MassRoots, Through its Planned Acquisition of Empire Services, Inc., Poised to Benefit from Rising Metal Markets and Inflationary Pressures

MassRoots (OTCPink:MSRT) expects significant revenue growth from the acquisition of Empire Services, due to rising metal prices and inflation. Empire aims to expand by acquiring profitable metal recycling facilities. MassRoots plans to apply for uplisting to Nasdaq or NYSE American post-acquisition, potentially increasing stock visibility and liquidity. The company has implemented technology solutions enhancing efficiency and volume at Empire's facilities. Established in 2002, Empire operates 10 facilities in Virginia and North Carolina and projects continued expansion.

- Projected revenue growth from acquisition of Empire Services.

- Expected increase in profit margins due to rising metal prices.

- Plans to expand through acquisition of independent metal recycling facilities.

- Technology solutions implemented to enhance operating efficiencies.

- Potential uplisting to Nasdaq or NYSE American to improve stock visibility.

- Reliance on market conditions which may fluctuate significantly.

- Risks associated with successful integration of Empire Services.

- Forward-looking statements carry uncertainties that may affect actual outcomes.

Insights

Analyzing...

MassRoots, Inc. (“MassRoots” or the “Company”) (OTCPink:MSRT) is pleased to report that it expects Empire Services, Inc. (“Empire”) to realize significant revenue growth and higher profit margins as a result of rising metal prices and inflationary pressures. Further, Empire plans to aggressively expand its footprint over the coming weeks through the roll-up of independent, profitable metal recycling facilities.

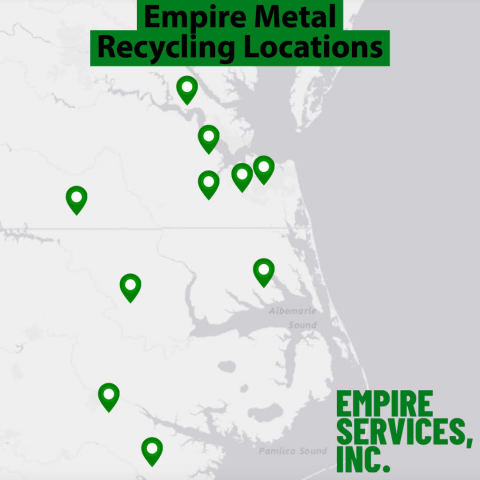

Empire Metal Recycling Locations as of June 14, 2021 (Graphic: Business Wire)

MassRoots recently entered into a Letter of Intent to acquire Empire, which is expected to result in MassRoots generating significant revenues and positive cashflows from operations. Upon closing of the Empire acquisition, the Company intends to apply to uplist to the Nasdaq Capital Market or the NYSE American Market, which MassRoots believes would result in a significant increase in visibility, liquidity, and institutional interest for its stock.

“Over the coming weeks, we plan to aggressively expand Empire’s footprint through the roll-up of independent, profitable metal recycling facilities,” stated Danny Meeks, Chairman of MassRoots. “With inflationary pressures continuing to increase and unabating demand for metals independent of a potential infrastructure investment package, we believe there will be a robust market for metals for the foreseeable future. These are the market conditions in which Empire thrives and has historically generated the highest revenues and profit margins.”

Isaac Dietrich, Chief Executive Officer of MassRoots added, “We have implemented several technology solutions that have already increased metal volumes and operating efficiencies at Empire’s existing facilities. These include a cloud-based ERP system, a corporate website with live metal prices, and in the very near future, an instant online quoting system for people looking to sell their junk cars. The planned closing of the Empire acquisition is proceeding on schedule and I believe will be transformative for the more than 30,000 loyal and supportive MassRoots shareholders.”

Established in 2002, Empire operates 10 metal recycling facilities in Virginia and North Carolina and expects to continue expanding its footprint in the coming weeks. It has historically generated higher profit margins when market prices for metal rise.

About MassRoots

MassRoots, Inc. (OTC Pink: MSRT) is a leading technology company which aims to deliver quality information and create operating efficiencies through cloud-based solutions. MassRoots has been covered by CNBC, CNN, Financial Times, Wall Street Journal, New York Times, Reuters, and the Associated Press.

About Empire Services

Established in 2002, Empire Services, Inc. operates 10 metal recycling facilities in Virginia and North Carolina and expects to continue expanding its footprint in the coming quarters. Empire is headquartered in Virginia and has approximately 65 employees as of June 2021.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These include, without limitation, statements about expected closing of Empire acquisition, the future revenues of the Company, the future synergy between the Company and Empire’s business, and the listing on a senior exchange. These statements are identified by the use of the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project” and similar expressions that are intended to identify forward-looking statements. All forward-looking statements speak only as of the date of this press release. You should not place undue reliance on these forward-looking statements. Although we believe that our plans, objectives, expectations, and intentions reflected in or suggested by the forward-looking statements are reasonable, we can give no assurance that these plans, objectives, expectations or intentions will be achieved. Forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from historical experience and present expectations or projections. Actual results may differ materially from those in the forward-looking statements and the trading price for our common stock may fluctuate significantly. Forward-looking statements also are affected by the risk factors described in our filings with the U.S. Securities and Exchange Commission. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210614005188/en/