Grid Metals Corp. Files National Instrument 43-101 Technical Report for MM Copper/Nickel Project in Southeastern Manitoba

Grid Metals Corp. (TSXV: GRDM, OTCQB: MSMGF) announced the filing of a National Instrument 43-101 Technical Report for its MM Project in southeastern Manitoba. The project, consisting of the Makwa and Mayville deposits, contains substantial metal resources: 317 million pounds of copper, 263 million pounds of nickel, and 452,000 ounces of precious metals in indicated open pit categories. Exploration drilling is planned for the New Manitoba deposit, with permits applied and financing secured. The project aims to increase contained tonnage to 75-100 million tonnes with similar or higher grades. The resources are conventional sulphide metal deposits, suitable for marketable nickel and copper concentrates. The MM Project could significantly contribute to the North American EV supply chain, aligning with the Inflation Reduction Act. The technical report was prepared by qualified persons from Micon International

- Filing of National Instrument 43-101 Technical Report enhances transparency and compliance.

- Substantial metal resources: 317 million pounds of copper, 263 million pounds of nickel, and 452,000 ounces of precious metals in indicated open pit categories.

- Exploration drilling planned for the New Manitoba deposit, aiming to increase contained tonnage to 75-100 million tonnes.

- The MM Project aligns with North American EV supply chain needs, potentially benefiting from the Inflation Reduction Act.

- Existing working capital will finance the exploration program, ensuring financial stability.

- No immediate revenue generation from the exploration phase.

- Potential risks associated with exploration drilling and the accuracy of resource estimates.

TORONTO, ON / ACCESSWIRE / June 24, 2024 / Grid Metals Corp. (TSXV:GRDM)(OTCQB:MSMGF) ("Grid" or the "Company") today announced that it has filed on SEDAR the technical report for the updated Mineral Resource Estimate ("MRE") for its copper/nickel MM Project in (previously "Makwa Mayville") Project in southeastern Manitoba, prepared in accordance with CIM (2019) Best Practice Guidelines.

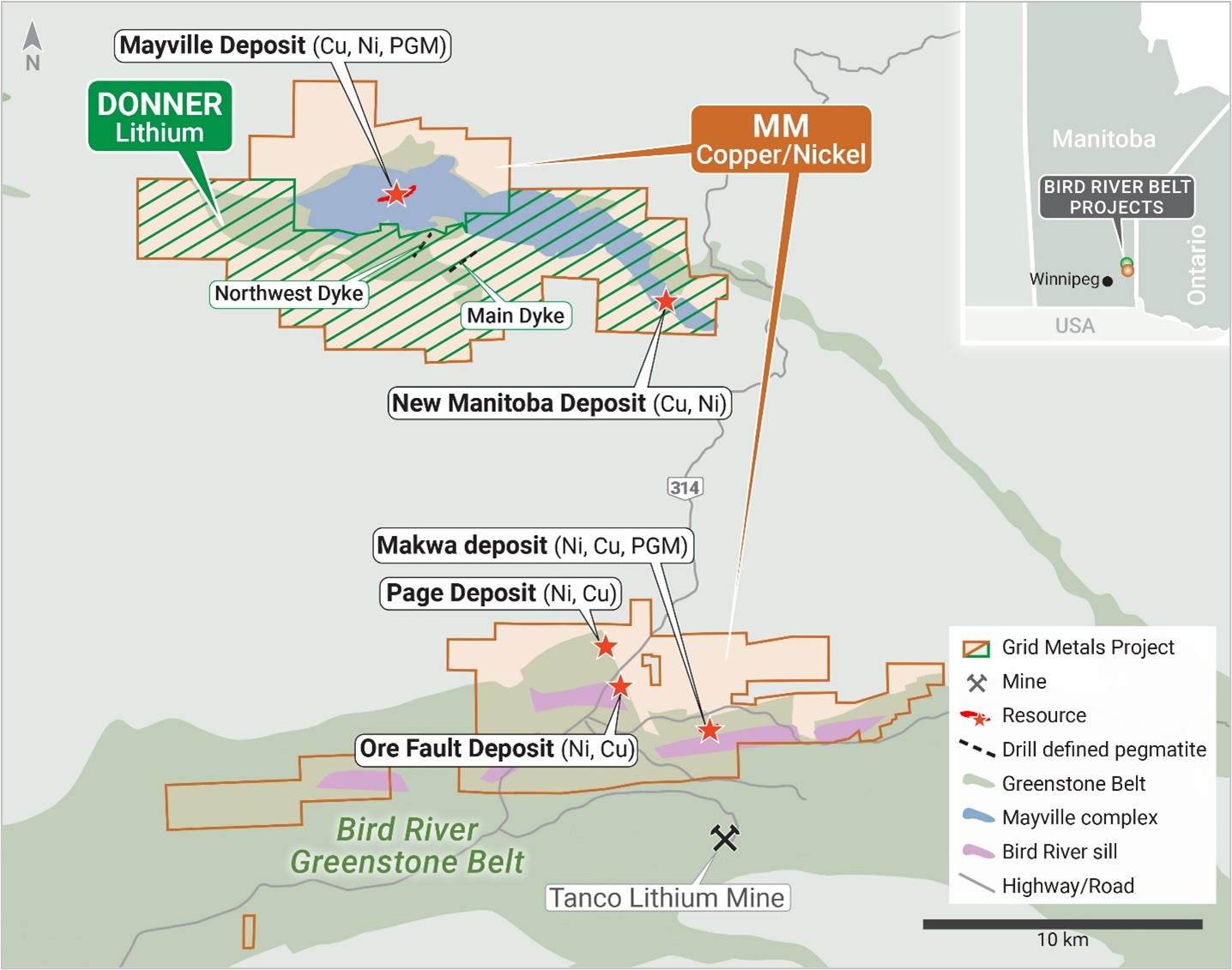

The MM Project resource comprises two separate deposits, located approximately 35 km apart, and approximately 145 kilometres from Winnipeg, the capital of Manitoba. Makwa is a nickel dominant resource with palladium, platinum and copper credits while Mayville is a copper dominant deposit with significant nickel content as well as platinum group metals. Contained metal content in the indicated open pit category includes 317 million pounds of copper, 263 million pounds of nickel and 452,000 ounces of precious metals ( palladium, platinum and gold). Details of the MRE were contained in the press release of Grid Metals Corp. dated May 6, 2024 and in Table 1A and Table 2 following.

Exploration Drilling Planned - The Company has applied for exploration drill permits in order to enable exploration drilling at the Mayville Property in the area of and along strike of the historical New Manitoba deposit - one of three deposits acquired in the MM Project area which are not part of the current resource. Historical drilling at the New Manitoba yielded copper-nickel-cobalt mineralization with similar metal ratios to that of the Mayville Deposit, also located along the northern arm of the Bird River Greenstone Belt. The exploration program will be financed by existing working capital of the Company and is scheduled to commence during the third quarter of 2024.

The exploration target/model at MM is to increase the contained tonnage to a range between 75 and 100 million tonnes with similar or higher grade to the current resource. The current resources are conventional sulphide metal deposits which have had extensive metallurgical testwork completed which has demonstrated their ability to produce marketable nickel and copper concentrates that contain associated precious metal by-products. The Company is of the view that there is a scarcity of North American domiciled nickel deposits ( in particular ) with attractive grade/tonnage and capital intensity metrics that can be developed to supply future demand for nickel required in response to the Inflation Reduction Act ( United States ). Located in the attractive ESG friendly mining jurisdiction of Manitoba Canada , the MM Project has the potential to become an important contributor to the North American EV supply chain.

Qualified Persons Statements

The Grid Metals' MM Project 2024 Mineral Resource Estimate with an effective date of December 31, 2023 was prepared by Messrs. Alan J. San Martin, MAusIMM (CP) and Charley Murahwi, P.Geo. from Micon International Limited, both of whom are Independent Qualified Persons in accordance with the guidelines of the Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Dr. Dave Peck, P.Geo., is the Qualified Person for purposes of National Instrument 43-101 and has reviewed and approved the technical content of this release.

About Grid Metals Corp.

Grid Metals is focused on both lithium and copper/nickel projects in the Bird River area, approximately 150 km northeast of Winnipeg Manitoba. The Donner Lithium project is a

All of the Company's southeastern Manitoba projects are located on the Traditional Lands of the Sagkeeng First Nation with whom the Company maintains an Exploration Agreement.

Resource Estimate

The updated mineral resource estimate for the MM Project is provided in Tables 1 and 2, below.

Table 1A. Mayville Pit Constrained and Underground Resource as of December 31, 2023.

Mining | Category | Tonnage | Density | CuEq | Cu | Ni | Co | Pd | Pt | Au | SR |

|---|---|---|---|---|---|---|---|---|---|---|---|

% | % | % | % | g/t | g/t | g/t | |||||

OP | Indicated | 32,019,000 | 3.00 | 0.61 | 0.40 | 0.16 | 0.01 | 0.13 | 0.05 | 0.05 | 3.17 |

Inferred | - | - | - | - | - | - | - | - | - | ||

UG | Indicated | 322,461 | 3.00 | 1.62 | 0.96 | 0.37 | 0.02 | 0.19 | 0.08 | 0.11 | NA |

Inferred | 203,323 | 3.00 | 1.50 | 0.96 | 0.32 | 0.02 | 0.16 | 0.08 | 0.11 |

*SR = strip ratio

Table 1B. Makwa Pit Constrained and Underground Resources as of December 31, 2023

Mining | Category | Zone | Tonnage | Density | NiEq | Ni | Cu | Co | Pd | Pt | SR |

|---|---|---|---|---|---|---|---|---|---|---|---|

% | % | % | % | g/t | g/t | ||||||

OP | Indicated | HG1 | 4,846,590 | 2.94 | 1.26 | 0.89 | 0.17 | 0.03 | 0.71 | 0.19 | 4.66 |

LG1 | 9,370,784 | 2.88 | 0.48 | 0.28 | 0.08 | 0.01 | 0.19 | 0.06 | |||

HG1 + LG1 | 14,217,374 | 2.90 | 0.75 | 0.48 | 0.11 | 0.02 | 0.37 | 0.10 | |||

Inferred | LG1 | 18,000 | 2.88 | 0.36 | 0.23 | 0.04 | 0.01 | 0.11 | 0.04 | ||

UG | Indicated | HG1 | 437,743 | 2.94 | 1.19 | 0.83 | 0.11 | 0.03 | 0.73 | 0.21 | NA |

LG1 | 62,783 | 2.88 | 0.53 | 0.30 | 0.08 | 0.01 | 0.27 | 0.08 | |||

HG1 + LG1 | 500,526 | 2.93 | 1.11 | 0.77 | 0.11 | 0.02 | 0.67 | 0.19 | |||

Inferred | HG1 + LG1 | - | - | - | - | - | - | - | - |

*SR = strip ratio

Notes to Accompany the Makwa and Mayville Resource Estimate:

- The effective date of this Mineral Resource Estimate is December 31, 2023.

- The MRE presented above uses economic assumptions for both, surface mining and underground mining.

- The MRE has been classified in the Indicated and Inferred categories following spatial grade continuity analysis and geological confidence.

- The calculated cut-off grades to report the MRE are dynamic in nature following metallurgical recovery curves, the average COG for Makwa is 0.30 % Ni in surface mining and 0.84 % Ni in underground mining, for Mayville is 0.30 % Cu in surface mining and 1.37 % Cu in underground mining.

- The economic parameters used metal prices of US

$9.0 /lb Ni, US$3.75 /lb Cu, US$23.0 /lb Co, US$900 /oz Pt, US$1,400 /oz Pd and US$1,750 /Au with specific metallurgical recovery curves detailed in tables 4.14 and 14.15 of the technical report (copper recoveries of87% to high grade copper concentrate (28% ) & nickel recoveries range from50% to68% to10% nickel concentrate at Mayville and 50-68% nickel recovery to10% nickel concentrate based on average grades and over70% recovery for highest grade (+1% Ni) blocks at Makwa), a mining cost of US$3.5 /t in surface and US$80.0 /t in underground. Processing cost of US$15 /t and a General & Administration cost of US$3.2 /t. - For surface mining the open pits at Makwa and Mayville use a slope angle of 53°.

- The block models for Makwa and Mayville are rotated and use a block size of 10 m x 5 m x 5 m with the narrow side across strike (North-South).

- The open pit optimization uses a re-blocked size of 10 m x 10 m x 10 m and for the underground the optimization uses stopes of 20 m long by 20 m high and a minimum mining width of 3 m.

- Messrs. Alan J. San Martin, MAusIMM(CP) and Charley Murahwi, P.Geo. from Micon International Limited are the Qualified Persons (QPs) for this Mineral Resource Estimate (MRE).

- Mineral resources unlike mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The mineral resources have been estimated in accordance with the CIM Best Practice Guidelines (2019) and the CIM Definition Standards (2014).

- Totals may not add correctly due to rounding.

- Equivalent (Eq) Grade Calculations: (a) Makwa NiEq = Ni% + ((Cu% x CuR x CuP) + (Co% x CoR x CoP) + (Pt g/t x PtR x PtP) + (Pd g/t x PdR x PdP))/(NiR x NiP); (b) Mayville CuEq* = Cu% + ((Ni% x NiR x NiP) + (Co% x CoR x CoP) + (Pt g/t x PtR x PtP) + (Pd g/t x PdR x PdP) + (Au g/t x AuR x AuP))/(CuR x CuP). NiEQ = nickel equivalent grade. R = metal recovery. P = metal price.

- The Mayville CuEq calculation assumes the production of separate Cu and Ni concentrates.

- Metallurgical recoveries range as follows using input grades at the cutoff grade (low end) and 2 times the average open pit resource grade (high end): Makwa: Ni: 36 to

86% ; Cu:85.6% (invariant); Co: fixed to nickel recoveries; Pd: 59 to90% (capped); Pt: 39 to90% (capped); Mayville: For the copper concentrate model :Cu: 86.5 to86.9% ; Ni:5% (fixed); Co: (5% - fixed to nickel recovery); Pd:42% (fixed); Pt:35% (fixed); Co:30% (fixed); For the nickel concentrate model: Cu:5% (fixed); Ni: 42 to69% ;Co: matches nickel recoveries; Pd:33% ; Pt:21% ; Au:10% .

Table 2. Contained Metal Values for the Open Pit Resources at the Makwa and Mayville Properties (Indicated Category only)

Deposit | CuEq | NiEq | Cu | Ni | Co | Pd | Pt | Au |

(t) | (t) | (t) | (t) | (t) | koz | koz | koz | |

| Mayville | 195,316 | - | 128,076 | 51,230 | 3,202 | 134 | 51 | 51 |

| Makwa | - | 106,630 | 15,639 | 68,243 | 2,843 | 169 | 46 | - |

| Combined | 195,316 | 106,630 | 143,715 | 119,474 | 6,045 | 303 | 97 | 51 |

Deposit | CuEq | NiEq | Cu | Ni | Co | Pd | Pt | Au |

lbs | lbs | lbs | lbs | lbs | oz | oz | oz | |

| Mayville | 430,597,339 | - | 282,358,911 | 112,943,564 | 7,058,973 | 133,826 | 51,472 | 51,472 |

| Makwa | - | 235,079,303 | 34,478,298 | 150,450,754 | 6,268,781 | 169,127 | 45,710 | - |

| Combined | 430,597,339 | 235,079,303 | 316,837,209 | 263,394,318 | 13,327,754 | 302,953 | 97,182 | 51,472 |

On Behalf of the Board of Grid Metals Corp.

For more information about the Company, please see the Company website at www.gridmetalscorp.com or contact:

Robin Dunbar - President, CEO & Director Telephone: 416-955-4773 Email: rd@gridmetalscorp.com

Brandon Smith - Chief Development Officer - bsmith@gridmetalscorp.com

David Black - Investor Relations Email: info@gridmetalscorp.com

We seek safe harbour. This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, "forward-looking statements"). Such forward-looking statements include the Company's closing of the proposed financial transactions, sale of royalty and property interests. the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward- looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company's Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

SOURCE: Grid Metals Corp.

View the original press release on accesswire.com