Meridian Reports Further Broad Shallow Zones of Mineralization at Cabaçal Including CD-535 - 21.6m @ 3.1g/t AuEq / 2.1% CuEq from 85m

Meridian Mining UK S (TSX:MNO, OTCQX:MRRDF) reports strong results from its Cabaçal Cu-Au-Ag project. Highlights include:

- CD-535: 21.6m @ 3.1g/t AuEq / 2.1% CuEq from 85.0m

- CD-534: 25.9m @ 1.4g/t AuEq / 0.9% CuEq from 80.8m

- CD-529: 16.1m @ 2.8g/t AuEq / 1.9% CuEq from 92.1m

The company has identified multiple structural inflexions along the 2km strike length of the deposit, where most Cu-Au-Ag mineralization is found. New targets for potential Cu-Au mineralization repeats have been identified along the 10km Mine Corridor. Meridian's understanding of local mineralization control has allowed them to target and rank the belt's exploration upside.

Meridian Mining UK S (TSX:MNO, OTCQX:MRRDF) riporta risultati eccellenti dal suo progetto Cabaçal Cu-Au-Ag. I punti salienti includono:

- CD-535: 21.6m @ 3.1g/t AuEq / 2.1% CuEq da 85.0m

- CD-534: 25.9m @ 1.4g/t AuEq / 0.9% CuEq da 80.8m

- CD-529: 16.1m @ 2.8g/t AuEq / 1.9% CuEq da 92.1m

L'azienda ha identificato numerose flessioni strutturali lungo i 2 km di estensione del deposito, dove si trova la maggior parte della mineralizzazione Cu-Au-Ag. Sono stati identificati nuovi obiettivi per potenziali ripetizioni di mineralizzazione Cu-Au lungo il Corridoio Minerario di 10 km. La comprensione da parte di Meridian del controllo della mineralizzazione locale ha consentito loro di mirare e classificare il potenziale di esplorazione del cinturone.

Meridian Mining UK S (TSX:MNO, OTCQX:MRRDF) informa sobre los sólidos resultados de su proyecto Cabaçal Cu-Au-Ag. Los aspectos destacados incluyen:

- CD-535: 21.6m @ 3.1g/t AuEq / 2.1% CuEq desde 85.0m

- CD-534: 25.9m @ 1.4g/t AuEq / 0.9% CuEq desde 80.8m

- CD-529: 16.1m @ 2.8g/t AuEq / 1.9% CuEq desde 92.1m

La empresa ha identificado múltiples inflexiones estructurales a lo largo de la extensión de 2 km del depósito, donde se encuentra la mayor parte de la mineralización Cu-Au-Ag. Se han identificado nuevos objetivos para posibles repeticiones de mineralización Cu-Au a lo largo del Corredor Minero de 10 km. La comprensión de Meridian sobre el control de la mineralización local les ha permitido apuntar y clasificar el potencial de exploración de la cinturón.

Meridian Mining UK S (TSX:MNO, OTCQX:MRRDF)는 Cabaçal Cu-Au-Ag 프로젝트의 강력한 결과를 보고합니다. 주요 내용은 다음과 같습니다:

- CD-535: 21.6m @ 3.1g/t AuEq / 2.1% CuEq, 85.0m에서

- CD-534: 25.9m @ 1.4g/t AuEq / 0.9% CuEq, 80.8m에서

- CD-529: 16.1m @ 2.8g/t AuEq / 1.9% CuEq, 92.1m에서

회사는 광석의 대부분이 발견되는 2km 스트라이크 길이를 따라 다양한 구조적 변곡점을 확인했습니다. 10km 광산 복도의 잠재적 Cu-Au 광물화 반복을 위한 새로운 목표가 확인되었습니다. Meridian의 지역 광물화 제어에 대한 이해는 그들이 채굴 벨트의 탐사 잠재력을 목표로 하고 순위를 매길 수 있도록 했습니다.

Meridian Mining UK S (TSX:MNO, OTCQX:MRRDF) rapporte de solides résultats de son projet Cabaçal Cu-Au-Ag. Les points forts comprennent :

- CD-535 : 21,6 m @ 3,1 g/t AuEq / 2,1 % CuEq à partir de 85,0 m

- CD-534 : 25,9 m @ 1,4 g/t AuEq / 0,9 % CuEq à partir de 80,8 m

- CD-529 : 16,1 m @ 2,8 g/t AuEq / 1,9 % CuEq à partir de 92,1 m

L'entreprise a identifié plusieurs inflexions structurales le long des 2 km de la longueur de la dépose, où se trouve la majorité de la minéralisation Cu-Au-Ag. De nouveaux objectifs pour des répétitions potentielles de minéralisation Cu-Au ont été identifiés le long du Corridor Minier de 10 km. La compréhension par Meridian du contrôle de la minéralisation locale leur a permis de cibler et de classer le potentiel d'exploration de la ceinture.

Meridian Mining UK S (TSX:MNO, OTCQX:MRRDF) berichtet über starke Ergebnisse aus ihrem Cabaçal Cu-Au-Ag-Projekt. Zu den Höhepunkten gehören:

- CD-535: 21,6m @ 3,1g/t AuEq / 2,1% CuEq von 85,0m

- CD-534: 25,9m @ 1,4g/t AuEq / 0,9% CuEq von 80,8m

- CD-529: 16,1m @ 2,8g/t AuEq / 1,9% CuEq von 92,1m

Das Unternehmen hat mehrere strukturelle Wenden entlang der 2 km langen Lagerstätte identifiziert, wo sich der größte Teil der Cu-Au-Ag-Mineralisierung befindet. Neue Ziele für potenzielle Wiederholungen der Cu-Au-Mineralisierung entlang des 10 km langen Bergbauraums wurden identifiziert. Meridians Verständnis der lokalen Mineralisierungssteuerung hat es ihnen ermöglicht, das Explorationspotenzial des Gürtels zu zielen und zu bewerten.

- Strong drill results with wide zones of Cu-Au-Ag mineralization (e.g., 21.6m @ 3.1g/t AuEq)

- Identification of multiple new targets for Cu-Au mineralization along the 10km Mine Corridor

- Improved understanding of structural controls on mineralization, enhancing exploration targeting

- Potential for additional discoveries and underground extensions of the Cabaçal deposit

- None.

Multiple targets for Cabaçal-type Cu-Au repeats identified along the 10km Mine Corridor

LONDON, UK / ACCESSWIRE / September 4, 2024 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to announce further strong results from its Cabaçal Cu-Au-Ag project ("Cabaçal"). Wide zones of Cu-Au-Ag mineralization continue to be defined, highlighted by CD-535 returning 21.6m @ 3.1g/t AuEq /

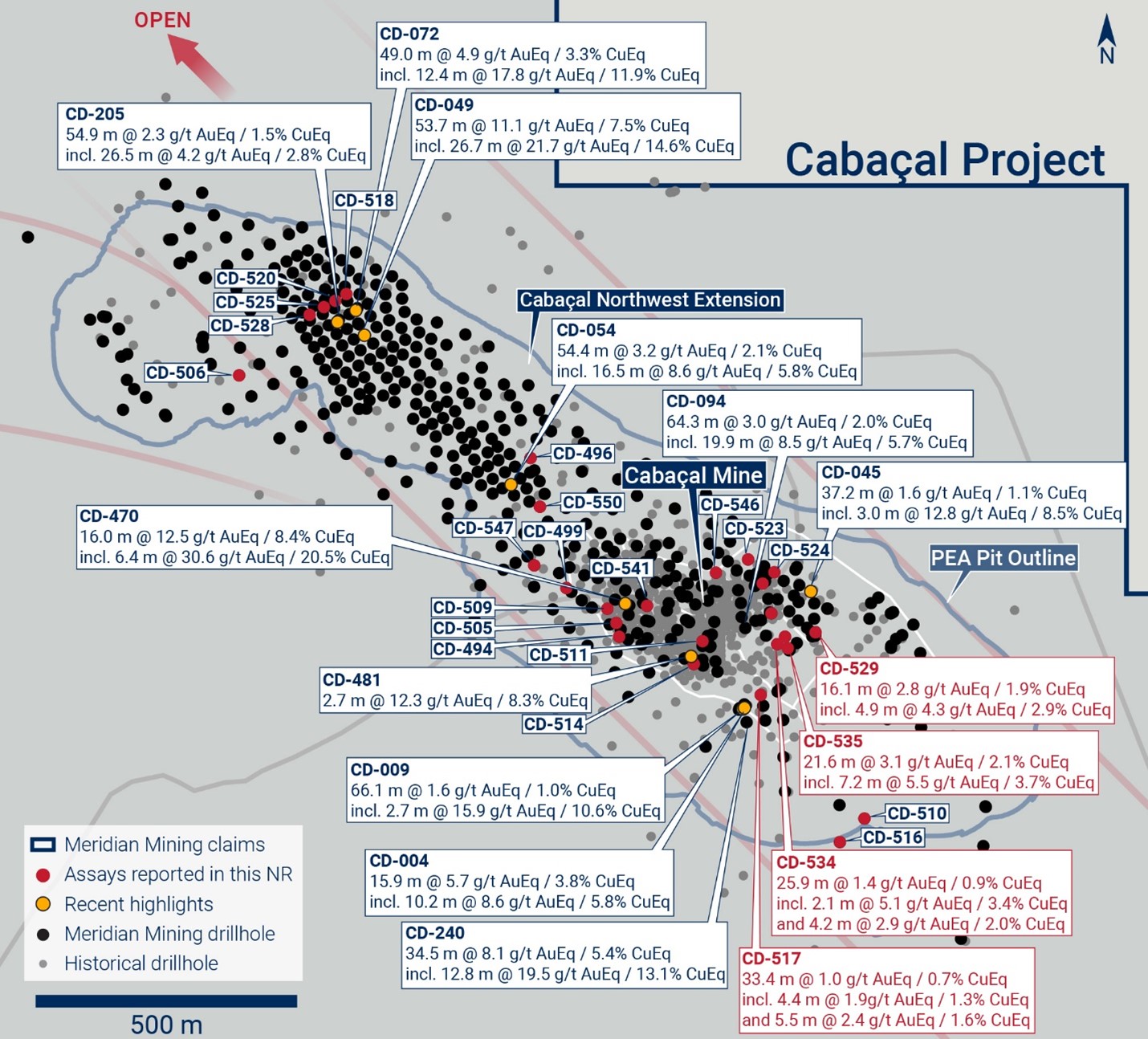

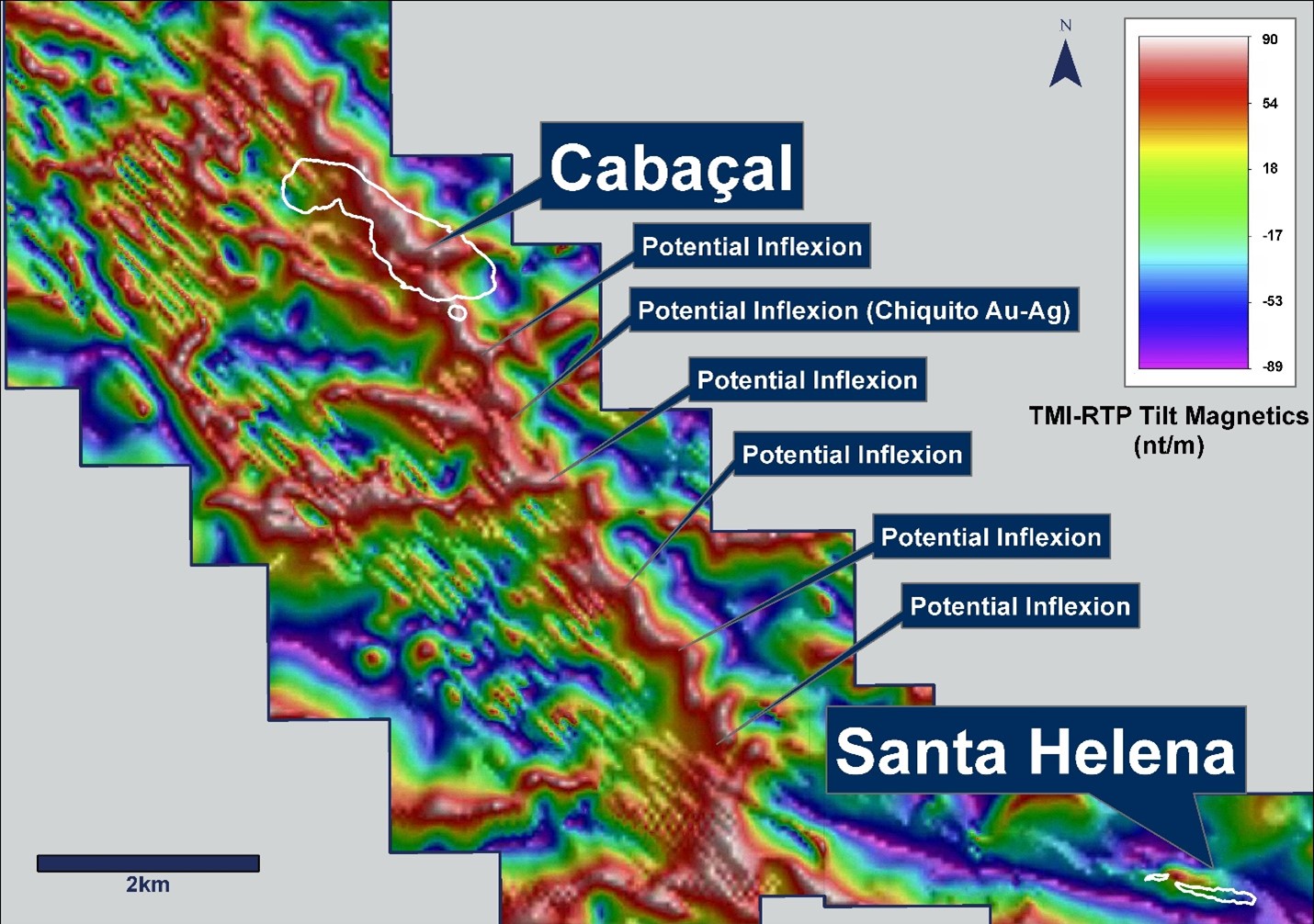

A detailed review of the Cabaçal drill program's results has identified multiple structural inflexions along the 2km strike length of the deposit, within which, the bulk of the Cu-Au-Ag mineralization is found. The Company has reviewed its geophysical data, and identified multiple signs for repeats of these structures, down dip of the mine and importantly extending along the 10km Mine Corridor ("Figure 2"). These new targets can be considered prospective for repeats for Cu-Au mineralization, and exploration programs to drill test these structures are advancing.

Highlights Reported Today

Meridian reports further broad, shallow copper, gold, and silver results from the Cabaçal deposit;

CD-535 (CCZ): 21.6m @ 3.1g/t AuEq /

2.1% CuEq from 85.0m; Including:7.2m @ 5.5g/t AuEq /

3.7% CuEq from 99.4m;

CD-534 (CCZ): 25.9m @ 1.4g/t AuEq /

0.9% CuEq from 80.8m; including:2.1m @ 5.1g/t AuEq /

3.4% CuEq from 82.2m;4.2m @ 2.9g/t AuEq /

2.0% CuEq from 102.6m;

CD-529 (ECZ): 16.1m @ 2.8g/t AuEq /

1.9% CuEq from 92.1m; including:4.9m @ 4.3g/t AuEq /

2.9% CuEq from 98.0m;

CD-517 (SCZ): 33.4m @ 1.0g/t AuEq /

0.7% CuEq from 103.2m; including:4.4m @ 1.9g/t AuEq /

1.3% CuEq from 119.1m; and5.5m @ 2.4g/t AuEq /

1.6% CuEq from 130.4m.

Multiple new targets for Cu-Au mineralization host structures generated in Cabaçal Mine Corridor;

Identification of structural flexures hosting strongest Cu-Au mineralization within the Cabaçal deposit increases the ability to target exploration efforts towards the VMS belt for further potential discovery;

Multiple untested greenfield targets with the potential for Cabaçal repeats following the trend of the district scale tonalite intrusion, initially identified over the 10km Mine Corridor; and

Down dip extension of local flexures to be tested for potential underground extensions of Cabaçal Cu-Au deposit.

*See technical note for true thickness estimate and separate AuEq and CuEq equations.

1 See Cabaçal Gold-Copper Project NI 43-101 PEA March 30, 2023, https://meridianmining.co/cabacal/

Mr. Gilbert Clark, CEO, comments: "It is pleasing to report once again that drilling at Cabaçal has intercepted ten's of meters of robust copper-gold-silver mineralization starting at shallow depths. We have taken a large step forward in opening the belt's exploration upside by unlocking the local structural "inflexions" that host Cabaçal's mineralization. Understanding this local control on mineralization has allowed our geologist to identify, target and rank our belt's exploration upside. As our programs have shown, Cabaçal is one of the very few advanced Cu-Au VMS belts, where the emerging greenfields upside remains intact, largely untested and is centred around a stand-alone asset; the hub and spoke development model."

Cabaçal Drill Results

Cabaçal's drill programs2 continue to deliver a flow of solid gold-copper-silver results across the deposit("Table 1"; Figure 1"). CD-535's 21.6m @ 3.1g/t AuEq including 7.2m @ 5.5g/t AuEq showed the presence of strong intact zones of mineralization in the southern sector of the mine where further definition is ongoing in areas of wider spaced drilling. The focus of drilling is now contributing to final stages of mine planning and on targeting areas where data has been historically lost in whole or in part, along with some infill of areas of wider spaced drilling.

Cabaçal Analogue For Near-Mine Exploration

The drilling to date has now provided a good framework for evaluating the geometric relationships between mineralization and rheological contacts - particularly the interface between the mine sequence and the felsic volcanic footwall (the "TAC"), where better grades are associated with inflexions in the contact and intersections between the northwest Mine Corridor trend and cross-structures. In developing gold exploration targets in particular, the Meridian team has scrutinized the developing datasets for inflexions and intersections in basement trends, as it has become increasingly apparent that the Cabaçal deposit and the gold overprint event is particularly precipitated at sites where the TAC flattens and is locally deflected from a north-western to a more east-western strike orientation. Aerial magnetic data shows a number of analogue deflections of similar character to that evident at Cabaçal ("Figure 2").

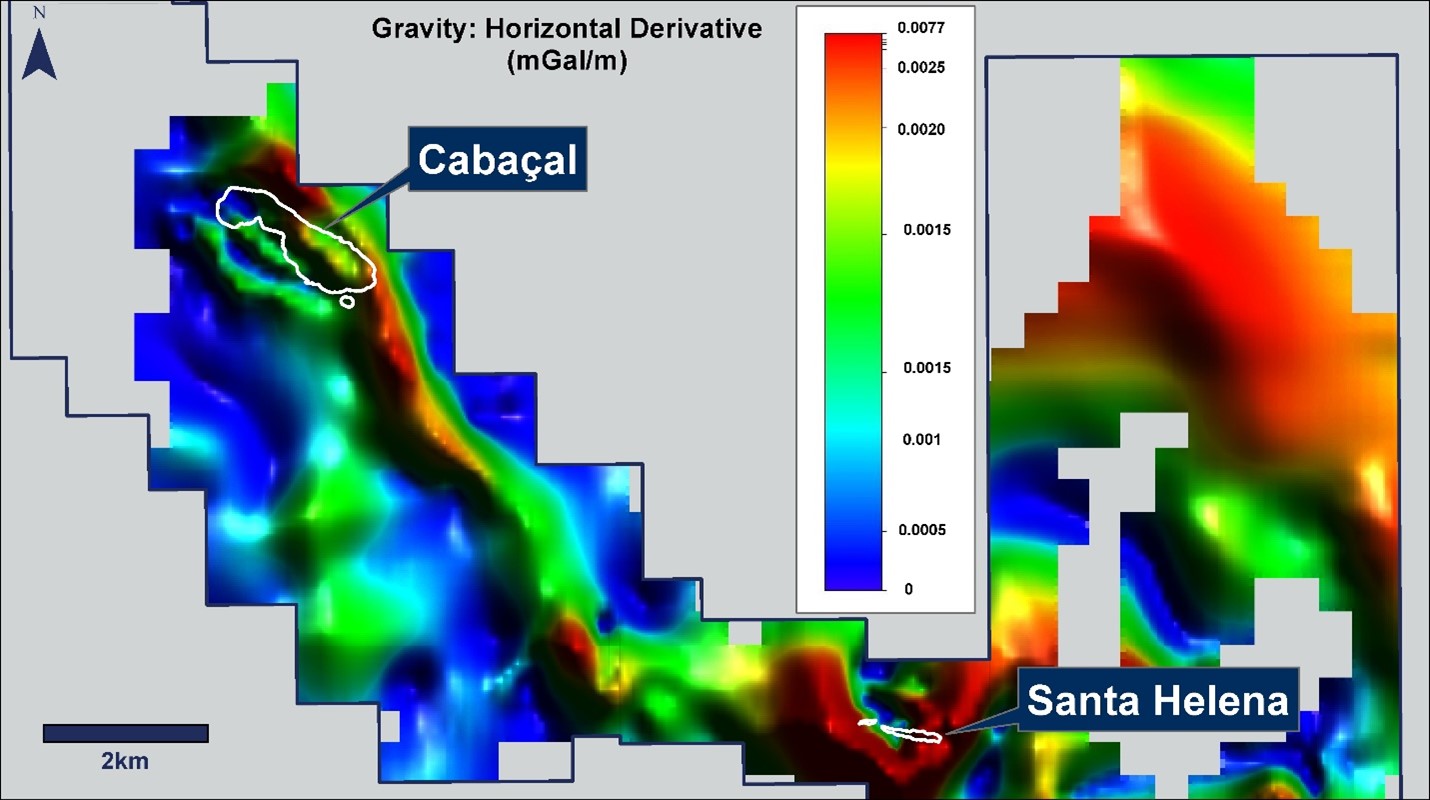

The gravity data shows Cabaçal localized in a northwest-striking gravity low, again with a slight counterclockwise rotation from the dominant regional trend ("Figure 3"). A second gravity low, virtually undrilled, is positioned to the southwest of Cabaçal and , separate regional inflexions are seen in the gravity pattern in the southern sector of the Chiquito region, and in the Sucuri area where the belt deflects to an east-western trend. These initial prospects will now be subject to a full suite of field exploration techniques including diamond drilling.

2 Meridian Mining News release of January 10, 2024.

About Meridian

Meridian Mining is focused on:

The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

The initial resource definition at the second high-grade VMS asset at Santa Helena as first stage of Hub and Spoke development strategy;

Regional scale exploration of the Cabaçal VMS belt to expand the Hub and Spoke strategy; and

Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold,

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Phone: +1 778 715-6410 (BST)

Twitter: https://twitter.com/MeridianMining

Stay up to date by subscribing for news alerts here: https://meridianmining.co/subscribe/

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with

Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield

Qualified Person

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

SOURCE: Meridian Mining UK S

View the original press release on accesswire.com