Nasdaq Announces Mid-Month Open Short Interest Positions in Nasdaq Stocks as of Settlement Date April 15, 2025

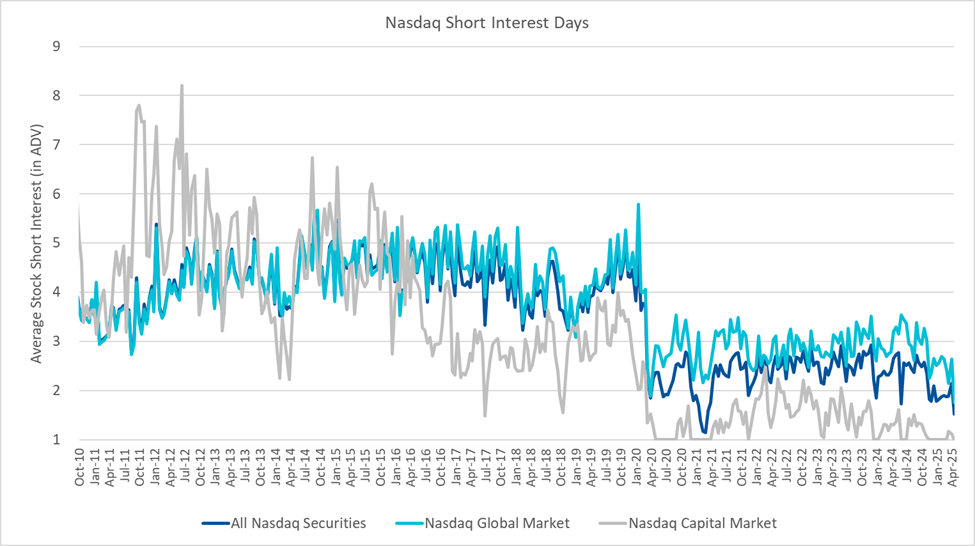

Nasdaq (NDAQ) has released its mid-month short interest report for April 15, 2025. The report shows total short interest across all Nasdaq securities reached 15.82 billion shares, up from 15.75 billion in the previous period.

In the Nasdaq Global Market, short interest totaled 13.21 billion shares across 3,143 securities, compared to 13.07 billion shares in 3,140 securities from March 31. The days-to-cover ratio decreased to 1.76 days from 2.64 days.

For the Nasdaq Capital Market, short interest was 2.61 billion shares across 1,634 securities, down from 2.68 billion shares in 1,625 securities. The days-to-cover ratio decreased to 1.00 from 1.12. Overall, the combined markets showed a days-to-cover ratio of 1.52, down from 2.14 in the previous period.

Nasdaq (NDAQ) ha pubblicato il rapporto sullo short interest a metà mese, aggiornato al 15 aprile 2025. Il rapporto indica che il totale delle azioni shortate su tutti i titoli Nasdaq ha raggiunto 15,82 miliardi di azioni, in aumento rispetto ai 15,75 miliardi del periodo precedente.

Nel Nasdaq Global Market, lo short interest ha totalizzato 13,21 miliardi di azioni su 3.143 titoli, rispetto ai 13,07 miliardi su 3.140 titoli al 31 marzo. Il rapporto giorni per copertura è sceso a 1,76 giorni da 2,64 giorni.

Per il Nasdaq Capital Market, lo short interest è stato di 2,61 miliardi di azioni su 1.634 titoli, in calo rispetto ai 2,68 miliardi su 1.625 titoli. Il rapporto giorni per copertura è diminuito a 1,00 da 1,12. Complessivamente, i mercati combinati hanno mostrato un rapporto giorni per copertura di 1,52, in calo rispetto a 2,14 nel periodo precedente.

Nasdaq (NDAQ) ha publicado su informe de interés corto a mitad de mes, correspondiente al 15 de abril de 2025. El informe muestra que el interés corto total en todos los valores Nasdaq alcanzó 15.82 mil millones de acciones, un aumento respecto a los 15.75 mil millones del período anterior.

En el Nasdaq Global Market, el interés corto totalizó 13.21 mil millones de acciones en 3,143 valores, comparado con 13.07 mil millones en 3,140 valores al 31 de marzo. La ratio de días para cubrir disminuyó a 1.76 días desde 2.64 días.

Para el Nasdaq Capital Market, el interés corto fue de 2.61 mil millones de acciones en 1,634 valores, una bajada desde 2.68 mil millones en 1,625 valores. La ratio de días para cubrir bajó a 1.00 desde 1.12. En conjunto, los mercados combinados mostraron una ratio de días para cubrir de 1.52, inferior a 2.14 en el período previo.

나스닥 (NDAQ)은 2025년 4월 15일 기준 중순 공매도 잔고 보고서를 발표했습니다. 보고서에 따르면 모든 나스닥 증권의 총 공매도 잔고는 158억 2천만 주로, 이전 기간의 157억 5천만 주에서 증가했습니다.

나스닥 글로벌 마켓에서는 3,143개 종목에 걸쳐 공매도 잔고가 132억 1천만 주로, 3월 31일의 3,140개 종목, 130억 7천만 주와 비교해 증가했습니다. 커버데이 비율은 2.64일에서 1.76일로 감소했습니다.

나스닥 캐피털 마켓의 공매도 잔고는 1,634개 종목에 걸쳐 26억 1천만 주로, 1,625개 종목, 26억 8천만 주에서 감소했습니다. 커버데이 비율은 1.12일에서 1.00일로 줄었습니다. 전체적으로 결합된 시장의 커버데이 비율은 이전 기간 2.14일에서 1.52일로 감소했습니다.

Nasdaq (NDAQ) a publié son rapport sur les positions vendeuses à mi-mois, au 15 avril 2025. Le rapport indique que le total des positions vendeuses sur l’ensemble des titres Nasdaq a atteint 15,82 milliards d’actions, en hausse par rapport à 15,75 milliards lors de la période précédente.

Sur le Nasdaq Global Market, les positions vendeuses s’élevaient à 13,21 milliards d’actions réparties sur 3 143 titres, contre 13,07 milliards sur 3 140 titres au 31 mars. Le ratio jours de couverture est passé de 2,64 à 1,76 jour.

Pour le Nasdaq Capital Market, les positions vendeuses s’élevaient à 2,61 milliards d’actions sur 1 634 titres, en baisse par rapport à 2,68 milliards sur 1 625 titres. Le ratio jours de couverture est passé de 1,12 à 1,00. Au total, les marchés combinés ont affiché un ratio jours de couverture de 1,52, en baisse par rapport à 2,14 lors de la période précédente.

Nasdaq (NDAQ) hat seinen Zwischenbericht zum Short Interest zum 15. April 2025 veröffentlicht. Der Bericht zeigt, dass das gesamte Short Interest über alle Nasdaq-Wertpapiere 15,82 Milliarden Aktien erreichte, gegenüber 15,75 Milliarden im vorherigen Zeitraum.

Im Nasdaq Global Market belief sich das Short Interest auf 13,21 Milliarden Aktien bei 3.143 Wertpapieren, verglichen mit 13,07 Milliarden Aktien bei 3.140 Wertpapieren zum 31. März. Das Days-to-Cover-Verhältnis sank von 2,64 auf 1,76 Tage.

Im Nasdaq Capital Market lag das Short Interest bei 2,61 Milliarden Aktien über 1.634 Wertpapiere, gegenüber 2,68 Milliarden Aktien bei 1.625 Wertpapieren. Das Days-to-Cover-Verhältnis sank von 1,12 auf 1,00. Insgesamt zeigten die kombinierten Märkte ein Days-to-Cover-Verhältnis von 1,52, gegenüber 2,14 im vorherigen Zeitraum.

- None.

- None.

NEW YORK, April 25, 2025 (GLOBE NEWSWIRE) -- At the end of the settlement date of April 15, 2025, short interest in 3,143 Nasdaq Global MarketSM securities totaled 13,211,633,004 shares compared with 13,072,444,217 shares in 3,140 Global Market issues reported for the prior settlement date of March 31, 2025. The mid-April short interest represents 1.76 days compared with 2.64 days for the prior reporting period.

Short interest in 1,634 securities on The Nasdaq Capital MarketSM totaled 2,609,354,721 shares at the end of the settlement date of April 15, 2025, compared with 2,682,510,166 shares in 1,625 securities for the previous reporting period. This represents a 1.00 day average daily volume; the previous reporting period’s figure was 1.12.

In summary, short interest in all 4,777 Nasdaq® securities totaled 15,820,987,725 shares at the April 15, 2025 settlement date, compared with 4,765 issues and 15,754,954,383 shares at the end of the previous reporting period. This is 1.52 days average daily volume, compared with an average of 2.14 days for the prior reporting period.

The open short interest positions reported for each Nasdaq security reflect the total number of shares sold short by all broker/dealers regardless of their exchange affiliations. A short sale is generally understood to mean the sale of a security that the seller does not own or any sale that is consummated by the delivery of a security borrowed by or for the account of the seller.

For more information on Nasdaq Short interest positions, including publication dates, visit

http://www.nasdaq.com/quotes/short-interest.aspx

or http://www.nasdaqtrader.com/asp/short_interest.asp.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

Media Contact:

Camille Stafford

camille.stafford@nasdaq.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9bc9e53e-7e3c-48e6-a8d6-78e548435d4d

NDAQO