North Bay Resources Announces First Gold Concentrate Settlement and up to 160m (525 ft.) @ 0.6 g/t Au, including 76m (249 ft.) @ 1.1 g/t Au, Fran Gold Project, British Columbia

North Bay Resources (OTC: NBRI) has announced the successful settlement of its first gold concentrate sale from the Fran Gold Project, processed at their Bishop Gold Mill. The concentrate, derived from approximately 10 tons of ore, yielded 1.401 oz of gold and 0.658 oz of silver, resulting in a net payment of $3,981.83.

The company reports that current net value is approximately $400 per ton, with expectations to increase to $800 per ton after optimization and flotation circuit implementation. Transportation costs are expected to decrease from $300 to $200 per ton due to a new rail siding. The mill's direct operating cost is projected at $35 per ton.

Recent data compilation has revealed a bulk tonnage gold deposit at Fran, with significant drill intercepts including 157.9m @ 0.6 g/t Au, including 76.1m @ 1.1 g/t Au. The deposit area has been identified to exceed 1000m x 100m x 300m within a 1700m strike length. The project is located near Centerra Gold's Mt. Milligan Project and Artemis Gold's Blackwater Mine.

North Bay Resources (OTC: NBRI) ha annunciato il successo della prima vendita di concentrato d'oro dal Fran Gold Project, lavorato presso il loro impianto di lavorazione di Bishop Gold. Il concentrato, derivato da circa 10 tonnellate di minerale, ha prodotto 1,401 once d'oro e 0,658 once d'argento, generando un pagamento netto di $3,981.83.

L'azienda riferisce che il valore netto attuale è di circa $400 per tonnellata, con aspettative di aumentare a $800 per tonnellata dopo l'ottimizzazione e l'implementazione del circuito di flottazione. I costi di trasporto dovrebbero diminuire da $300 a $200 per tonnellata grazie a un nuovo binario. Il costo operativo diretto dell'impianto è previsto a $35 per tonnellata.

Recenti dati compilati hanno rivelato un deposito d'oro a tonnellaggio elevato a Fran, con significativi intercettamenti da perforazione che includono 157.9m @ 0.6 g/t Au, inclusi 76.1m @ 1.1 g/t Au. L'area del deposito è stata identificata per superare 1000m x 100m x 300m all'interno di una lunghezza di strike di 1700m. Il progetto si trova vicino al progetto Mt. Milligan di Centerra Gold e alla miniera Blackwater di Artemis Gold.

North Bay Resources (OTC: NBRI) ha anunciado el exitoso acuerdo de su primera venta de concentrado de oro del Fran Gold Project, procesado en su molino de oro en Bishop. El concentrado, derivado de aproximadamente 10 toneladas de mineral, produjo 1.401 oz de oro y 0.658 oz de plata, resultando en un pago neto de $3,981.83.

La compañía informa que el valor neto actual es de aproximadamente $400 por tonelada, con expectativas de aumentar a $800 por tonelada tras la optimización y la implementación del circuito de flotación. Se espera que los costos de transporte disminuyan de $300 a $200 por tonelada debido a una nueva vía de ferrocarril. El costo operativo directo del molino se proyecta en $35 por tonelada.

Recientes compilaciones de datos han revelado un depósito de oro a gran escala en Fran, con importantes intercepciones de perforación que incluyen 157.9m @ 0.6 g/t Au, incluyendo 76.1m @ 1.1 g/t Au. El área del depósito se ha identificado para superar los 1000m x 100m x 300m dentro de una longitud de strike de 1700m. El proyecto está ubicado cerca del proyecto Mt. Milligan de Centerra Gold y de la mina Blackwater de Artemis Gold.

North Bay Resources (OTC: NBRI)는 Bishop Gold Mill에서 가공된 Fran Gold Project의 첫 번째 금 농축물 판매의 성공적인 합의를 발표했습니다. 이 농축물은 약 10톤의 광석에서 유래되었으며, 1.401온스의 금과 0.658온스의 은을 생산하여 순지급액 $3,981.83을 기록했습니다.

회사는 현재 순가치가 톤당 약 $400이며, 최적화 및 부유선 구현 후 톤당 $800으로 증가할 것으로 예상하고 있다고 보고했습니다. 새로운 철도 측선 덕분에 운송 비용은 톤당 $300에서 $200로 줄어들 것으로 예상됩니다. 밀의 직접 운영 비용은 톤당 $35로 예상됩니다.

최근 데이터 수집 결과 Fran에서 대량 금 매장지가 발견되었으며, 주요 시추 인터셉트에는 157.9m @ 0.6 g/t Au가 포함되며, 76.1m @ 1.1 g/t Au도 포함됩니다. 매장지 면적은 1000m x 100m x 300m를 초과하며, 1700m의 스트라이크 길이를 가지고 있습니다. 이 프로젝트는 Centerra Gold의 Mt. Milligan Project와 Artemis Gold의 Blackwater Mine 근처에 위치하고 있습니다.

North Bay Resources (OTC: NBRI) a annoncé le règlement réussi de sa première vente de concentré d'or du Fran Gold Project, traité dans leur usine de traitement de Bishop Gold. Le concentré, dérivé d'environ 10 tonnes de minerai, a produit 1,401 oz d'or et 0,658 oz d'argent, entraînant un paiement net de 3,981.83 $.

L'entreprise rapporte que la valeur nette actuelle est d'environ 400 $ par tonne, avec des attentes d'augmentation à 800 $ par tonne après optimisation et mise en œuvre du circuit de flottation. Les coûts de transport devraient diminuer de 300 $ à 200 $ par tonne grâce à une nouvelle voie ferrée. Le coût d'exploitation direct de l'usine est estimé à 35 $ par tonne.

Des compilations de données récentes ont révélé un dépôt d'or à fort tonnage à Fran, avec des intercepts de forage significatifs, y compris 157.9m @ 0.6 g/t Au, y compris 76.1m @ 1.1 g/t Au. La zone de dépôt a été identifiée comme dépassant 1000m x 100m x 300m dans une longueur de strike de 1700m. Le projet est situé près du projet Mt. Milligan de Centerra Gold et de la mine Blackwater d'Artemis Gold.

North Bay Resources (OTC: NBRI) hat den erfolgreichen Abschluss seines ersten Verkaufs von Goldkonzentrat aus dem Fran Gold Project bekannt gegeben, das in ihrer Bishop Gold Mill verarbeitet wurde. Das Konzentrat, das aus etwa 10 Tonnen Erz gewonnen wurde, ergab 1,401 Unzen Gold und 0,658 Unzen Silber und führte zu einer Nettobezahlung von $3,981.83.

Das Unternehmen berichtet, dass der aktuelle Nettowert bei etwa $400 pro Tonne liegt, mit der Erwartung, dass er nach der Optimierung und Implementierung des Flotationskreislaufs auf $800 pro Tonne steigen wird. Die Transportkosten sollen von $300 auf $200 pro Tonne sinken, dank einer neuen Gleisverbindung. Die direkten Betriebskosten der Mühle werden auf $35 pro Tonne geschätzt.

Aktuelle Datensammlungen haben ein Goldlager mit hohem Volumen im Fran gezeigt, mit signifikanten Bohrinterzepten, darunter 157.9m @ 0.6 g/t Au, einschließlich 76.1m @ 1.1 g/t Au. Das Lagergebiet wurde identifiziert, um 1000m x 100m x 300m innerhalb einer Strike-Länge von 1700m zu überschreiten. Das Projekt befindet sich in der Nähe des Mt. Milligan-Projekts von Centerra Gold und der Blackwater-Mine von Artemis Gold.

- First successful gold concentrate sale completed with net payment of $3,981.83

- Expected revenue increase from $400 to $800 per ton after optimization

- Transportation costs reduction from $300 to $200 per ton due to new rail siding

- Low direct operating costs of $35 per ton

- Significant gold intercepts discovered in bulk tonnage deposit

- 5,000 tons of ore already stockpiled at project site

- Current recovery rates require optimization to reach target 90%+ recovery

- Flotation circuit not yet operational, limiting current recovery efficiency

- High moisture content in concentrate requiring implementation of drying circuit

BISHOP, Calif., April 07, 2025 (GLOBE NEWSWIRE) -- North Bay Resources, Inc. (the “Company” or “North Bay”) (OTC: NBRI) is pleased to announce final acceptance and settlement of the Company’s first gold concentrate sale from a test shipment of ore from the Company’s Fran Gold Project processed at the Company’s Bishop Gold Mill. All Refinery requirements have been met and comparison of assays between the Company’s assay and in-house assay, for settlement of the gold, silver, and moisture content have been agreed. The Company utilizes ALS Geochemistry, Reno, NV, for concentrate assay and the Refinery, Just Refiners, Reno NV, utilizes their in-house laboratory. The concentrate represents approximately 10 tons of gross ore processed inclusive of moisture content. The recovery is from initial operations of the gravity only circuit with the flotation circuit to be brought on-line this month. The Company currently has an additional test shipment in process and has recently completed a 3rd gold concentrate shipment.

Refinery Settlement

| LBS. (WET) | 281 | ||

| MOISTURE | 18.22 | % | |

| LBS (DRY) | 230 | ||

| DST | 0.115 | ||

| Au oz/dst | 12.181 | ||

| Ag oz/dst | 5.719 | ||

| Au: | 1.401 oz | ||

| Ag: | 0.658 oz | ||

| Metal Price Aptil 2, 2025 | |||

| Au | $ | 3,119.75 | |

| Ag | $ | 33.87 | |

| Total Value | $ | 4,172.29 | |

| Net Payment | $ | 3,981.83 | |

Bishop Gold Mill Operations

The net value paid on the recent gold sale is equivalent to approximately

Seventy-five tons of ore is currently stockpiled at the Bishop Gold Mill. The ore will continue to be processed as part of optimization and ramp-up with additional shipments to follow. There is approximately 5,000 tons of stockpiled ore at the Project site. The main focus of optimization is now the flotation circuit. The Company has all necessary re-agents and has tested the mechanical aspects of the flotation circuit. The selective testing of the titration controls for frother and reagents is now underway. The implementation of the flotation circuit is expected to increase recovery by up to

Fran Gold Project

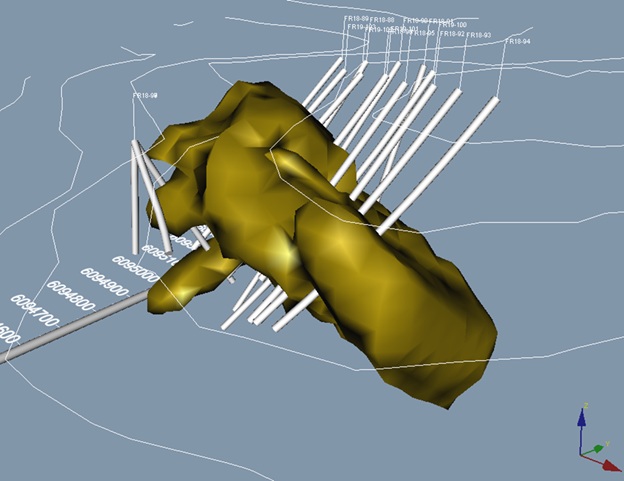

Recent data re-compilation has resulted in the discovery of a bulk tonnage gold deposit at Fran (see Press Release dated April 1, 2025). Re-calculation utilizing a 3D Model originally created at the time of the 2018-2019 drilling has provided for an initial volumetric model of the deposit. The model represents less than half of the known deposit and utilizes a very small portion of the 104 drill holes. Never-the-less a number of significant features can be noted including the general strike and orientation as well as continuation of the deposit to a significant extent at depth and to the East in addition to being open to a limited extent to the West and potential for a smaller parallel system to the South. The deposit model also shows the near surface aspect of the deposit which has been verified by extensive surface trenching.

Fran Gold 3D Model DDH 2018-2019

Approximately half of the 104 historic diamond drill holes have been re-analyzed to date.

Significant Drill Intercepts

| Hole ID | From (m) | To (m) | Width (m) | Grade g/t |

| 2006-43 | 153.0 | 193.2 | 40.2 | 0.7 |

| 2006-47 | 35.1 | 81.6 | 46.5 | 1.3 |

| 2006-49 | 104.1 | 119.3 | 15.1 | 2.7 |

| 2006-50A | 44.3 | 118.1 | 73.8 | 0.7 |

| 2006-51 | 66.1 | 85.4 | 19.3 | 0.7 |

| 2006-53 | 79.8 | 92.9 | 13.1 | 1.6 |

| 2006-55 | 27.9 | 100.5 | 72.5 | 1.8 |

| 2006-56 | 90.5 | 116.5 | 26.1 | 1.2 |

| 2006-58 | 61.4 | 157.4 | 96.0 | 0.3 |

| 2006-59 | 21.8 | 74.1 | 52.3 | 0.6 |

| 2006-60 | 90.5 | 131.5 | 41.0 | 0.7 |

| 2006-61 | 9.1 | 58.8 | 49.6 | 0.6 |

| 2006-62 | 79.9 | 150.3 | 70.5 | 0.5 |

| 2007-68 | 127.1 | 147.1 | 20.0 | 0.8 |

| 2007-69 | 171.3 | 197.8 | 26.6 | 0.5 |

| 2007-70 | 131.1 | 246.0 | 114.9 | 0.7 |

| 2007-71 | 32.9 | 116.9 | 84.0 | 0.9 |

| 2007-72 | 78.9 | 106.9 | 28.0 | 0.3 |

| 2007-73 | 180.6 | 194.2 | 13.6 | 0.4 |

| 2007-74 | 111.9 | 269.8 | 157.9 | 0.6 |

| incl. | 111.9 | 188.0 | 76.1 | 1.1 |

| 2007-75 | 49.0 | 124.5 | 75.5 | 0.8 |

| 2007-76 | 133.2 | 169.8 | 36.6 | 0.9 |

| 2018-91 | 249.4 | 296.0 | 46.6 | 0.4 |

| 2018-94 | 222.0 | 339.2 | 117.2 | 0.6 |

| 2018-95 | 202.7 | 309.0 | 106.3 | 1.0 |

| 2018-96 | 134.7 | 284.0 | 149.3 | 0.9 |

| 2018-103 | 105.7 | 178.6 | 72.9 | 1.4 |

Past exploration and development, including over 18,000m (55,000ft.) of diamond drilling, has shown large intercepts of mixed vein and disseminated gold. The deposit area has been identified to be in excess of 1000m x 100m x 300m within a known strike length of 1700m. The Fran Gold Project is next to Centerra Gold’s Mt. Milligan Project, with Reserves of 264Mt grading 0.3 gram per tonne gold and

On behalf of the Board of Directors of

NORTH BAY RESOURCES INC.

Jared Lazerson

CEO

X: @NorthBayRes

YouTube: North Bay Resources - YouTube

LinkedIn: North Bay Resources Inc | LinkedIn

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d6d8dbf3-98a1-4857-9932-7a187b9838b1