Meridian Drills Into Shallow High-Grade Cu-Au-Zn & Ag Massive to Semi-Massive Sulphides on the Open Western Limit of Santa Helena

Meridian Mining (OTCQX:MRRDF) has announced significant drilling results at its Santa Helena Au-Cu-Ag & Zn deposit. The key highlight is drill hole CD-651, which intercepted 33.4m @ 2.0g/t AuEq (1.4% CuEq), including 13.1m @ 4.2g/t AuEq (2.8% CuEq) from shallow depths.

Additional notable results include CD-655 returning 9.9m @ 5.6g/t AuEq (3.7% CuEq) from 3.8m in the mine area infill drilling. The company has also discovered a new 2,200m copper-gold soil anomaly at Santa Fé, located 5km southeast of Santa Helena, with peak values of 547 ppm Cu, 2539 ppm Pb, 1135 ppm Zn, and 65 ppb Au.

The western extension of Santa Helena remains open for further exploration, and the company has revised its timeline for mineral resource estimation to H2 2025. Metallurgical studies are ongoing to optimize metal recovery from various geometallurgical domains.

Meridian Mining (OTCQX:MRRDF) ha annunciato risultati significativi di perforazione presso il deposito di Au-Cu-Ag & Zn Santa Helena. Il risultato più importante riguarda il foro di sondaggio CD-651, che ha intercettato 33,4 m con una media di 2,0 g/t AuEq (1,4% CuEq), inclusi 13,1 m con 4,2 g/t AuEq (2,8% CuEq) da profondità poco profonde.

Altri risultati rilevanti includono il foro CD-655, che ha restituito 9,9 m con 5,6 g/t AuEq (3,7% CuEq) a 3,8 m di profondità nell'area della miniera durante la perforazione di riempimento. L'azienda ha inoltre scoperto una nuova anomalia di rame-oro nel suolo di 2.200 m a Santa Fé, situata a 5 km a sud-est di Santa Helena, con valori massimi di 547 ppm Cu, 2539 ppm Pb, 1135 ppm Zn e 65 ppb Au.

L'estensione occidentale di Santa Helena rimane aperta a ulteriori esplorazioni e la società ha aggiornato la tempistica per la stima delle risorse minerarie al secondo semestre 2025. Sono in corso studi metallurgici per ottimizzare il recupero dei metalli in diversi domini geometallurgici.

Meridian Mining (OTCQX:MRRDF) ha anunciado resultados significativos de perforación en su depósito de Au-Cu-Ag & Zn Santa Helena. El dato más destacado es el pozo CD-651, que interceptó 33,4 m con 2,0 g/t AuEq (1,4% CuEq), incluyendo 13,1 m con 4,2 g/t AuEq (2,8% CuEq) desde profundidades superficiales.

Otros resultados notables incluyen el pozo CD-655, que reportó 9,9 m con 5,6 g/t AuEq (3,7% CuEq) a 3,8 m en la perforación de relleno en el área de la mina. La compañía también ha descubierto una nueva anomalía de suelo de cobre y oro de 2.200 m en Santa Fé, ubicada a 5 km al sureste de Santa Helena, con valores máximos de 547 ppm Cu, 2539 ppm Pb, 1135 ppm Zn y 65 ppb Au.

La extensión occidental de Santa Helena sigue abierta para futuras exploraciones, y la empresa ha revisado su calendario para la estimación de recursos minerales al segundo semestre de 2025. Los estudios metalúrgicos continúan para optimizar la recuperación de metales en distintos dominios geometalúrgicos.

Meridian Mining (OTCQX:MRRDF)는 Santa Helena Au-Cu-Ag & Zn 광상에서 중요한 시추 결과를 발표했습니다. 주요 성과는 시추공 CD-651로, 얕은 깊이에서 33.4m 구간에 2.0g/t AuEq (1.4% CuEq)를 포함하여 13.1m 구간에 4.2g/t AuEq (2.8% CuEq)을 확인했습니다.

추가로 주목할 만한 결과로는 광산 지역 내 충진 시추에서 3.8m 깊이부터 9.9m 구간에 5.6g/t AuEq (3.7% CuEq)를 기록한 CD-655 시추공이 있습니다. 또한 회사는 Santa Helena에서 남동쪽으로 5km 떨어진 Santa Fé에서 2,200m 규모의 새로운 구리-금 토양 이상체를 발견했으며, 최고값은 Cu 547 ppm, Pb 2539 ppm, Zn 1135 ppm, Au 65 ppb입니다.

Santa Helena의 서쪽 확장 구간은 추가 탐사가 가능하며, 회사는 광물 자원 추정 일정을 2025년 하반기로 조정했습니다. 다양한 지질-제련 영역에서 금속 회수를 최적화하기 위한 제련학 연구가 진행 중입니다.

Meridian Mining (OTCQX:MRRDF) a annoncé des résultats significatifs de forage sur son gisement Au-Cu-Ag & Zn de Santa Helena. Le point fort est le trou de forage CD-651, qui a intercepté 33,4 m à 2,0 g/t AuEq (1,4% CuEq), incluant 13,1 m à 4,2 g/t AuEq (2,8% CuEq) à faible profondeur.

D'autres résultats notables incluent le trou CD-655, qui a retourné 9,9 m à 5,6 g/t AuEq (3,7% CuEq) à 3,8 m dans la zone de forage de comblement de la mine. La société a également découvert une nouvelle anomalie de sol cuivre-or de 2 200 m à Santa Fé, située à 5 km au sud-est de Santa Helena, avec des valeurs maximales de 547 ppm Cu, 2539 ppm Pb, 1135 ppm Zn et 65 ppb Au.

L’extension ouest de Santa Helena reste ouverte à une exploration supplémentaire, et la société a révisé son calendrier pour l’estimation des ressources minérales au second semestre 2025. Des études métallurgiques sont en cours pour optimiser la récupération des métaux dans différents domaines géométallurgiques.

Meridian Mining (OTCQX:MRRDF) hat bedeutende Bohrergebnisse bei seiner Santa Helena Au-Cu-Ag & Zn Lagerstätte bekannt gegeben. Das Highlight ist das Bohrloch CD-651, das 33,4 m mit 2,0 g/t AuEq (1,4% CuEq) durchschnitten hat, darunter 13,1 m mit 4,2 g/t AuEq (2,8% CuEq) aus flachen Tiefen.

Weitere bemerkenswerte Ergebnisse umfassen CD-655, das im Bereich der Bergwerksnachbohrung 9,9 m mit 5,6 g/t AuEq (3,7% CuEq) ab 3,8 m Tiefe lieferte. Das Unternehmen hat zudem eine neue 2.200 m lange Kupfer-Gold-Bodenanomalie bei Santa Fé entdeckt, 5 km südöstlich von Santa Helena, mit Spitzenwerten von 547 ppm Cu, 2539 ppm Pb, 1135 ppm Zn und 65 ppb Au.

Die westliche Erweiterung von Santa Helena bleibt für weitere Erkundungen offen, und das Unternehmen hat seinen Zeitplan für die Schätzung der Mineralressourcen auf das zweite Halbjahr 2025 angepasst. Metallurgische Studien laufen, um die Metallrückgewinnung aus verschiedenen geometallurgischen Bereichen zu optimieren.

- High-grade shallow mineralization discovered in western extension: CD-651 with 33.4m @ 2.0g/t AuEq

- New Cu-Au-Zn discovery at Santa Fé with 2,200m soil anomaly

- Multiple zones of massive to semi-massive VMS mineralization identified

- Potential for expansion as mineralization remains open at both ends of Santa Helena

- Mineral resource estimation delayed to H2 2025 due to additional drilling requirements

- Some historical drill holes were too shallow or partially un-assayed, limiting previous deposit interpretation

Highlights:

Meridian drills into a VMS pile hosting massive to semi-massive Cu-Au-Zn & Ag sulphides on the western edge of Santa Helena:

CD-651: 33.4m @ 2.0g/t AuEq (

1.4% CuEq) from 151.0m;Including:

13.1m @ 4.2g/t AuEq (

2.8% CuEq) from 151.4m;

4.4m @ 6.5g/t AuEq (

4.4% CuEq) from 214.0m;

Santa Helena mine area infill drilling returns more shallow high-grade mineralization;

CD-655: 9.9m @ 5.6g/t AuEq (

3.7% CuEq) from 3.8m;

Meridian announces discovery of "open" 2,200m copper-gold soil anomaly at Santa Fé; and

Potential for Santa Helena to be a second hub within the Cabaçal belt strengthens.

LONDON, UK / ACCESS Newswire / April 15, 2025 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to announce that it has drilled laterally into a VMS pile hosting Cu-Au-Zn & Ag massive to semi-massive sulphides on the western limit of the Santa Helena Au-Cu-Ag & Zn deposit "Santa Helena". CD-651 returned 33.4m @ 2.0g/t AuEq (

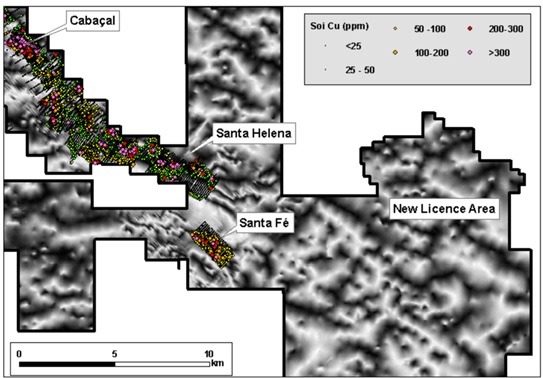

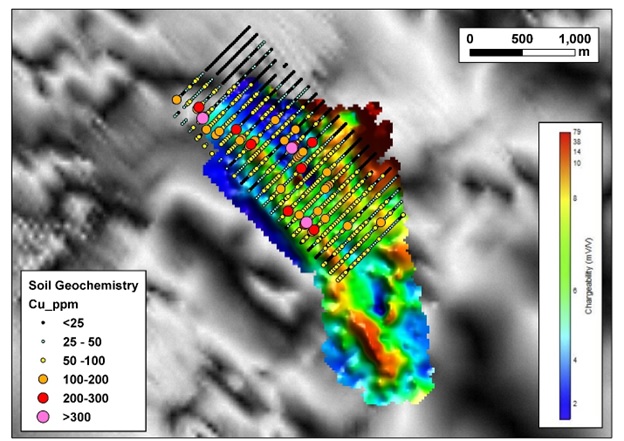

The Company is also announcing that its exploration team has defined a new Cu-Au and Zn discovery at Santa Fé ("Santa Fé"), 5km southeast of Santa Helena. Santa Fé hosts an open Cu-Au-Zn soil geochemical anomaly extending over 2,200m with a coincident Induced Polarization ("IP") anomaly. Further geophysical and surface mapping is ongoing with Santa Fé projected to be drill ready by late in Q2.

Mr. Gilbert Clark, CEO, comments: "CD-651 returned multiple shallow layers of massive to semi-massive, and disseminated sulphides, hosting high-grades of Au-Cu-Ag & Zn mineralization starting at only 26m below surface. With CD-651's strong sulphides, it now makes the whole of the Santa Helena system resemble a string of precious and base metal pearls, just like the black smokers that create VMS deposits. The mineralization at both ends of Santa Helena remains open for extensions and more drilling is needed to close-off and in-fill this system. I believe that by combining this growth at Santa Helena with the exciting Santa Fé discovery the potential for a future second mining Hub centred on Santa Helena is apparent. This growth potential builds on the exceptional PFS results for Cabaçal[1], and this is why Meridian's Cabaçal project is Brazil's and South America's most prospective Cu-Au VMS belt."

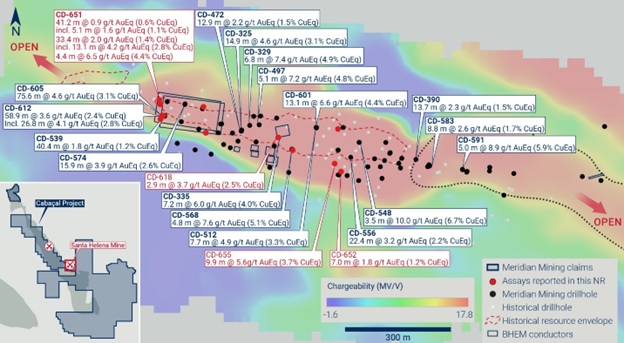

Santa Helena Drilling

The Santa Helena drill program continues to build the resource potential of the western sector of the exploration target area, ("Figure 1"). New mineralization has been defined in areas where the VMS sheet had not previously been projected. CD-651's success in intercepting shallow semi-massive to massive high-grade VMS mineralization confirms that this western extension of Santa Helena's system is open, and more continuous than originally modelled ("Table 1"). Drilling from the 2024 campaign in this western extension had outlined a gold-rich shallow zone, with drill holes CD-539, CD-600, CD-605, and CD-612[2] outlining a mineralized position considered to be up to 15-17m thick. CD-651's further western extensions of this Au-Cu-Ag & Zn mineralization, importantly indicates that some of the historical holes stopped short of the mineralization or failed to fully assay the VMS horizon.

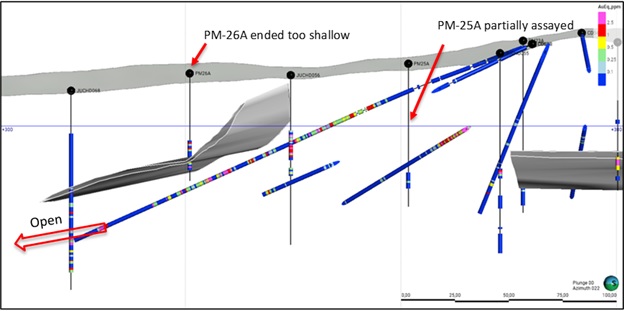

It is apparent after reviewing the Company's recent drill results, that the previous interpretation of the Santa Helena western edge, limited the size of the deposit due to historical drill holes being too shallow (PM-26A) or being partially un-assayed (PM-25A) ("Figure 2"). In addition, Meridian's field validation checks suggested that one mineralized hole, JUCHD-056, was mislocated in the historical database. Meridian's continued success in intercepting high-grade Au-Cu-Ag & Zn mineralization, indicates a far stronger and open system than historically modelled. As a result of this success, additional drilling is needed to close off this western zone of Santa Helena's mineralization before a mineral resource can be estimated; this will now be later in H2, 2025.

Lateral drilling has continued at a low angle while the Company evaluates options to establish alternative platforms. Following adaptations to the drill rig, CD-651 extended further west than the Company's previous limits of drilling. The recent results of CD-651 have returned multiple zones of semi-massive to massive VMS mineralization:

41.2m @ 0.9g/t AuEq (

0.6% CuEq) from 78.0m;Including: 5.1m @ 1.6g/t AuEq (

1.1% CuEq) from 102.7m;

33.4m @ 2.0g/t AuEq (

1.4% CuEq) from 151.0m;Including: 13.1m @ 4.2g/t AuEq (

2.8% CuEq) from 151.4m;

4.4m @ 6.5g/t AuEq (

4.4% CuEq) from 214.0m;

In addition, new results from drill holes in this western position include:

CD-624: 73.7m @ 1.0g/t AuEq (

0.7% CuEq) from 22.6m;Including: 22.4m @ 1.5g/t AuEq (

1.0% CuEq) from 22.6m;

CD-643: 30.3m @ 1.2g/t AuEq (

0.8% CuEq ) from 66.4m;Including: 7.6m @ 2.5g/t AuEq (

1.7% CuEq ) from 66.4m;

CD-661: 46m @ 1.5g/t AuEq (

1% CuEq ) from 2.0mIncluding 7.6m @ 2.6g/t AuEq (

1.7% CuEq ) from 2.0mAnd 41.7m @ 0.9g/t AuEq (

0.6% CuEq ) from 54.0m

Metallurgical studies continue assessment of optimizing metal recovery from this and other geometallurgical domains.

Drilling over the main sheet includes a combination of infill and verification drilling, where incomplete historical data has created uncertainty in the modelling approach. An angled hole, CD-618, was drilled where hole PM-10A terminated at 27.5m, having been sampled to 27.1m with some doubt as to whether it traversed the full layer. CD-618 intersected 2.9m @ 3.7g/t AuEq from 40.8m in the VMS position, with additional mineralization intercepted in the footwall positions, including 4.8m @ 1.6g/t AuEq (

Two historical holes were twinned (JUCHD-100, JUCHD-112) where composites had been recorded but for which individual assays were lost, making the holes unsuitable for resource estimation. Twin holes returned:

CD-655: 9.9m @ 5.6g/t AuEq (

3.7% CuEq) from 3.8m;Including: 6.7m @ 7.5g/t AuEq (

5.1% CuEq) from 6.0m; and

CD-652: 7.0m @ 1.8g/t AuEq (

1.2% CuEq) from 10.3m.

The more complete data enables better modelling of the VMS horizon where the partial data implied a more restricted extent.

Santa Fé Exploration Discovery

Through the Company's regional exploration programs, a new target area in the southeast of the Cabaçal Belt, Santa Fé, (" Figure 3") has returned multiple strong surface geochemical anomalies ("Figure 4"), in a position not defined by historical exploration campaigns. A soil survey grid extending over 2.2km has returned peak values of 547 ppm Cu, 2539 ppm Pb, 1135 ppm Zn, and 65 ppb Au. Alluvial cover constrains the geochemical effectiveness of the grid extensions. The area has limited exposure but subcrop and float characteristic of the chlorite-altered mine sequence succession were observed, with rock chips returning up to

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with

Gold equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. AuEq (g/t) = (Au(g/t) *

Induced polarization surveys have been conducted by the Company's in-house team utilizing its GDD GRx8-16c receiver and 5000W-2400-15A transmitter. Results are sent daily for processing and quality control to the Company's consultancy, Core Geophysics. Modelling of conductivity response is undertaken using industry-standard Maxwell software. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person Statement

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, verified and approved the technical information in this news release.

About Meridian

Meridian Mining is focused on:

• The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

• The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

• Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

• Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Pre-feasibility Study technical report (the "PFS Technical Report") dated March 31, 2025, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study" outlines a base case after-tax NPV5 of USD 984 million and

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold,

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company's profile on SEDAR+ at www.sedarplus.ca and on the Company's website at www.meridianmining.co

The PFS Technical Report was prepared for the Company by Tommaso Roberto Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering Canada ULC; Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering Canada ULC; John Anthony McCartney, C.Geol., Ausenco Chile Ltda.; Porfirio Cabaleiro Rodriguez (Engineer Geologist FAIG), of GE21 Consultoria Mineral; Leonardo Soares (PGeo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral; Norman Lotter (Mineral Processing Engineer; P.Eng.), of Flowsheets Metallurgical Consulting Inc.; and, Juliano Felix de Lima (Engineer Geologist MAIG), of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

8th Floor, 4 More London Riverside

London SE1 2AU

United Kingdom

Email: info@meridianmining.co

Ph: +1 778 715-6410 (BST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Cautionary Statement on Forward-Looking Information

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Assay Results from Santa Helena Drilling

Hole-id | Dip | Azi | EOH | Zone | Int | AuEq | CuEq | Au | Cu | Ag | Zn | Pb | From |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

(m) | (m) | (g/t) | (%) | (g/t) | (%) | (g/t) | (%) | (%) | (m) | ||||

CD-661 | -21 | 280 | 95.7 | SHM |

| Subparallel Hole | |||||||

|

|

|

|

| 46.0 | 1.5 | 1.0 | 0.6 | 0.7 | 5.6 | 0.4 | 0.9 | 2.0 |

|

|

|

| Including | 7.6 | 2.6 | 1.7 | 2.5 | 0.6 | 6.4 | 0.2 | 0.6 | 2.0 |

|

|

|

|

| 41.7 | 0.9 | 0.6 | 0.0 | 0.2 | 5.6 | 1.4 | 0.0 | 54.0 |

CD-655 | -90 | 000 | 25.2 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 9.9 | 5.6 | 3.7 | 1.4 | 1.5 | 35.1 | 5.7 | 0.7 | 3.8 |

|

|

|

| Including | 8.1 | 6.6 | 4.4 | 1.6 | 1.8 | 41.1 | 6.9 | 0.8 | 5.6 |

|

|

|

| Including | 6.7 | 7.5 | 5.1 | 1.8 | 2.1 | 47.7 | 7.6 | 0.9 | 6.0 |

|

|

|

| Including | 1.6 | 11.6 | 7.8 | 3.4 | 4.2 | 83.8 | 7.5 | 1.0 | 8.2 |

CD-652 | -90 | 000 | 35.5 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6.7 | 0.3 | 0.2 | 0.0 | 0.1 | 3.2 | 0.3 | 0.1 | 0.9 |

|

|

|

|

| 7.0 | 1.8 | 1.2 | 0.3 | 0.6 | 40.5 | 1.4 | 0.8 | 10.3 |

|

|

|

| Including | 5.2 | 2.3 | 1.6 | 0.4 | 0.7 | 51.9 | 1.6 | 0.9 | 10.7 |

|

|

|

| Including | 2.3 | 3.7 | 2.5 | 0.3 | 1.6 | 68.9 | 2.1 | 1.6 | 10.7 |

CD-651 | -21 | 295 | 231.1 | SHM |

| Subparallel Hole | |||||||

|

|

|

|

| 41.2 | 0.9 | 0.6 | 0.3 | 0.1 | 10.9 | 1.0 | 0.5 | 78.0 |

|

|

|

| Including | 16.6 | 1.2 | 0.8 | 0.2 | 0.1 | 16.1 | 1.8 | 0.5 | 102.7 |

|

|

|

| Including | 5.1 | 1.6 | 1.1 | 0.4 | 0.1 | 15.2 | 2.8 | 0.8 | 102.7 |

|

|

|

|

| 2.4 | 0.9 | 0.6 | 0.7 | 0.1 | 16.8 | 0.6 | 0.2 | 132.0 |

|

|

|

|

| 3.0 | 1.0 | 0.7 | 0.2 | 0.1 | 16.2 | 1.4 | 0.6 | 140.0 |

|

|

|

|

| 33.4 | 2.0 | 1.4 | 0.3 | 0.3 | 24.4 | 3.1 | 0.7 | 151.0 |

|

|

|

| Including | 13.1 | 4.2 | 2.8 | 0.4 | 0.6 | 48.4 | 6.5 | 1.2 | 151.4 |

|

|

|

| Including | 5.9 | 5.7 | 3.8 | 0.5 | 0.7 | 65.2 | 9.2 | 1.8 | 151.4 |

|

|

|

| Including | 3.4 | 5.9 | 4.0 | 0.6 | 1.0 | 66.3 | 8.8 | 1.4 | 161.0 |

|

|

|

|

| 2.4 | 2.7 | 1.8 | 0.3 | 0.6 | 28.0 | 3.4 | 0.6 | 189.0 |

|

|

|

|

| 4.4 | 6.5 | 4.4 | 0.4 | 0.6 | 65.6 | 11.6 | 2.1 | 214.0 |

CD-644 | -71 | 186 | 45.1 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 9.5 | 0.8 | 0.6 | 0.2 | 0.2 | 7.0 | 0.9 | 0.4 | 4.7 |

|

|

|

|

| 3.2 | 0.6 | 0.4 | 0.2 | 0.1 | 3.6 | 0.8 | 0.0 | 17.2 |

|

|

|

|

| 2.4 | 1.4 | 0.9 | 0.4 | 0.1 | 5.6 | 2.3 | 0.5 | 24.7 |

CD-643 | -26 | 280 | 145.5 | SHM |

| Subparallel Hole | |||||||

|

|

|

|

| 30.3 | 1.2 | 0.8 | 0.7 | 0.3 | 10.9 | 0.7 | 0.9 | 66.4 |

|

|

|

| Including | 7.6 | 2.5 | 1.7 | 2.0 | 0.5 | 23.8 | 0.8 | 2.5 | 66.4 |

CD-637 | -90 | 000 | 71.0 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 0.9 | 1.7 | 1.2 | 0.4 | 0.7 | 11.2 | 1.0 | 0.1 | 31.2 |

|

|

|

|

| 2.9 | 1.7 | 1.1 | 0.2 | 0.2 | 11.8 | 2.9 | 0.5 | 43.2 |

|

|

|

|

| 1.1 | 1.7 | 1.1 | 0.6 | 0.1 | 20.1 | 2.5 | 1.2 | 50.7 |

CD-633 | -21 | 009 | 119.3 | SHM | NSR |

|

|

|

|

|

|

|

|

CD-630 | -66 | 315 | 85.9 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.5 | 0.8 | 0.5 | 0.1 | 0.0 | 7.1 | 1.5 | 0.4 | 70.4 |

|

|

|

|

| 0.5 | 1.4 | 0.9 | 0.0 | 0.3 | 5.7 | 2.4 | 0.3 | 75.2 |

CD-624 | -21 | 290 | 140.3 | SHM |

| Subparallel Hole | |||||||

|

|

|

|

| 73.7 | 1.0 | 0.7 | 0.3 | 0.4 | 8.9 | 0.7 | 0.3 | 22.6 |

|

|

|

| Including | 22.4 | 1.5 | 1.0 | 0.8 | 0.6 | 13.7 | 0.4 | 0.9 | 22.6 |

|

|

|

| Including | 15.5 | 1.8 | 1.2 | 1.0 | 0.6 | 14.2 | 0.4 | 1.0 | 22.6 |

|

|

|

| Including | 8.1 | 2.2 | 1.5 | 1.4 | 0.8 | 5.6 | 0.6 | 0.7 | 22.6 |

|

|

|

|

| 3.2 | 0.4 | 0.3 | 0.0 | 0.0 | 1.8 | 0.8 | 0.0 | 99.4 |

CD-621 | -70 | 190 | 77.8 | SHM | NSR |

|

|

|

|

|

|

|

|

CD-618 | -61 | 181 | 106.9 | SHM |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2.9 | 3.7 | 2.5 | 0.8 | 0.9 | 30.7 | 4.2 | 0.9 | 40.8 |

|

|

|

|

| 3.7 | 0.8 | 0.5 | 0.3 | 0.0 | 14.2 | 1.3 | 0.7 | 45.7 |

|

|

|

|

| 4.8 | 1.6 | 1.0 | 0.9 | 0.0 | 39.4 | 1.5 | 1.1 | 54.4 |

|

|

|

|

| 3.3 | 0.9 | 0.6 | 0.1 | 0.1 | 7.2 | 1.5 | 0.3 | 72.9 |

|

|

|

|

| 2.1 | 1.7 | 1.1 | 0.8 | 0.1 | 17.8 | 2.3 | 1.2 | 79.0 |

[1] Meridian Mining news release of March 10, 2025.

[2]Meridian Mining news release of November 20th and December 16, 2024.

SOURCE: Meridian Mining SE

View the original press release on ACCESS Newswire