Myriad Uranium Corp. Announces Proposed Transaction Respecting Copper Mountain Project in Wyoming, USA

- Myriad has the potential to earn up to 75% interest in Copper Mountain Project, a significant global uranium prospect.

- Positive potential for significant global uranium prospect.

- Myriad to acquire initial 50% interest in the Property by making cash payments and issuing shares.

- Option to acquire additional 25% interest by making expenditures.

- Joint venture agreement to be negotiated upon successful earning of initial interest.

- None.

Vancouver, British Columbia--(Newsfile Corp. - September 18, 2023) - Myriad Uranium Corp. (CSE: M) (OTCQB: MYRUF) (FSE: C3Q) ("Myriad" or the "Company") is pleased to announce that it has signed a binding letter of intent ("LOI") dated as of today's date with Rush Rare Metals Corp. ("Rush") which, subject to due diligence, would give Myriad the option (the "Option") to earn up to a

A brief video regarding the transaction and Copper Mountain can be viewed here.

The Copper Mountain Project

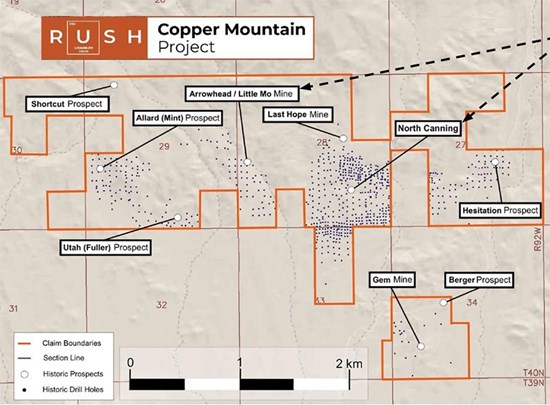

The Property is comprised of 110 claims in the Copper Mountain district of Wyoming, widely regarded as one of the best uranium exploration jurisdictions in the world. Within the Copper Mountain claims area are several known historic zones of uranium mineralization, including the Canning, Hesitation, Mint and Fuller deposits, as well as a historical mine previously known as the Arrowhead Mine, which produced approximately 500,000 pounds of uranium in the 1960's and 1970's. Prior to a vast reduction of uranium exploration in the USA throughout the 1980's, Copper Mountain was the focus of several significant drill programs, and there are estimated to be as many as 2000 historical drill holes in the claim area. Consequently, there is an abundance of historical data, including drill logs, geological reports, maps, resource estimations, and geological team discussion memos, which will all need to be carefully reviewed and analysed. Note some but not all of the historical data has been located, and the research to find any missing data continues.

A map showing the Copper Mountain claim boundaries, known uranium occurrences, and some historical drilling locations is provided below, as well as photographs of the landscape near the Canning Deposit.

Figure 1: Map of the Copper Mountain Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6301/180954_32cb29ace4cc8b32_002full.jpg

Figure 2: Picture of Copper Mountain Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6301/180954_32cb29ace4cc8b32_003full.jpg

"This will be a transformative transaction for Myriad," stated Thomas Lamb, Myriad's CEO. "We already have the potential to make one or even several world-class discoveries next to Africa's largest and highest-grade uranium deposits. But now, assuming everything goes as planned over the next 30 days, we will be on a trajectory to earn up to

Thomas Lamb then added, "And there are many macro positives. Wyoming is considered the top uranium mining jurisdiction in the US. Many of the leading near-term producing ISR projects in the United States are located in Wyoming, such as Cameco's Smith Ranch - Highland, Peninsula Energy's Lance Project, UR-Energy's Lost Creek and Energy Fuels' Nichols Ranch. UEC and enCore Energy also have several ISR projects projects in the state. The state of Wyoming and the local community of Riverton near the Copper Mountain Project both have a strong history of supporting uranium mining. Wyoming senator John Barrasso strongly supports uranium mining in the US and is leading a bill to ban Russian uranium imports.

"Finally, what gives me the most pleasure is that this is the best kind of transaction in that it's a real win-win. It enables Rush to focus on ramping up exploration on its principal asset, the Boxi rare earth project in Quebec, where channel sampling and other work along its 14 km dyke is returning up to

Pete Smith, Rush's CEO, commented, "this is a highly advantageous arrangement for both companies. Copper Mountain is an outstanding uranium prospect in one of the world's best uranium jurisdictions. Myriad and its team, including George Van Der Walt and David Miller as technical consultants, are already established as a top uranium exploration group, and they have the resources to advance Copper Mountain immediately. As a past uranium producer and with an abundance of historical information available for further analysis, including up to 2,000 drill holes and numerous historical resource estimations, Copper Mountain has the potential to become a significant global uranium prospect. While maintaining a substantial interest in Copper Mountain, Rush can continue its focus on its Boxi Property in Quebec, which has advanced with significant progress over the past summer. I expect that this deal will result in enhanced shareholder value for both companies going forward."

The Transaction

Under the LOI and subsequent Agreement, Myriad has the option to acquire an initial

Upon Myriad successfully earning an initial

Any Shares issued under the Agreement will be subject to a four month hold period under applicable securities laws. The value of any Shares issued under the Agreement following the Effective Date will be the value weighted average trading price of the Shares on the Canadian Securities Exchange (or such other Canadian stock exchange on which the Shares are trading at the applicable time) for the 10 trading days preceding the date on which such Shares are issued.

The proposed transaction is subject to several conditions, including completion of due diligence, execution of the Agreement, and receipt of all necessary regulatory approvals, including approval of the CSE (if applicable). The proposed transaction is an arms-length transaction and does not constitute a fundamental change or result in a change of control of either company, within the meaning of the policies of the CSE. Under the LOI, Myriad and Rush have agreed to proceed diligently and in good faith to negotiate and settle the terms of the Agreement, which are to be substantially the same as indicated in the LOI.

Myriad will provide an update respecting the proposed transaction in due course.

About Myriad Uranium Corp.

Myriad Uranium Corp. is a Canadian mineral exploration company with

A new video relating to this transaction is here. For additional information focused on Myriad's Niger projects, the Company's factsheet is here. A CEO interview with Crux Investor which may be of interest is here. A recent detailed interview with Uptrend Finance is here.

Myriad Contacts:

Thomas Lamb

President and Chief Executive Officer

tlamb@myriaduranium.com

###

Mineralization hosted on adjacent or nearby properties is not necessarily indicative of mineralization hosted on the Company's properties. This news release contains "forward-looking information" that is based on the Company's current expectations, estimates, forecasts and projections. This forward-looking information includes, among other things, the Company's business, plans, outlook and business strategy. The words "may", "would", "could", "should", "will", "likely", "expect," "anticipate," "intend", "estimate", "plan", "forecast", "project" and "believe" or other similar words and phrases are intended to identify forward-looking information. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect, including with respect to the Company's business plans respecting the exploration and development of the Company's mineral properties, the proposed work program on the Company's mineral properties and the potential and economic viability of the Company's mineral properties. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, but are not limited to: changes in economic conditions or financial markets; increases in costs; litigation; legislative, environmental and other judicial, regulatory, political and competitive developments; and technological or operational difficulties. This list is not exhaustive of the factors that may affect our forward-looking information. These and other factors should be considered carefully, and readers should not place undue reliance on such forward-looking information. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable law.

The CSE has not reviewed, approved or disapproved the contents of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/180954