Meridian Reports Gold and Base Metal Assays Up to 6.7% CuEq At Santa Helena

- Strong intercepts of copper, gold, silver, and zinc mineralization at the Santa Helena mine

- High-grade mineralization including CD-329: 6.8m @ 4.9% CuEq from 38.7m

- Santa Helena VMS trend mapped over 3.1km

- Drilling continues at Santa Helena and at the Cabaçal mine

- None.

Santa Helena intercepts multiple zones of shallow high-grade copper-gold-silver and zinc mineralization

LONDON, UK / ACCESSWIRE / October 23, 2023 / Meridian Mining UK S (TSX:MNO)(OTCQX:MRRDF)(Frankfurt/Tradegate:2MM) ("Meridian" or the "Company") is pleased to report further strong intercepts of shallow copper, gold, silver, and zinc mineralization at the Santa Helena mine ("Santa Helena"). New results include CD-329: 6.8m @

Drilling continues at Santa Helena and at the Cabaçal mine with further results pending.

Highlights Reported Today

- Further shallow high-grade gold and base metals intercepted at Santa Helena;

- Santa Helena returns near-surface high-grade gold and base metal mineralization:

- CD-329: 6.8m @

4.9% CuEq (1.2% Cu, 1.4g/t Au, 52.7g/t Ag &10.5% Zn) from 38.7m; - CD-332: 5.8m @

4.5% CuEq (1.1% Cu, 0.7g/t Au, 36.0g/t Ag &10.9% Zn) from 32.2m; - CD-335: 7.2m @

4.0% CuEq (1.5% Cu, 2.1g/t Au, 43.4g/t Ag &5.4% Zn) from 35.5m;

Including:- 1.7m @

6.7% CuEq (3.0% Cu,2.7% g/t Au, 63.6g/t Ag &8.9% Zn from 36.4m;

- 1.7m @

- CD-329: 6.8m @

- The prospective and open Santa Helena VMS trend now mapped over ~3.1km; and

- Cabaçal infill and extension drilling continues to deliver robust gold and copper mineralization.

True width is considered to be 80 to

Mr. Gilbert Clark, CEO, comments: "The Company is very pleased with the continued flow of strong gold and base metal intersections from Santa Helena at depths within easy reach of a potential open pit development. In addition, our ongoing geophysical program continues to map the prospective VMS target horizon as the survey continues to extend southeast from Santa Helena. Santa Helena's host geology has now been mapped over a 3.1km, and is open along strike and down plunge, delivering more upside to test going forward. Santa Helena is evolving to be a second potential open pitable resource target within the Cabaçal belt and is only a short trucking distance to the Cabaçal mine."

Santa Helena Drill Program

Santa Helena is a Cu-Au-Ag & Zn VMS deposit located ~9km to the southeast of the Cabaçal Mine. It has over 10,000m of historical drilling and is one of a series of exploration targets along the 11km Cabaçal Mine Corridor. The Company commenced initial drilling in August 2023 as part of a verification program, to validate the historical data in line with NI43-101 requirements, and to initiate scout drilling for resource extensions defined by geophysics. The Company's compilation of historical drill data indicated that many past holes were not completely sampled, that reconciliation of surveyed drilled positions and mine workings suggested that the high-grade massive sulphide mineralization was only partially mined. and that extensions of near-surface mineralization to the east were also not integrated into the historical resource calculations1. The Company has concluded that this historical resource area is considered open.

The Company has completed seventeen holes to date, with results reported thus far confirming strong near-surface mineralization2, including:

- CD-311: 19.1m @

1.3% CuEq from 8.0m, including 4.9m @4.6% CuEq from 22.2m; - CD-321: 23.1m @

1.0% CuEq from 6.1m, Including 3.6m @3.3% CuEq from 10.0m; and - CD-325: 14.9m @

3.1% CuEq from 26.3m, including 6.7m @4.3% CuEq from 27.5m.

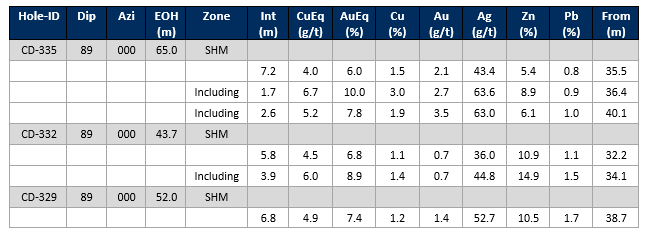

The latest results ("Table 1") have continued to test mineralization in the historical mine area, building out from the earlier CD-325 intersection. The results confirm the extension of robust widths of high-grade mineralization that remain open along strike and down plunge.

CD-332 was drilled ~65m, west-northwest of CD-325, and returned 5.8m @

CD-329 was drilled slightly off section to CD-325, twinning historical hole PM16A, which originally returned 12.9m @

CD-335 stepped out ~110m east-southeast of CD-325 and was drilled adjacent to two historical holes, PM11A: 7.9m @ 1Meridian Mining News Release of March 29, 2022.

2Meridian Mining News Release of September 12, 2022.

Assay results provide confidence in the historical data and the position of the underground workings, and emphasise the presence of good widths of high-quality mineralization amenable to evaluation for open pit extraction.

Recent drilling is probing shallower up-dip portions of the deposit which were not systematically drilled with the prior focus on under-ground development, focussing more in infill and resource extension, whilst geophysical programs continue to the east.

Santa Helena's Expanding near-mine Exploration Corridor

The Company has continued its Gradient Array Induced Polarization survey ("IP survey") over the east-southeastern extensions to Santa Helena, into the Alamo property. This newly defined chargeability corridor has been extended a further 400m southeastwards, now totaling 2.0km from the limit of Santa Helena's historical resource. The anomaly aligns with gold and base metal soil anomalies defined in BP surveys, continuing to add valuable context to this target as an extensional corridor for Santa Helena-style mineralization.

The Company considers that the branching architecture of the chargeability response is suggestive of cross-strike fold repetition of the VMS horizon. The Company continues to extend the IP survey along strike and will shortly diversify the program to include Fixed Loop EM along the extensional corridor, to test for conductors that may potentially mark a more copper-dominant sulphide assemblage.

Cabaçal Project Development and Resource Definition Program

The Company continues with drilling and project development studies at Cabaçal. A phase of hydrogeological drilling has been completed as part of the program for environmental licencing. Some drilling has focussed on testing the lateral limits of the resource in the Cabaçal Northwest Extension ("CNWE"), with further results now pending from the mine area and central portion of the CNWE.

About Meridian

Meridian Mining UK S is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- Regional scale exploration of the Cabaçal VMS belt; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage gold overprint event has emplaced high-grade gold mineralization.

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold,

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR at www.sedar.com.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Ph: +1 778 715-6410 (PST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at SGS laboratory in Belo Horizonte. Samples are dried, crushed with

• Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

• Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

• Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield

Copper equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. The metal equivalent formula s presented as a copper equivalent rather than a zinc equivalent, based on the Companies current assessment of the metal balance after the past zinc-focussed extraction. CuEq% = (Cu% *

The Gradient Array IP survey is being conducted using the Company's in-house team, utilizing its GDD GRx8‐16c receiver and 5000W‐2400‐15A transmitter. Data is processed by the Company's independent consultancy Core Geophysics. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person

Mr. Erich Marques, B.Sc., MAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Results Reported

Santa Helena

Cabaçal

Cabaçal

SOURCE: Meridian Mining UK S

View source version on accesswire.com:

https://www.accesswire.com/795378/meridian-reports-gold-and-base-metal-assays-up-to-67-cueq-at-santa-helena

FAQ

What are the recent results from the Santa Helena mine?

How long is the Santa Helena VMS trend?