Metals Acquisition Limited Announces March 2024 Quarterly Activities Report

Metals Acquisition (NYSE: MTAL; ASX: MAC) reported a strong quarter with progress on ASX listing, mine life extension, and solid production despite a power outage. Key highlights include a 67% increase in mine life, 64% increase in contained copper, and 42% increase in copper reserves. The company raised US$214 million in an ASX IPO, repaid US$127 million in liabilities, and had ~US$100 million in liquidity. However, production was down 11% due to power outage and lower grades, leading to an increase in C1 cash costs. Exploration drilling is ongoing, and the company announced a three-year copper production guidance. The CEO highlighted plans for future growth and welcomed a new CFO.

Strong progress in mine life extension and production despite power outage.

Raised US$214 million in ASX IPO, repaid US$127 million in liabilities, and had ~US$100 million in liquidity.

Exploration drilling continues, with a three-year copper production guidance announced.

Production down 11% due to power outage and lower grades, leading to an increase in C1 cash costs.

Safety performance during the quarter was disappointing, with two LTI's and two MTI's recorded.

Lower production volumes affected mining unit rates and overall costs.

Insights

Strong Progress Continues on the Back of ASX Listing With Significant Mine Life Extension and Solid Production Despite Power Outage

ST. HELIER, Jersey--(BUSINESS WIRE)-- Metals Acquisition Limited (NYSE: MTAL; ASX:MAC)

Figure 1 - CSA Copper Mine Recordable Injuries by Quarter (Graphic: Business Wire)

Metals Acquisition Limited ARBN 671 963 198 (NYSE: MTAL; ASX: MAC), a private limited company incorporated under the laws of Jersey, Channel Islands (“MAC” or the “Company”) is pleased to release its March 2024 quarterly activities report (“Q1 2024” or “March quarter”).

HIGHLIGHTS

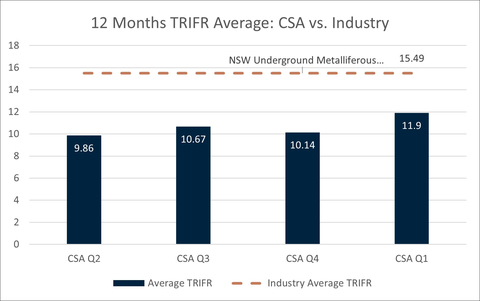

TRIFR of 11.9 – Q1 2024 increase albeit below industry average – implementing strategies to remediate.

-

64% increase in contained Copper (“Cu”) after replacement of depletion in Ore Reserves at3.3% Cu average grade. -

42% increase in contained Cu after replacement of depletion in Mineral Resources at4.9% Cu average grade. - 2023 Ore Reserve only extends 95m vertically below the current decline position.

- All deposits2, are open in at least one direction and drilling is continuing to further increase the R+R.

Three-year copper production guidance issued increasing by ~

-

Based on the updated R+R, Cu production guidance is provided for 3 years with the following ranges:

- 2024: 38,000 to 43,000;

- 2025: 43,000 to 48,000; and

- 2026: 48,000 to 53,000 Cu tonnes.

ASX IPO raise with increased liquidity and balance sheet strength

-

Raised

US ($214 million A ) (before costs) at$325 million A per CDI (the top of the indicative price range)4.$17.00 -

Repaid

US of interest-bearing liabilities including principal under the senior syndicated facility, the deferred consideration as well as the final completion adjustment with Glencore during Q1 2024.$127 million -

Liquidity of

~US as at 31 March 2024, expected to increase in the current quarter on the back of strong copper price.$100 million

Based on the reserve plan, Cu production should increase sequentially over remainder of 2024

-

Q1 2024 production of 8,786 tonnes of Cu is down

11% quarter on quarter and from our planned rate. - Lower production was driven by power outage and lower grades being mined from the East and West deposits.

- Mining shifted at the latter part of the quarter to higher grade areas within the QTSN and QTSC zones and reducing the mining at East and West deposits.

C1 Cash cost5 increased mainly due to power outage and lower grade

-

Q1 2024 C1 costs of

US /lb, up ~$2.15 8% on the prior quarter largely due to lower grade milled in addition to a site power outage which resulted in three days of lost production. -

Underground capital development of 467m (down

44% on Q4 2023) due to focus on the new mineral reserve plan, increased rehabilitation metres during the quarter, impacts from increased ground support requirements and underground waste storage.

Drilling and exploration results in the quarter

- MAC has continued drilling since acquiring the CSA Copper Mine in June 2023 with a view to expand its high quality resource base to underpin a new reserve estimate and mine plan.

- In March continuing exploration and resource development at the CSA Copper Mine saw additional drilling at QTS North, QTS Central, the near surface QTS South Upper A, the upper Pb-Zn mineralisation of the Eastern and Western Systems and the Cherry Prospect on CML5.

-

Drill results were reported including 19.2m @

10.4% Cu, 16.0m @10.4% Cu at QTS North and 3m @13.9% Cu QTS South Upper A.6 - Given that all the deposits are open, and a large drill program is underway, we consider it likely that there will be changes over the relevant period as the Company’s overall plan to continue operational and production improvement continues to develop.

- To improve exploration targeting underground Downhole Electromagnetic surveys are continuing to be employed by MAC with a permanent geophysical loop installed at QTSC. Drillhole UDD22135 was surveyed, which drilled through QTSC and some 400m east of the deposit, DHEM results are expected in Q2 2024.

- In March a high-powered Fixed-Loop Electromagnetic Geophysical Survey using low temperature Superconducting Quantum Interference Device sensors was commenced. The survey, upon completion, covered 26km² of highly prospective ground surrounding the CSA Mine on CML5 and encompassing exploration licence EL5693. This survey is partially complete and preliminary data indicates a number of anomalies have been generated.

-

During Q1 2024

US (Q4 2023:$1.3 million US ) was invested in exploration.$0.7 million

Unless stated otherwise all references to dollar or $ are in USD.

Metals Acquisition Limited’s CEO, Mick McMullen, said:

“Our operations performed largely as expected during the March quarter with the exception of lower mill grade and a power outage from a large off site storm event as announced in March. The quarter-on-quarter variances we are seeing is also impacted by the lower number of high grade stopes in Q1 relative to other quarters. The higher-grade stopes are a large proportion of our production and the timing of mining these has a significant impact on quarter on quarter production.

We ended the quarter with a large broken ore stockpile of high-grade ore which, combined with two large high grade stopes to be mined in Q2, will underpin a sequentially higher production during Q2. Based on the reserve plan, copper production should continue to increase sequentially over the remaining quarters of the year.

In this quarter, we successfully listed on the ASX and thank our new shareholders for their support. The listing is a huge milestone for the Company as we continue to expand towards our long-term goal of owning and operating multiple metals and mining assets to become a notable and respected player in the industry.

We have already put the additional liquidity to good use in reducing our overall interest-bearing liabilities by approximately

As part of the ongoing turnaround and optimisation at the CSA Copper Mine we announced subsequent to quarter-end the new Reserve and Resource Statement which is a snapshot in time based on information available back in August 2023. The new 2023 Reserves and Resources Statement shows a substantial increase of

The listing and the resource upgrade vindicate our belief that the CSA Copper Mine is a high-quality long life copper asset.

Importantly, despite the near doubling of the Ore Reserves and a

We also announced exploration drilling results in and around the mine confirm the high-grade nature of the operation with most deposits open at depth and in some cases up dip as well (QTSC). The results from the QTSS Upper A deposit are highly encouraging so close to surface and we are excited to see what additional value we can create through the drill bit.

Following the new Reserves and Resources Statement we also issued a three-year copper production guidance which shows copper production increasing by around

With a disciplined M&A strategy, we will continue to evaluate prospects for growth to enhance shareholder value.

Finally, we welcomed our new CFO, Morné Engelbrecht to our team. Morné brings a wealth of experience to the leadership team and he has already started to have a positive impact on our turn around of the CSA Copper Mine and provides additional management strength as we look to add value for shareholders.”

ESG

Safety

The TRIFR for the CSA Copper Mine increased from an average of 10.1 in Q4 2023 to 11.9 in Q1 2024 (refer Figure 1). This is below the NSW underground metalliferous TRIFR for 2022 of 15.5. Unfortunately, Q1 2024 has not been favourable for safety performance with two LTI’s, two MTI’s and one RWI recorded for the period. Whilst the TRIFR was below the industry average, the safety performance during the March quarter was disappointing and we are implementing strategies to remediate.

Figure 1 - CSA Copper Mine Recordable Injuries by Quarter

Regulatory

The March quarter was relatively quiet on regulatory matters and very much a business-as-usual quarter.

The site has reviewed and updated the Environmental Management System to be consistent with ISO14001, updated the Rehabilitation Management Plan, the Site Water Management Plan as well as a review and update of the Pollution Incident Response Management Plan.

The STSF Stage 9 buttress bulk earthworks are largely complete, with the surface stabilisation works underway. Geofabric has been placed over the buttresses and the 80,000m3 of screened waste rock from North TSF placed as capping to prevent erosion.

The project is tracking ahead of schedule and under budget. Current works to complete for April 2024 is screening of material to be used in Stage 10.

Figure 2 - CSA Copper Mine Covering Geofabric on Stage 9 Buttress

Planning work is underway for the Stage 10 lift, with the tender documents nearing completion.

Operations

Table 1 - Quarterly Operational Performance of the CSA Copper Mine

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Ore Tonnes Milled |

254,381 |

300,328 |

266,105 |

260,297 |

Grade Milled |

|

|

|

|

Copper Recovery (%) |

|

|

|

|

Copper Produced (t) |

7,779 |

9,845 |

9,832 |

8,786 |

Silver Produced (oz) |

99,117 |

115,081 |

114,969 |

102,182 |

|

|

|

|

|

Mining Cost/t Ore Mined (US$) |

|

|

|

|

Processing Cost/t Milled (US$) |

|

|

|

|

G+A Cost/t Milled (US$) |

|

|

|

|

Total Operating Cost/t (US$) |

|

|

|

|

C1 (US$/lb) |

|

|

|

|

Development Cost/metre (US$) |

|

|

|

|

Total Capital Expenditure (US$m) |

|

|

|

|

Tonnes Milled/employee |

162 |

201 |

189 |

184 |

The March quarter was affected by the sitewide power outage occurring on 29 February 2024, which resulted in three days of production being impacted when accounting for a restart and ramp up back to normal operational levels.

In addition, copper production was also affected by the lower mill grade, of

Mining has been redirected to the higher grade QTSN and QTSC deposits to maximise production in the near term whilst the ventilation constraints at the mine are removed.

Figure 3 - CSA Copper Mine Quarterly Copper Production

The average received copper price before hedge settlements was consistent when comparing to the prior period with March quarter at

In addition, the Australian dollar exchange rate was broadly flat compared to the prior quarter.

As seen in Figure 4, C1 cash costs increased quarter on quarter from

Figure 4 - CSA Copper Mine C1 Cash Costs

MAC management will continue to implement additional productivity measures to further reduce C1 costs.

Figure 5 provides an illustration of tonnes milled per employee with the slight decrease during the March quarter again driven by the decrease in tonnes milled due to the power outage affecting ore availability.

Figure 5 - CSA Copper Mine Tonnes Milled per Employee

Apart from copper production, the largest driver of C1 costs is the mining unit rate as mining accounts for approximately

Figure 6 - CSA Copper Mine Mining Unit Rate

Mining unit rates increased from the prior quarter partly a result of the lower capital development performed during the quarter, in addition to the impacts of lower volumes a result of the power outage and increase in costs.

The lower capital development performed resulted in a lower portion of costs able to be capitalised in the quarter, and hence contributed to the increase in the mining costs.

Figure 7 illustrates the cost per metre of development over the course of the year, with a

This is largely driven by the decrease in capital development metres from 841m in December quarter to 467m during the March quarter, with resources allocated to rehabilitation works instead of development.

Figure 7 - CSA Copper Mine Mining Development Costs

Figures 8 and 9 shows the unit rates for processing and site G&A for the year.

Processing costs per tonnes milled increased in the March quarter given the decrease in volume.

In addition, G&A unit rates also increased during the current quarter.

Figure 8 - CSA Copper Mine Processing Unit Rate

Figure 9 - CSA Copper Mine Site G+A Unit Rate

As seen in Figure 10, capital spend (including capitalized development) has increased over the quarter, largely driven by work on the TSF embankment. This is in line with previous indications to the market.

Capital development metres also decreased in the March quarter by

Figure 10 - CSA Copper Mine Site Capital Expenditure

Mine Plan, Resource and Reserve

Subsequent to quarter-end on 23 April 2024 we announced the release of the new 2023 Reserves and Resources Statement (“R+R”). The effective date for the R+R is 31 August 2023 and as such, any new information received after that time has not been incorporated into the R+R at this stage.

Highlights from the R+R include:

-

67% increase in mine life to 11-years (end of 2034) based on Ore Reserves only, compared to the 6-year mine life in the 2022 Resources and Reserves Statement -

64% increase in contained copper (“Cu”) after replacement of depletion to 0.5Mt in Ore Reserves (Refer Table 3 included in the R+R ASX Announcement on 23 April 2024 for breakdown) at an average grade of3.3% Cu -

42% increase in total contained Cu after replacement of depletion to 1Mt in total Mineral Resources (Refer Table 2 included in the R+R ASX Announcement on 23 April 2024 for breakdown) at an average grade of4.9% Cu -

83% increase in contained Cu after replacement of depletion to 0.8Mt in the Measured and Indicated Resources categories - Above increases have come after only 10 months of ownership and based on data from 2.5 months post-closing of the acquisition with the effective date for the R+R being 31 August 2023

- 2023 Ore Reserve only extends 95m vertically below the current decline position

- All deposits (other than QTSSU-A (feasibility study), are open in at least one direction and drilling is continuing to further increase the R+R, subject to exploration success and economic factors

Work is continuing on updating the mine plans as new information is received and importantly following on from the completion of MAC’s dual listing on the ASX and public offer that raised

Finance and Corporate

ASX IPO

During January the Company lodged a prospectus with the Australian Securities and Investments Commission to undertake an Initial Public Offering in

MAC raised

Based on the final price of

MAC was admitted to the ASX on 16 February 2024 and commenced trading on 20 February 2024 under the code ‘MAC’, and is now dual listed on the ASX and the NYSE.

Resignation of Non-Executive Director

Subsequent to quarter end on 3 April 2024, it was announced that Mr Rhett Bennett has resigned from his position as a Non-Executive Director of the Company. The Board has advanced a process to identify and recruit additional directors that align with the diversification objectives of the Company.

Three Year Production Guidance

Based on the updated R+R, the Company is providing the following production guidance for the next 3 years:

Table 2 - CSA Copper Mine Production Guidance

2024 |

2025 |

2026 |

||||

|

Low Range |

High Range |

Low Range |

High Range |

Low Range |

High Range |

Cu Production (tonnes) |

38,000 |

43,000 |

43,000 |

48,000 |

48,000 |

53,000 |

This 3-year production guidance is based primarily on Ore Reserves but also on measured and indicated Mineral Resources (as at 31 August 2023) and, given that all the deposits are open and a large drill program is underway, we consider it likely that there will be changes over the relevant period as the Company’s overall plan to continue operational and production improvement continues to develop.

Hedging

During the quarter, the Company delivered 3,105 tonnes of copper into the hedge book at an average price of

Table 3 – Hedge position

Year |

Tonnes |

Price US$/lb |

2024 |

9,315 |

|

2025 |

12,420 |

|

2026 |

5,175 |

|

Liquidity

During the quarter the Company paid a further

On 16 February 2024 MAC used part of the proceeds from the ASX IPO to repay in full the

As of 31 March 2024 the Company had

Conference Call

The Company will host a conference call and webcast to discuss the Company’s first quarter 2024 results on Monday, April 29, 2024 at 7:00 pm (

Details for the conference call and webcast are included below.

Webcast

Participants can access the webcast at the following link https://events.q4inc.com/attendee/225480402.

Conference Call

Participants can dial into the live call by dialling 800-274-8461 or +1-203-518-9783 and providing the conference ID ‘METALS’.

Replay

The conference call will be available for playback until July 29, 2024, and can be accessed by dialling 1-888-566-0859 or +1-402-220-0449 or visiting the webcast link https://events.q4inc.com/attendee/225480402.

This report is authorised for release by the Board of Directors.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL) is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification and decarbonization of the global economy.

Estimates of Mineral Resources and Ore Reserves and Production Target

This release contains estimates of Ore Reserves and Mineral Resources as well as a Production Target. The Ore Reserves, Mineral Resources and Production Target are reported in MAC’s ASX Announcement dated 23 April 2024 titled ‘Updated Resource and Reserve Statement and Production Guidance’ (the R&R Announcement). The Company is not aware of any new information or data that materially affects the information included in the R&R Announcement, and that all material assumptions and technical parameters underpinning the estimates or Ore Reserves and Mineral Resources in the R&R Announcement continue to apply and have not materially changed. The material assumptions underpinning the Production Target in the R&R Announcement continue to apply and have not materially changed. It is a requirement of the ASX Listing Rules that the reporting of ore reserves and mineral resources in

Forward Looking Statements

This release includes “forward-looking statements.” The forward-looking information is based on the Company’s expectations, estimates, projections and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of copper, continuing commercial production at the CSA Copper Mine without any major disruption, the receipt of required governmental approvals, the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate.

MAC’s actual results may differ from expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation, MAC’s expectations with respect to future performance of the CSA Copper Mine. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the supply and demand for copper; the future price of copper; the timing and amount of estimated future production, costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated reclamation expenses; claims and limitations on insurance coverage; the uncertainty in Mineral Resource estimates; the uncertainty in geological, metallurgical and geotechnical studies and opinions; infrastructure risks;; and other risks and uncertainties indicated from time to time in MAC’s other filings with the SEC and the ASX. MAC cautions that the foregoing list of factors is not exclusive. MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports filed with the SEC and the ASX. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing MAC’s assessment as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-IFRS financial information

MAC’s results are reported under International Financial Reporting Standards (IFRS), noting the results in this report have not been audited or reviewed. This release may also include certain non-IFRS measures including C1 costs. These C1 cost measures are used internally by management to assess the performance of our business, make decisions on the allocation of our resources and assess operational management. Non-IFRS measures have not been subject to audit or review and should not be considered as an indication of or alternative to an IFRS measure of financial performance.

__________________________

1 Refer to Reserves and Resource Statement issued subsequent to quarter end on 23 April 2024.

2 Other than QTSSU-A which is subject to a feasibility study. Also subject to exploration success and economic factors.

3 Assuming the mid-point outcome for each year.

4 Top of the guidance range was

5 MAC’s reports under International Financial Reporting Standards (IFRS), noting the results in this report have not been audited or reviewed. This release also includes certain non-IFRS measures including C1 costs. These measures are used internally by management to assess the performance of our business, make decisions on the allocation of our resources and assess operational management. Non-IFRS measures have not been subject to audit or review and should not be considered as an indication of or alternative to an IFRS measure of financial performance.

6 Refer to ASX announcement made on 19 March 2024.

7 Includes

View source version on businesswire.com: https://www.businesswire.com/news/home/20240429865979/en/

Mick McMullen

Chief Executive Officer

Metals Acquisition Limited.

investors@metalsacqcorp.com

Morne Engelbrecht

Chief Financial Officer

Metals Acquisition Limited.

Source: Metals Acquisition Limited