Meridian Drills Best Copper-Gold VMS Intercept at Cabaçal: 12.7% CuEq / 19.0g/t AuEq over 12.8m in High-Grade Feeder Zone

Meridian Mining UK (OTCQB: MRRDF) has announced significant progress in its drill program at Cabaçal. Drill hole CD-240 intersected a remarkable high-grade copper zone, yielding 34.5m @ 5.3% CuEq and 12.8m @ 12.7% CuEq results. These findings mark the highest-grade copper interval ever recorded at Cabaçal, with peak assay grades reaching 17.9% Cu and 34.1 g/t Au. The feeder zone remains open for further exploration, with ongoing drilling expected to enhance the existing resource base. This outcome may contribute positively to future economic studies.

- CD-240 drilled the highest-grade VMS copper-gold feeder zone at Cabaçal.

- Significant results include 34.5m @ 5.3% CuEq and 12.8m @ 12.7% CuEq.

- Peak assay grades of 17.9% Cu and 34.1 g/t Au indicate high mineral quality.

- The high-grade feeder zone is open for further results, indicating exploration potential.

- None.

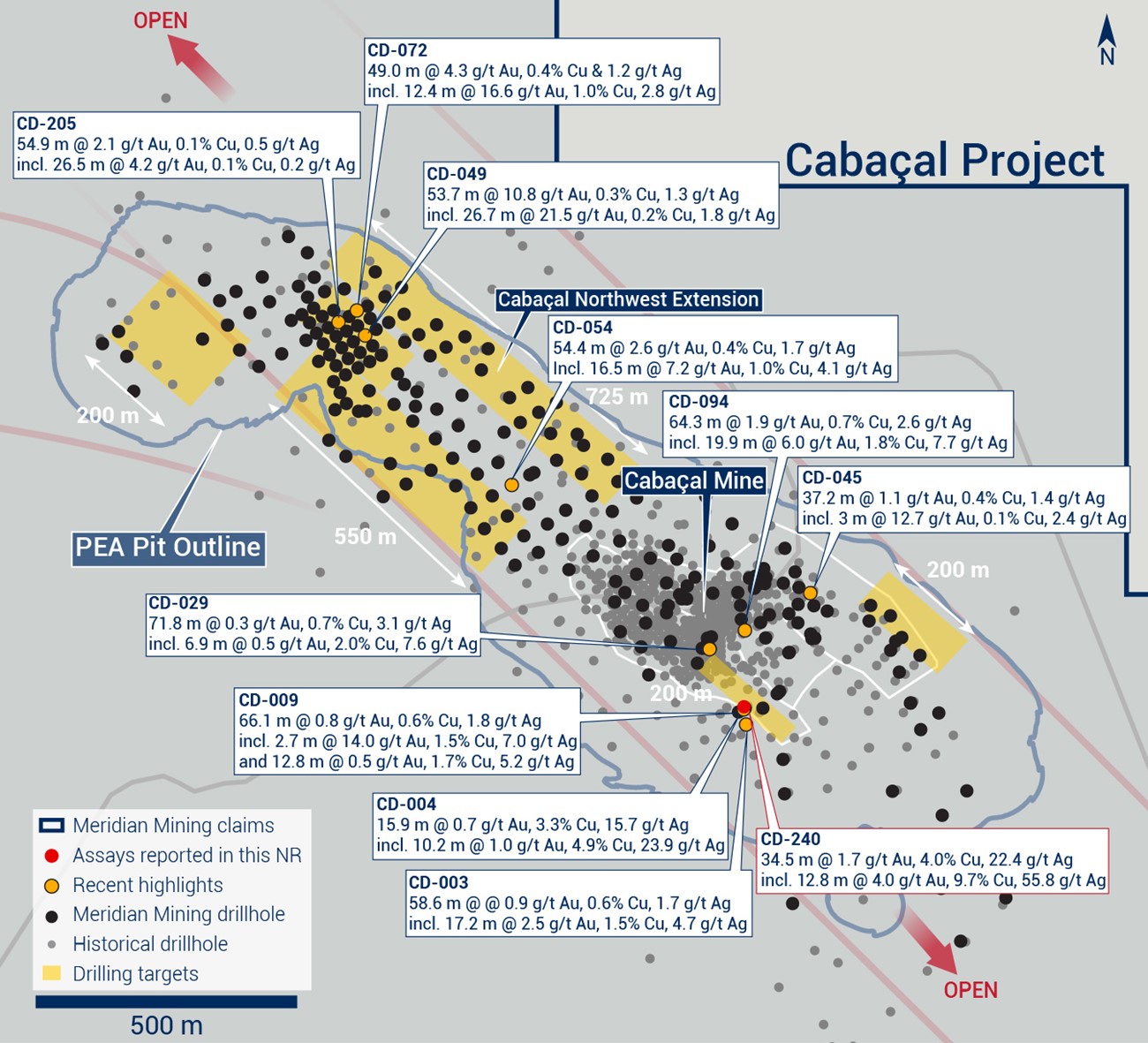

LONDON, UK / ACCESSWIRE / March 27, 2023 / Meridian Mining UK. S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQB:MRRDF) ("Meridian" or the "Company") is pleased to provide an update on the ongoing drill program at Cabaçal ("Figure 1"). Drill hole CD-240 has intersected a wide high-grade copper zone that grades 34.5m @

Highlights Reported Today

- Meridian's CD-240 drills the highest-grade VMS copper-gold feeder zone to date at Cabaçal;

- Cabaçal's highest grade copper zone returns:

- 34.5m @

5.3% CuEq / 7.9g/t AuEq (4.0% Cu, 1.7g/t Au & 22.4g/t Ag) from 125.35m; including: - 12.8m @

12.7% CuEq / 19.0g/t AuEq (9.7% Cu, 4.0g/t Au & 55.8g/t Ag) from 129.9m; - Peak assay grades of

17.9% Cu, 34.1 g/t Au, 105g/t Ag; and - CD-240 high-grade zone remains open.

- 34.5m @

Dr. Adrian McArthur, CEO, comments: "The highest-grade VMS results reported today from CD-240's copper-gold feeder zone highlight the tremendous upside that Cabaçal continues to offer. This trend has the potential to enhance the existing resource base and extends below the current open pit design. The targeting of this open mineralization in the Southern Copper Zone ("SCZ") is part of the ongoing drill program. We expect these results to deliver a positive contribution to the next phase of economic studies. Our technical team continues to analyse the historical data which led directly to these significant results in the high-grade SCZ's extensions."

Photo 1: CD-240's highest grading mineralized intervals

SCZ Copper Sulphide Feeder System

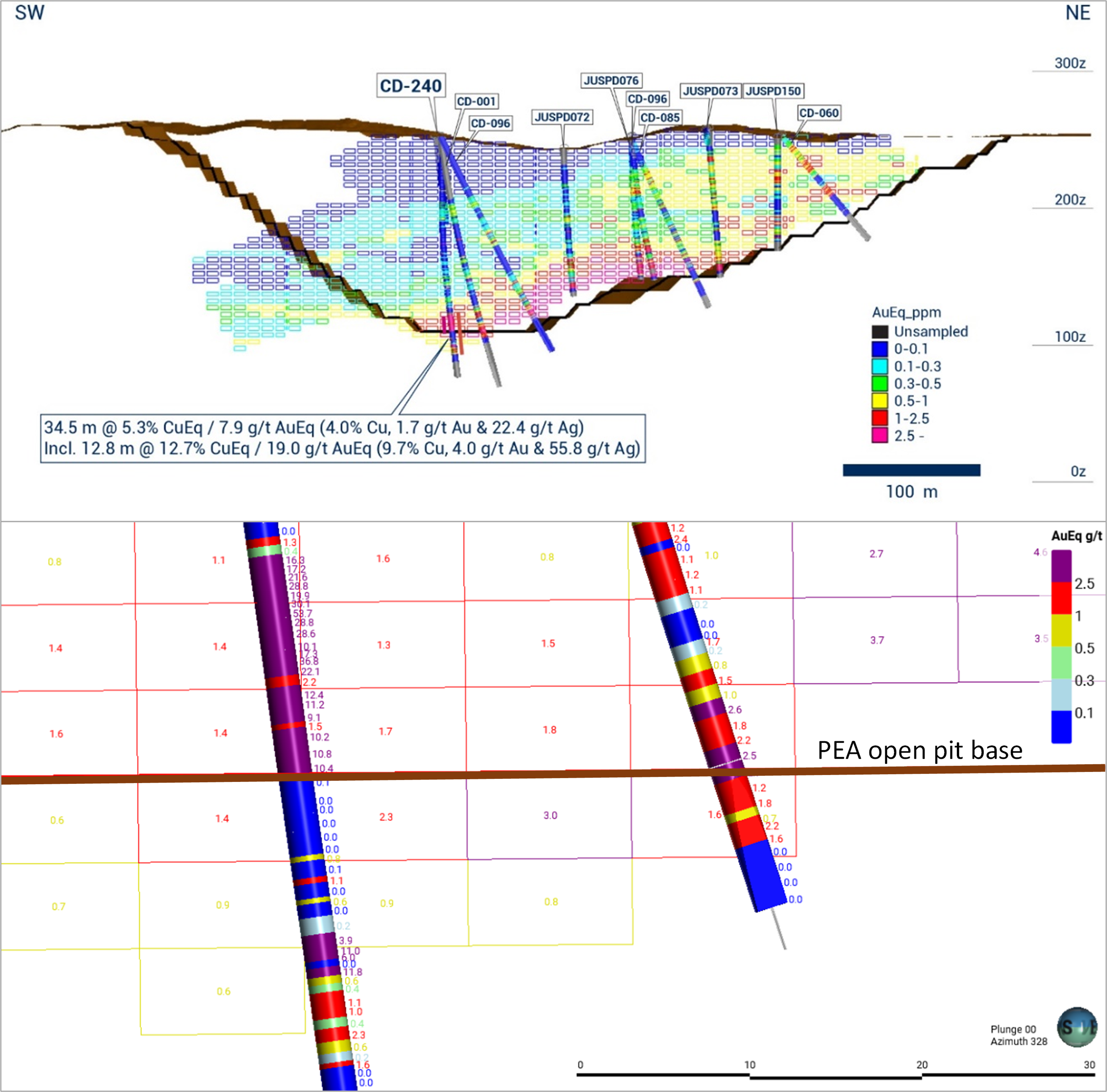

The Company will include this new zone, and the multiple of other higher-grade trends, defined since August 2022, in the upcoming Cabaçal resource update. CD-240's high-grade feeder zone ("Table 2") and its broader halo, are not in the current resource model. When included in the future resource upgrade, these results will improve localized metal content and economics (the block model's grades in CD-240's position are typically in the range of ~0.8 to 3.0g/t AuEq, compared to the average of 7.9g/t AuEq over the 34.5m intersection). The ongoing drill program aims to delineate the SCZ's extensions, which were not historically mined due to the historic gold focused cut-off grade, despite containing exceptional copper grades.

Figure 1: Location of SCZ drill hole CD-240

CD-240 is in a high-grade copper-gold feeder zone within the SCZ, also intersected by the historical holes JUSPD596, JUSPD482, and CAIK211. Unfortunately, complete data for ~28,000m of historical drilling including these intersections and others cannot be located, and therefore was not able to be used in Cabaçal's[2] 2022 resource calculation. The three SCZ intersections are quoted in a 1990 report on Cabaçal's potential[3]:

- JUSPD596: 15.0m @

5.2% Cu, 2.7g/t Au & 9.5g/t Ag; - JUSPD482: 13.4m @

5.5% Cu, 1.3g/t Au & 24.7g/t Ag; and - CAIK211: 29.3m @

6.0% Cu, 3.1g/t Au & 28.8g/t Ag.

Figure 2: Top: cross-sections of drill hole CD-240, bottom close up Cabaçal CD-240 and resource model

Meridian's team recently recovered some of BP's 1980s drill rig bulletins from a local warehouse, including JUSPD596's bulletin. This helped confirm the SCZ's high-grade copper-gold extensions with CD-240's success. Reviews of these bulletins continue. The 1990 report estimated the SCZ's high-grade extensions had dimensions of 80 to 100m long, 10 to 20m wide, and up to 25m thick, with VMS depositional controls. Further drilling will be conducted to confirm the zone's geometry and extension, but the CD-240 result is consistent with these interpretations. CD-240's strong results will have a positive impact both within the current PEA pit shell[4] and below the modelled pit floor.

Table 1: CD-240 composites

Table 2: CD-240 high-grade feeder zone assay results

About Meridian

Meridian Mining UK S is focused on the development and exploration of the advanced staged Cabaçal VMS gold‐copper project, the regional scale exploration of the Cabaçal VMS belt, the exploration in the Jaurú & Araputanga Greenstone belts all located in the State of Mato Grosso, Brazil and exploring the Espigão polymetallic project in the State of Rondônia, Brazil.

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine with in the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within units of deformed metavolcanic-sedimentary rocks. A later-stage sub-vertical gold overprint event has emplaced high-grade gold mineralization cross-cutting the dipping VMS layers.

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold,

The Preliminary Economic Assessment ("PEA") outlines a base case after-tax NPV5 of USD 573 million and

Cabaçal has excellent infrastructure with access by all-weather roads, clean electricity provided by nearby hydroelectric power stations, and local communities provide mining services and employees.

Readers are cautioned that the PEA is preliminary in nature and is intended to provide an initial assessment of the Cabaçal's economic potential and development options. The PEA mine schedule and economic assessment includes numerous assumptions and is based on inferred mineral resources. Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the inferred mineral resources to be considered in future advanced studies.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO and Director

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Technical Note

Gold equivalents are calculated as AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)).

Copper equivalents are calculated as CuEq(%) = (Cu% * %Recovery) = (0.6703*(Au(g/t) * %Recovery)) + (0.0087*(Ag(g/t) * %Recovery)), where:

- Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856;

- Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

- Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield. Gold price US

Qualified Person

Dr. Adrian McArthur, B.Sc. Hons, Ph.D. FAusIMM., CEO and President of Meridian as well as a Qualified Person as defined by National Instrument 43-101, has reviewed, verified and approved the technical information in this news release.

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Meridian believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Meridian cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to: the timing and successful completion of an updated mineral resource; the Company's expectations regarding Cabaçal's PEA; capital and other costs varying significantly from estimates; changes in world metal markets; changes in equity markets; ability to achieve goals; that the political environment in which the Company operates will continue to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; risks related to negative publicity with respect to the Company or the mining industry in general; reliance on a single asset; planned drill programs and results varying from expectations; unexpected geological conditions; local community relations; dealings with non-governmental organizations; delays in operations due to permit grants; environmental and safety risks; and other risks and uncertainties disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

[1] See technical notes.

[2] See Meridian News release, September 26, 2022

[3] Mason R and Kerr D (1990) Cabaçal I Mine - Mato Grosso State, Brazil. Definition of Ore Zones and Potential for New Ore Reserves. Internal report for Mineração Santa Martha

[4] See Meridian News release, March 6, 2023

SOURCE: Meridian Mining UK S

View source version on accesswire.com:

https://www.accesswire.com/745877/Meridian-Drills-Best-Copper-Gold-VMS-Intercept-at-Cabaal-127-CuEq-190gt-AuEq-over-128m-in-High-Grade-Feeder-Zone

FAQ

What recent drilling results were announced by Meridian Mining on March 27, 2023?

What does the drill hole CD-240's results imply for the Cabaçal project?

How do the latest assay grades compare to previous estimates at Cabaçal?