Meridian Reports High-Grade Assay Results & New Geophysical Targets at Santa Helena

Meridian Mining UK. S (TSX:MNO, OTCQX:MRRDF) has reported high-grade assay results from its Santa Helena Au-Cu-Ag & Zn VMS deposit in Brazil. Key highlights include:

- CD-574: 15.9m @ 3.9g/t AuEq / 2.6% CuEq from 58.2m, including 5.5m @ 9.0g/t AuEq / 6.0% CuEq from 60.1m

- CD-556: 22.4m @ 3.2g/t AuEq / 2.2% CuEq from 9.2m, including 5.5m @ 7.8g/t AuEq / 5.2% CuEq from 21.3m

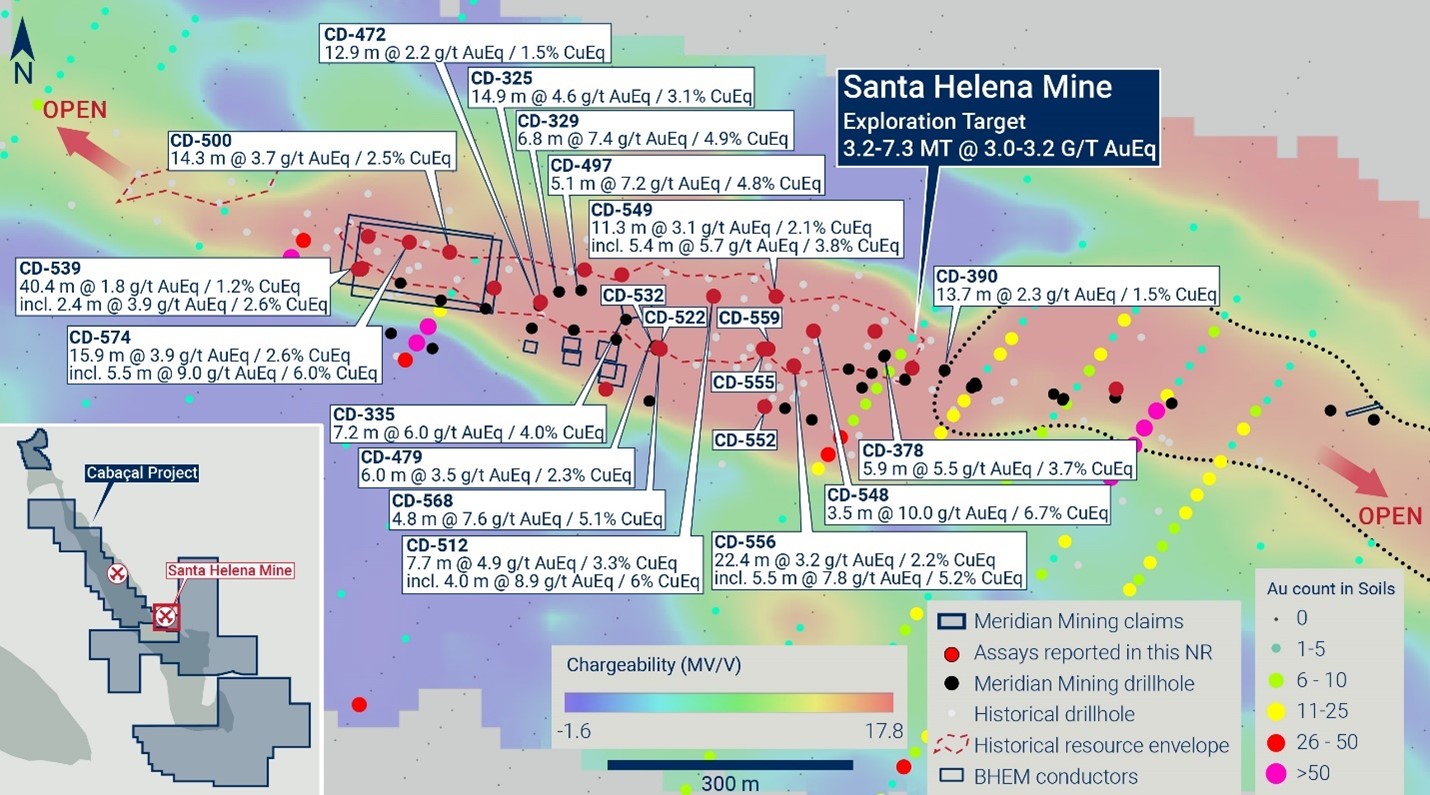

The results extend and infill Santa Helena's high-grade continuous mineralization and will be included in the pending resource estimate in Q4 2024. Geophysical programs have also identified potential targets for blind extensions to the main mineralized trend.

The company's CEO, Gilbert Clark, stated that these results confirm the over 1.0km continuity of the host sulphide mineralization and its potential to convert into their next high-grade open pitable deposit.

Meridian Mining UK. S (TSX:MNO, OTCQX:MRRDF) ha riportato risultati di analisi ad alta legge dal suo deposito VMS Santa Helena Au-Cu-Ag & Zn in Brasile. I punti salienti includono:

- CD-574: 15.9m @ 3.9g/t AuEq / 2.6% CuEq da 58.2m, inclusi 5.5m @ 9.0g/t AuEq / 6.0% CuEq da 60.1m

- CD-556: 22.4m @ 3.2g/t AuEq / 2.2% CuEq da 9.2m, inclusi 5.5m @ 7.8g/t AuEq / 5.2% CuEq da 21.3m

I risultati estendono e riempiono la mineralizzazione continua ad alta legge di Santa Helena e saranno inclusi nella stima delle risorse in sospeso nel Q4 2024. I programmi geofisici hanno anche identificato potenziali obiettivi per estensioni cieche alla principale tendenza mineralizzata.

Il CEO dell'azienda, Gilbert Clark, ha dichiarato che questi risultati confermano la continuità della mineralizzazione solfidica ospite per oltre 1.0 km e il suo potenziale per essere convertita nel prossimo deposito ad alta legge adatto all'escavazione mediante open pit.

Meridian Mining UK. S (TSX:MNO, OTCQX:MRRDF) ha reportado resultados de análisis de alta ley de su depósito VMS Santa Helena Au-Cu-Ag & Zn en Brasil. Los puntos destacados incluyen:

- CD-574: 15.9m @ 3.9g/t AuEq / 2.6% CuEq desde 58.2m, incluyendo 5.5m @ 9.0g/t AuEq / 6.0% CuEq desde 60.1m

- CD-556: 22.4m @ 3.2g/t AuEq / 2.2% CuEq desde 9.2m, incluyendo 5.5m @ 7.8g/t AuEq / 5.2% CuEq desde 21.3m

Los resultados extienden y rellenan la mineralización continua de alta ley de Santa Helena y serán incluidos en la estimación de recursos pendiente en el Q4 2024. Los programas geofísicos también han identificado objetivos potenciales para extensiones ciegas a la tendencia mineralizada principal.

El CEO de la empresa, Gilbert Clark, declaró que estos resultados confirman la continuidad de la mineralización de sulfuros hospedantes por más de 1.0 km y su potencial para convertirse en su próximo depósito de alta ley adecuado para minería a cielo abierto.

Meridian Mining UK. S (TSX:MNO, OTCQX:MRRDF)는 브라질의 Santa Helena Au-Cu-Ag & Zn VMS 매장에서 고품질 분석 결과를 보고했습니다. 주요 하이라이트는 다음과 같습니다:

- CD-574: 58.2m에서 15.9m @ 3.9g/t AuEq / 2.6% CuEq, 60.1m에서 5.5m @ 9.0g/t AuEq / 6.0% CuEq 포함

- CD-556: 9.2m에서 22.4m @ 3.2g/t AuEq / 2.2% CuEq, 21.3m에서 5.5m @ 7.8g/t AuEq / 5.2% CuEq 포함

결과는 Santa Helena의 고품질 지속적인 광물화를 확장 및 보완하며, 2024년 4분기에 예정된 자원 추정치에 포함될 것입니다. 지구물리학 프로그램은 또한 주요 광물화 경향에 대한 맹목적인 확장 잠재적 목표를 식별했습니다.

회사의 CEO인 길버트 클락(Gilbert Clark)은 이 결과가 호스트 황화물 광물화의 1.0km 이상의 연속성을 확인하고, 이를 통해 다음의 고품질 오픈핏 채굴 가능성을 갖춘 매장으로 전환할 수 있는 잠재력을 가지고 있다고 말했습니다.

Meridian Mining UK. S (TSX:MNO, OTCQX:MRRDF) a rapporté des résultats d'analyse de haute qualité de son gisement VMS Santa Helena Au-Cu-Ag & Zn au Brésil. Les points clés incluent :

- CD-574 : 15.9m @ 3.9g/t AuEq / 2.6% CuEq à partir de 58.2m, incluant 5.5m @ 9.0g/t AuEq / 6.0% CuEq à partir de 60.1m

- CD-556 : 22.4m @ 3.2g/t AuEq / 2.2% CuEq à partir de 9.2m, incluant 5.5m @ 7.8g/t AuEq / 5.2% CuEq à partir de 21.3m

Les résultats prolongent et complètent la minéralisation continue de haute qualité de Santa Helena et seront inclus dans l'estimation des ressources en attente pour le Q4 2024. Des programmes géophysiques ont également identifié des cibles potentielles pour des extensions invisibles de la tendance minéralisée principale.

Le PDG de l'entreprise, Gilbert Clark, a déclaré que ces résultats confirment la continuité de plus de 1.0 km de la minéralisation sulfureuse hôte et son potentiel à être convertie en leur prochain gisement ouvert de haute qualité.

Meridian Mining UK. S (TSX:MNO, OTCQX:MRRDF) hat Ergebnisse von Hochgradanalysen aus seinem Santa Helena Au-Cu-Ag & Zn VMS-Vorkommen in Brasilien gemeldet. Die wichtigsten Höhepunkte sind:

- CD-574: 15.9m @ 3.9g/t AuEq / 2.6% CuEq aus 58.2m, einschließlich 5.5m @ 9.0g/t AuEq / 6.0% CuEq aus 60.1m

- CD-556: 22.4m @ 3.2g/t AuEq / 2.2% CuEq aus 9.2m, einschließlich 5.5m @ 7.8g/t AuEq / 5.2% CuEq aus 21.3m

Die Ergebnisse erweitern und ergänzen die hochgradige kontinuierliche Mineralisierung von Santa Helena und werden in die ausstehende Ressourcenschätzung im Q4 2024 einfließen. Geophysikalische Programme haben auch potenzielle Ziele für blinde Extensions zur Hauptmineralisierungstrend identifiziert.

Der CEO des Unternehmens, Gilbert Clark, erklärte, dass diese Ergebnisse die über 1.0 km lange Kontinuität der Wirtsulfidmineralisierung bestätigen und ihr Potenzial zur Umwandlung in deren nächstes hochgradiges, aufgeschlossenes Abbaugebiet aufzeigen.

- High-grade assay results from Santa Helena deposit, including 15.9m @ 3.9g/t AuEq / 2.6% CuEq from 58.2m

- Results extend and infill high-grade continuous mineralization

- Pending resource estimate scheduled for Q4 2024

- Geophysical programs identified potential targets for blind extensions

- Confirmation of over 1.0km continuity of host sulphide mineralization

- Potential for conversion into high-grade open pitable deposit

- None.

CD-574 returns high-grade core of 5.5m @ 9.0g/t AuEq /

LONDON, UK / ACCESSWIRE / September 23, 2024 / Meridian Mining UK. S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to announce several of the strongest results to date from its Santa Helena Au-Cu-Ag & Zn VMS deposit ("Santa Helena"), part of the greater Au-Cu Cabaçal Project ("Cabaçal"), in the state of Mato Grosso, Brazil. High-grade highlights include CD-574, returning 15.9m @ 3.9g/t AuEq /

Highlights Reported Today

Meridian's Santa Helena drill program reports continued high-grade Au-Cu-Ag & Zn mineralization;

Meridian intercepts more shallow high-grade Au-Cu-Ag & Zn mineralization at Santa Helena;

CD-574: 15.9m @ 3.9g/t AuEq /

2.6% CuEq from 58.2m; Including:5.5m @ 9.0g/t AuEq /

6.0% CuEq from 60.1m;

CD-556: 22.4m @ 3.2g/t AuEq /

2.2% CuEq from 9.2m; Including:5.5m @ 7.8g/t AuEq /

5.2% CuEq from 21.3m ;

CD-512: 7.7m @ 4.9g/t AuEq /

3.3% CuEq from 61.1m; Including:4.0m @ 8.9g/t AuEq /

6.0% CuEq from 61.6m;

CD-549: 11.3m @ 3.1g/t AuEq /

2.1% CuEq from 43.4m; Including:5.4m @ 5.7g/t AuEq /

3.8% CuEq from 43.4m;

CD-548: 3.5m @ 10.0g/t AuEq /

6.7% CuEq from 47.6m;CD-568: 4.8m @ 7.6g/t AuEq /

5.1% CuEq from 48.0m;

Santa Helena's geophysical program has outlined near-mine open upside to test; and

Open targets to test for potential massive sulphide extensions defined by Mise-à-la-Masse, new BHEM tool, and surface surveys.

See technical note for true thickness estimate and separate AuEq and CuEq equations.

Mr. Gilbert Clark, CEO, comments: "This strong flow of high-grade gold, copper, silver and zinc assays from shallow depths at Santa Helena, confirms the over 1.0km continuity of the host sulphide mineralization, as does its potential to convert into our next high-grade open pitable deposit. I'm pleased with Santa Helena's advance with the resource estimate scheduled for the fourth quarter, while the ongoing mining and engineering studies are placing it into our Hub and Spoke development pipeline. The tailored geophysical programs over Santa Helena have outlined some new, near-mine extensional targets and also provided a set of targeting parameters to explore the greater belt for similar but "blind" massive sulphide mineralization, allowing us to more accurately target Cabaçal's upside."

Santa Helena Drill Results

Santa Helena's drilling has delivered a steady flow of gold, copper, silver zinc and some lead mineralization, consolidating the footprint of the deposit's western, central and eastern sectors. The geometry, depth, continuity and robust grades of the mineralization to date indicate that Santa Helena's potential to host open pitable resources continues to be maintained. Drilling remains in progress to characterize the western limit of the deposit, where CD-574 returned 15.9m @3.9g/t AuEq /

Drilling was also directed further to the west, where lower angle oblique holes are necessary due to access constraints. CD-539 returned 40.4m @ 1.8g/t AuEq /

Similar important results have been delivered over the shallower up-plunge sector of the deposit to the east, with results from CD-556 highlighting the presence of mineralization at shallow depths, returning 22.4m @ 3.2g/t AuEq /

The eastern sector drilling also includes robust results from the northern synformal fold limb of the deposit, such as CD-549: 11.3m @ 3.1g/t AuEq /

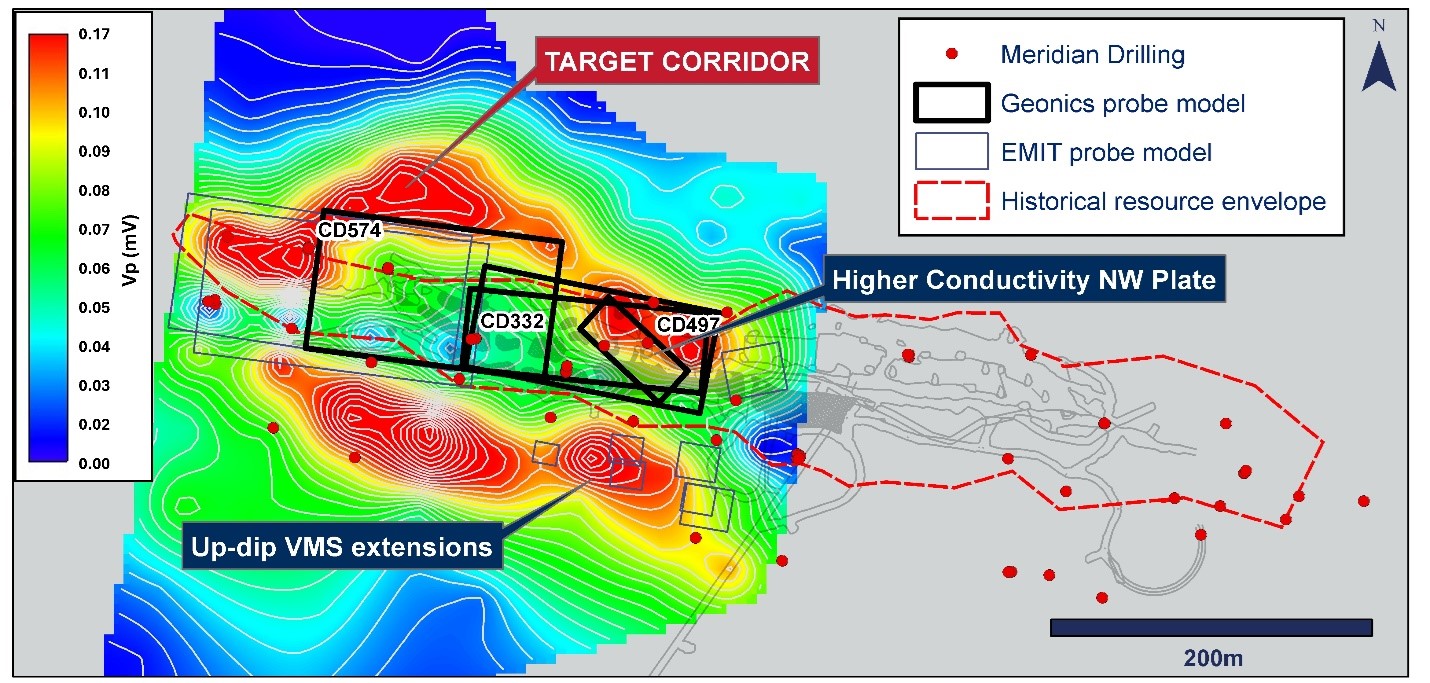

Santa Helena Geophysics

Meridian is now deploying a range of bore-hole electromagnetic ("BHEM") and surface geophysical methods to test for possible near-mine sulphide extensions that are positioned beyond the limits of the know massive sulphide pile.

The Geonics probe shows versatility in better mapping the lower conductivity sulphide assemblages, typical of those present along the Cabaçal belt to date. BHEM has advanced in the western sector of the Santa Helena prospect. Modelling of the BHEM plates is resolving conductors of up to 150m strike length with a conductivity thickness of 10 - 52 Siemens, aligning well with the thickened hinge zone of the massive sulphide pile. Higher conductivity plates appear to correlate with intersections with higher copper sulphide content (survey of CD-497, in which individual sample grades peaked between 3.1 -

CD-574, CD-332 and CD-497 were used as platforms for a Mise-à-la-Masse ("MALM") bore-hole geophysical survey. The MALM survey method maps surface potentials (or voltages) associated with resistivity contrasts linked with geology. Sulphide bodies are particularly amenable to the technique due to their conductivity contrast against more resistive host rocks. The three drill holes were selected at the western limit of the historical mine area (as the presence of historical mining cavities can subdue the natural signal). The survey detected a response over known sulphide mineralization, although unexpectedly a trend emerged projecting to the northwest with an offset peak located ~75m northwest of the CD-574 collar position ("Figure 2"). This outlying trend deflects back and merges again with the known mineralization around the CD-497 position. The anomaly overlaps with the position of fixed loop surface EM conductors. It is possible that a non-sulphide conductivity response may be generated by features such as a weathering trough, but the anomaly has interesting context and some drilling will be directed into this area. A positive supporting feature is that the strike of the more conductive BHEM anomaly projects towards the trend of the MALM anomaly.

About Meridian

Meridian Mining is focused on:

The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold,

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Ph: +1 778 715-6410 (BST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with

Gold equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. AuEq (g/t) = (Au(g/t) *

The Mise-à-la-Masse survey is being conducted using the Company's in-house team, utilizing its GDD GRx8-16c receiver and 5000W-2400-15A transmitter. Data is processed by the Company's independent consultancy Core Geophysics. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Assay results reported in this release.

Hole-id | Dip | Azi | EOH | Zone | Int | AuEq | CuEq | Au | Cu | Ag | Zn | Pb | From |

(m) | (m) | (g/t) | (%) | (g/t) | (%) | (g/t) | (%) | (%) | (m) | ||||

CD-574 | -48 | 192 | 84.1 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 15.9 | 3.9 | 2.6 | 1.6 | 0.5 | 40.0 | 4.3 | 0.7 | 58.2 |

|

|

|

| Including | 5.5 | 9.0 | 6.0 | 3.8 | 1.3 | 96.2 | 9.6 | 1.5 | 60.1 |

CD-569 | -89 | 000 | 56.0 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.9 | 0.4 | 0.3 | 0.1 | 0.0 | 8.1 | 0.7 | 0.1 | 14.1 |

CD-568 | -36 | 142 | 72.1 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.5 | 1.7 | 1.2 | 1.4 | 0.5 | 1.8 | 0.2 | 0.0 | 44.2 |

|

|

|

|

| 4.8 | 7.6 | 5.1 | 2.7 | 3.0 | 50.7 | 3.7 | 0.4 | 48.0 |

|

|

|

| Including | 3.4 | 10.3 | 6.9 | 3.6 | 4.0 | 68.9 | 5.0 | 0.6 | 49.0 |

|

|

|

|

| 4.1 | 0.5 | 0.4 | 0.0 | 0.1 | 3.0 | 0.8 | 0.1 | 66.0 |

CD-567 | -65 | 032 | 65.2 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.2 | 0.5 | 0.4 | 0.1 | 0.3 | 6.0 | 0.3 | 0.0 | 31.5 |

|

|

|

|

| 4.1 | 2.6 | 1.8 | 0.4 | 0.2 | 21.6 | 4.5 | 0.8 | 35.2 |

|

|

|

| Including | 1.6 | 5.8 | 3.9 | 0.7 | 0.5 | 46.8 | 10.3 | 1.9 | 36.4 |

|

|

|

|

| 1.2 | 1.0 | 0.7 | 0.2 | 0.0 | 9.3 | 1.8 | 0.9 | 45.7 |

|

|

|

|

| 2.6 | 0.8 | 0.5 | 0.8 | 0.0 | 9.0 | 0.4 | 0.2 | 51.3 |

CD-560 | -45 | 036 | 70.8 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5.3 | 1.6 | 1.1 | 0.6 | 0.3 | 12.4 | 1.7 | 0.1 | 25.8 |

|

|

|

| Including | 1.1 | 5.1 | 3.4 | 2.5 | 1.0 | 45.3 | 4.1 | 0.4 | 26.6 |

|

|

|

|

| 0.6 | 1.6 | 1.1 | 0.3 | 0.0 | 12.2 | 3.0 | 0.3 | 36.3 |

|

|

|

|

| 0.5 | 6.3 | 4.2 | 0.9 | 0.5 | 77.5 | 10.5 | 2.0 | 39.4 |

|

|

|

|

| 2.7 | 0.4 | 0.3 | 0.2 | 0.0 | 3.0 | 0.6 | 0.1 | 41.7 |

|

|

|

|

| 2.4 | 0.3 | 0.2 | 0.0 | 0.0 | 3.4 | 0.5 | 0.2 | 49.8 |

CD-559 | -50 | 209 | 66.3 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.4 | 0.5 | 0.3 | 0.0 | 0.1 | 6.7 | 0.6 | 0.0 | 4.7 |

|

|

|

|

| 11.2 | 1.9 | 1.3 | 0.3 | 0.6 | 21.7 | 1.6 | 0.5 | 12.0 |

|

|

|

| Including | 1.5 | 3.0 | 2.0 | 0.7 | 1.3 | 25.0 | 1.6 | 0.3 | 12.9 |

|

|

|

| Including | 3.3 | 4.1 | 2.8 | 0.6 | 1.4 | 47.4 | 3.4 | 0.7 | 17.8 |

|

|

|

|

| 3.3 | 1.5 | 1.0 | 0.7 | 0.1 | 15.6 | 1.8 | 0.6 | 36.4 |

|

|

|

|

| 0.9 | 0.4 | 0.3 | 0.0 | 0.0 | 2.0 | 0.9 | 0.0 | 42.0 |

CD-556 | -45 | 213 | 90.0 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 22.4 | 3.2 | 2.2 | 0.8 | 1.1 | 24.0 | 2.7 | 0.6 | 9.2 |

|

|

|

| Including | 5.5 | 7.8 | 5.2 | 2.0 | 2.6 | 65.1 | 5.8 | 1.4 | 21.3 |

|

|

|

|

| 6.2 | 0.4 | 0.3 | 0.1 | 0.1 | 3.0 | 0.7 | 0.2 | 44.5 |

|

|

|

|

| 1.5 | 0.8 | 0.5 | 0.4 | 0.1 | 3.4 | 0.9 | 0.0 | 57.6 |

Hole-id | Dip | Azi | EOH | Zone | Int | AuEq | CuEq | Au | Cu | Ag | Zn | Pb | From |

(m) | (m) | (g/t) | (%) | (g/t) | (%) | (g/t) | (%) | (%) | (m) | ||||

CD-555 | -26 | 210 | 86.1 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6.0 | 0.7 | 0.5 | 0.1 | 0.2 | 5.4 | 0.9 | 0.2 | 9.6 |

|

|

|

|

| 4.9 | 1.3 | 0.9 | 0.3 | 0.5 | 15.5 | 0.7 | 0.1 | 22.1 |

|

|

|

|

| 13.1 | 3.7 | 2.5 | 0.8 | 1.3 | 26.2 | 2.7 | 0.4 | 29.7 |

|

|

|

| Including | 6.2 | 6.4 | 4.3 | 1.6 | 2.3 | 41.8 | 4.7 | 0.6 | 36.6 |

|

|

|

| Including | 2.0 | 9.2 | 6.2 | 2.3 | 3.7 | 57.0 | 5.4 | 0.7 | 39.4 |

|

|

|

|

| 3.8 | 2.7 | 1.8 | 0.3 | 0.6 | 13.1 | 4.0 | 0.5 | 44.9 |

|

|

|

| Including | 1.8 | 5.0 | 3.4 | 0.6 | 1.1 | 24.8 | 7.2 | 0.9 | 46.2 |

|

|

|

|

| 3.6 | 0.3 | 0.2 | 0.0 | 0.0 | 4.0 | 0.6 | 0.2 | 55.6 |

|

|

|

|

| 13.1 | 0.9 | 0.6 | 0.1 | 0.2 | 5.2 | 1.2 | 0.2 | 64.0 |

CD-553 | -65 | 316 | 118.8 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4.9 | 0.5 | 0.4 | 0.3 | 0.0 | 4.4 | 0.7 | 0.1 | 102.9 |

|

|

|

|

| 3.6 | 0.3 | 0.2 | 0.0 | 0.1 | 1.3 | 0.6 | 0.0 | 110.8 |

CD-552 | -26 | 270 | 101.2 | SHM | Subparallel Hole | ||||||||

|

|

|

|

| 16.5 | 0.7 | 0.5 | 0.1 | 0.0 | 9.8 | 1.2 | 0.2 | 8.0 |

|

|

|

|

| 8.6 | 1.9 | 1.3 | 0.4 | 0.1 | 18.8 | 3.3 | 0.4 | 34.1 |

|

|

|

| Including | 2.4 | 4.3 | 2.8 | 1.2 | 0.1 | 46.2 | 7.1 | 0.8 | 39.5 |

|

|

|

|

| 4.0 | 0.4 | 0.3 | 0.0 | 0.0 | 7.9 | 0.6 | 0.2 | 47.0 |

|

|

|

|

| 7.4 | 0.4 | 0.3 | 0.0 | 0.0 | 2.5 | 0.8 | 0.1 | 57.3 |

|

|

|

|

| 4.7 | 0.6 | 0.4 | 0.0 | 0.0 | 3.4 | 1.2 | 0.3 | 94.3 |

CD-549 | -60 | 045 | 105.4 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 0.6 | 1.0 | 0.7 | 1.5 | 0.0 | 0.9 | 0.1 | 0.0 | 12.0 |

|

|

|

|

| 0.7 | 1.7 | 1.1 | 2.5 | 0.0 | 1.0 | 0.1 | 0.0 | 19.7 |

|

|

|

|

| 11.3 | 3.1 | 2.1 | 0.7 | 0.8 | 31.1 | 3.1 | 0.5 | 43.4 |

|

|

|

| Including | 5.4 | 5.7 | 3.8 | 1.3 | 1.6 | 58.3 | 5.5 | 0.8 | 43.4 |

|

|

|

|

| 3.7 | 0.3 | 0.2 | 0.2 | 0.0 | 1.3 | 0.3 | 0.1 | 70.0 |

|

|

|

|

| 0.9 | 0.6 | 0.4 | 0.0 | 0.0 | 1.4 | 1.3 | 0.1 | 80.5 |

CD-548 | -45 | 031 | 90.2 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.5 | 10.0 | 6.7 | 2.5 | 2.0 | 88.4 | 11.8 | 1.8 | 47.6 |

|

|

|

|

| 0.8 | 2.4 | 1.6 | 0.4 | 0.1 | 31.7 | 4.0 | 0.6 | 55.3 |

|

|

|

|

| 0.6 | 1.9 | 1.3 | 0.6 | 0.2 | 25.6 | 2.5 | 0.7 | 59.6 |

CD-545 | -50 | 189 | 81.1 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 12.3 | 1.7 | 1.2 | 0.2 | 0.6 | 29.0 | 1.4 | 0.4 | 55.0 |

|

|

|

| Including | 2.1 | 6.5 | 4.4 | 0.9 | 3.2 | 154.5 | 1.2 | 1.8 | 56.0 |

CD-542 | -80 | 051 | 103.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.0 | 2.4 | 1.6 | 0.9 | 0.8 | 31.8 | 1.4 | 0.3 | 63.1 |

|

|

|

|

| 4.1 | 0.4 | 0.2 | 0.2 | 0.0 | 2.4 | 0.5 | 0.2 | 83.4 |

|

|

|

|

| 1.6 | 1.0 | 0.7 | 0.2 | 0.0 | 9.1 | 1.8 | 0.6 | 91.8 |

Hole-id | Dip | Azi | EOH | Zone | Int | AuEq | CuEq | Au | Cu | Ag | Zn | Pb | From |

(m) | (m) | (g/t) | (%) | (g/t) | (%) | (g/t) | (%) | (%) | (m) | ||||

CD-539 | -31 | 290 | 131.7 | SHM | Subparallel Hole | ||||||||

|

|

|

|

| 1.3 | 0.5 | 0.4 | 0.0 | 0.3 | 8.8 | 0.2 | 0.7 | 10.6 |

|

|

|

|

| 40.4 | 1.8 | 1.2 | 0.5 | 0.6 | 24.6 | 1.0 | 1.0 | 16.9 |

|

|

|

| Including | 2.4 | 3.9 | 2.6 | 4.1 | 0.8 | 5.8 | 0.5 | 1.5 | 18.9 |

|

|

|

|

| 12.3 | 0.4 | 0.3 | 0.0 | 0.0 | 2.5 | 0.7 | 0.0 | 61.0 |

CD-538 | -75 | 007 | 172.6 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.9 | 0.7 | 0.5 | 0.0 | 0.1 | 1.1 | 1.5 | 0.0 | 58.0 |

|

|

|

|

| 0.5 | 1.6 | 1.0 | 0.0 | 0.2 | 30.1 | 2.4 | 0.5 | 95.0 |

|

|

|

|

| 1.3 | 0.9 | 0.6 | 0.1 | 0.1 | 12.1 | 1.5 | 0.4 | 99.5 |

|

|

|

|

| 1.9 | 0.6 | 0.4 | 0.0 | 0.0 | 2.2 | 1.3 | 0.4 | 104.1 |

|

|

|

|

| 0.8 | 0.7 | 0.4 | 0.0 | 0.0 | 0.6 | 1.5 | 0.0 | 108.4 |

CD-536 | -89 | 000 | 89.5 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2.9 | 0.3 | 0.2 | 0.0 | 0.0 | 2.4 | 0.5 | 0.2 | 75.0 |

CD-532 | -45 | 089 | 135.4 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4.3 | 2.7 | 1.8 | 0.4 | 0.9 | 24.8 | 2.7 | 0.3 | 48.0 |

|

|

|

|

| 3.8 | 1.2 | 0.8 | 0.1 | 0.1 | 7.0 | 2.4 | 0.4 | 57.8 |

|

|

|

|

| 3.3 | 0.4 | 0.2 | 0.0 | 0.0 | 2.0 | 0.7 | 0.1 | 69.1 |

CD-530 | -45 | 026 | 75.0 | SHM | NSR |

|

|

|

|

|

|

|

|

CD-522 | -21 | 093 | 132.0 | SHM | Subparallel Hole | ||||||||

|

|

|

|

| 13.4 | 2.6 | 1.7 | 0.5 | 0.8 | 21.9 | 2.5 | 0.5 | 76.1 |

|

|

|

| Including | 4.9 | 4.2 | 2.8 | 0.9 | 1.4 | 32.3 | 3.5 | 0.6 | 76.1 |

|

|

|

| Including | 9.6 | 3.4 | 2.3 | 0.6 | 1.1 | 28.1 | 3.2 | 0.6 | 76.1 |

|

|

|

|

| 2.0 | 2.0 | 1.3 | 0.2 | 0.1 | 22.4 | 3.8 | 1.7 | 97.0 |

|

|

|

|

| 5.5 | 1.3 | 0.9 | 0.5 | 0.1 | 13.6 | 1.9 | 0.8 | 101.5 |

CD-521 | -51 | 008 | 100.3 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 15.4 | 3.8 | 2.5 | 0.3 | 0.8 | 37.7 | 5.2 | 0.7 | 37.2 |

|

|

|

| Including | 3.4 | 9.8 | 6.5 | 1.2 | 2.2 | 90.7 | 12.7 | 2.2 | 42.7 |

|

|

|

| Including | 9.9 | 5.3 | 3.5 | 0.5 | 1.2 | 52.8 | 7.1 | 1.0 | 42.7 |

|

|

|

|

| 9.8 | 0.6 | 0.4 | 0.1 | 0.1 | 2.3 | 0.9 | 0.1 | 61.0 |

CD-519 | -49 | 188 | 104.9 | SHM | Metallurgical Hole | ||||||||

|

|

|

|

| 15.0 | 2.3 | 1.6 | 0.8 | 0.7 | 14.1 | 1.7 | 0.7 | 22.5 |

CD-515 | -85 | 177 | 111.1 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.1 | 2.4 | 1.6 | 0.1 | 0.2 | 24.7 | 4.3 | 0.9 | 47.3 |

|

|

|

|

| 21.7 | 2.6 | 1.8 | 1.2 | 0.4 | 33.2 | 2.5 | 0.7 | 62.5 |

|

|

|

| Including | 2.9 | 4.7 | 3.1 | 1.0 | 0.4 | 43.8 | 7.3 | 1.2 | 64.2 |

|

|

|

| Including | 6.2 | 4.7 | 3.2 | 1.7 | 1.1 | 87.0 | 3.5 | 1.6 | 76.9 |

|

|

|

|

| 4.7 | 0.5 | 0.4 | 0.6 | 0.0 | 5.8 | 0.1 | 0.2 | 91.1 |

CD-512 | -50 | 187 | 150.1 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7.7 | 4.9 | 3.3 | 1.0 | 1.4 | 38.3 | 5.0 | 0.8 | 61.1 |

|

|

|

| Including | 4.0 | 8.9 | 6.0 | 1.7 | 2.7 | 70.6 | 8.9 | 1.3 | 61.6 |

|

|

|

|

| 6.2 | 0.7 | 0.5 | 0.1 | 0.0 | 6.2 | 1.3 | 0.3 | 72.3 |

|

|

|

|

| 2.7 | 0.5 | 0.4 | 0.1 | 0.1 | 3.6 | 0.9 | 0.3 | 85.3 |

Hole-id | Dip | Azi | EOH | Zone | Int | AuEq | CuEq | Au | Cu | Ag | Zn | Pb | From |

(m) | (m) | (g/t) | (%) | (g/t) | (%) | (g/t) | (%) | (%) | (m) | ||||

CD-508 | -88 | 000 | 99.5 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.0 | 0.9 | 0.6 | 0.0 | 0.0 | 12.7 | 1.6 | 0.3 | 54.9 |

|

|

|

|

| 3.0 | 0.6 | 0.4 | 0.1 | 0.3 | 3.9 | 0.4 | 0.1 | 61.1 |

CD-507 | -51 | 009 | 141.3 | SHM | NSR |

|

|

|

|

|

|

|

|

CD-502 | -47 | 189 | 81.3 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 13.2 | 0.5 | 0.4 | 0.4 | 0.0 | 5.9 | 0.5 | 0.3 | 22.6 |

|

|

|

|

| 10.2 | 0.4 | 0.3 | 0.1 | 0.1 | 4.3 | 0.5 | 0.1 | 40.6 |

|

|

|

|

| 2.0 | 0.4 | 0.2 | 0.0 | 0.1 | 3.3 | 0.3 | 0.1 | 64.2 |

CD-490 | -89 | 000 | 124.9 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.0 | 2.9 | 1.9 | 0.0 | 0.2 | 22.2 | 5.9 | 1.4 | 56.3 |

|

|

|

|

| 2.5 | 1.5 | 1.0 | 0.1 | 0.1 | 25.9 | 2.6 | 0.6 | 69.5 |

|

|

|

|

| 1.7 | 0.6 | 0.4 | 0.0 | 0.1 | 1.4 | 1.1 | 0.0 | 77.3 |

|

|

|

|

| 2.0 | 2.1 | 1.4 | 2.4 | 0.1 | 59.6 | 0.0 | 0.9 | 110.0 |

SOURCE: Meridian Mining SE

View the original press release on accesswire.com

FAQ

What are the key assay results reported by Meridian Mining for the Santa Helena deposit?

When is Meridian Mining (MRRDF) expecting to release the resource estimate for Santa Helena?

What geophysical methods has Meridian Mining used at Santa Helena?