Nasdaq Announces End-of-Month Open Short Interest Positions in Nasdaq Stocks as of Settlement Date January 31, 2025

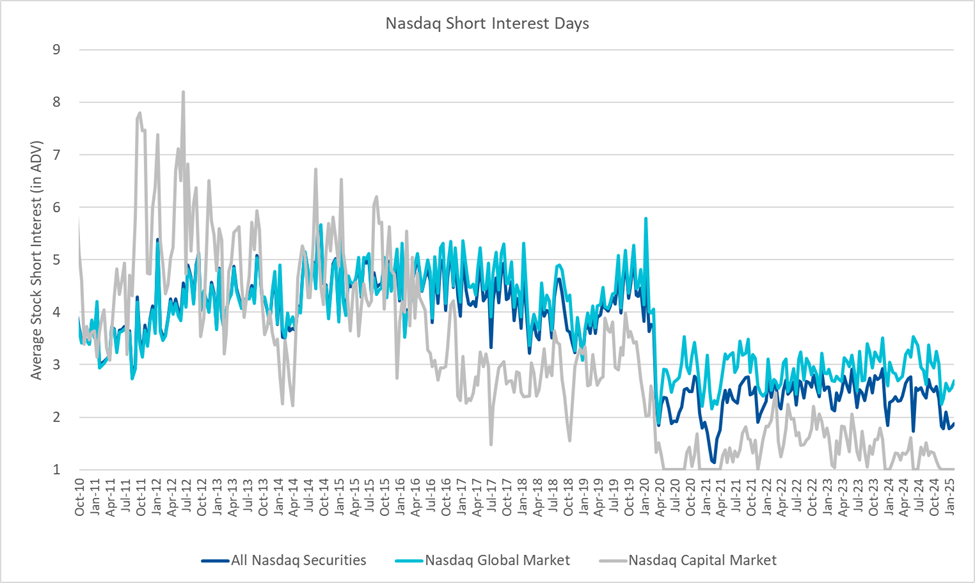

Nasdaq has reported short interest positions for securities as of January 31, 2025. In the Nasdaq Global Market, short interest across 3,109 securities totaled 12.17 billion shares, down from 12.40 billion shares across 3,099 securities on January 15, 2025. The mid-January short interest represents 2.69 days compared to 2.56 days in the prior period.

For the Nasdaq Capital Market, short interest in 1,621 securities reached 2.41 billion shares, slightly lower than the previous 2.42 billion shares across 1,635 securities. The average daily volume remained steady at 1.00 day.

Overall, total short interest across all 4,730 Nasdaq securities amounted to 14.58 billion shares, decreasing from 14.83 billion shares in 4,734 issues in the previous period. The average daily volume increased to 1.88 days from 1.82 days.

Nasdaq ha riportato le posizioni degli interessi corti per i titoli al 31 gennaio 2025. Nel Mercato Globale Nasdaq, gli interessi corti su 3.109 titoli hanno totalizzato 12,17 miliardi di azioni, in calo rispetto ai 12,40 miliardi di azioni su 3.099 titoli del 15 gennaio 2025. Gli interessi corti di metà gennaio rappresentano 2,69 giorni rispetto a 2,56 giorni nel periodo precedente.

Per il Mercato Capitale Nasdaq, gli interessi corti in 1.621 titoli hanno raggiunto 2,41 miliardi di azioni, leggermente inferiori ai precedenti 2,42 miliardi di azioni su 1.635 titoli. Il volume medio giornaliero è rimasto stabile a 1,00 giorno.

In totale, gli interessi corti su tutti i 4.730 titoli Nasdaq ammontano a 14,58 miliardi di azioni, in diminuzione rispetto ai 14,83 miliardi di azioni in 4.734 titoli nel periodo precedente. Il volume medio giornaliero è aumentato a 1,88 giorni rispetto a 1,82 giorni.

Nasdaq ha reportado posiciones de intereses cortos para valores a partir del 31 de enero de 2025. En el Mercado Global Nasdaq, los intereses cortos en 3,109 valores totalizaron 12.17 mil millones de acciones, disminuyendo desde 12.40 mil millones de acciones en 3,099 valores al 15 de enero de 2025. Los intereses cortos de mediados de enero representan 2.69 días en comparación con 2.56 días en el periodo anterior.

Para el Mercado de Capitales Nasdaq, los intereses cortos en 1,621 valores alcanzaron 2.41 mil millones de acciones, ligeramente inferiores a los 2.42 mil millones de acciones en 1,635 valores anteriores. El volumen diario promedio se mantuvo estable en 1.00 día.

En general, el interés corto total en los 4,730 valores Nasdaq ascendió a 14.58 mil millones de acciones, disminuyendo desde 14.83 mil millones de acciones en 4,734 valores en el periodo anterior. El volumen diario promedio aumentó a 1.88 días desde 1.82 días.

나스닥는 2025년 1월 31일 기준으로 증권에 대한 공매도 잔고를 보고했습니다. 나스닥 글로벌 마켓에서는 3,109개의 증권에서 공매도 잔고가 총 121억 7천만 주에 달해, 2025년 1월 15일의 3,099개 증권에서의 124억 주에서 감소했습니다. 1월 중순의 공매도 잔고는 이전 기간의 2.56일에 비해 2.69일을 나타냅니다.

나스닥 자본 시장에서 1,621개의 증권에 대한 공매도 잔고는 24억 1천만 주에 도달하여 이전 1,635개의 증권에서의 24억 2천만 주보다 약간 낮아졌습니다. 평균 일일 거래량은 1.00일로 일정하게 유지되었습니다.

전반적으로, 모든 4,730개의 나스닥 증권에서의 총 공매도 잔고는 145억 8천만 주에 달하여, 이전 기간의 147억 8천만 주에서 감소했습니다. 평균 일일 거래량은 1.82일에서 1.88일로 증가했습니다.

Nasdaq a rapporté les positions d'intérêts à découvert pour les titres au 31 janvier 2025. Dans le Marché Global Nasdaq, les intérêts à découvert sur 3.109 titres totalisaient 12,17 milliards d'actions, en baisse par rapport à 12,40 milliards d'actions sur 3.099 titres au 15 janvier 2025. Les intérêts à mi-janvier représentent 2,69 jours par rapport à 2,56 jours dans la période précédente.

Pour le Marché des Capitaux Nasdaq, les intérêts à découvert dans 1.621 titres ont atteint 2,41 milliards d'actions, légèrement inférieurs aux 2,42 milliards d'actions sur 1.635 titres précédents. Le volume moyen quotidien est resté stable à 1,00 jour.

Dans l'ensemble, le total des intérêts à découvert sur les 4.730 titres Nasdaq s'est élevé à 14,58 milliards d'actions, en baisse par rapport à 14,83 milliards d'actions dans 4.734 valeurs dans la période précédente. Le volume moyen quotidien a augmenté à 1,88 jour contre 1,82 jour.

Nasdaq hat die Positionen der Leerverkäufe für Wertpapiere zum 31. Januar 2025 berichtet. Im Nasdaq Global Market betrugen die Leerverkäufe bei 3.109 Wertpapieren insgesamt 12,17 Milliarden Aktien, ein Rückgang von 12,40 Milliarden Aktien bei 3.099 Wertpapieren am 15. Januar 2025. Die Leerverkäufe Mitte Januar repräsentieren 2,69 Tage im Vergleich zu 2,56 Tagen im vorherigen Zeitraum.

Für den Nasdaq Kapitalmarkt erreichten die Leerverkäufe in 1.621 Wertpapieren 2,41 Milliarden Aktien, leicht niedriger als die vorherigen 2,42 Milliarden Aktien bei 1.635 Wertpapieren. Das durchschnittliche tägliche Volumen blieb stabil bei 1,00 Tag.

Insgesamt belief sich das gesamte Leerverkaufsvolumen über alle 4.730 Nasdaq-Wertpapiere auf 14,58 Milliarden Aktien, was einen Rückgang von 14,83 Milliarden Aktien in 4.734 Ausgaben im vorherigen Zeitraum darstellt. Das durchschnittliche tägliche Volumen stieg von 1,82 Tagen auf 1,88 Tage.

- None.

- None.

NEW YORK, Feb. 11, 2025 (GLOBE NEWSWIRE) -- At the end of the settlement date of January 31, 2025, short interest in 3,109 Nasdaq Global MarketSM securities totaled 12,170,722,591 shares compared with 12,402,417,655 shares in 3,099 Global Market issues reported for the prior settlement date of January 15, 2025. The mid-January short interest represents 2.69 days compared with 2.56 days for the prior reporting period.

Short interest in 1,621 securities on The Nasdaq Capital MarketSM totaled 2,410,655,463 shares at the end of the settlement date of January 31, 2025, compared with 2,424,890,788 shares in 1,635 securities for the previous reporting period. This represents a 1.00 day average daily volume; the previous reporting period’s figure was 1.00.

In summary, short interest in all 4,730 Nasdaq® securities totaled 14,581,378,054 shares at the January 31, 2025 settlement date, compared with 4,734 issues and 14,827,308,443 shares at the end of the previous reporting period. This is 1.88 days average daily volume, compared with an average of 1.82 days for the prior reporting period.

The open short interest positions reported for each Nasdaq security reflect the total number of shares sold short by all broker/dealers regardless of their exchange affiliations. A short sale is generally understood to mean the sale of a security that the seller does not own or any sale that is consummated by the delivery of a security borrowed by or for the account of the seller.

For more information on Nasdaq Short interest positions, including publication dates, visit http://www.nasdaq.com/quotes/short-interest.aspx or http://www.nasdaqtrader.com/asp/short_interest.asp.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

Media Contact:

Camille Stafford

camille.stafford@nasdaq.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4cdababb-4379-4e9b-a7c2-9c802b5ee122

NDAQO