Nasdaq Capital Access Platforms Launches Leading Indicator for IPO Activity

- None.

- None.

Insights

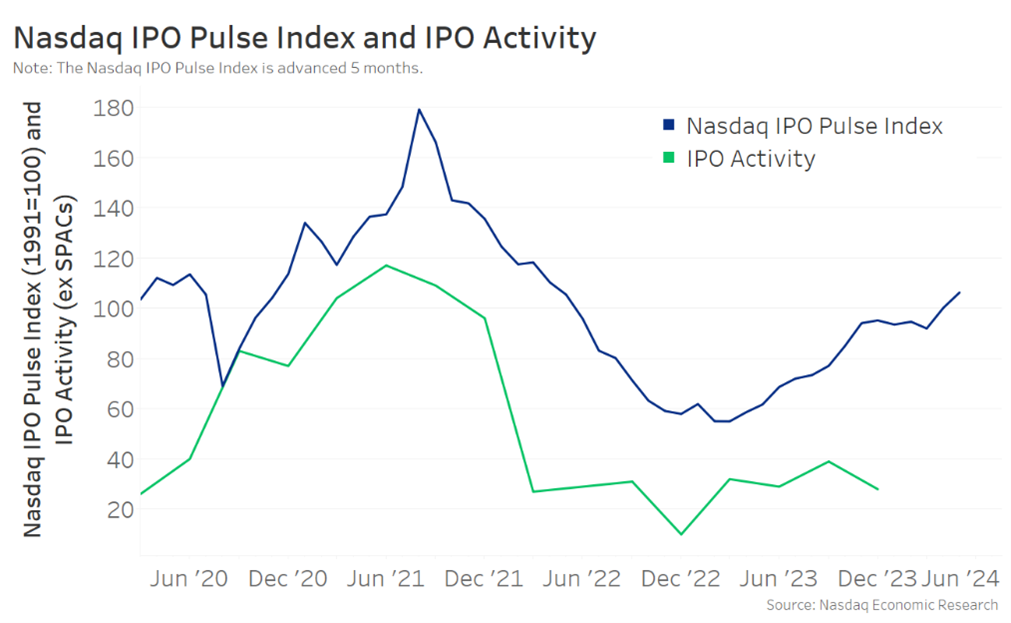

The introduction of the Nasdaq IPO Pulse Index is a strategic move by Nasdaq to provide a predictive tool for gauging the health and trajectory of the IPO market. This index is significant as it offers a six-month forecast of IPO activity, which is a critical period for investors and companies planning to go public. The index's predictive nature is based on data analytics, which can be a game-changer for market participants.

From a market research perspective, the index's current high level, the highest since 2021, indicates a robust appetite for IPOs in the near future. This could signal a recovering or growing economy where companies feel confident to seek public investment. Such an environment is conducive to increased liquidity and investment opportunities, potentially leading to a more vibrant stock market. However, it is crucial to monitor the index alongside other economic indicators to validate its predictive accuracy.

For financial analysts, the Nasdaq IPO Pulse Index provides an additional layer of information when evaluating potential investments in new listings. The uptrend in the index suggests that there may be increased investor confidence and a conducive environment for companies considering going public. This could lead to a greater number of investment opportunities and diversification options for portfolios.

However, an uptrend in the IPO market can also lead to market saturation, where the influx of new stocks could dilute attention and capital from existing offerings. It's important for analysts to assess the quality of upcoming IPOs and not just the quantity, as a crowded market could also increase volatility. The long-term success of these IPOs will depend on the individual companies' fundamentals and market conditions at the time of listing.

An economist would interpret the launch of the Nasdaq IPO Pulse Index as a reflection of broader economic trends. An uptick in IPO activity typically correlates with economic expansion and investor optimism. It can also be a leading indicator of capital markets' health, suggesting that businesses are able to raise capital effectively and investors are willing to take on the risk associated with new ventures.

However, economists would also caution that the index should be viewed in the context of overall economic conditions. For instance, if the uptrend in the IPO Pulse Index contrasts with other economic indicators suggesting a downturn, this could indicate an over-enthusiasm in the market that may not be sustainable. It's essential to consider the index in conjunction with factors such as interest rates, employment figures and GDP growth to get a comprehensive picture of the economic landscape.

The “Nasdaq IPO Pulse Index” leverages a data-driven approach to provide corporates and investors with an approximate six-month forecast of directional shifts in IPO activity

NEW YORK, Jan. 23, 2024 (GLOBE NEWSWIRE) -- Nasdaq (Nasdaq: NDAQ) today announced its Capital Access Platforms division launched a new leading indicator to provide corporates and investors with an outlook for the direction of initial public offering (IPO) activity with a high degree of predictability six months out. The “Nasdaq IPO Pulse Index” suggests an upswing in potential IPO activity when it is in an uptrend – it is now at its highest level since 2021 – compared to a pullback in IPO activity when the index is trending in the other direction.

“Companies analyzing an initial public offering are always looking for key indicators and metrics to help them plan for the most optimal time to list,” said Karen Snow, Global Head of Listings at Nasdaq. “We developed the Nasdaq IPO Pulse Index to empower them with a data-driven forecast of where we believe the listings market will be in the future. It also provides unique information for institutional and retail investors to factor into their decisions about investing in new issuances.”

The Nasdaq IPO Pulse Index is driven by six leading indicators of IPO market activity including:

- Year-over-year changes in the Fed Funds Rate

- Year-over-year changes in the VIX Index

- Recent returns (S&P 500 Price Annual Growth)

- Valuations (S&P 500 Enterprise Value to Sales Ratio Annual Growth)

- Investor sentiment

- Nasdaq’s proprietary IPO data

More than 50 candidate series were rigorously backtested over the last three decades to arrive at these six indicators, which we believe have proved to consistently lead directional shifts in IPO activity. Combined, the Nasdaq IPO Pulse Index anticipates turns in IPO activity by about six months on average.

Caption: With the Nasdaq IPO Pulse Index at a two-year high, it’s likely IPO activity will remain in an uptrend at least through the first half of the year.

“The Nasdaq IPO Pulse Index is updated each quarter and is now at a current two-year high, which historically means IPO activity should remain in an uptrend through the first half of this year,” said Phil Mackintosh, Chief Economist at Nasdaq. “We carefully curated the index methodology that blends industry and proprietary Nasdaq data to provide corporates and investors with a pulse of how receptive the markets may be to new issuances in the near-term.”

To learn more about the Nasdaq IPO Pulse Index, please visit our website or click here to read a detailed whitepaper about the innovative indicator for IPO activity.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

Nasdaq Media Contact

| Peter Gau (201) 388-9682 Peter.gau@nasdaq.com | Sophia Weiss (646) 483-6960 Sophia.weiss@nasdaq.com |

The IPO Pulse indicator is provided for educational purposes only and should not be construed as investment advice. Nasdaq does not recommend or endorse any securities offering or investment strategy. Before making any investments you are urged to read the relevant company’s SEC filings, undertake your own due diligence, and carefully evaluate the company. Advice from a securities professional is strongly advised.

-NDAQG-

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6ae3015e-6f09-40e2-ab21-b8108e3a5dfc