The company expanded its reserves with the acquisition of Buenaventura's interest in Minera Yanacocha, adding 2.7 million ounces of gold and other significant resources. Over 90% of reserves are in top-tier jurisdictions, and the company maintains a gold reserve life of over 10 years. Notably, copper reserves stand at 15.1 billion pounds.

Exploration expenditures are projected at $250 million for 2022, focusing on near-mine expansions.

- Gold mineral reserves slightly decreased but maintained strong figures at 92.8 million ounces.

- Acquisition of Buenaventura's interest strengthens overall reserves with an addition of 2.7 million ounces.

- Over 90% of gold reserves located in top-tier jurisdictions.

- Gold reserve life at operating sites exceeds 10 years.

- Significant copper reserves of 15.1 billion pounds reinforce diversification.

- Gold mineral reserves experienced a net decrease due to depletion of 7.1 million ounces.

- Unfavorable net revisions of 0.8 million ounces impacted overall reserve figures.

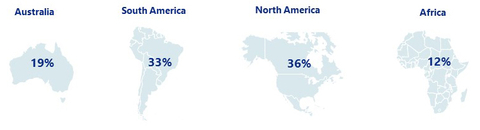

PERCENTAGE OF GOLD RESERVES BY JURISDICTION

"

KEY HIGHLIGHTS AND DIFFERENTIATORS:

- Robust gold Mineral Reserves of 92.8 million ounces

- Over 90 percent of gold reserves in top-tier jurisdictions

- Addition of 6.5 million ounces in 2021 primarily through drilling

-

Gold reserve life at operating sites of 10 years or more, underpinned by a strong base at Boddington, Tanami, Ahafo, Yanacocha, Peñasquito, and

Nevada Gold Mines (NGM), and further enhanced from our seven other operating mines and equity ownership inPueblo Viejo -

Significant gold reserves per share with 120 ounces per 1,000 shares, including the purchase of

Buenaventura's interest in Minera Yanacocha - Measured & Indicated gold Mineral Resources of 68.3 million ounces and Inferred of 33.2 million ounces

- Significant exposure to copper with 15.1 billion pounds in reserves, 17.8 billion pounds in Measured & Indicated resources and 8.6 billion pounds in Inferred resources

- Additional exposure to other metals such as silver, zinc, and lead mainly at Peñasquito

-

Announced the acquisition of

Buenaventura's 43.65% interest in Minera Yanacocha inFebruary 2022 ; further enhancing world-class asset ownership with a consistent district consolidation strategy1

PERCENTAGE OF GOLD RESERVES BY JURISDICTION2

Newmont’s reserve base is a key differentiator with over 90 percent of gold reserves located in top-tier jurisdictions, an operating reserve life of more than 10 years and average reserve grade of 1.06 grams per tonne. In addition,

PROVEN & PROBABLE GOLD RESERVES |

||

| In millions of ounces | ||

| 2020 Gold Reserves | 94.2 |

|

| Additions | 6.5 |

|

| Net Revisions | (0.8 |

) |

| Depletion | (7.1 |

) |

| Reported 2021 Gold Reserves | 92.8 |

|

| Minera Yanacocha Transaction4 | 2.7 |

|

| Adjusted 2021 Gold Reserves | 95.5 |

|

For 2021,

Additions before revisions of 6.5 million ounces through exploration met the Company’s target despite higher costs and challenges created by the pandemic with travel restrictions and additional safety protocols. Notable reserve additions for the year from Newmont’s operating sites included:

-

Cerro Negro added 1.1 million ounces primarily due to drilling in the Eastern Districts - Tanami added 0.8 million ounces largely due to the first declaration of reserves at Liberator

- Éléonore added 0.4 million ounces primarily from drilling

- Merian added 0.4 million attributable ounces primarily from drilling at the Maraba open pit

- Ahafo added 0.4 million ounces primarily from drilling and updated technical assumptions at Subika Underground

- Newmont’s 38.5 percent interest in NGM added 3.0 million attributable ounces primarily from drilling at Goldrush

Net unfavorable revisions include 0.9 million ounces at Cerro Negro due to reserve downgrades related to drill spacing studies and updated technical assumptions. In addition gold Mineral Reserves reported negative revisions of 0.4 million ounces at Tanami, 0.2 million ounces at Boddington, 0.2 million ounces at

Newmont’s 38.5 percent interest in NGM represented 19.3 million attributable ounces of gold reserves at year end, as compared to 17.4 million ounces at the end of 2020.

Gold reserve grade improved three percent to 1.06 grams per tonne compared to 1.03 grams per tonne in the prior year largely due to higher-grade reserves from the Company’s 38.5 percent equity ownership in

MEASURED & INDICATED GOLD RESOURCES |

INFERRED GOLD RESOURCES |

|||||||

| In millions of ounces | In millions of ounces |

|

||||||

| 2020 Gold Resources | 69.6 |

|

2020 Gold Resources | 31.6 |

|

|||

| Additions | 1.6 |

|

Additions | 3.3 |

|

|||

| Net Revisions | 3.0 |

|

Net Revisions | 0.6 |

|

|||

| Conversions | (5.9 |

) |

Conversions | (2.3 |

) |

|||

| Reported 2021 Gold Resources | 68.3 |

|

Reported 2021 Gold Resources | 33.2 |

|

|||

| Minera Yanacocha Transaction4 | 7.4 |

|

Minera Yanacocha Transaction4 | 3.6 |

|

|||

| Adjusted 2021 Gold Resources | 75.7 |

|

Adjusted 2021 Gold Resources | 36.8 |

|

|||

In 2021,

Measured and Indicated Gold Mineral Resources added through exploration programs were 1.6 million ounces and included notable additions before revisions of 0.3 million ounces at Tanami and 0.2 million ounces at Ahafo South underground.

Measured and Indicated gold Mineral Resources reported net revisions of 3.0 million ounces mainly driven by positive revisions of 1.3 million ounces at Boddington and 0.6 million ounces at Tanami. Additionally NGM added 2.1 million attributable ounces. Positive revisions were partially offset by negative revisions, including 1.1 million ounces at CC&V and 0.5 million ounces at Peñasquito.

Inferred Gold Mineral Resources added through exploration programs were 3.3 million ounces and included notable additions before revisions of 0.4 million ounces at Ahafo South, 0.4 million ounces at Éléonore, 0.4 million ounces at Cerro Negro and 0.4 million ounces at Tanami. Additionally, NGM added 0.8 million attributable ounces.

Inferred Gold Mineral Resources reported net revisions of 0.6 million ounces mainly driven by positive revisions of 0.6 million ounces at Cerro Negro and 0.3 million ounces at Ahafo South underground. Additionally, NGM added 1.1 million attributable ounces. Positive revisions were partially offset by negative revisions of 0.7 million ounces at Peñasquito and 0.5 million ounces at Tanami.

Newmont’s Measured and Indicated gold Mineral Resource grade increased slightly to 0.66 grams per tonne compared to 0.65 grams per tonne in the prior year. Inferred gold Mineral Resource grade of 0.69 grams per tonne increased compared with 0.65 grams per tonne from 2020.

OTHER METALS

In 2021, copper reserves decreased slightly to 15,090 million pounds from 15,220 pounds in the prior year primarily due to mining depletion. Copper resources increased to 17,820 million pounds of Measured & Indicated and 8,640 million pounds of Inferred from 17,620 million pounds of Measured and Indicated and 8,620 million pounds of Inferred due to the addition of a layback at Boddington. 2021 copper figures exclude 700 million pounds of reserves and 2,645 million pounds of resources acquired through the purchase of

Silver reserves decreased from 613 million ounces to 568 million ounces in the prior year, largely due to depletion at Peñasquito. Silver resources also decreased to 422 million ounces of Measured & Indicated and 163 million ounces of Inferred from 482 million ounces of Measured and Indicated and 204 million ounces of Inferred due to design updates at Peñasquito. 2021 silver figures exclude 49 million pounds of resources acquired through the purchase of

Lead reserves decreased to 2,580 million pounds from 2,940 million pounds in the prior year, and zinc reserves also decreased to 6,250 million pounds from 6,810 million pounds. These decreases are largely due to depletion at Peñasquito. Measured & Indicated lead resources decreased to 1,230 million pounds from 1,700 million pounds and Inferred lead resources decreased to 480 million pounds from 900 million pounds. Measured & Indicated zinc resources decreased to 2,690 million pounds from 3,700 million pounds and Inferred zinc resources decreased to 1,070 million pounds from 1,700 million pounds. These decreases are primarily due to design updates at Peñasquito.

1 |

The reserve and resource table contained herein reflect |

|

2 |

|

|

3 |

Gold Equivalent Ounces calculated using Mineral Reserve pricing as shown below and metallurgical recoveries for each metal on a site by site basis. |

|

4 |

In |

EXPLORATION OUTLOOK

Newmont’s attributable exploration expenditure for managed operations is expected to be approximately

Additionally, Newmont’s share of exploration investment for its non-managed joint ventures will total approximately

Geographically, the Company expects to invest approximately 38 percent in

GOLD RESERVE SENSITIVITY

A

For additional details on Newmont’s reported Gold, Copper, Silver, Zinc, Lead and Molybdenum Mineral Reserves and Mineral Resources, please refer to the tables at the end of this release.

KEY RESERVE AND RESOURCE ASSUMPTIONS: |

||

|

At |

|

|

2021 |

2020 |

Gold Reserves (US$/oz.) |

|

|

Gold Resources (US$/oz.) |

|

|

Copper Reserves (US$/lb.) |

|

|

Copper Resources (US$/lb.) |

|

|

Silver Reserves (US$/oz.) |

|

|

Silver Resources (US$/oz.) |

|

|

Zinc Reserves (US$/lb.) |

|

|

Zinc Resources (US$/lb.) |

|

|

Lead Reserves (US$/lb.) |

|

|

Lead Resources (US$/lb.) |

|

|

Australian Dollar (A$:US$) |

|

|

Canadian Dollar (C$:US$) |

|

|

Mexican Peso (M$:US$) |

|

|

West Texas Intermediate (US$/bbl.) |

|

|

RESERVE AND RESOURCE TABLES

Proven and Probable reserves are based on extensive drilling, sampling, mine modeling and metallurgical testing from which we determine economic feasibility. The price sensitivity of reserves depends upon several factors including grade, metallurgical recovery, operating cost, waste-to-ore ratio and ore type. Metallurgical recovery rates vary depending on the metallurgical properties of each deposit and the production process used. The reserve tables included in this release list the average metallurgical recovery rate for each deposit, which takes into account the assumed processing methods. The cut-off grade, or lowest grade of material considered economic to process, varies with material type, price, metallurgical recoveries, operating costs and co- or by-product credits. The Proven and Probable reserve figures presented herein are estimates based on information available at the time of calculation. No assurance can be given that the indicated levels of recovery of gold, silver, copper, lead, zinc and molybdenum will be realized. Ounces of gold and silver or tonnes of copper, zinc, lead, or molybdenum included in the Proven and Probable reserves are those contained prior to losses during metallurgical treatment. Reserve estimates may require revision based on actual production. Market fluctuations in the price of gold, silver, copper, zinc, lead, or molybdenum, as well as increased production costs or reduced metallurgical recovery rates, could render certain Proven and Probable reserves containing relatively lower grades of mineralization uneconomic to exploit and might result in a reduction of reserves.

The Measured, Indicated, and Inferred resource figures presented herein are estimates based on information available at the time of calculation and are exclusive of reserves. A “Mineral Resource” is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade, or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. Ounces of gold and silver or tonnes of copper, zinc, lead, and molybdenum included in the Measured, Indicated and Inferred resources are those contained prior to losses during metallurgical treatment. Market fluctuations in the price of gold, silver, copper, zinc, lead and molybdenum, as well as increased production costs or reduced metallurgical recovery rates, could change future estimates of resources. Please refer to the reserves and resources cautionary statement at the end of the release.

Proven and Probable reserves disclosed at

We publish reserves annually, and will recalculate reserves at

Attributable Proven, Probable and Combined Gold Reserves (1) |

|||||||||||||||||||||

|

|

||||||||||||||||||||

|

|

|

|

Proven Reserves |

|

Probable Reserves |

|

Proven and Probable Reserves |

|

|

Proven and Probable Reserves |

||||||||||

|

|

|

|

Tonnage (2) |

Grade |

Gold (3) |

|

Tonnage (2) |

Grade |

Gold (3) |

|

Tonnage (2) |

Grade |

Gold (3) |

|

|

Tonnage (2) |

Grade |

Gold (3) |

||

Deposits/Districts |

|

|

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

Metallurgical

|

(000

|

(g/tonne) |

Ounces

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

CC&V Open Pits (4) |

|

100 |

% |

|

70,700 |

0.44 |

1,000 |

|

15,400 |

0.37 |

180 |

|

86,100 |

0.43 |

1,180 |

|

60 |

% |

105,200 |

0.48 |

1,610 |

CC&V Leach Pads (4)(5) |

|

100 |

% |

|

— |

|

— |

|

31,200 |

0.81 |

810 |

|

31,200 |

0.81 |

810 |

|

57 |

% |

33,000 |

0.82 |

880 |

Total CC&V, |

|

|

|

70,700 |

0.44 |

1,000 |

|

46,600 |

0.66 |

990 |

|

117,300 |

0.53 |

1,990 |

|

59 |

% |

138,200 |

0.56 |

2,490 |

|

Musselwhite, |

|

100 |

% |

|

2,800 |

5.07 |

460 |

|

6,700 |

6.07 |

1,310 |

|

9,500 |

5.77 |

1,770 |

|

96 |

% |

8,900 |

6.25 |

1,790 |

Porcupine Underground (7) |

|

100 |

% |

|

2,300 |

7.24 |

530 |

|

900 |

7.97 |

240 |

|

3,200 |

7.46 |

770 |

|

92 |

% |

5,000 |

6.90 |

1,100 |

|

|

100 |

% |

|

5,900 |

1.60 |

310 |

|

33,700 |

1.41 |

1,520 |

|

39,600 |

1.44 |

1,830 |

|

94 |

% |

42,300 |

1.43 |

1,950 |

Total |

|

|

|

8,200 |

3.19 |

840 |

|

34,600 |

1.58 |

1,760 |

|

42,800 |

1.89 |

2,600 |

|

93 |

% |

47,300 |

2.01 |

3,050 |

|

Éléonore, |

|

100 |

% |

|

2,200 |

5.03 |

350 |

|

9,000 |

5.06 |

1,470 |

|

11,200 |

5.05 |

1,820 |

|

91 |

% |

7,800 |

5.00 |

1,260 |

Peñasquito Open Pits |

|

100 |

% |

|

107,200 |

0.62 |

2,140 |

|

219,100 |

0.56 |

3,910 |

|

326,300 |

0.58 |

6,050 |

|

69 |

% |

348,200 |

0.60 |

6,680 |

Peñasquito Stockpiles (10) |

|

100 |

% |

|

7,800 |

0.43 |

110 |

|

27,900 |

0.19 |

170 |

|

35,700 |

0.24 |

280 |

|

69 |

% |

39,600 |

0.33 |

420 |

Total Peñasquito, |

|

|

|

115,000 |

0.61 |

2,250 |

|

247,000 |

0.51 |

4,080 |

|

362,000 |

0.54 |

6,330 |

|

69 |

% |

387,800 |

0.57 |

7,100 |

|

TOTAL |

|

|

|

198,900 |

0.77 |

4,900 |

|

343,900 |

0.87 |

9,610 |

|

542,800 |

0.83 |

14,510 |

|

78 |

% |

590,000 |

0.83 |

15,690 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Yanacocha Open Pits (12) |

|

51.35 |

% |

|

16,500 |

0.66 |

350 |

|

68,200 |

0.68 |

1,490 |

|

84,700 |

0.68 |

1,840 |

|

57 |

% |

95,100 |

0.66 |

2,020 |

Yanacocha Underground (13) |

|

51.35 |

% |

|

— |

|

— |

|

7,000 |

6.20 |

1,390 |

|

7,000 |

6.20 |

1,390 |

|

97 |

% |

7,000 |

6.20 |

1,390 |

Total Yanacocha, |

|

|

|

16,500 |

0.66 |

350 |

|

75,200 |

1.19 |

2,880 |

|

91,700 |

1.10 |

3,230 |

|

74 |

% |

102,100 |

1.04 |

3,410 |

|

Merian, Suriname (14) |

|

75 |

% |

|

47,100 |

1.36 |

2,050 |

|

54,500 |

1.11 |

1,950 |

|

101,600 |

1.22 |

4,000 |

|

93 |

% |

107,500 |

1.15 |

3,970 |

|

|

100 |

% |

|

1,800 |

8.93 |

500 |

|

7,200 |

8.88 |

2,060 |

|

9,000 |

8.89 |

2,560 |

|

94 |

% |

9,000 |

8.90 |

2,570 |

Pueblo Viejo Open Pits |

|

40 |

% |

|

5,000 |

2.20 |

350 |

|

8,200 |

2.33 |

620 |

|

13,200 |

2.28 |

970 |

|

89 |

% |

19,600 |

2.34 |

1,470 |

Pueblo Viejo Stockpiles (10) |

|

40 |

% |

|

— |

|

— |

|

37,400 |

2.20 |

2,640 |

|

37,400 |

2.20 |

2,640 |

|

89 |

% |

35,800 |

2.30 |

2,640 |

Total |

|

|

|

5,000 |

2.20 |

350 |

|

45,600 |

2.22 |

3,260 |

|

50,600 |

2.22 |

3,610 |

|

89 |

% |

55,400 |

2.31 |

4,110 |

|

NuevaUnión, |

|

50 |

% |

|

— |

|

— |

|

341,100 |

0.47 |

5,110 |

|

341,100 |

0.47 |

5,110 |

|

66 |

% |

341,100 |

0.47 |

5,110 |

Norte Abierto, |

|

50 |

% |

|

— |

|

— |

|

598,800 |

0.60 |

11,620 |

|

598,800 |

0.60 |

11,620 |

|

74 |

% |

598,800 |

0.60 |

11,620 |

TOTAL |

|

|

|

70,400 |

1.44 |

3,250 |

|

1,122,400 |

0.75 |

26,880 |

|

1,192,800 |

0.79 |

30,130 |

|

78 |

% |

1,213,900 |

0.79 |

30,790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

100 |

% |

|

237,400 |

0.70 |

5,360 |

|

239,100 |

0.66 |

5,080 |

|

476,500 |

0.68 |

10,440 |

|

86 |

% |

534,700 |

0.67 |

11,490 |

Boddington Stockpiles (16) |

|

100 |

% |

|

2,700 |

0.68 |

60 |

|

79,100 |

0.43 |

1,090 |

|

81,800 |

0.44 |

1,150 |

|

79 |

% |

86,400 |

0.43 |

1,200 |

Total Boddington, |

|

|

|

240,100 |

0.70 |

5,420 |

|

318,200 |

0.60 |

6,170 |

|

558,300 |

0.65 |

11,590 |

|

85 |

% |

621,100 |

0.64 |

12,690 |

|

Tanami, |

|

100 |

% |

|

12,700 |

4.97 |

2,040 |

|

22,100 |

5.25 |

3,740 |

|

34,800 |

5.15 |

5,780 |

|

98 |

% |

36,200 |

5.05 |

5,870 |

TOTAL |

|

|

|

252,800 |

0.92 |

7,460 |

|

340,300 |

0.91 |

9,910 |

|

593,100 |

0.91 |

17,370 |

|

89 |

% |

657,300 |

0.88 |

18,560 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Ahafo South Open Pits (21) |

|

100 |

% |

|

11,800 |

2.35 |

890 |

|

39,700 |

1.67 |

2,140 |

|

51,500 |

1.83 |

3,030 |

|

95 |

% |

50,000 |

1.90 |

3,050 |

Ahafo South Underground (22) |

|

100 |

% |

|

9,400 |

3.76 |

1,140 |

|

12,700 |

2.68 |

1,100 |

|

22,100 |

3.14 |

2,240 |

|

94 |

% |

17,100 |

3.53 |

1,940 |

Ahafo South Stockpiles (10) |

|

100 |

% |

|

28,300 |

0.92 |

830 |

|

— |

|

— |

|

28,300 |

0.92 |

830 |

|

89 |

% |

36,200 |

0.92 |

1,070 |

Total Ahafo South, |

|

|

|

49,500 |

1.80 |

2,860 |

|

52,400 |

1.92 |

3,240 |

|

101,900 |

1.86 |

6,100 |

|

94 |

% |

103,300 |

1.82 |

6,060 |

|

Ahafo North, |

|

100 |

% |

|

— |

|

— |

|

46,300 |

2.40 |

3,570 |

|

46,300 |

2.40 |

3,570 |

|

91 |

% |

45,100 |

2.40 |

3,480 |

|

|

100 |

% |

|

15,800 |

1.61 |

810 |

|

10,900 |

1.89 |

660 |

|

26,700 |

1.72 |

1,470 |

|

92 |

% |

34,200 |

1.70 |

1,870 |

Akyem Stockpiles (10) |

|

100 |

% |

|

13,900 |

0.78 |

350 |

|

— |

|

— |

|

13,900 |

0.78 |

350 |

|

91 |

% |

15,100 |

0.82 |

400 |

Total Akyem, |

|

|

|

29,700 |

1.22 |

1,160 |

|

10,900 |

1.89 |

660 |

|

40,600 |

1.40 |

1,820 |

|

91 |

% |

49,300 |

1.43 |

2,270 |

|

TOTAL |

|

|

|

79,200 |

1.58 |

4,020 |

|

109,600 |

2.12 |

7,470 |

|

188,800 |

1.89 |

11,490 |

|

92 |

% |

197,700 |

1.86 |

11,810 |

|

Nevada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

NGM Open Pits |

|

38.5 |

% |

|

10,000 |

1.86 |

600 |

|

119,500 |

1.21 |

4,650 |

|

129,500 |

1.26 |

5,250 |

|

70 |

% |

134,300 |

1.26 |

5,440 |

NGM Stockpiles (10) |

|

38.5 |

% |

|

14,300 |

2.03 |

940 |

|

14,900 |

|

1,250 |

|

29,200 |

2.33 |

2,190 |

|

68 |

% |

33,300 |

2.36 |

2,530 |

NGM Underground |

|

38.5 |

% |

|

13,600 |

9.95 |

4,340 |

|

28,000 |

8.39 |

7,560 |

|

41,600 |

8.90 |

11,900 |

|

88 |

% |

29,700 |

9.85 |

9,420 |

TOTAL NEVADA (25) |

|

|

|

37,900 |

4.82 |

5,880 |

|

162,400 |

2.58 |

13,460 |

|

200,300 |

3.00 |

19,340 |

|

81 |

% |

197,300 |

2.74 |

17,390 |

|

TOTAL |

|

|

|

639,200 |

1.24 |

25,510 |

|

2,078,600 |

1.01 |

67,330 |

|

2,717,800 |

1.06 |

92,840 |

|

81 |

% |

2,856,200 |

1.03 |

94,240 |

|

(1) |

See cautionary statement regarding reserves and resources. 2021 and 2020 reserves were estimated at a gold price of |

|

(2) |

Tonnages include allowances for losses resulting from mining methods. Tonnages are rounded to the nearest 100,000. |

|

(3) |

Ounces are estimates of metal contained in ore tonnages and do not include allowances for processing losses. Metallurgical recovery rates represent the estimated amount of metal to be recovered through metallurgical extraction processes. Ounces may not recalculate as they are rounded to the nearest 10,000. |

|

(4) |

Cut-off grades utilized in 2021 reserves were as follows: oxide mill material not less than 1.32 gram per tonne and leach material not less than 0.10 gram per tonne. |

|

(5) |

Leach pad material is the material on leach pads at the end of the year from which gold remains to be recovered. In-process reserves are reported separately where ounces exceed 100,000 and are greater than |

|

(6) |

Cut-off grade utilized in 2021 reserves not less than 3.10 gram per tonne. |

|

(7) |

Cut-off grade utilized in 2021 reserves not less than 4.00 gram per tonne. |

|

(8) |

Cut-off grade utilized in 2021 reserves not less than 0.44 gram per tonne. |

|

(9) |

Cut-off grade utilized in 2021 reserves not less than 4.30 gram per tonne. |

|

(10) |

Stockpiles are comprised primarily of material that has been set aside to allow processing of higher grade material in the mills. Stockpiles increase or decrease depending on current mine plans. Stockpile reserves are reported separately where ounces exceed 100,000 and are greater than |

|

(11) |

Gold cut-off grade varies with level of silver, lead and zinc credits. |

|

(12) |

Gold cut-off grades utilized in 2021 reserves were as follows: oxide leach material not less than 0.07 gram per tonne and refractory mill material not less than 1.45 gram per tonne. |

|

(13) |

Gold cut-off grades utilized in 2021 reserves were as follows: oxide mill material not less than 2.10 gram per tonne and refractory mill material varies with level of copper and silver credits. |

|

(14) |

Cut-off grade utilized in 2021 reserves not less than 0.33 gram per tonne. |

|

(15) |

Cut-off grade utilized in 2021 reserves not less than 5.00 gram per tonne. |

|

(16) |

The |

|

(17) |

Project is currently undeveloped. Reserve estimates provided by the NuevaUnión joint venture. |

|

(18) |

Project is currently undeveloped. Reserve estimates provided by the Norte Abierto joint venture |

|

(19) |

Gold cut-off grade varies with level of copper credits. |

|

(20) |

Cut-off grade utilized in 2021 reserves not less than 2.20 gram per tonne. |

|

(21) |

Cut-off grade utilized in 2021 reserves not less than 0.46 gram per tonne. |

|

(22) |

Cut-off grade utilized in 2021 reserves not less than 2.40 gram per tonne. |

|

(23) |

Cut-off grade utilized in 2021 reserves not less than 0.57 gram per tonne. |

|

(24) |

Cut-off grade utilized in 2021 reserves not less than 0.56 gram per tonne. |

|

(25) |

Reserve estimates provided by Barrick, the operator of the NGM joint venture. |

|

(26) |

In |

Attributable Gold Mineral Resources (1)(2) - |

||||||||||||||||||||||

|

|

|

|

Measured Resource |

|

Indicated Resource |

|

Measured and Indicated Resource (3) |

|

Inferred Resource |

|

|

||||||||||

|

|

|

|

Tonnage |

Grade |

Gold |

|

Tonnage |

Grade |

Gold |

|

Tonnage |

Grade |

Gold |

|

Tonnage |

Grade |

Gold |

|

|

||

Deposits/Districts |

|

Share |

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

Metallurgical

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

CC&V,Colorado |

|

100 |

% |

|

54,000 |

0.41 |

700 |

|

24,100 |

0.38 |

300 |

|

78,100 |

0.40 |

1,000 |

|

12,700 |

0.39 |

160 |

|

62 |

% |

Musselwhite, |

|

100 |

% |

|

1,400 |

3.58 |

160 |

|

2,300 |

3.55 |

270 |

|

3,700 |

3.56 |

430 |

|

3,200 |

4.22 |

440 |

|

96 |

% |

Porcupine Underground |

|

100 |

% |

|

300 |

5.25 |

50 |

|

900 |

6.12 |

180 |

|

1,200 |

5.92 |

230 |

|

1,100 |

6.43 |

220 |

|

92 |

% |

|

|

100 |

% |

|

500 |

0.49 |

10 |

|

83,200 |

1.40 |

3,750 |

|

83,700 |

1.40 |

3,760 |

|

77,000 |

1.24 |

3,070 |

|

92 |

% |

Total |

|

|

|

800 |

2.33 |

60 |

|

84,100 |

1.45 |

3,930 |

|

84,900 |

1.46 |

3,990 |

|

78,100 |

1.31 |

3,290 |

|

92 |

% |

|

Éléonore, |

|

100 |

% |

|

300 |

5.72 |

50 |

|

1,700 |

4.73 |

260 |

|

2,000 |

4.86 |

310 |

|

3,800 |

5.28 |

650 |

|

91 |

% |

Peñasquito, |

|

100 |

% |

|

31,400 |

0.27 |

280 |

|

176,600 |

0.27 |

1,500 |

|

208,000 |

0.27 |

1,780 |

|

89,800 |

0.40 |

1,160 |

|

69 |

% |

|

|

50 |

% |

|

— |

— |

— |

|

21,000 |

0.37 |

250 |

|

21,000 |

0.37 |

250 |

|

1,600 |

0.21 |

10 |

|

50 |

% |

Coffee, |

|

100 |

% |

|

1,000 |

2.01 |

60 |

|

54,500 |

1.19 |

2,080 |

|

55,500 |

1.20 |

2,140 |

|

6,800 |

1.07 |

230 |

|

80 |

% |

|

|

50 |

% |

|

128,400 |

0.36 |

1,500 |

|

423,400 |

0.23 |

3,130 |

|

551,800 |

0.26 |

4,630 |

|

99,100 |

0.21 |

670 |

|

73 |

% |

TOTAL |

|

|

|

217,300 |

0.40 |

2,810 |

|

787,700 |

0.46 |

11,720 |

|

1,005,000 |

0.45 |

14,530 |

|

295,100 |

0.70 |

6,610 |

|

79 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Conga, |

|

51.35 |

% |

|

— |

— |

— |

|

356,300 |

0.65 |

7,490 |

|

356,300 |

0.65 |

7,490 |

|

118,400 |

0.39 |

1,480 |

|

75 |

% |

|

|

51.35 |

% |

|

5,500 |

0.42 |

70 |

|

52,400 |

0.46 |

770 |

|

57,900 |

0.46 |

840 |

|

96,700 |

0.80 |

2,470 |

|

66 |

% |

Yanacocha Underground |

|

51.35 |

% |

|

— |

6.29 |

10 |

|

1,800 |

6.28 |

370 |

|

1,800 |

6.28 |

380 |

|

1,900 |

4.93 |

300 |

|

97 |

% |

Total Yanacocha, |

|

|

|

5,500 |

0.45 |

80 |

|

54,200 |

0.65 |

1,140 |

|

59,700 |

0.64 |

1,220 |

|

98,600 |

0.87 |

2,770 |

|

70 |

% |

|

Merian, Suriname |

|

75 |

% |

|

4,500 |

0.94 |

140 |

|

32,600 |

1.14 |

1,200 |

|

37,100 |

1.12 |

1,340 |

|

28,500 |

1.01 |

920 |

|

88 |

% |

Cerro Negro Underground |

|

100 |

% |

|

100 |

5.48 |

20 |

|

1,300 |

7.38 |

300 |

|

1,400 |

7.25 |

320 |

|

7,500 |

6.85 |

1,650 |

|

93 |

% |

|

|

100 |

% |

|

900 |

4.40 |

120 |

|

1,000 |

4.09 |

130 |

|

1,900 |

4.24 |

250 |

|

100 |

3.49 |

10 |

|

90 |

% |

Total |

|

100 |

% |

|

1,000 |

4.51 |

140 |

|

2,300 |

5.96 |

430 |

|

3,300 |

5.52 |

570 |

|

7,600 |

6.82 |

1,660 |

|

93 |

% |

|

|

40 |

% |

|

37,300 |

2.01 |

2,410 |

|

57,100 |

1.89 |

3,470 |

|

94,400 |

1.94 |

5,880 |

|

25,400 |

1.72 |

1,410 |

|

89 |

% |

NuevaUnión, |

|

50 |

% |

|

4,800 |

0.47 |

70 |

|

118,300 |

0.59 |

2,260 |

|

123,100 |

0.59 |

2,330 |

|

239,800 |

0.40 |

3,050 |

|

68 |

% |

Norte Abierto, |

|

50 |

% |

|

77,200 |

0.61 |

1,510 |

|

596,900 |

0.49 |

9,320 |

|

674,100 |

0.50 |

10,830 |

|

369,600 |

0.37 |

4,360 |

|

76 |

% |

Agua Rica, |

|

18.75 |

% |

|

141,900 |

0.25 |

1,150 |

|

137,400 |

0.15 |

650 |

|

279,300 |

0.20 |

1,800 |

|

139,900 |

0.09 |

410 |

|

35 |

% |

TOTAL |

|

|

|

272,200 |

0.63 |

5,500 |

|

1,355,100 |

0.60 |

25,960 |

|

1,627,300 |

0.60 |

31,460 |

|

1,027,800 |

0.49 |

16,060 |

|

73 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Boddington, |

|

100 |

% |

|

96,200 |

0.53 |

1,640 |

|

180,500 |

0.54 |

3,110 |

|

276,700 |

0.53 |

4,750 |

|

3,300 |

0.50 |

50 |

|

84 |

% |

|

|

100 |

% |

|

10,200 |

1.88 |

620 |

|

16,600 |

1.69 |

900 |

|

26,800 |

1.76 |

1,520 |

|

2,900 |

1.62 |

150 |

|

90 |

% |

Tanami Underground |

|

100 |

% |

|

1,400 |

3.11 |

140 |

|

4,900 |

4.25 |

660 |

|

6,300 |

4.00 |

800 |

|

9,600 |

5.39 |

1,670 |

|

97 |

% |

Total Tanami, |

|

100 |

% |

|

11,600 |

2.03 |

760 |

|

21,500 |

2.27 |

1,560 |

|

33,100 |

2.18 |

2,320 |

|

12,500 |

4.53 |

1,820 |

|

97 |

% |

TOTAL |

|

|

|

107,800 |

0.69 |

2,400 |

|

202,000 |

0.72 |

4,670 |

|

309,800 |

0.71 |

7,070 |

|

15,800 |

3.68 |

1,870 |

|

89 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Ahafo South |

|

100 |

% |

|

500 |

0.56 |

10 |

|

30,000 |

1.16 |

1,120 |

|

30,500 |

1.15 |

1,130 |

|

13,500 |

1.33 |

570 |

|

93 |

% |

Ahafo Underground |

|

100 |

% |

|

— |

|

— |

|

16,600 |

3.99 |

2,120 |

|

16,600 |

3.99 |

2,120 |

|

10,800 |

3.34 |

1,160 |

|

90 |

% |

Total Ahafo South, |

|

|

|

500 |

0.56 |

10 |

|

46,600 |

2.16 |

3,240 |

|

47,100 |

2.15 |

3,250 |

|

24,300 |

2.21 |

1,730 |

|

91 |

% |

|

Ahafo North Open Pits, |

|

100 |

% |

|

2,800 |

1.21 |

100 |

|

10,400 |

1.90 |

630 |

|

13,200 |

1.76 |

730 |

|

9,800 |

1.60 |

500 |

|

92 |

% |

Akyem Open Pits |

|

100 |

% |

|

900 |

0.57 |

20 |

|

1,100 |

0.67 |

20 |

|

2,000 |

0.62 |

40 |

|

1,300 |

1.43 |

60 |

|

91 |

% |

Akyem Underground |

|

100 |

% |

|

— |

|

— |

|

6,800 |

3.69 |

810 |

|

6,800 |

3.69 |

810 |

|

5,400 |

2.97 |

520 |

|

93 |

% |

Total Akyem, |

|

|

|

900 |

0.57 |

20 |

|

7,900 |

3.27 |

830 |

|

8,800 |

3.00 |

850 |

|

6,700 |

2.69 |

580 |

|

92 |

% |

|

TOTAL |

|

|

|

4,200 |

1.01 |

130 |

|

64,900 |

2.26 |

4,700 |

|

69,100 |

2.18 |

4,830 |

|

40,800 |

2.15 |

2,810 |

|

91 |

% |

|

Nevada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

NGM Open Pits and Stockpiles |

|

38.5 |

% |

|

18,300 |

1.89 |

1,110 |

|

181,100 |

0.90 |

5,230 |

|

199,400 |

0.99 |

6,340 |

|

101,100 |

0.82 |

2,670 |

|

67 |

% |

NGM Underground |

|

38.5 |

% |

|

8,500 |

5.89 |

1,610 |

|

11,900 |

6.35 |

2,430 |

|

20,400 |

6.16 |

4,040 |

|

15,300 |

6.48 |

3,180 |

|

86 |

% |

Total NGM (8) |

|

|

|

26,800 |

3.17 |

2,720 |

|

193,000 |

1.23 |

7,660 |

|

219,800 |

1.47 |

10,380 |

|

116,400 |

1.56 |

5,850 |

|

76 |

% |

|

TOTAL NEVADA |

|

|

|

26,800 |

3.17 |

2,720 |

|

193,000 |

1.23 |

7,660 |

|

219,800 |

1.47 |

10,380 |

|

116,400 |

1.56 |

5,850 |

|

76 |

% |

|

TOTAL |

|

|

|

628,300 |

0.67 |

13,560 |

|

2,602,700 |

0.65 |

54,710 |

|

3,231,000 |

0.66 |

68,270 |

|

1,495,900 |

0.69 |

33,200 |

|

76 |

% |

|

(1) |

Resources are reported exclusive of reserves. |

|

(2) |

Resources are estimated at a gold price of |

|

(3) |

Project is currently undeveloped. Resource estimates provided by Teck Resources. |

|

(4) |

Resource estimates provided by Barrick, the operator of |

|

(5) |

Project is currently undeveloped. Resource estimates provided by the NuevaUnión joint venture. |

|

(6) |

Project is currently undeveloped. Resource estimates provided by the Norte Abierto joint venture. |

|

(7) |

Project is currently undeveloped. Resource estimates provided by Yamana, the operator of the Agua Rica joint venture. |

|

(8) |

Resource estimates provided by Barrick, the operator of the NGM joint venture. |

|

(9) |

In |

Attributable Copper Reserves (1) |

||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||

|

|

|

|

Proven Reserves |

|

Probable Reserves |

|

Proven and Probable Reserves |

|

|

|

Proven and Probable Reserves |

||||||||||||||

|

|

|

|

Tonnage (2) |

Grade |

Copper (3) |

|

Tonnage (2) |

Grade |

Copper (3) |

|

Tonnage (2) |

Grade |

Copper (3) |

|

Metallurgical |

|

Tonnage (2) |

Grade |

Copper (3) |

||||||

Deposits/Districts |

|

Share |

|

(000

|

(Cu %) |

Pounds

|

|

(000

|

(Cu %) |

Pounds

|

|

(000

|

(Cu %) |

Pounds

|

|

Recovery |

|

(000

|

(Cu %) |

Pounds

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Yanacocha Open Pits and Underground, |

|

51.35 |

% |

|

— |

|

— |

|

57,700 |

0.61 |

% |

780 |

|

57,700 |

0.61 |

% |

780 |

|

84 |

% |

|

57,700 |

0.62 |

% |

790 |

|

NuevaUnión, |

|

50 |

% |

|

— |

|

— |

|

1,118,000 |

0.40 |

% |

9,800 |

|

1,118,000 |

0.40 |

% |

9,800 |

|

88 |

% |

|

1,118,000 |

0.40 |

% |

9,800 |

|

Norte Abierto, |

|

50 |

% |

|

— |

|

— |

|

598,800 |

0.22 |

% |

2,890 |

|

598,800 |

0.22 |

% |

2,890 |

|

87 |

% |

|

598,800 |

0.22 |

% |

2,890 |

|

TOTAL |

|

|

|

— |

|

— |

|

1,774,500 |

0.34 |

% |

13,470 |

|

1,774,500 |

0.34 |

% |

13,470 |

|

87 |

% |

|

1,774,500 |

0.34 |

% |

13,480 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

100 |

% |

|

237,400 |

0.10 |

% |

540 |

|

239,100 |

0.11 |

% |

590 |

|

476,500 |

0.11 |

% |

1,130 |

|

82 |

% |

|

534,700 |

0.11 |

% |

1,260 |

Boddington Stockpiles, |

|

100 |

% |

|

2,600 |

0.09 |

% |

10 |

|

79,100 |

0.09 |

% |

150 |

|

81,700 |

0.09 |

% |

160 |

|

77 |

% |

|

86,400 |

0.09 |

% |

160 |

TOTAL |

|

|

|

240,000 |

0.10 |

% |

550 |

|

318,200 |

0.11 |

% |

740 |

|

558,200 |

0.11 |

% |

1,290 |

|

82 |

% |

|

621,100 |

0.10 |

% |

1,420 |

|

Nevada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

NGM, Nevada (9) |

|

38.5 |

% |

|

6,900 |

0.17 |

% |

30 |

|

80,200 |

0.17 |

% |

300 |

|

87,100 |

0.17 |

% |

330 |

|

65 |

% |

|

82,600 |

0.18 |

% |

320 |

TOTAL NEVADA |

|

|

|

6,900 |

0.17 |

% |

30 |

|

80,200 |

0.17 |

% |

300 |

|

87,100 |

0.17 |

% |

330 |

|

65 |

% |

|

82,600 |

0.18 |

% |

320 |

|

TOTAL |

|

|

|

246,900 |

0.11 |

% |

580 |

|

2,172,900 |

0.30 |

% |

14,510 |

|

2,419,800 |

0.28 |

% |

15,090 |

|

87 |

% |

|

2,478,200 |

0.28 |

% |

15,220 |

|

| (1) |

See footnote (1) to the Gold Reserves table above. Copper reserves for 2021 and 2020 were estimated at a copper price of |

|

| (2) | See footnote (2) to the Gold Reserves table above. Tonnages are rounded to nearest 100,000. |

|

| (3) | Pounds are estimates of metal contained in ore tonnages and do not include allowances for processing losses. Metallurgical recovery rates represent the estimated amount of metal to be recovered through metallurgical extraction processes. Pounds may not recalculate as they are rounded to the nearest 10 million. |

|

| (4) | Reserve estimates relate to the undeveloped Yanacocha Sulfide project. Copper cut-off grade varies with level of gold and silver credits. |

|

| (5) | Project is currently undeveloped. Reserve estimates provided by the NuevaUnión joint venture. |

|

| (6) | Project is currently undeveloped. Reserve estimates provided by the Norte Abierto joint venture. |

|

| (7) | Copper cut-off grade varies with level of gold credits. |

|

| (8) |

Stockpiles are comprised primarily of material that has been set aside to allow processing of higher grade material in the mills. Stockpiles increase or decrease depending on current mine plans. Stockpiles are reported separately where pounds exceed 100 million and are greater than |

|

| (9) | Reserve estimates provided by Barrick, the operator of the NGM joint venture. |

|

| (10) |

In |

Attributable Copper Mineral Resources (1)(2) - |

|||||||||||||||||||||||

|

|

|

|

Measured Resource |

Indicated Resource |

Measured and Indicated Resource |

Inferred Resource |

|

|

||||||||||||||

|

|

|

|

Tonnage |

Grade |

Copper |

Tonnage |

Grade |

Copper |

Tonnage |

Grade |

Copper |

Tonnage |

Grade |

Copper |

|

|

||||||

Deposits/Districts |

|

Share |

|

(000

|

(Cu %) |

Pounds

|

(000

|

(Cu %) |

Pounds

|

(000

|

(Cu %) |

Pounds

|

(000

|

(Cu %) |

Pounds

|

|

Metallurgical

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

50 |

% |

|

128,400 |

0.72 |

% |

2,030 |

423,400 |

0.39 |

% |

3,630 |

551,800 |

0.47 |

% |

5,660 |

99,100 |

0.27 |

% |

600 |

|

91 |

% |

TOTAL |

|

|

|

128,400 |

0.72 |

% |

2,030 |

423,400 |

0.39 |

% |

3,630 |

551,800 |

0.47 |

% |

5,660 |

99,100 |

0.27 |

% |

600 |

|

91 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Conga, |

|

51.35 |

% |

|

— |

— |

% |

— |

356,300 |

0.26 |

% |

2,040 |

356,300 |

0.26 |

% |

2,040 |

118,400 |

0.19 |

% |

490 |

|

84 |

% |

Yanacocha Open Pits and Stockpiles |

|

51.35 |

% |

|

— |

— |

% |

— |

48,600 |

0.39 |

% |

420 |

48,600 |

0.39 |

% |

420 |

18,700 |

0.39 |

% |

160 |

|

80 |

% |

Yanacocha Underground |

|

51.35 |

% |

|

— |

— |

% |

— |

1,800 |

0.09 |

% |

— |

1,800 |

0.09 |

% |

— |

1,900 |

0.13 |

% |

10 |

|

96 |

% |

Total Yanacocha, |

|

|

|

— |

— |

% |

— |

50,400 |

0.38 |

% |

420 |

50,400 |

0.38 |

% |

420 |

20,600 |

0.37 |

% |

170 |

|

81 |

% |

|

NuevaUnión, |

|

50 |

% |

|

164,300 |

0.19 |

% |

700 |

349,900 |

0.34 |

% |

2,650 |

514,200 |

0.30 |

% |

3,350 |

602,100 |

0.39 |

% |

5,150 |

|

89 |

% |

Norte Abierto, |

|

50 |

% |

|

57,600 |

0.24 |

% |

310 |

551,200 |

0.19 |

% |

2,340 |

608,800 |

0.20 |

% |

2,650 |

361,700 |

0.18 |

% |

1,450 |

|

90 |

% |

Agua Rica, |

|

18.75 |

% |

|

141,900 |

0.51 |

% |

1,580 |

137,400 |

0.36 |

% |

1,100 |

279,300 |

0.43 |

% |

2,680 |

139,900 |

0.23 |

% |

710 |

|

86 |

% |

TOTAL |

|

|

|

363,800 |

0.32 |

% |

2,590 |

1,445,200 |

0.27 |

% |

8,550 |

1,809,000 |

0.28 |

% |

11,140 |

1,242,700 |

0.29 |

% |

7,970 |

|

87 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Boddington, |

|

100 |

% |

|

96,200 |

0.11 |

% |

220 |

180,500 |

0.11 |

% |

450 |

276,700 |

0.11 |

% |

670 |

3,300 |

0.09 |

% |

10 |

|

82 |

% |

TOTAL |

|

|

|

96,200 |

0.11 |

% |

220 |

180,500 |

0.11 |

% |

450 |

276,700 |

0.11 |

% |

670 |

3,300 |

0.09 |

% |

10 |

|

82 |

% |

|

Nevada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

NGM, Nevada (7) |

|

38.5 |

% |

|

3,100 |

0.14 |

% |

10 |

111,500 |

0.14 |

% |

340 |

114,600 |

0.14 |

% |

350 |

19,900 |

0.13 |

% |

60 |

|

66 |

% |

TOTAL NEVADA |

|

|

|

3,100 |

0.14 |

% |

10 |

111,500 |

0.14 |

% |

340 |

114,600 |

0.14 |

% |

350 |

19,900 |

0.13 |

% |

60 |

|

66 |

% |

|

TOTAL |

|

|

|

591,500 |

0.37 |

% |

4,850 |

2,160,600 |

0.27 |

% |

12,970 |

2,752,100 |

0.29 |

% |

17,820 |

1,365,000 |

0.29 |

% |

8,640 |

|

88 |

% |

|

(1) |

Resources are reported exclusive of reserves. |

|

(2) |

Resources for 2021 and 2020 were estimated at a copper price of |

|

(3) |

Project is currently undeveloped. Resource estimates provided by Teck Resources. |

|

(4) |

Project is currently undeveloped. Resource estimates provided by the NuevaUnión joint venture. |

|

(5) |

Project is currently undeveloped. Resource estimates provided by the Norte Abierto joint venture. |

|

(6) |

Project is currently undeveloped. Resource estimates provided by Yamana, the operator of the Agua Rica joint venture. |

|

(7) |

Resource estimates provided by Barrick, the operator of the NGM joint venture. |

|

(8) |

In |

Attributable Proven, Probable and Combined Silver Reserves (1) |

||||||||||||||||||||||

|

|

|

||||||||||||||||||||

|

|

|

|

Proven Reserves |

|

Probable Reserves |

|

Proven and Probable Reserves |

|

|

|

Proven and Probable Reserves |

||||||||||

|

|

|

|

Tonnage (2) |

Grade |

Silver (3) |

|

Tonnage (2) |

Grade |

Silver (3) |

|

Tonnage (2) |

Grade |

Silver (3) |

|

|

|

Tonnage (2) |

Grade |

Silver (3) |

||

Deposits/Districts |

|

|

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

Metallurgical

|

|

(000

|

(g/tonne) |

Ounces

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Peñasquito Open Pits, |

|

100 |

% |

|

107,200 |

38.79 |

133,650 |

|

219,100 |

32.75 |

230,760 |

|

326,300 |

34.73 |

364,410 |

|

87 |

% |

|

348,200 |

35.10 |

392,890 |

Peñasquito Stockpiles, |

|

100 |

% |

|

7,800 |

31.10 |

7,810 |

|

27,900 |

24.15 |

21,670 |

|

35,700 |

25.67 |

29,480 |

|

87 |

% |

|

39,600 |

25.81 |

32,860 |

TOTAL |

|

|

|

115,000 |

38.26 |

141,460 |

|

247,000 |

31.78 |

252,430 |

|

362,000 |

33.84 |

393,890 |

|

87 |

% |

|

387,800 |

34.15 |

425,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Yanacocha Open Pits and Underground (6) |

|

51.35 |

% |

|

1,200 |

7.57 |

280 |

|

48,900 |

19.08 |

30,000 |

|

50,100 |

18.80 |

30,280 |

|

55 |

% |

|

55,700 |

17.82 |

31,910 |

Yanacocha Stockpiles (5) |

|

51.35 |

% |

|

1,400 |

31.48 |

1,450 |

|

— |

— |

— |

|

1,400 |

31.48 |

1,450 |

|

75 |

% |

|

2,700 |

36.02 |

3,120 |

Yanacocha Leach Pads (7) |

|

51.35 |

% |

|

— |

— |

— |

|

47,300 |

8.16 |

12,400 |

|

47,300 |

8.16 |

12,400 |

|

5 |

% |

|

55,400 |

8.18 |

14,560 |

Total Yanacocha, |

|

|

|

2,600 |

20.81 |

1,730 |

|

96,200 |

13.85 |

42,400 |

|

98,800 |

13.85 |

44,130 |

|

42 |

% |

|

113,800 |

13.85 |

49,590 |

|

|

|

100 |

% |

|

1,700 |

71.26 |

4,010 |

|

7,200 |

54.16 |

12,540 |

|

8,900 |

57.51 |

16,550 |

|

76 |

% |

|

9,000 |

70.75 |

20,420 |

|

|

40 |

% |

|

5,000 |

11.18 |

1,790 |

|

45,600 |

14.85 |

21,790 |

|

50,600 |

14.49 |

23,580 |

|

77 |

% |

|

55,400 |

15.16 |

26,990 |

NuevaUnión, |

|

50 |

% |

|

— |

— |

— |

|

1,118,000 |

1.31 |

47,170 |

|

1,118,000 |

1.31 |

47,170 |

|

66 |

% |

|

1,118,000 |

1.31 |

47,170 |

Norte Abierto, |

|

50 |

% |

|

— |

— |

— |

|

598,800 |

1.52 |

29,340 |

|

598,800 |

1.52 |

29,340 |

|

74 |

% |

|

598,800 |

1.52 |

29,340 |

TOTAL |

|

|

|

9,300 |

25.14 |

7,530 |

|

1,865,800 |

2.56 |

153,240 |

|

1,875,100 |

2.67 |

160,770 |

|

63 |

% |

|

1,895,000 |

2.85 |

173,510 |

|

Nevada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

NGM, Nevada (12) |

|

38.5 |

% |

|

5,200 |

7.40 |

1,230 |

|

60,000 |

6.35 |

12,250 |

|

65,200 |

6.43 |

13,480 |

|

38 |

% |

|

59,800 |

6.99 |

13,430 |

TOTAL NEVADA |

|

|

|

5,200 |

7.40 |

1,230 |

|

60,000 |

6.35 |

12,250 |

|

65,200 |

6.43 |

13,480 |

|

38 |

% |

|

59,800 |

6.99 |

13,430 |

|

TOTAL |

|

|

|

129,500 |

36.08 |

150,220 |

|

2,172,800 |

5.98 |

417,920 |

|

2,302,300 |

7.68 |

568,140 |

|

74 |

% |

|

2,342,600 |

8.14 |

612,690 |

|

(1) |

See footnote (1) to the Gold Reserves table above. Silver reserves for 2021 and 2020 were estimated at a silver price of |

|

(2) |

See footnote (2) to the Gold Reserves table above. Tonnages are rounded to nearest 100,000. |

|

(3) |

See footnote (3) to the Gold Reserves table above. Ounces may not recalculate as they are rounded to the nearest 10,000. |

|

(4) |

Silver cut-off grade varies with gold, lead and zinc credits. |

|

(5) |

Stockpiles are comprised primarily of material that has been set aside to allow processing of higher grade material in the mills. Stockpiles increase or decrease depending on current mine plans. Stockpile reserves are reported separately where ounces exceed 100,000 and are greater than |

|

(6) |

Silver cut-off grade varies with gold and copper credits. |

|

(7) |

Leach Pad material is the material on leach pads at the end of the year from which silver remains to be recovered. In-process material reserves are reported separately where tonnage or ounces are greater than |

|

(8) |

Silver cut-off grade varies with gold credits. |

|

(9) |

The |

|

(10) |

Project is currently undeveloped. Reserve estimates provided by the NuevaUnión joint venture. |

|

(11) |

Project is currently undeveloped. Reserve estimates provided by the Norte Abierto joint venture. |

|

(12) |

Reserve estimates provided by Barrick, the operator of the NGM joint venture. |

|

(13) |

In |

Attributable Silver Mineral Resources (1)(2) - |

||||||||||||||||||||||

|

|

|

|

Measured Resource |

|

Indicated Resource |

|

Measured and Indicated Resource |

|

Inferred Resource |

|

|

||||||||||

|

|

|

|

Tonnage |

Grade |

Silver |

|

Tonnage |

Grade |

Silver |

|

Tonnage |

Grade |

Silver |

|

Tonnage |

Grade |

Silver |

|

|

||

Deposits/Districts |

|

Share |

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

(000

|

(g/tonne) |

Ounces

|

|

Metallurgical

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Peñasquito, |

|

100 |

% |

|

31,400 |

25.71 |

25,990 |

|

176,600 |

26.36 |

149,620 |

|

208,000 |

26.26 |

175,610 |

|

89,800 |

28.00 |

80,840 |

|

87 |

% |

|

|

50 |

% |

|

— |

0.00 |

— |

|

21,000 |

13.94 |

9,400 |

|

21,000 |

13.94 |

9,400 |

|

1,600 |

11.08 |

570 |

|

25 |

% |

|

|

50 |

% |

|

128,400 |

5.79 |

23,900 |

|

423,400 |

3.75 |

51,030 |

|

551,800 |

4.22 |

74,930 |

|

99,100 |

2.65 |

8,440 |

|

64 |

% |

TOTAL |

|

|

|

159,800 |

9.71 |

49,890 |

|

621,000 |

10.52 |

210,050 |

|

780,800 |

10.35 |

259,940 |

|

190,500 |

14.67 |

89,850 |

|

75 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Conga, |

|

51.35 |

% |

|

— |

0.00 |

— |

|

356,300 |

2.06 |

23,580 |

|

356,300 |

2.06 |

23,580 |

|

89,900 |

1.13 |

3,250 |

|

70 |

% |

Yanacocha Open Pits and Stockpiles |

|

51.35 |

% |

|

4,600 |

3.31 |

490 |

|

44,600 |

13.09 |

18,750 |

|

49,200 |

12.17 |

19,240 |

|

14,400 |

13.09 |

6,070 |

|

43 |

% |

Yanacocha Underground |

|

51.35 |

% |

|

— |

1.13 |

— |

|

1,800 |

64.29 |

3,760 |

|

1,800 |

62.68 |

3,760 |

|

1,900 |

37.56 |

2,260 |

|

87 |

% |

Total Yanacocha, |

|

|

|

4,600 |

3.31 |

490 |

|

46,400 |

15.09 |

22,510 |

|

51,000 |

14.03 |

23,000 |

|

16,300 |

15.90 |

8,330 |

|

55 |

% |

|

Cerro Negro Underground |

|

100 |

% |

|

100 |

46.22 |

140 |

|

1,300 |

57.30 |

2,360 |

|

1,400 |

56.55 |

2,500 |

|

7,500 |

39.04 |

9,400 |

|

75 |

% |

|

|

100 |

% |

|

900 |

8.53 |

240 |

|

1,000 |

7.87 |

250 |

|

1,900 |

8.18 |

490 |

|

100 |

11.07 |

20 |

|

60 |

% |

Total |

|

|

|

1,000 |

12.15 |

380 |

|

2,300 |

35.92 |

2,610 |

|

3,300 |

28.76 |

2,990 |

|

7,600 |

38.80 |

9,420 |

|

74 |

% |

|

|

|

40 |

% |

|

37,300 |

11.51 |

13,800 |

|

57,100 |

10.85 |

19,940 |

|

94,400 |

11.11 |

33,740 |

|

25,400 |

9.00 |

7,360 |

|

|

|

NuevaUnión, |

|

50 |

% |

|

164,300 |

0.96 |

5,080 |

|

349,800 |

1.19 |

13,360 |

|

514,100 |

1.12 |

18,440 |

|

602,100 |

1.16 |

22,520 |

|

66 |

% |

Norte Abierto, |

|

50 |

% |

|

77,200 |

1.20 |

2,990 |

|

596,900 |

1.07 |

20,550 |

|

674,100 |

1.09 |

23,540 |

|

369,600 |

0.95 |

11,340 |

|

78 |

% |

Agua Rica, |

|

18.75 |

% |

|

120,200 |

2.90 |

11,190 |

|

135,700 |

2.41 |

10,520 |

|

255,900 |

2.64 |

21,710 |

|

139,300 |

1.62 |

7,260 |

|

43 |

% |

TOTAL |

|

|

|

404,600 |

2.61 |

33,930 |

|

1,544,500 |

2.28 |

113,070 |

|

1,949,100 |

2.35 |

147,000 |

|

1,250,200 |

1.73 |

69,480 |

|

61 |

% |

|

Nevada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

NGM, Nevada (8) |

|

38.5 |

% |

|

2,900 |

5.57 |

520 |

|

84,000 |

5.54 |

14,960 |

|

86,900 |

5.54 |

15,480 |

|

18,900 |

5.60 |

3,410 |

|

38 |

% |

TOTAL NEVADA |

|

|

|

2,900 |

5.57 |

520 |

|

84,000 |

5.54 |

14,960 |

|

86,900 |

5.54 |

15,480 |

|

18,900 |

5.60 |

3,410 |

|

38 |

% |

|

TOTAL |

|

|

|

567,300 |

4.62 |

84,340 |

|

2,249,500 |

4.68 |

338,080 |

|

2,816,800 |

4.66 |

422,420 |

|

1,459,600 |

3.47 |

162,740 |

|

66 |

% |

|

(1) |

Resources are reported exclusive of reserves. |

|

(2) |

Resource for 2021 and 2020 were estimated at a silver price of |

|

(3) |

Project is currently undeveloped. Resource estimates provided by Teck Resources. |

|

(4) |

Resource estimates provided by Barrick, the operator of |

|

(5) |

Project is currently undeveloped. Resource estimates provided by the NuevaUnión joint venture. |

|

(6) |

Project is currently undeveloped. Resource estimates provided by the Norte Abierto joint venture. |

|

(7) |

Project is currently undeveloped. Resource estimates provided by Yamana, the operator of the Agua Rica joint venture. |

|

(8) |

Resource estimates provided by Barrick, the operator of the NGM joint venture. |

|

(9) |

In |

Attributable Zinc Reserves (1) |

||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||

|

|

|

|

Proven Reserves |

|

Probable Reserves |

|

Proven and Probable Reserves |

|

|

|

Proven and Probable Reserves |

||||||||||||||

|

|

|

|

Tonnage (2) |

Grade |

Zinc (3) |

|

Tonnage (2) |

Grade |

Zinc (3) |

|

Tonnage (2) |

Grade |

Zinc (3) |

|

Metallurgical |

|

Tonnage (2) |

Grade |

Zinc (3) |

||||||

Deposits/Districts |

|

Share |

|

(000

|

(Zn %) |

Pounds

|

|

(000

|

(Zn %) |

Pounds

|

|

(000

|

(Zn %) |

Pounds

|

|

Recovery |

|

(000

|

(Zn %) |

Pounds

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Peñasquito Open Pits, |

|

100 |

% |

|

107,200 |

0.96 |

% |

2,260 |

|

219,100 |

0.74 |

% |

3,590 |

|

326,300 |

0.81 |

% |

5,850 |

|

81 |

% |

|

348,200 |

0.83 |

% |

6,380 |

Peñasquito Stockpiles, |

|

100 |

% |

|

7,800 |

0.67 |

% |

120 |

|

27,900 |

0.45 |

% |

280 |

|

35,700 |

0.50 |

% |

400 |

|

81 |

% |

|

39,600 |

0.49 |

% |

430 |

TOTAL |

|

|

|

115,000 |

0.94 |

% |

2,380 |

|

247,000 |

0.71 |

% |

3,870 |

|

362,000 |

0.78 |

% |

6,250 |

|

81 |

% |

|

387,800 |

0.80 |

% |

6,810 |

|

| (1) |

See footnote (1) to the Gold Reserves table above. Zinc reserves for 2021 and 2020 were estimated at a zinc price of |

|

| (2) | See footnote (2) to the Gold Reserves table above. Tonnages are rounded to nearest 100,000. |

|

| (3) | See footnote (3) to the Copper Reserves table above. Pounds may not recalculate as they are rounded to the nearest 10 million. |

|

| (4) | Zinc cut-off grade varies with level of gold, silver and zinc credits. |

|

| (5) |

Stockpiles are comprised primarily of material that has been set aside to allow processing of higher grade material in the mills. Stockpiles increase or decrease depending on current mine plans. Stockpile reserves are reported separately where tonnes exceed 10,000 and are greater than |

Attributable Zinc Resources (1)(2) - |

||||||||||||||||||||||||

|

|

|

|

Measured Resource |

|

Indicated Resource |

Measured and Indicated Resource |

Inferred Resource |

|

|

||||||||||||||

|

|

|

|

Tonnage |

Grade |

Zinc |

|

Tonnage |

Grade |

Zinc |

Tonnage |

Grade |

Zinc |

Tonnage |

Grade |

Zinc |

|

|

||||||

Deposits/Districts |

|

Share |

|

(000

|

(Zn %) |

Pounds

|

|

(000

|

(Zn %) |

Pounds

|

(000

|

(Zn %) |

Pounds

|

(000

|

(Zn %) |