METALLA ADDS ROYALTIES ON BARRICK GOLD'S WORLD CLASS LAMA COMPLEX

Metalla Royalty & Streaming Ltd. (MTA, MTAFF) has announced a Royalty Purchase Agreement to acquire royalties on Barrick Gold Corp.'s Lama project for $7.5 million, consisting of cash and shares. The royalties include a 2.5% to 3.75% gross value return on gold and silver, and a 0.25% to 3.0% net smelter return on copper. Barrick is investing $75 million in resource definition at Lama, with promising drill results. A development decision is anticipated in 2024. This transaction enhances Metalla's exposure to a significant gold deposit, boosting potential shareholder value.

- Acquisition of valuable royalties on Barrick Gold's Lama project for $7.5 million.

- Potential increase in royalty rates based on gold production exceeding 5 Moz.

- Barrick's $75 million investment in resource definition indicates strong project potential.

- Promising mineralization discovered during drilling, enhancing exploration upside.

- Transaction subject to customary closing conditions, including Barrick's consent, which introduces uncertainty.

Insights

Analyzing...

(All dollar amounts are in United States dollars unless otherwise indicated)

VANCOUVER, BC, Dec. 12, 2022 /PRNewswire/ - Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company") (NYSE American: MTA) (TSXV: MTA) is pleased to announce it has entered into a Royalty Purchase Agreement ("RPA") with an arm's length third-party dated December 9, 2022, to acquire an existing

Brett Heath, President & CEO of Metalla, commented, "The Lama project is part of one of the largest gold deposits in the world currently being contemplated by Barrick as a standalone operation. Our royalty will provide Metalla shareholders with outstanding exposure to one of the most significant geological gold bearing trends with a substantial amount of near-term growth, exploration upside, and first in class operator." Mr. Heath continued "We are excited by the

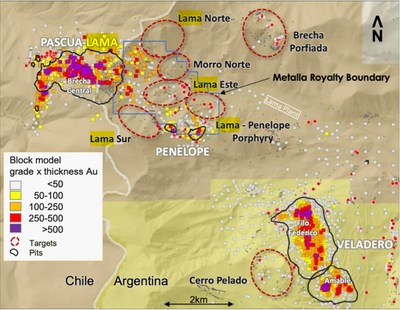

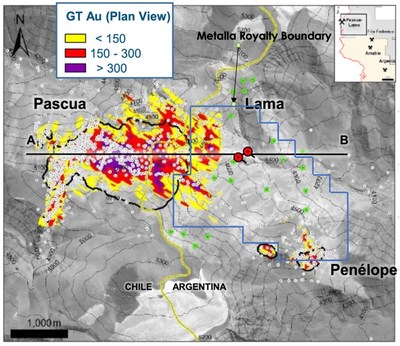

Lama is the Argentine portion of the 21Moz gold Pascua-Lama project straddling the border between Chile and Argentina. The Chilean Pascua portion has been placed into a closure process while the Argentina Lama portion, which has contained metal of 3.13 Moz gold and 236.9 Moz silver, is being considered as a standalone underground project as part of a potential Veladero-Lama complex operation. Barrick has spent over

Barrick has committed up to

The gold GVR royalty provides for an escalation feature whereby the royalty rate increases from

Penelope is a satellite pit of the greater Lama project in the southeast section of the Lama project and less than 10km from the Veladero mine which is in a

Reserve & Resource Estimate – Penelope | ||||||

Tonnes | Gold | Silver | ||||

(000's) | (g/t) | (Koz) | (g/t) | (Koz) | ||

Measured Resources | 570 | 2.7 | 51.5 | 5.2 | 95 | |

Indicated Resources | 6,870 | 2.1 | 475.1 | 6.4 | 1,425 | |

Measured & Indicated Resources | 7,450 | 2.2 | 526.6 | 6.4 | 1,520 | |

Inferred Resources | 30 | 2.2 | 2.2 | 3.4 | 3.39 | |

Metalla has agreed to pay an aggregate of

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, M.Sc., geologist and member of the Association of Professional Geoscientists of Ontario and the Ordre des Géologues du Québec and a consultant to Metalla. Mr. Beaudry is a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Metalla is a precious metals royalty and streaming company. Metalla provides shareholders with leveraged precious metal exposure through a diversified and growing portfolio of royalties and streams. Our strong foundation of current and future cash-generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

For further information, please visit our website at www.metallaroyalty.com.

ON BEHALF OF METALLA ROYALTY & STREAMING LTD.

signed "Brett Heath"

Website: www.metallaroyalty.com

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accept responsibility for the adequacy or accuracy of this release.

Notes:

- For details on the estimation of mineral resources and reserves, including the key assumptions, parameters and methods used to estimate the Mineral Resources and Mineral Reserves and technical data on the project, Canadian investors should refer to the NI 43-101 Technical Report for the Pascua Lama Project titled "Technical Report on the Pascua Lama Project" dated March 31, 2011 (the "2011 Technical Report") and on file at www.sedar.com. Production numbers and gold contained figure from pg.135.

- See Barrick February 22, 2018 Press Release.

- See Barrick Q3 2021 Results Presentation, Barrick Argentina Q3 2021 Media Day, Barrick Q1 2021 Results Presentation.

- See Barrick 2021 Annual Information Form and 2020 Annual Information Form and 2012 Barrick Gold Annual Report.

- Numbers may not add due to rounding.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability.

TECHNICAL AND THIRD-PARTY INFORMATION

Except where otherwise stated, the disclosure in this press release relating to Lama is based on information publicly disclosed by the owners or operators of this property and information/data available in the public domain as at the date hereof and none of this information has been independently verified by Metalla. Specifically, as a royalty holder, Metalla has limited, if any, access to the property subject to the royalties. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some information publicly reported by the operator may relate to a larger property than the area covered by Metalla's royalty interests. Metalla's royalty interests often cover less than

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this press release, including any references to mineral resources or mineral reserves, was prepared in accordance with Canadian National Instrument 43-101 ("NI 43-101"), which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC") applicable to U.S. domestic issuers. Accordingly, the scientific and technical information contained or referenced in this press release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

"Inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements include, but are not limited to: the satisfaction of the conditions required for the closing of the Transaction; the closing of the Transaction; the authorization by the TSX Venture Exchange and NYSE of the issuance of common shares in connection with the Transaction; statements with respect to expected construction and production at Lama, the accretive nature of and value to be derived from the Transaction, future exploration, development, production, costs, recoveries, cash flow, the profitability margins that are expected to be achieved at Lama, life of mine, relative size of mine, expansion, current and potential future estimates of mineral reserves and resources on, and other anticipated developments, achievements and economics of, Lama, and the Company's potential to become a leading gold and silver company, accumulate additional royalties and streams, future returns and future cash generation. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Metalla to control or predict, that may cause Metalla's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the risk that the parties may be unable to satisfy the closing conditions for the Transaction or that the Transaction may not be completed; the consent of Barrick being delayed, conditioned or withheld; the Company's ability to make the required payments under the RPA including the remaining

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-adds-royalties-on-barrick-golds-world-class-lama-complex-301700185.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-adds-royalties-on-barrick-golds-world-class-lama-complex-301700185.html

SOURCE Metalla Royalty and Streaming Ltd.