Meridian Maps Multiple New EM Plates Extending Out From Santa Helena Mine

Meridian Mining UK S (OTCQB: MRRDF) announced significant advancements at the Santa Helena deposit, part of its Cabaçal project. Following surface electromagnetic (EM) surveys, multiple untested geophysical targets have been identified, suggesting considerable upside potential for Cu-Zn-Au-Ag mineralization. The combined results from EM and induced polarization (IP) surveys highlight new sites for exploration, potentially enhancing the mine's prospect for open-pitable deposits. Meridian has outlined plans to resume drilling activities in the Cabaçal region after the holiday break, with an emphasis on confirming these new targets.

- Identification of multiple untested geophysical targets extending from the Santa Helena deposit.

- Potential for substantial open-pitable Cu-Zn-Au-Ag mineralization growth at Santa Helena.

- Plans to resume drilling programs, signaling commitment to resource confirmation and further exploration.

- None.

Untested targets for further Cu-Zn-Au-Ag massive sulphide and feeder zones defined

LONDON, UK / ACCESSWIRE / January 24, 2023 / Meridian Mining UK. S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQB:MRRDF) ("Meridian" or the "Company") is pleased to provide an update on its successful geophysical exploration programs within the Cabaçal mine corridor. Recently completed surface electromagnetic ("EM") surveys have outlined multiple EM plates down dip from the high-grade Cu-Zn-Au-Ag massive sulphides of the Santa Helena deposit ("Santa Helena"). An Induced Polarization ("IP") survey has also been completed over the Santa Helena deposit and combined with the EM plates has generated a new geophysical model extending the mine's untested and unmined upside, generating multiple near-surface targets to follow up on. These near mine prospects have created further potential for the extension of open-pitable Cu-Zn-Au-Ag mineralization at Santa Helena. Follow up resource confirmation and delineation programs are being planned.

Highlights Reported Today

- Santa Helena EM survey defines multiple potential extensions to Cu-Zn-Au-Ag rich massive sulphides and associated feeder zone;

- Combined EM and IP survey results defined new untested upside with Santa Helena's mineralised envelope extending out from historical mine;

- Geophysical responses are open along strike and at shallow open-pitable depths;

- New geophysical trend follows strike and extends outwards from Santa Helena's gold overprint;

- Future geophysical programs to extend from Santa Helena along trend to the Álamo prospect; and

- Meridian is restarting the Cabaçal drill programs after Christmas and New Year break.

Dr. Adrian McArthur, CEO and President comments: "These initial results from the geophysical program have been extremely valuable in expanding the upside of further open-pitable mineralization at Santa Helena. Like the Cabaçal deposit, Santa Helena's history and geology is a partially mined (Cu-Zn dominant) VMS mineralization being overprinted by a later stage gold event. The 15,700 m of historical but selectively assayed drilling was focused on the narrow trend of high-grade Cu-Zn-Au-Ag massive sulphides. The extension of the VMS targets by these geophysical results outside of the historical drilling strengthens the open-pit potential of the deposit, which is further enhanced by the potential to extend down dip the high-grade gold overprint of Santa Helena."

Santa Helena Geophysical Results

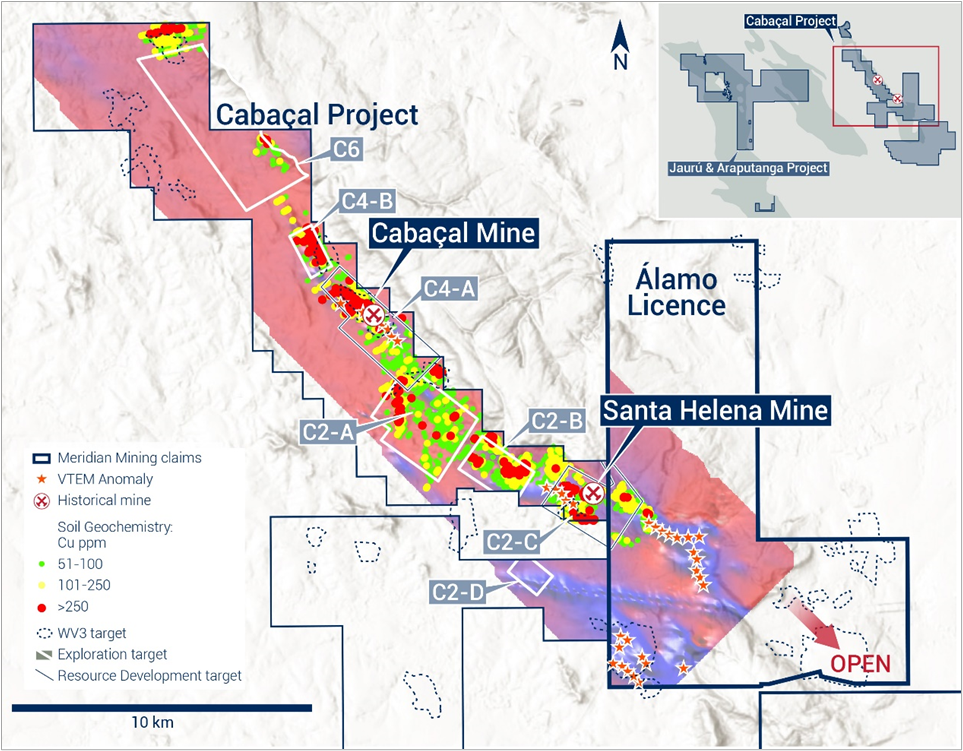

Prior to the New Year's recess, the Company undertook its first campaign of geophysics over the Santa Helena deposit ("Figure 1"), which represents a potential satellite open-pit development target for the Cabaçal project. The objective of the survey was to test the open high-grade Cu-Zn-Au-Ag massive sulphide mineralization for near-mine extensions. Significant widths of mineralization have been historically reported from surface and underground drilling[1], including:

- BPM surface drill hole JUCHD031: 27.6m @

1.6% Cu, 1.5g/t Au,4.4% Zn & 36.3g/t Ag from 24.9m; and - PML underground drill hole FSS24: 17.5m @

0.7% Cu, 1.0g/t Au,7.2% Zn & 25. 5g/t Ag from 21.5m;

Figure 1: Location of Santa Helena, to the NW of the recently renewed Álamo licence. Geophysical fingerprinting of the Santa Helena deposit will provide a useful template for corridors to be covered hosting WorldView 3 Satellite targets, soil anomalies, and VTEM anomalies to the southeast. Gridded conductivity image in the background with darker blue areas marking conductive trends.

Meridian has concluded two phases of surface geophysical surveys, using surface electromagnetic fixed loop techniques, and induced polarization techniques. The current campaign of work detected three shallow dipping plates interpreted to be bedrock conductors, with modelled extents of 500 x 300m, 250 x 300m, 350 x 300m ("Figure 2"). The EM plates have a typical conductivity thickness for Cu-Zn sulphides of 4 Siemens. The leading edge of the two most eastern plates align with the position of the resource envelope and extend outwards a further ~200 - 250m to the north-northwest into sparely drilled areas. Nine historical BPM drill holes were drilled in this location for which assays have not been completely preserved. A third plate modelled to the west falls into an area untested by drilling. Given the deformed character of the host sequence, it is encouraging to have geophysical anomalies extending beyond the main resource area, and future drill programs will test for additional Cu-Zn-Au-Ag sulphide mineralization and for the replications of the gold overprint.

[1] Meridian Mining News release of February 07, 2022

Figure 2: View to the west of Santa Helena historical mine, drilling and the EM plates and IP anomalies. Drill holes are coloured by Cu grade (light grey unsampled). The three Maxwell EM plates dip to the north. The higher threshold chargeability inversion shells (21-24-27-30mV/V) are shown in the eastern sector of the deposit and remain open.

To supplement the EM survey, the Company has completed a gradient array IP survey. The peak response aligns well with the Cu-Zn-Au-Ag sulphide resource and remains open to the east ("Figure 2"), suggesting some sulphide presence in the shallower up-plunge sector of the deposit beyond the historical resource limit. The peak chargeability response follows the strike of the deposit in the eastern sector, reaching ranges of 30 mV/V (millivolts per volt) - characterized as a moderate to strong response for VMS mineralization. The southern margin of the chargeability response is fairly sharp, but the northern margin shows a broader chargeability response projecting into the area of the conductivity plates. The western margin of the chargeability response becomes slightly divergent to the modelled mineralization envelope. It will be important to verify if any local fold concentrations of sulphide mineralization are present. The peak chargeability response corridor in the western corridor has not been effectively drilled. The Company is awaiting environmental permits to extend the survey east and west of the current limits.

Santa Helena Deposit

The Santa Helena deposit (historically also referred to as C2C, and Monte Cristo), is located 9km to the southeast of the Cabaçal Mine area, within the 11km Mine Corridor trend. The deposit was first discovered by BP Minerals ("BPM") in 1984. The deposit is associated with the same host geology as that of the Cabaçal Mine. The former operator at Santa Helena, Prometálica ("PML"), commissioned the underground mine in 2006 with a historical measured and indicated resource of 1.12 Mt @

The deposit plunges gently west-northwest. Shallow oxide gold mineralization is recognized in historical trenching to the east of the resource limit[3], which was not previously considered in SRK's historical 2007 estimate for the deposit nor was it extensively tested by angled drilling. Meridian is targeting Santa Helena as a potential satellite open pit prospect using typical open pit parameters. Both BPM and PML focused on the underground development and on the higher-grade massive sulphide mineralization. Numerous historical holes have not been sampled to conclusively demonstrate the limit of mineralization (or analysed for the full suite of elements). In the oxide zone, similar to the Cabaçal deposit, the upper intervals of the drill holes have also not been systematically sampled. Of the 39 PML holes, gold assays are not available for 12 of the holes, and in an additional 9 of the holes, the first recorded sample starts within the mineralized halo (grades of 0.1 - 1.0g/t Au). The sampling approach in the original BPM holes (for which data is available in the JUCHD series) is similar, with an average starting depth of 22.4m. Whilst some angled holes were drilled by BPM, historical drilling was overwhelmingly vertical unsuited to testing the late stage overprinting vertical gold structures now recognized in the belt.

[2] The historical resource estimate for Santa Helena (also referred to as Monte Cristo) was completed by SRK and presented to Prometálica in a report dated 30 March 2007: NI 43-101 Technical Report Brazilian Resources Inc. Monte Cristo Mine. State of Mato Grosso, Brazil. Report by SRK Consulting, Project Numb

Initiation of 2023 programs

The Company is conducting a search of historical collars to test whether any of the historical holes remain accessible for potential DHEM surveys. After finalizing its programs at Santa Helena, the Company will continue geophysical and geochemical programs in the "C2" corridor between Cabaçal and Santa Helena, and on the Álamo exploration licence to the southeast which has recently been renewed for a second three-year term and where reconnaissance mapping has defined a number of Cu-Zn gossans[4]. Drilling has now restarted at Cabaçal after the new year recess period.

About Cabaçal

In November 2020, Meridian signed a Purchase Agreement to acquire

Meridian has defined an open trend of shallow copper-gold mineralization centred on the Cabaçal Mine. This mineralization trends Northwest-Southeast, sub-crops along its Northeast limits, dips to the southwest at 26° and is up to 90m thick; presenting excellent open-pit geometry and mineral endowment. Meridian is currently focused on infill drilling along a 2,000m corridor along this trend.

Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within units of deformed metavolcanic-sedimentary rocks ("VMS"). A later-stage sub-vertical gold overprint event has emplaced high-grade gold mineralization truncating the dipping VMS layers. It was explored and developed by BP Minerals/Rio-Tinto from 1983 to 1991 and then by the Vendors in the mid-2000's. This historical exploration database includes over 83,000 metres of drilling, extensive regional mapping, soil surveys, metallurgy from production reports, and both surface and airborne geophysics. The majority of Cabaçal's prospects remain to be tested.

Cabaçal has excellent infrastructure with access by all-weather roads, clean electricity provided by nearby hydroelectric power stations, and local communities provide mining services and employees. Cabaçal consists of 1 mining license, 1 mining lease application, and 7 exploration claims which total 44,265 hectares. The September 2022 Cabaçal mineral resource estimate consists of Indicated resources of 52.9Mt @ 0.6g/t Au,

Monte Cristo Mine. State of Mato Grosso, Brazil. Report by SRK Consulting, Project Number 164802. Compiled by Nick Michael, Clay Taylor, Alva Kuestermeyer. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. Meridian has not treated the resource and reserve stated in this report as a current mineral resource or reserves for purposes of National Instrument 43-101.

[3] Meridian Mining News release of March 29, 2022

[4] Meridian Mining News Announcement of 10 January 2023.

About Meridian

Meridian Mining UK S is focused on the acquisition, exploration, and development activities in Brazil. The Company is currently focused on resource development of the Cabaçal VMS gold‐copper project, the regional scale exploration of the Cabaçal VMS belt, the exploration in the Jaurú & Araputanga Greenstone belts all located in the state of Mato Grosso and exploring the Espigão polymetallic project in the State of Rondônia Brazil.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO, President, and Director

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Technical Note

Geophysical targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit. The gravity program is being executed by Meridian's trained in‐house team using a new gravity meter (CG‐6 Autograv™) purchased from Scintrex. Electromagnetic surveys have been conducted using the SMARTem Geophysical Receiver System manufactured by ElectroMagnetic Imaging Technology (EMIT). Induced polarization surveys have been conducted by the Company's in-house team utilizing its GDD GRx8-16c receiver and 5000W-2400-15A transmitter. Results are sent daily for processing and quality control to the Company's consultancy, Core Geophysics. Modelling of conductivity response is undertaken using industry-standard Maxwell software. In BP sampling, gold was analysed historically be fire assay and base metals by three acid digest and ICP finish. Silver was analysed by samples were analysed by aqua regia digest with an atomic absorption finish.

Qualified Person

Dr. Adrian McArthur, B.Sc. Hons, Ph.D. FAusIMM., CEO and President of Meridian as well as a Qualified Person as defined by National Instrument 43-101, has supervised the preparation of the technical information in this news release.

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

SOURCE: Meridian Mining UK S

View source version on accesswire.com:

https://www.accesswire.com/736453/Meridian-Maps-Multiple-New-EM-Plates-Extending-Out-From-Santa-Helena-Mine

FAQ

What are the recent developments for Meridian Mining (MRRDF) regarding the Santa Helena deposit?

What is the significance of the EM and IP survey results for MRRDF's stock?

When will Meridian Mining resume drilling programs in Santa Helena?