Murchison Minerals Acquires New Base Metals Project in Quebec

Murchison Minerals Ltd. has secured an agreement to acquire 100% interest in 75 mineral claims spanning 2,377 hectares in Quebec's Barraute-Landrienne mining camp. To finalize this deal, Murchison will pay a total of $500,000 and invest $1,000,000 in property development over six years. Key exploration targets include zinc-silver-gold deposits, with a significant nearby deposit at Abcourt-Barvue. The agreement entails a 1% NSR royalty for the Optionor, which can be bought out for $1,000,000. This strategic acquisition enhances Murchison's potential for future discoveries and shareholder value.

- Acquisition of mineral claims enhances exploration potential.

- Proximity to Abcourt-Barvue deposit increases strategic value.

- The project is drill-ready with solid geological targets.

- None.

BURLINGTON, ON / ACCESSWIRE / May 6, 2021 / Murchison Minerals Ltd. ("Murchison" or the "Company") (TSXV:MUR) announces that it has entered into an agreement ("the Agreement") with Gestion Aline Leclerc Inc. (the "Optionor") granting Murchison an option to earn

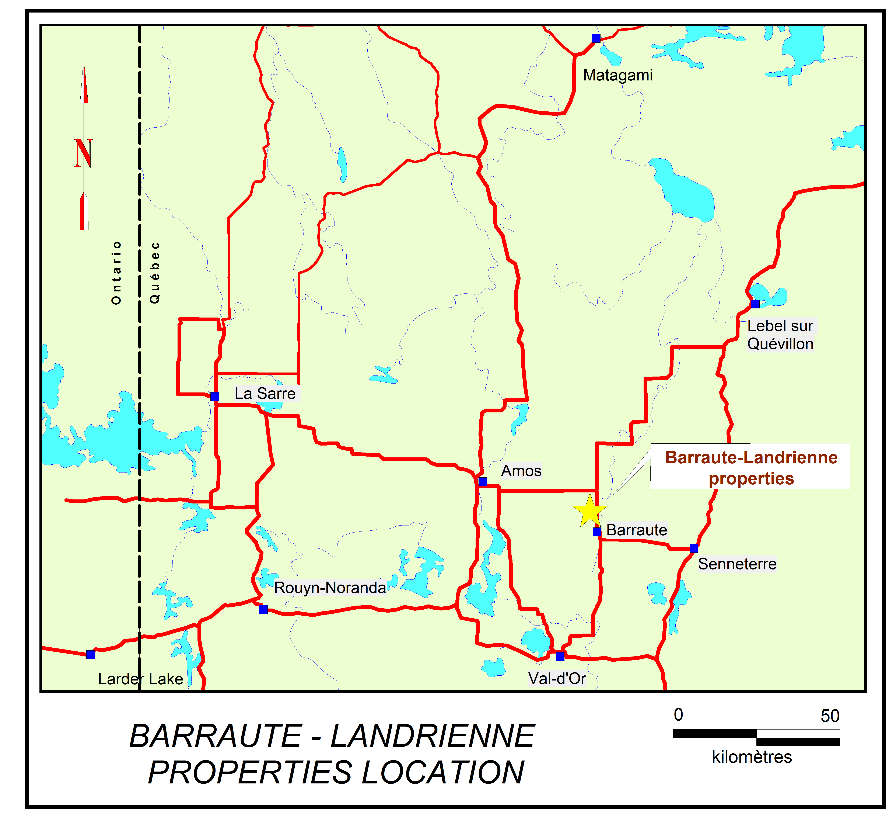

These claims, split into 4 blocks are located in the Barraute-Landrienne mining camp, approximately 60 km north of Val-d'Or, and about 4 km northwest of the municipality of Barraute in Quebec and were selected targeting new zinc-silver-gold deposits. These four blocks of claims are believed to host some of the best untested geological/geophysical base-metal targets in the area and are considered ready for drilling.

Figure 1, Location of Claim Blocks.

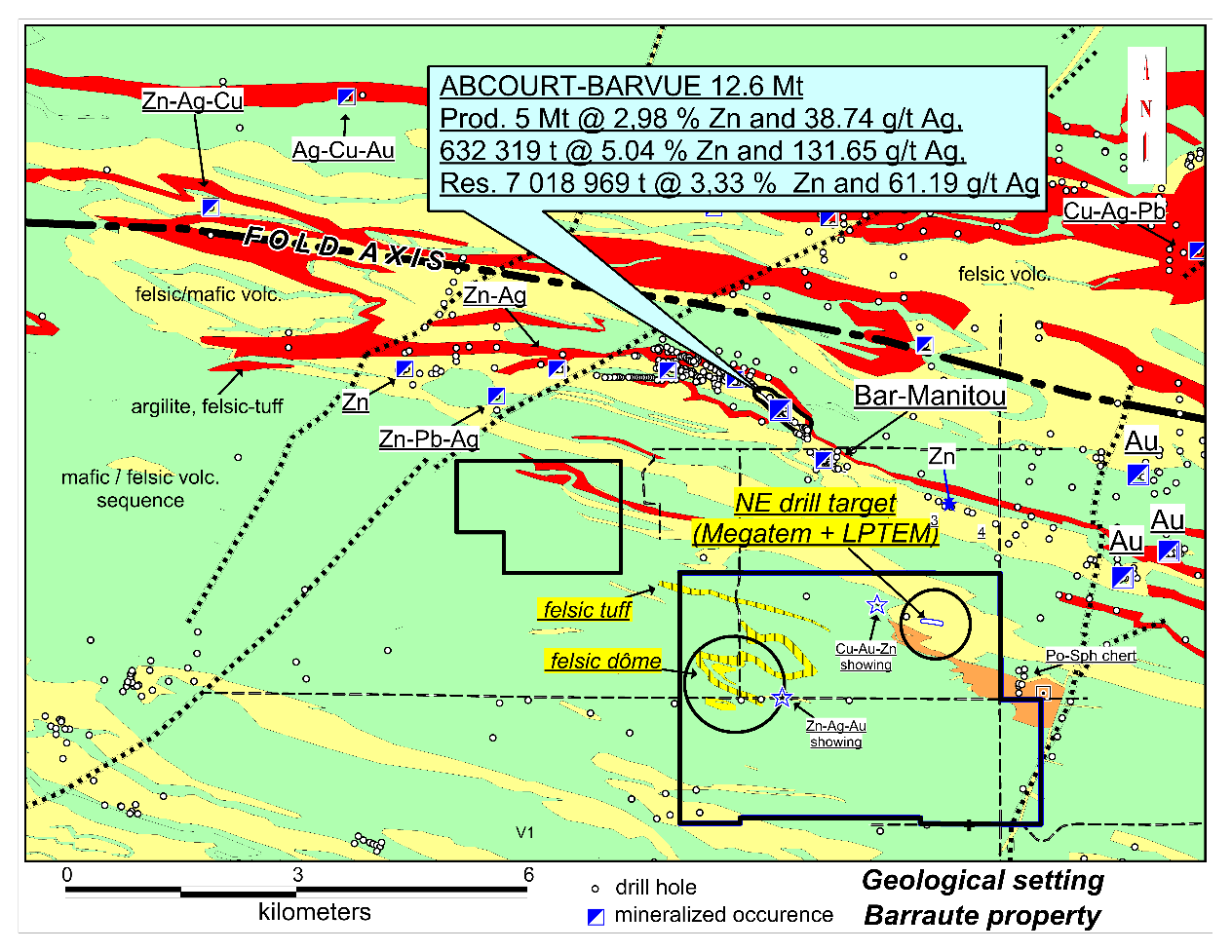

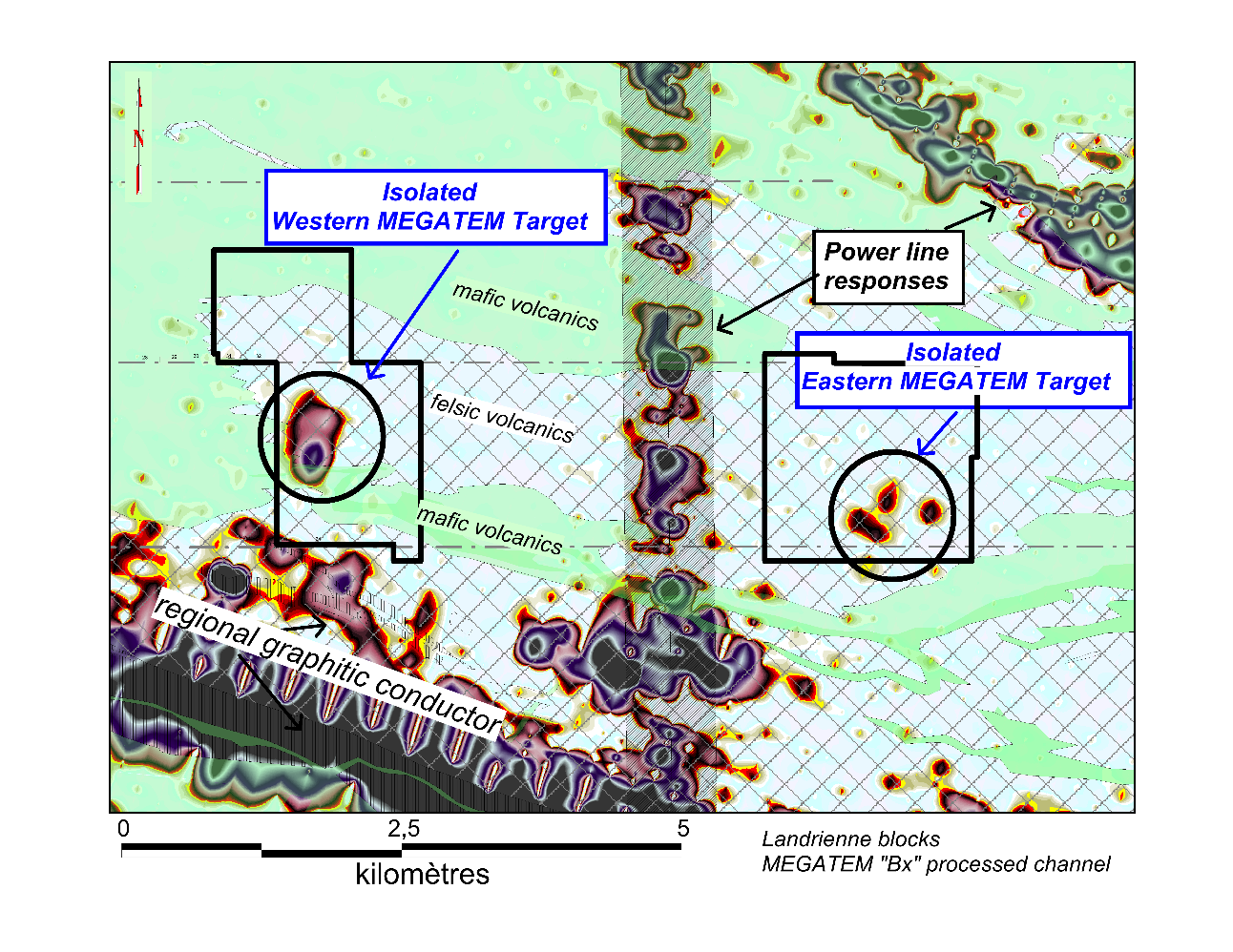

Exploration work completed throughout the past several years by the Optionor and others resulted in a new geological interpretation suggesting the correlation of the Abcourt-Barvue Mine stratigraphy within the Barraute property. Further west, the Landrienne property hosts several untested isolated Megatem geophysical anomalies, near felsic-mafic volcanic contacts.

The Barraute mining camp hosts several mineralized showings and polymetallic metal deposits including the substantial 15.7 Mt zinc-silver Abcourt-Barvue deposit located at only 2 km from the Barraute property.

Zinc-silver mineralization was discovered in the region in 1950. The Abcourt-Barvue deposit of Abcourt Mines Inc. was in operation during two periods: between 1952 and 1957 by Barvue Mines Limited and between 1985 and 1990 by Abcourt. In all 5,002,19 metric tonnes grading 38.74 g/t Ag and

These newly acquired properties are located near all needed infrastructure and human resources for exploration and possible future operations.

Figure 2, Location of the Barraute Claim Blocks.

Figure 3, Location of the Landrienne Claim Blocks and the EM anomalies.

Transaction Details

In order to earn

Timeline | Cash Payments or Number of Consideration Shares | Expenditures | |

1. | on or before the first | ||

2. | on or before the second |

| |

3. | on or before the third |

| |

4. | on or before the fourth |

| |

5. | on or before the fifth |

|

|

6. | on or before the sixth |

| Nil |

TOTAL |

| ||

Chief Executive Officer Jean-Charles Potvin comments: "We are very pleased to add the Barraute-Landrienne property group to Murchison's Quebec property portfolio. With excellent road access, nearby infrastructure and very favourable geological setting being proximal to the large Abcourt-Barvue zinc-silver deposit right next door makes this acquisition fortuitous for Murchison. The ability to acquire this highly desirable, drill ready, land package in a historic mining district at reasonable cost enhances our opportunity for future discoveries and building value for our shareholders."

Qualifying Statement

The foregoing scientific and technical disclosures have been reviewed by Claude Britt, P. Geo., qualified person as defined by National Instrument 43-101. Mr. Britt is an independent consultant to Murchison and the Barraute project.

About Murchison Minerals Ltd. (TSXV: MUR)

Murchison is a Canadian‐based exploration company focused on the exploration and development of the

Additional information about Murchison and its exploration projects can be found on the Company's website at www.murchisonminerals.com.

For further information, please contact:

Jean‐Charles (JC) Potvin, President and CEO or Erik H Martin, CFO

Tel: (416) 350‐3776

info@murchisonminerals.com

CHF Capital Markets

Cathy Hume, CEO

Tel: 416-868-1079 x 251

cathy@chfir.com

Forward‐Looking Information

Certain information set forth in this news release may contain forward‐looking information that involves substantial known and unknown risks and uncertainties. This forward‐looking information is subject to numerous risks and uncertainties, certain of which are beyond the control of the Company, including, but not limited to, the impact of general economic conditions, industry conditions, and dependence upon regulatory approvals. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward‐looking information. The parties undertake no obligation to update forward‐looking information except as otherwise may be required by applicable securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Murchison Minerals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/645027/Murchison-Minerals-Acquires-New-Base-Metals-Project-in-Quebec

FAQ

What acquisition did Murchison Minerals make?

What are the financial commitments associated with the Murchison acquisition?

What is the significance of the Barraute-Landrienne mining camp for Murchison Minerals?

What is the expected impact of this acquisition on Murchison Minerals' future?