Grid Metals Receives Positive Engineering Study; Primero Report Outlines Viability and Costs of Reconfiguring True North Mill for Lithium Processing

- Grid Metals Corp. receives positive scoping-level mill reconfiguration study for the True North Mill, giving confidence to move forward with the mill lease agreement. Mill capacity estimated at 450,000 tpa of lithium feed, with initial capex of C$50 million. Grid is targeting production of ~75,000 tpa of spodumene concentrate from True North.

- None.

Insights

Analyzing...

TORONTO, ON / ACCESSWIRE / October 25, 2023 / Grid Metals Corp. (TSXV:GRDM)(OTCQB:MSMGF) ("Grid" or the "Company") is pleased to announce the receipt of a scoping-level mill reconfiguration study (the 'Study') completed by Primero Group for the True North Mill located in Bissett, Manitoba. The Study examined the viability and costing of reconfiguring the existing True North gold mill in order to process lithium ore from Grid's Donner Lake property to produce a saleable lithium concentrate. The Primero Study outlined best-in-class capital intensity and quantified operating costs, giving Grid the confidence to move forward with the mill lease. As a result of the positive findings, Grid is proceeding with the lease agreement with 1911 Gold Corporation - the owner of the True North Mill. Grid's objective of entering into the lease is to be one of the next producing lithium companies in North America.

Background and Primero Mandate

Grid retained Primero Group, a global leader in lithium process engineering, in July 2023 to complete a scoping-level review of reconfiguring the existing mill to produce spodumene concentrate from Donner Lake feed. The mandate included:

- Developing a processing flow sheet for the mill based on a new round of concurrent metallurgical testwork and determining overall viability of the mill reconfiguration

- Developing a modified plant layout

- Determining electrical power requirements and an equipment list for the mill

- Determining capital ('capex') and operational ('opex') expenditure costs for the mill

- Generating a conceptual mass balance for the lithium spodumene processing circuit

- Estimating the scope and cost for a feasibility level study for the mill reconfiguration

Highlights of the Study include:

- Mill capacity was estimated at 450,000 tonnes per annum (' tpa') of lithium feed for the production of spodumene concentrate, assuming

90% mill availability. This compares favourably to the stated nominal annual capacity of the current mill configuration of 475,000 tonnes. Note that the current mineral resource estimate at the Donner Lake property, announced on July 18, 2023, is 6.8 million tonnes grading1.39% Li2O. - An optimal grind size of 125 microns was determined (see testwork below). Existing mill grinding capacity was not considered a constraint on throughput.

- Initial capex for the mill reconfiguration is estimated at C

$50 million which includes a30% contingency. This includes capex relating to crushing, grinding, mica flotation, magnetic separation, spodumene flotation, concentrate handling, and tailings handling. Existing infrastructure and utility connections will be used. Capex includes the addition of magnetic separation and mica flotation circuits required to produce a marketable spodumene concentrate. - The processing cost was estimated at C

$34.81 /t processed and G&A was estimated at C$17.73 /t processed. This equates to total milling costs of C$316.14 /t spodumene concentrate produced. Labour and reagents made up42% and32% , respectively, of the processing cost. Primero has identified opportunities to reduce G&A costs. - Primero recommended a value engineering phase to complete further trade-off studies and optimization of the True North Mil for a cost of C

$400,000 0. - Primero gave an estimate for an Engineering, Procurement and Construction Management ('EPCM') study at a feasibility-level design at approximately C

$1.6 million .

Testwork Program Completed to Support Primero Study

- A metallurgical test program was completed by XPS Process Solutions Laboratories (Falconbridge, Ontario) during the course of the Primero study to support the design of the mill circuit.

- The new metallurgical test program resulted in ~

70% recoveries using the new flow sheet. The recovery is subject to the mill receiving a crushed (to ~20 microns) and sorted product. The met work aligns well with prior metallurgical test work completed by the XPS lab earlier this year that achieved recoveries of ~75% (see Grid Metals' June 26, 2023 press release). - The new metallurgical testing produced a marketable spodumene concentrate with a grade of

5.5% Li2O and a low iron content of1.4% Fe2O3.

Robin Dunbar, CEO of Grid Metals, commented, "The work completed by Primero has outlined a low capital intensity project and has quantified operating and capital costs. This study gives us confidence to move forward with the lease agreement for the True North Mill. The True North Lease Agreement gives Grid access to a permitted mill and tailings facility within trucking distance of our Donner Lake lithium resource. We believe that with the True North Mill lease, the Donner Lake lithium project can be one of the next producing lithium projects in North America. We are moving ahead with further permitting, engineering and study work to advance our Donner Lake lithium project towards near-term production. We are conceptually targeting production of ~ 75,000 tpa of spodumene concentrate from True North based on 450,000 tonnes throughput and

True North Mill Overview

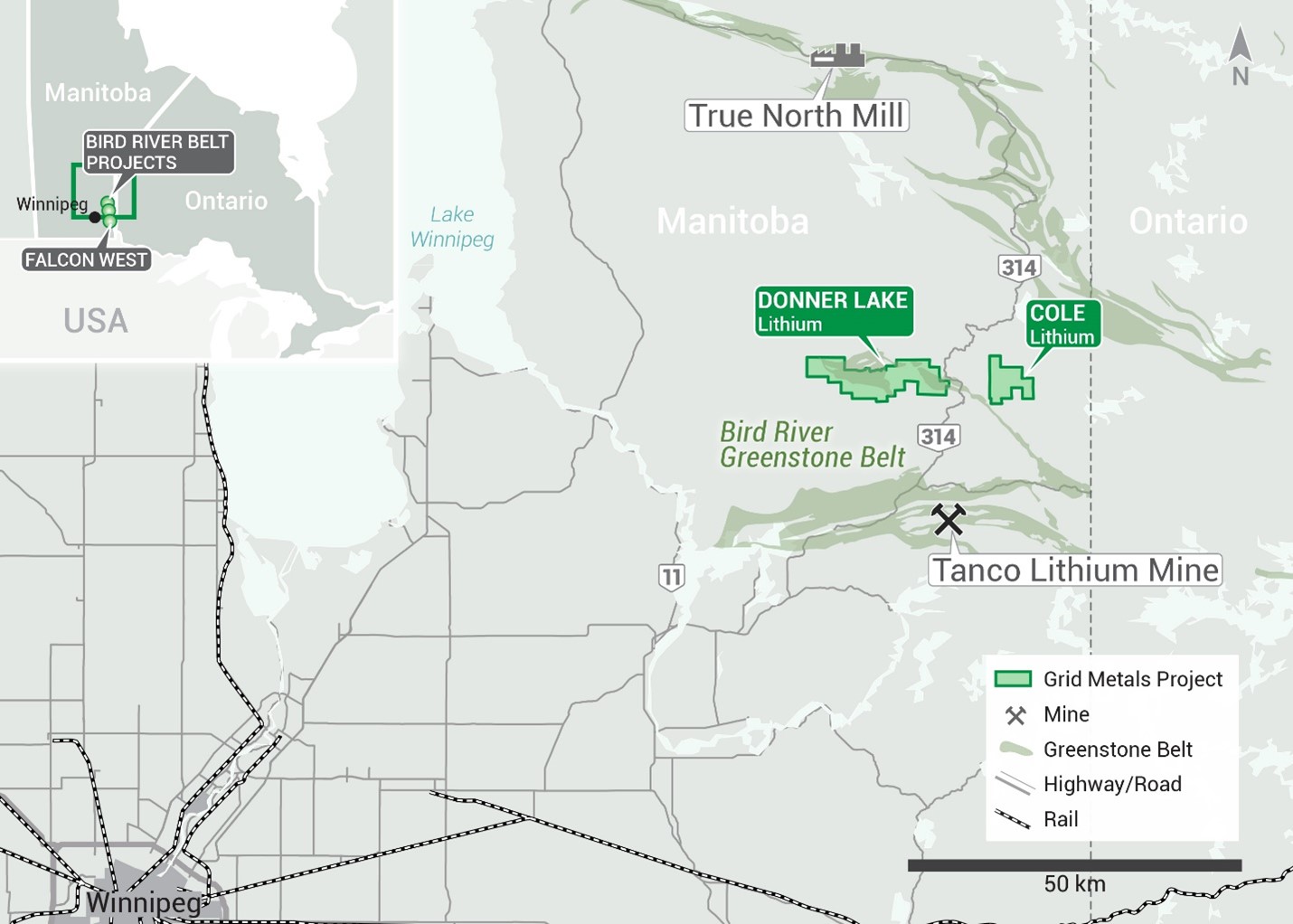

The True North mill, located in Bissett, Manitoba, sits approximately 85 km by existing all-weather road from the Donner Lake Lithium Project (see Figure 1). The project site boasts excellent infrastructure (see Figure 2) including an assay lab, large workshop, and camp facilities along with the recently idled processing facility and tailings management area. The mill was last operational in November 2022 when it was used to reprocess gold tailings. The current processing facility consists of crushing, milling, centrifugal gravity concentration and flotation circuits.

As part of its due diligence for the Donner Lake project, Grid commissioned a separate study on the tailings facility at True North focused on estimating both future capacity and engineering work required to utilize the existing tailings facility for future deposition from the reconfigured mill. The study determined that the existing tailings facility was sufficient to move ahead with the project.

Lease Agreement for True North Mill

On the basis of the positive Primero study, Grid is proceeding with the Lease Agreement for the True North Mill (the "Lease") that was announced on July 18, 2023. The Lease is subject to certain amendments that reduce the near-term cash funding requirements from Grid. The Lease included a due diligence period that was extended to October 24, 2023 by the mutual agreement of Grid and 1911 Gold Corporation. The initial payment under the Lease of C

The initial lease term is five years followed by a two-year notice period for cancellation and including an option to extend the lease, by mutual agreement, for an additional five years. The lease agreement provides Grid with the right to use the mill to process lithium feed and to reconfigure the existing mill. The Lessor has the right to utilize the mill to process gold ore in the future under certain terms and conditions during the term of the lease subject to bearing the capital and operating costs thereof.

Under the terms of the lease, following the payment of C

Permitting of Mining and Milling Operations - Grid is pursuing a two-stage permitting process for the Donner Lake lithium project. An Advanced Exploration Permit ('AEP') application (announced on August 2, 2023) has been submitted by Grid. The permit application, when approved, will enable extraction of a bulk sample of up to 10,000 tonnes from the Donner Lake site. The second permitting step is an application for an Environmental Act Licence (mining permit) which is expected to be submitted to the provincial regulators in 2024. The True North Mill will require an amendment to its existing permits in order to enable the processing of lithium feed and use of the tailings facility.

Qualified Persons Statements

The Grid Metals Donner Lake project 2023 Mineral Resource Estimate was prepared by Mr. Rohan Millar, P.Geo., of SGS Geological Services, an Independent Qualified Person, in accordance with the guidelines of the Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), with an effective date of the 27th June, 2023.

The Primero Study was authored by Ian Holl, P Eng., an employee of Primero Group Americas.

Dr. Dave Peck, P.Geo., has reviewed and approved the technical content of this release for purposes of National Instrument 43-101.

About Grid Metals Corp.

Grid Metals is focused on its Donner Lake Lithium Project located in the Bird River greenstone belt in southeastern Manitoba, approximately 150 km northeast of Winnipeg Manitoba. Grid has a

On Behalf of the Board of Grid Metals Corp.

For more information about the Company, please see the Company website at www.gridmetalscorp.com or contact:

Robin Dunbar - President, CEO & Director - rd@gridmetalscorp.com Tel: 416 955-4773

Brandon Smith - Chief Development Officer - bsmith@gridmetalscorp.com

David Black - Investor Relations - info@gridmetalscorp.com

We seek safe harbour. This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, "forward-looking statements"). Such forward-looking statements include the Company's closing of the proposed financial transactions, sale of royalty and property interests. the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward- looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company's Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This news release does not constitute an offer of securities for sale in the United States. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States absent U.S. registration or an applicable exemption from U.S. registration requirements.

SOURCE: Grid Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/796338/grid-metals-receives-positive-engineering-study-primero-report-outlines-viability-and-costs-of-reconfiguring-true-north-mill-for-lithium-processing