MicroVision Announces Second Quarter 2024 Results

MicroVision (NASDAQ:MVIS), a leader in MEMS-based solid-state automotive lidar and ADAS solutions, announced its Q2 2024 results. Revenue increased to $1.9 million, up from $0.3 million in Q2 2023, driven by hardware sales to an agricultural market customer. The company reported a net loss of $23.9 million, or $0.11 per share. MicroVision is actively engaging with top-tier global automotive OEMs, with seven high-volume RFQs for passenger vehicles and custom development opportunities. The company is also pursuing near-term revenue opportunities in the industrial heavy equipment sector. To extend its financial runway, MicroVision has reduced operating expenses and is focusing on near-term revenue opportunities in non-automotive markets. The company ended Q2 2024 with $56.7 million in cash and cash equivalents.

MicroVision (NASDAQ:MVIS), leader nelle soluzioni lidar e ADAS automobilistiche a stato solido basate su MEMS, ha annunciato i risultati del secondo trimestre 2024. I ricavi sono aumentati a $1,9 milioni, rispetto a $0,3 milioni nel secondo trimestre 2023, grazie alle vendite hardware a un cliente del settore agricolo. L'azienda ha riportato una perdita netta di $23,9 milioni, ovvero $0,11 per azione. MicroVision sta collaborando attivamente con i principali OEM automobilistici globali, con sette richieste di offerta ad alto volume per veicoli passeggeri e opportunità di sviluppo personalizzato. L'azienda sta anche perseguendo opportunità di ricavo a breve termine nel settore delle attrezzature pesanti industriali. Per allungare la propria sostenibilità finanziaria, MicroVision ha ridotto le spese operative e si sta concentrando su opportunità di ricavo a breve termine nei mercati non automobilistici. L'azienda ha chiuso il secondo trimestre 2024 con $56,7 milioni in contanti e equivalenti di cassa.

MicroVision (NASDAQ:MVIS), líder en soluciones de lidar y ADAS automotrices basadas en MEMS, anunció sus resultados del segundo trimestre de 2024. Los ingresos aumentaron a $1.9 millones, en comparación con $0.3 millones en el segundo trimestre de 2023, impulsados por las ventas de hardware a un cliente del mercado agrícola. La compañía reportó una pérdida neta de $23.9 millones, o $0.11 por acción. MicroVision está activamente en contacto con principales OEM automotrices globales, con siete solicitudes de cotización de alto volumen para vehículos de pasajeros y oportunidades de desarrollo personalizado. La empresa también está buscando oportunidades de ingresos a corto plazo en el sector de equipos pesados industriales. Para extender su proyección financiera, MicroVision ha reducido los gastos operativos y se enfoca en oportunidades de ingresos a corto plazo en mercados no automotrices. La compañía finalizó el segundo trimestre de 2024 con $56.7 millones en efectivo y equivalentes de efectivo.

마이크로비전(MicroVision)(NASDAQ:MVIS)은 MEMS 기반 고체 자동차 라이다 및 ADAS 솔루션의 선두주자로서 2024년 2분기 실적을 발표했습니다. 수익은 190만 달러로 증가했습니다, 2023년 2분기 30만 달러에 비해, 이는 농업 시장 고객에게 하드웨어 판매에 힘입은 결과입니다. 회사는 2390만 달러의 순손실, 주당 0.11달러를 보고했습니다. 마이크로비전은 주요 글로벌 자동차 OEM들과 적극적으로 협력하고 있으며, 승용차를 위한 고용량 RFQ 7건과 맞춤형 개발 기회를 가지고 있습니다. 회사는 또한 산업용 중장비 부문에서 단기 수익 기회를 추구하고 있습니다. 재정적 지속 가능성을 높이기 위해, 마이크로비전은 운영 비용을 줄이고 비자동차 시장에서 단기 수익 기회에 집중하고 있습니다. 회사는 2024년 2분기를 5670만 달러의 현금 및 현금성 자산을 보유한 상태로 종료했습니다.

MicroVision (NASDAQ:MVIS), un leader dans les solutions lidar et ADAS automobiles à base de MEMS, a annoncé ses résultats du deuxième trimestre 2024. Les revenus ont augmenté à 1,9 million de dollars, contre 0,3 million de dollars au deuxième trimestre 2023, grâce aux ventes d'équipements à un client du marché agricole. La société a enregistré une perte nette de 23,9 millions de dollars, soit 0,11 dollar par action. MicroVision s'engage activement avec des OEM automobiles mondiaux de premier plan, avec sept demandes de devis de grande envergure pour des véhicules particuliers et des opportunités de développement sur mesure. L'entreprise recherche également des opportunités de revenus à court terme dans le secteur des équipements lourds industriels. Pour étendre sa marge financière, MicroVision a réduit ses dépenses d'exploitation et se concentre sur des opportunités de revenus à court terme dans des marchés non automobiles. L'entreprise a terminé le deuxième trimestre 2024 avec 56,7 millions de dollars en espèces et équivalents de trésorerie.

MicroVision (NASDAQ:MVIS), ein führendes Unternehmen für MEMS-basierte Festkörper-Lidar- und ADAS-Lösungen für Automobile, hat seine Ergebnisse für das zweite Quartal 2024 bekannt gegeben. Der Umsatz stieg auf 1,9 Millionen Dollar, im Vergleich zu 0,3 Millionen Dollar im zweiten Quartal 2023, was auf Hardware-Verkäufe an einen Kunden aus dem Agrarsektor zurückzuführen ist. Das Unternehmen meldete einen Nettoverlust von 23,9 Millionen Dollar, also 0,11 Dollar pro Aktie. MicroVision engagiert sich aktiv mit führenden globalen OEMs der Automobilindustrie und bearbeitet sieben Anfragen für Angebote mit hohem Volumen für Personenkraftwagen sowie maßgeschneiderte Entwicklungsmöglichkeiten. Das Unternehmen sucht außerdem kurzfristige Einnahmequellen im Bereich der industriellen Schwerlastgeräte. Um die finanzielle Stabilität zu verlängern, hat MicroVision die Betriebskosten gesenkt und konzentriert sich auf kurzfristige Einnahmequellen in nicht-automobilen Märkten. Das Unternehmen schloss das zweite Quartal 2024 mit 56,7 Millionen Dollar an Bargeld und liquiden Mitteln.

- Revenue increased to $1.9 million in Q2 2024, up from $0.3 million in Q2 2023

- Engaged in seven high-volume RFQs for passenger vehicles with top-tier global automotive OEMs

- Pursuing near-term revenue opportunities in the industrial heavy equipment sector

- Reduced operating expenses to extend financial runway

- Net loss increased to $23.9 million in Q2 2024, compared to $20.6 million in Q2 2023

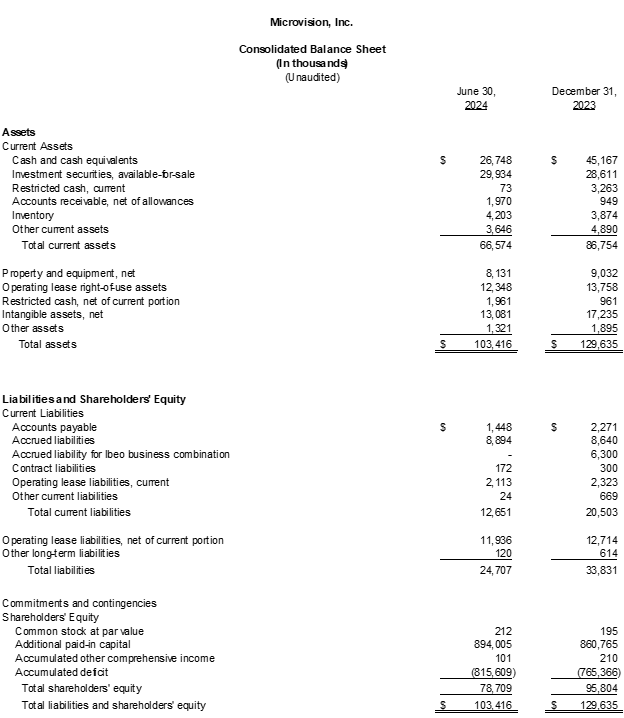

- Cash and cash equivalents decreased to $56.7 million from $73.8 million at the end of 2023

- Cash used in operations increased to $18.6 million in Q2 2024, up from $16.6 million in Q2 2023

- Automotive projects are taking longer to ramp up due to industry headwinds

Insights

MicroVision's Q2 2024 results show mixed signals. Revenue increased to

The company's pivot to near-term industrial opportunities while maintaining automotive OEM engagements is a strategic move to weather industry headwinds. However, the lack of concrete automotive contracts and the continued cash burn raise questions about long-term viability. Investors should closely monitor the company's ability to secure meaningful contracts and improve its cash position in the coming quarters.

MicroVision's focus on MEMS-based lidar for automotive and ADAS applications positions it in a high-potential market. The company's engagement in seven high-volume RFQs for passenger vehicles is promising, but the extended timelines in the automotive industry are challenging. The pivot towards industrial applications, particularly in heavy equipment, demonstrates adaptability but may not fully offset the delayed automotive revenue.

The mention of pre-RFQ collaborations suggests potential for future contracts, but the lack of specific details or timelines is concerning. The company's ability to leverage its technology across both automotive and industrial sectors could be a key differentiator, but execution and market penetration remain critical challenges in the competitive lidar space.

MicroVision's Q2 results reflect the broader challenges in the automotive lidar market. The increased revenue from industrial customers signals a potential diversification strategy, which could help mitigate risks associated with the slower-than-expected adoption of lidar in passenger vehicles. However, the company's high cash burn rate and widening losses indicate that it's still in a precarious financial position.

The market for lidar technology remains highly competitive, with several well-funded players vying for OEM contracts. MicroVision's ability to secure seven high-volume RFQs is positive, but without confirmed contracts, the company's market position remains uncertain. Investors should watch for concrete evidence of market traction and improved financial metrics in future quarters to gauge the company's long-term prospects.

REDMOND, WA / ACCESSWIRE / August 7, 2024 / MicroVision, Inc. (NASDAQ:MVIS), a leader in MEMS-based solid-state automotive lidar and ADAS solutions, today announced its second quarter 2024 results.

Key Business Highlights for Q2 2024

Building momentum toward full year guidance with Q2 revenue from industrial customers.

Actively engaging with top-tier global automotive OEMs, with seven high-volume RFQs for passenger vehicles and custom development opportunities.

Pursuing multiple near-term revenue opportunities with industrial customers in heavy equipment vertical.

Extending financial runway and operational efficiencies, streamlining cash burn and leveraging near-term hardware and software sales to automotive and industrial customers.

"We are pleased with our continued engagement in RFQs with automotive OEMs and are also excited by the uptick in interest in pre-RFQ collaboration and development work. With project delays and other automotive industry headwinds, we have worked hard to position MicroVision to successfully withstand these challenges," said Sumit Sharma, MicroVision's Chief Executive Officer. "We've reduced operating expenses to extend our financial runway and are focused on near-term revenue opportunities in non-automotive markets."

"While automotive projects are taking longer to ramp up, we remain actively engaged with multiple global OEMs for near-term custom development projects involving passenger vehicles scheduled for launch later this decade," continued Sharma.

Key Financial Highlights for Q2 2024

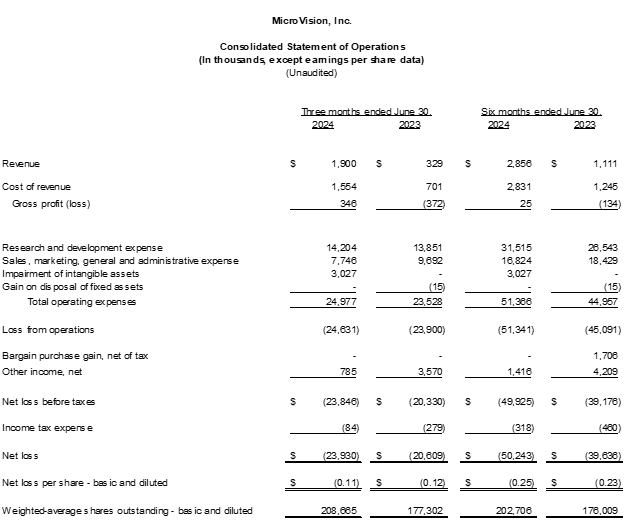

Revenue for the second quarter of 2024 was

$1.9 million , compared to$0.3 million for the second quarter of 2023, primarily driven by hardware sales to a long-standing customer in the agricultural market.Net loss for the second quarter of 2024 was

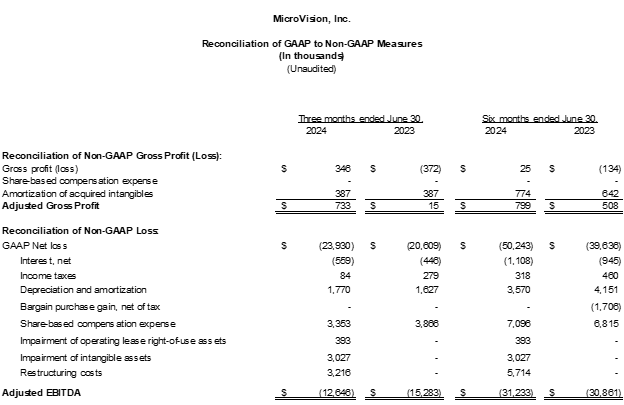

$23.9 million , or$0.11 per share, which includes$3.4 million of non-cash, share-based compensation expense and$3.0 million of non-cash, asset impairment charge, compared to a net loss of$20.6 million , or$0.12 per share, which includes$3.9 million of non-cash, share-based compensation expense, for the second quarter of 2023.Adjusted EBITDA for the second quarter of 2024 was a

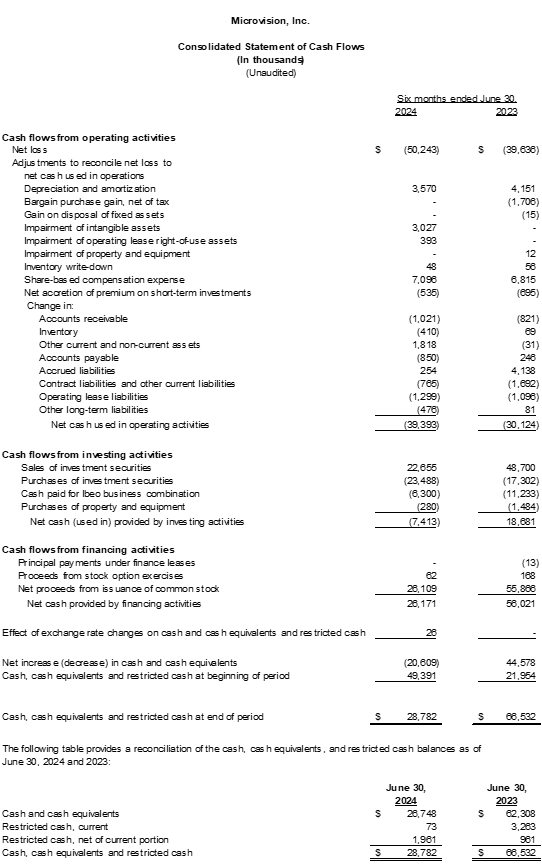

$12.6 million loss, compared to a$15.3 million loss for the second quarter of 2023.Cash used in operations in the second quarter of 2024 was

$18.6 million , compared to cash used in operations in the second quarter of 2023 of$16.6 million .The Company ended the second quarter of 2024 with

$56.7 million in cash and cash equivalents, including investment securities, compared to$73.8 million at December 31, 2023.

Conference Call and Webcast: Q2 2024 Results

MicroVision will host a conference call and webcast, consisting of prepared remarks by management, a slide presentation, and a question-and-answer session at 1:30 PM PT/4:30 PM ET on Wednesday, August 7, 2024 to discuss the financial results and provide a business update. Analysts and investors may pose questions to management during the live webcast on August 7, 2024.

The live webcast and slide presentation can be accessed on the Company's Investor Relations website under the Events tab at https://ir.microvision.com/events. The webcast will be archived on the website for future viewing.

About MicroVision

With offices in the U.S. and Germany, MicroVision is a pioneering company in MEMS-based laser beam scanning technology that integrates MEMS, lasers, optics, hardware, algorithms and machine learning software into its proprietary technology to address existing and emerging markets. The Company's integrated approach uses its proprietary technology to provide automotive lidar sensors and solutions for advanced driver-assistance systems (ADAS) and for non-automotive applications including industrial, smart infrastructure and robotics. The Company has been leveraging its experience building augmented reality micro-display engines, interactive display modules, and consumer lidar modules.

For more information, visit the Company's website at www.microvision.com, on Facebook at www.facebook.com/microvisioninc, and LinkedIn at https://www.linkedin.com/company/microvision/.

MicroVision, MAVIN, MOSAIK, and MOVIA are trademarks of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties of their respective owners.

Non-GAAP information

To supplement MicroVision's condensed financial statements presented in accordance with GAAP, the Company presents investors with the non-GAAP financial measures "adjusted EBITDA" and "adjusted Gross Profit." Adjusted EBITDA consists of GAAP net income (loss) excluding the impact of the following: interest income and interest expense; income tax expense; depreciation and amortization; bargain purchase gain; share-based compensation; impairment charges; and restructuring costs. Adjusted Gross Profit is calculated as GAAP gross profit before share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

MicroVision believes that the presentation of adjusted EBITDA and adjusted Gross Profit provides important supplemental information to management and investors regarding financial and business trends, provides consistency and comparability with MicroVision's past financial reports, and facilitates comparisons with other companies in the Company's industry, many of which use similar non-GAAP financial measures to supplement their GAAP results. Internally, management uses these non-GAAP measures when evaluating operating performance because the exclusion of the items described above provides an additional useful measure of the Company's operating results and facilitates comparisons of the Company's core operating performance against prior periods and its business objectives. Externally, the Company believes that adjusted EBITDA and adjusted Gross Profit are useful to investors in their assessment of MicroVision's operating performance and the valuation of the Company.

Adjusted EBITDA and adjusted Gross Profit are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of MicroVision's business as determined in accordance with GAAP. The Company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from its non-GAAP financial measures should not be construed as an inference that these costs are unusual or infrequent.

The Company compensates for limitations of the adjusted EBITDA measure by prominently disclosing GAAP net income (loss), which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation from GAAP net income (loss) to adjusted EBITDA.

Similarly for adjusted Gross Profit, the Company compensates for limitations of the measure by prominently disclosing GAAP gross profit which is the difference between Revenue and Cost of revenue, which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation by backing out share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

Forward-Looking Statements

Certain statements contained in this release, including customer engagement and the likelihood of success, opportunities for revenue and cash, expense reduction, market position, product portfolio, product and manufacturing capabilities, and expected revenue, expenses and cash usage are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of its commercial partners to perform as expected under its agreements; its financial and technical resources relative to those of its competitors; its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company's SEC reports, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changes in circumstances or any other reason.

Investor Relations Contact

Jeff Christensen

Darrow Associates Investor Relations

MVIS@darrowir.com

Media Contact

Marketing@MicroVision.com

SOURCE: MicroVision, Inc

View the original press release on accesswire.com