Meridian Commences Cabaçal's PFS & Advances Santa Helena Resource Delineation in Expansion of the Cabaçal Belt's Hub and Spoke Strategy

- None.

- None.

Santa Helena returns 11.0m @ 5.2g/t AuEq & 6.8m @ 3.3g/t AuEq in newly discovered layer of Au-Cu-Ag and Zn VMS mineralization.

LONDON, UK / ACCESSWIRE / January 10, 2024 / Meridian Mining UK S (TSX:MNO)(OTCQX:MRRDF)(Frankfurt/Tradegate:2MM) ("Meridian" or the "Company") is pleased to report its strategy to further advance multiple prospects within the Cabaçal VMS Belt as part of a "Hub and Spoke" strategy to maximise value for shareholders. The Cabaçal Project's ("Cabaçal") current engineering and drill programs will be upgraded to complete a Pre-Feasibility Study ("PFS") on an expanded production case, to delineate higher certainty of the core asset value.

Due to the continued success of drilling at the Santa Helena mine ("Santa Helena"), the Company has decided to advance the historical mine towards a resource estimate to maximise its optionality within the broader VMS belt. Santa Helena has the potential to be the first step towards the Hub and Spoke strategy envisaged for the development of the wider Cabaçal Belt's growth potential.

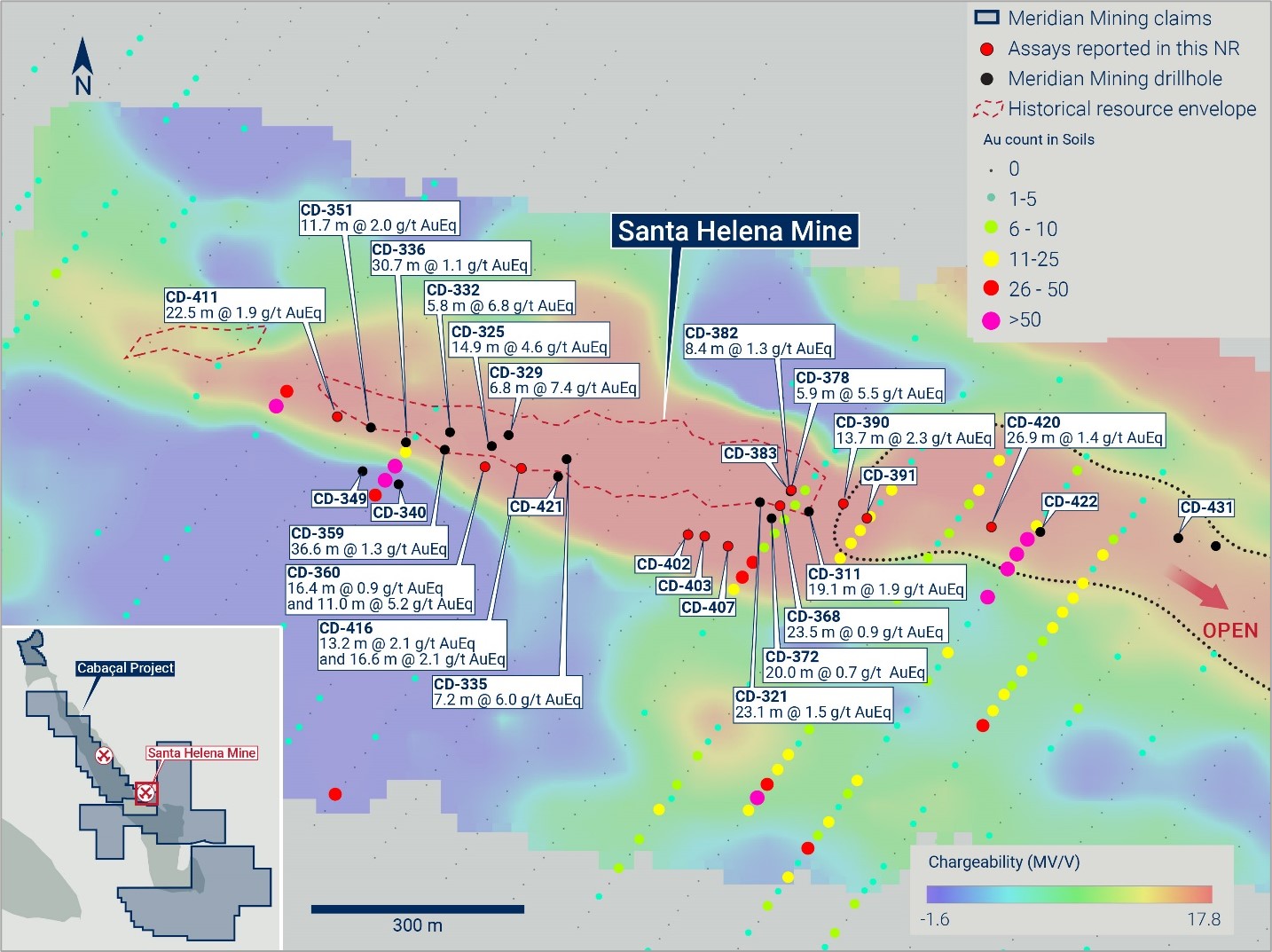

The Company further announces that it has discovered a rich layer of Au-Cu-Ag and Zn VMS mineralization projecting below the main VMS mine horizon at Santa Helena, grading 11.0m @ 5.2g/t AuEq (CD-360) and 6.8m @ 3.3g/t AuEq (CD-416). Further extensions of the VMS mine horizon have been intersected in CD-420, and CD-431, up to 510m to the east of the historical resource envelope ("Figure 1"). Further assay results from Cabaçal and Santa Helena are pending.

Highlights Reported Today

- Cabaçal's work programs upgraded to produce a Pre-Feasibility Study in 2024 leading to higher project certainty;

- Santa Helena's robust growth in resource potential to be advanced towards first resource in 2024;

- Santa Helena's drilling intercepts new Au-Cu-Ag and Zn rich VMS lens located below mine sequence;

- CD-360: 11.0m @ 5.2g/t AuEq (0.9g/t Au,

2.2% Cu, 22.1g/t Ag &3.5% Zn) from 30.0m; - CD-416: 16.6m @ 2.1g/t AuEq (0.7g/t Au,

0.6% Cu, 14.7g/t Ag &1.7% Zn) from 41.4m;

Including 6.8m @ 3.3g/t AuEq (1.3g/t Au,1.1% Cu, 23.3g/t Ag &1.9% Zn) from 41.4m;

- CD-360: 11.0m @ 5.2g/t AuEq (0.9g/t Au,

- Santa Helena's prospective VMS mine sequence extended by 0.51km to the east with multiple hits;

- Cabaçal Mine area continues to return robust results of Au-Cu & Ag mineralization;

- CD-365: 50.5m @ 1.0g/t AuEq (0.7g/t Au,

0.3% Cu & 1.1g/t Ag) from 19.8m; and

- CD-365: 50.5m @ 1.0g/t AuEq (0.7g/t Au,

- Cabaçal Purchase Agreement amended to reflect changes in Project timeline deliverables.

Mr. Gilbert Clark, CEO, comments: "2024 has started with an expansion of our strategy of developing satellite deposits "Spokes" in the Cabaçal belt to feed a central processing "Hub" at Cabaçal. By upgrading Cabaçal's current PEA1 to a PFS standard and removing all Inferred Resources from future financial and mining modelling, we will achieve a higher certainty on its hard asset value, with only a modest increase in the data and studies required. In 2024, Santa Helena's programs will be firmly advancing towards its inaugural resource, with a strong focus on maximising the potential for open-pitable resources, and exposing it to the optionality of the hub and spoke strategy proposed for the Cabaçal VMS belt.

1 Meridian Mining news release dated March 6, 2023

Today's results from Santa Helena have outperformed our expectations with robust assays from infill drilling, with a half a kilometre extension of the mine horizon eastwards beyond its historical resource limits, and with the identification of a strong layer of Au-Cu-Ag and Zn mineralization that projects below the mine horizon. This new horizon presents a tremendous opportunity, as historical drilling has generally not been projected deep enough to effectively test this horizon. All combined, it illustrates both the near-mine and along strike upside that remains.

The Cabaçal mine area continues to deliver robust zones of copper-gold & silver mineralization from shallow depths. We continue to see examples of gold only mineralization, separate to the copper-gold VMS envelope, which reinforces the importance of evaluating the potential of the greater Cabaçal belt for large gold-only deposits related to the later-stage gold event.

As Meridian sets out its well supported development plans for 2024 and beyond, the focus is to create greater hard asset value as a near term developer and operator of one of the most prospective copper-gold VMS belts in South America."

Cabaçal Pre-Feasibility Study and Near-Term Incorporation of the Santa Helena Deposit

The Company has reviewed the growing database of the Cabaçal deposit and the greater Cabaçal VMS belt and has decided to expand the general project data programs to produce a PFS for the Cabaçal mine. The PFS mine schedule and financial model will be focused on an initial throughput of 2.5Mt p.a. then expanded to reach a maximum throughput of 4.5Mt using project cash flow in year four. The larger throughput has been proposed and applied for via the Preliminary License application2. This positions the Cabaçal mine as a central processing hub for the long-term development of the Cabaçal VMS belt. Meridian has already engaged with Brazilian and International engineering groups on the PFS that will be completed to a cost estimate classification of AACE 4. They will be reporting their estimations for the completion of the PFS schedule shortly. To accommodate the collation of the general project data for the PFS, the Company has agreed with the Cabaçal vendors to modify the Cabaçal Purchase Agreement's3 schedule so that the subsequent Feasibility Study is completed by September 30, 2025 with no additional financial consideration required.

Given Santa Helena's strong historical drill results, their ongoing confirmation, and the recent successes in expanding the resource potential, the Company has been given a strong boost for creating potentially the next open pitable resource, that will leverage off the optionality of the proposed Cabaçal belt's development strategy. The Company has reviewed Santa Helena's historical technical and operational reports and held discussions with the previous mill operating personnel. From this, the planned metallurgical studies for the Santa Helena mineralization have historical operational knowledge and technical data inputs, to guide the testwork from the outset.

Santa Helena Drill Program Update

Santa Helena is a Cu-Au-Ag & Zn VMS deposit located ~9km to the southeast of the Cabaçal Mine. It has over 10,000m of historical drilling and is the most advanced of a series of exploration targets along the Cabaçal Mine Corridor. The Company commenced initial drilling in August 20234 as part of a verification program, to validate the historical data in line with NI43-101 requirements, and to initiate scout drilling for resource extensions defined by geophysics and coincident geochemical anomalies. The Company's compilation of historical drill data indicated that many past holes were not completely sampled, that reconciliation of surveyed drilled positions and mine workings (and records), indicated that the high-grade massive sulphide mineralization was only partially mined. and that extensions of near-surface mineralization to the east were also not integrated into the historical resource calculations. The Company has concluded that this historical resource area is considered open, and based on new and historical data defined an Exploration Target of 3.2 - 7.2 Mt @ 3.0 - 3.2g/t AuEq5. The Company has completed thirty holes for 1730m to date. Initial results from holes drilled along the main trend for resource verification and resource extension were very positive6. The latest results ("Table 1") have continued to define mineralization up-dip and south of the historical resource limits, and in the eastern sector of the deposit and its extensions into the projection of the associated geophysical and geochemical anomaly ("Figure 1"), yielding a number of significant results.

2 Meridian Mining news release dated August 8, 2023

3 Meridian Mining News Release of December 5, 2023

4 Meridian Mining news release dated October 23, November 14, and December 5, 2023

5 Meridian Mining News Release of December 5, 2023

6 Meridian Mining news release dated October 23, November 14, and December 5, 2023

Figure 1: Santa Helena Drilling Results.

Drilling continued to test strike extensions east and west from the areas where Meridian had previously had success in testing a gold in soil anomaly, over a position shown on historical BP mapping as a barren post-mineralization gabbro. The extension of a geophysical chargeability anomaly over this area, coupled with the soil anomaly, led Meridian to believe that mineralization extended into this area, beyond the limits of the historical resource envelope. Meridian's initial drilling has confirmed this position as an upward projection of the VMS mineralized horizon (CD-336, CD-340, CD-349, CD-351, CD-359).

New results from this area have been returned from holes CD-360 and CD-416, collared ~60m and 100m east-southeast of CD-359 (36.6m @ 1.3g/t AuEq from 13.0m). Although a gold in soil anomaly was not evident in these newly collared positions, both holes intersected near-surface mineralization, masked by a shallow veneer of transported colluvial overburden. CD-360's upper intersection of 16.4m @ 0.9g/t AuEq from 6.0m commenced with a shallow gold zone (3.0m @ 2.8g/t Au from 6.0m), in the projected up-dip position from the historical resource envelope. CD-360 drilled through a band of gabbro and intersected a second zone of high-grade mineralization, returning 11.0m @ 5.2g/t AuEq from 30.0m, including: 2.4m @ 21.9g/t AuEq from 37.0m, with the richest sulphide band being ~ 50m south of, and at the same elevation as the underground mining galleries. CD-416 intersected the predicted mineralization up-dip from the historical resource, with an interval of 13.2m @ 2.1g/t AuEq from 11.0m. CD-416 was then deepened below the barren gabbro sill and encountered a separate zone of 16.6m @ 2.1g/t AuEq from 41.4m. Further drilling will be undertaken to trace this newly defined mineralized position along and across strike.

Figure 2: Santa Helena's second VMS lens projecting below historical resource.

CD-411 (22.5m @ 1.9g/t AuEq from 11.0m), a step-out hole, a further 50m west-northwest of previously reported CD-351 (11.7m @ 2.0g/t AuEq from 27.0m), intercepted strong mineralization that remains open.

Initial drilling has been undertaken in the eastern up-dip sector of Santa Helena outside of its historical resource envelope. Initial results have included CD-402 (17.0 m @ 0.4 g/t AuEq from 3.0m) and CD-403 (16.5 m @ 0.7g/t AuEq from 1.7m). CD-407 was abandoned after intersecting the old workings and will be redrilled in the future. CD-368, drilled closer to but outside the resource margin, intersected 23.5m @ 0.9 g/t AuEq from 10.1m, including 5.5 m @ 2.2 g/t AuEq from 13.6m.

Promisingly, early drill tests stepping out significantly to the east of the Santa Helena show potential for definition of additional resources. CD-420, drilled 250m east-southeast of the margin of the historical resource, returned 26.9m @ 1.4g/t AuEq from surface. 260m further east-southeast again (510m from the edge of the historical resource) hole CD-431 encountered a sulphide assemblage of sphalerite-pyrite-chalcopyrite-galena from 42.7-43.6m for which assays are pending. Defining the continuity of sulphide mineralization in this position is very encouraging for the prospectivity of the geophysical chargeability anomaly which extends over a 2km strike beyond the limits of the historical resource.

Cabaçal Drill Program Update

Drilling in the Cabaçal mine area continues to deliver robust zones of copper-gold and silver mineralization ("Figure 3") from shallow depths ("Table 1"). We continue to see examples in the drilling of gold only mineralization (CD-365: 6.2m @ 2.5g/t Au from 37.5m), separate to and outside of the copper envelope.

Figure 3: Cabaçal Mine drill results updated.

In cases, this gold only mineralization can be in chloritic alteration intervals with little sulphide content, which may have a subtle geophysical response. This reinforces the exploration potential for the Cabaçal belt to host large gold only deposits related to the late-stage gold event, in addition to targets for gold-base metal mineralization associated with the earlier VMS event.

The company has accumulated a critical mass of drill core to undertake a pilot plant metallurgical test, incorporating sample intervals from the main mine area and the CNWE as part of the program transitioning to a PFS, which will also generate a Cu-Au-Ag concentrate sample for marketing purposes.

The focus of drilling in early 2024 will be directed towards the inferred to unclassified areas of the resource, some of which have been difficult to access with conventional drilling due to topographic constraints. Equipment has been sourced ahead of the shutdown period to facilitate the drilling of low-angle holes to access these areas, which will be used on recommencement of the program from the last week of January.

About Meridian

Meridian Mining UK S is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- Regional scale exploration of the Cabaçal VMS belt; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage gold overprint event has emplaced high-grade gold mineralization.

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold,

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR at.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Ph: +1 778 715-6410 (PST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at SGS laboratory in Belo Horizonte. Samples are dried, crushed with

- Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

- Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

- Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield

Gold equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. AuEq (g/t) = (Au_(g/t) *

The Gradient Array IP survey was conducted using the Company's in-house team, utilizing its GDD GRx8‐16c receiver and 5000W‐2400‐15A transmitter. Data is processed by the Company's independent consultancy Core Geophysics. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person

Mr. Erich Marques, B.Sc., MAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Results Reported

Santa Helena drill results

Hole-ID | Dip | Azi | EOH (m) | Zone | Int (m) | AuEq (g/t) | CuEq (%) | Au (g/t) | Cu (%) | Ag (g/t) | Zn (%) | Pb (%) | From (m) |

CD-420 | -59 | 214 | 60.4 | SHM | |||||||||

26.9 | 1.4 | 0.9 | 0.6 | 0.4 | 16.2 | 0.8 | 0.9 | 0.0 | |||||

CD-416 | -46 | 188 | 87.2 | SHM | |||||||||

13.2 | 2.1 | 1.4 | 1.1 | 0.7 | 9.0 | 0.8 | 0.3 | 11.0 | |||||

Including | 4.7 | 2.7 | 1.8 | 1.5 | 1.2 | 12.9 | 0.2 | 0.1 | 17.4 | ||||

16.6 | 2.1 | 1.4 | 0.7 | 0.6 | 14.7 | 1.7 | 0.4 | 41.4 | |||||

Including | 6.8 | 3.3 | 2.2 | 1.3 | 1.1 | 23.3 | 1.9 | 0.5 | 41.4 | ||||

CD411 | -46 | 187 | 67.0 | CD411 | |||||||||

22.5 | 1.9 | 1.3 | 1.0 | 0.6 | 10.0 | 1.0 | 0.7 | 11.0 | |||||

Including | 6.9 | 3.7 | 2.5 | 2.6 | 1.1 | 17.7 | 1.0 | 1.7 | 11.0 | ||||

CD-407 | -60 | 034 | 14.9 | SHM | Abandoned | ||||||||

CD-403 | -65 | 035 | 40.7 | SHM | |||||||||

16.5 | 0.7 | 0.5 | 0.5 | 0.1 | 5.9 | 0.7 | 0.2 | 1.7 | |||||

Including | 3.2 | 2.0 | 1.3 | 1.9 | 0.1 | 12.4 | 1.3 | 0.1 | 6.0 | ||||

CD-402 | -90 | 000 | 35.0 | SHM | |||||||||

17.0 | 0.4 | 0.2 | 0.1 | 0.1 | 5.8 | 0.5 | 0.2 | 3.0 | |||||

CD-391 | -61 | 214 | 46.9 | SHM | |||||||||

12.5 | 0.9 | 0.6 | 0.2 | 0.3 | 10.5 | 0.8 | 0.2 | 5.0 | |||||

Including | 2.5 | 2.8 | 1.8 | 0.7 | 0.9 | 28.2 | 2.1 | 0.7 | 13.3 | ||||

4.9 | 0.9 | 0.6 | 0.1 | 0.1 | 8.5 | 1.7 | 0.7 | 25.9 | |||||

CD-390 | -50 | 057 | 75.3 | SHM | |||||||||

13.7 | 2.3 | 1.5 | 0.8 | 0.6 | 18.3 | 1.9 | 0.3 | 28.2 | |||||

Including | 3.3 | 8.1 | 5.4 | 2.3 | 2.5 | 69.6 | 6.5 | 0.8 | 38.6 | ||||

7.5 | 0.3 | 0.2 | 0.1 | 0.0 | 4.1 | 0.5 | 0.2 | 46.5 | |||||

CD-383 | -60 | 034 | 65.9 | SHM | |||||||||

5.1 | 0.4 | 0.2 | 0.1 | 0.0 | 1.5 | 0.6 | 0.1 | 30.4 | |||||

12.5 | 0.6 | 0.4 | 0.1 | 0.0 | 4.7 | 1.0 | 0.3 | 43.0 | |||||

CD-368 | -61 | 214 | 51.0 | SHM | |||||||||

23.5 | 0.9 | 0.6 | 0.4 | 0.3 | 8.5 | 0.5 | 0.3 | 10.1 | |||||

Including | 5.5 | 2.2 | 1.5 | 0.9 | 1.0 | 13.6 | 0.5 | 0.4 | 13.6 | ||||

CD-360 | 45 | 187 | 50.0 | SHM | |||||||||

16.4 | 0.9 | 0.6 | 0.6 | 0.3 | 3.6 | 0.4 | 0.3 | 6.0 | |||||

Including | 3.0 | 2.8 | 1.9 | 2.8 | 0.5 | 13.7 | 0.4 | 1.7 | 6.0 | ||||

11.0 | 5.2 | 3.5 | 0.9 | 2.2 | 22.1 | 3.5 | 0.6 | 30.0 | |||||

Including | 2.4 | 21.9 | 14.7 | 3.9 | 9.5 | 89.7 | 14.5 | 2.6 | 37.0 | ||||

Cabaçal drill results

Hole-ID | Dip | Azi | EOH (m) | Zone | Int (m) | AuEq (g/t) | CuEq (%) | Au (g/t) | Cu (%) | Ag (g/t) | From (m) |

CD-401 | -50 | 061 | 40.5 | CWNE | NSI | ||||||

CD-394 | -48 | 061 | 40.0 | CWNE | NSI | ||||||

CD-392 | -50 | 058 | 88.4 | CWNE | |||||||

8.0 | 0.5 | 0.4 | 0.1 | 0.3 | 0.4 | 38.0 | |||||

8.6 | 2.7 | 1.8 | 0.5 | 1.5 | 2.9 | 64.1 | |||||

Including | 2.4 | 6.5 | 4.4 | 1.1 | 3.7 | 6.9 | 70.3 | ||||

CD-389 | -50 | 059 | 37.9 | CWNE | NSI | ||||||

CD-388 | -60 | 043 | 128.0 | SCZ | |||||||

13.0 | 0.3 | 0.2 | 0.0 | 0.2 | 0.4 | 27.0 | |||||

37.5 | 1.0 | 0.7 | 0.8 | 0.2 | 1.1 | 47.0 | |||||

Including | 2.9 | 3.8 | 2.5 | 3.5 | 0.3 | 1.0 | 53.0 | ||||

Including | 5.1 | 2.2 | 1.5 | 1.9 | 0.3 | 1.6 | 66.7 | ||||

CD-387 | -50 | 059 | 109.2 | CWNE | |||||||

3.0 | 0.5 | 0.3 | 0.0 | 0.3 | 0.1 | 46.0 | |||||

8.7 | 0.6 | 0.4 | 0.5 | 0.1 | 0.2 | 68.0 | |||||

4.9 | 2.3 | 1.5 | 0.5 | 1.1 | 11.2 | 84.8 | |||||

Including | 1.2 | 6.4 | 4.3 | 0.7 | 3.6 | 34.8 | 86.4 | ||||

CD-386 | -50 | 061 | 48.7 | CWNE | NSI | ||||||

CD-385 | -60 | 043 | 130.6 | SCZ | |||||||

2.3 | 2.1 | 1.4 | 1.3 | 0.6 | 6.1 | 78.8 | |||||

9.0 | 0.9 | 0.6 | 0.4 | 0.4 | 0.5 | 88.0 | |||||

Including | 5.6 | 1.2 | 0.8 | 0.6 | 0.4 | 0.7 | 88.0 | ||||

8.2 | 0.7 | 0.5 | 0.3 | 0.3 | 0.6 | 109.0 | |||||

CD-384 | -50 | 060 | 90.5 | CWNE | |||||||

3.3 | 0.4 | 0.2 | 0.0 | 0.2 | 0.6 | 27.7 | |||||

16.90.30.20.20.10.757.7 | 16.9 | 0.3 | 0.2 | 0.2 | 0.1 | 0.7 | 57.7 | ||||

CD-381 | -59 | 042 | 60.6 | SCZ | |||||||

2.0 | 0.6 | 0.4 | 0.0 | 0.4 | 1.1 | 5.5 | |||||

5.9 | 0.8 | 0.5 | 0.1 | 0.5 | 1.2 | 23.5 | |||||

4.9 | 0.5 | 0.3 | 0.5 | 0.0 | 0.7 | 34.6 | |||||

5.5 | 1.6 | 1.1 | 0.5 | 0.8 | 3.4 | 46.0 | |||||

Including | 3.0 | 2.7 | 1.8 | 0.7 | 1.4 | 5.6 | 53.5 | ||||

CD-380 | -50 | 062 | 50.7 | CWNE | NSI | ||||||

CD-377 | -60 | 041 | 100.3 | CCZ | |||||||

9.6 | 0.8 | 0.6 | 0.1 | 0.5 | 1.8 | 15.7 | |||||

Including | 2.2 | 2.1 | 1.4 | 0.4 | 1.2 | 4.3 | 22.0 | ||||

49.7 | 0.4 | 0.2 | 0.2 | 0.2 | 0.4 | 33.0 | |||||

CD-376 | -50 | 058 | 67.4 | CWNE | |||||||

11.9 | 0.6 | 0.4 | 0.2 | 0.3 | 4.4 | 19.5 | |||||

3.7 | 0.3 | 0.2 | 0.1 | 0.1 | 3.4 | 38.8 |

Hole-ID | Dip | Azi | EOH (m) | Zone | Int (m) | AuEq (g/t) | CuEq (%) | Au (g/t) | Cu (%) | Ag (g/t) | From (m) |

CD-374 | -65 | 058 | 97.6 | CCZ | |||||||

2.3 | 0.6 | 0.4 | 0.0 | 0.4 | 1.6 | 15.0 | |||||

6.6 | 0.4 | 0.3 | 0.4 | 0.1 | 0.2 | 28.5 | |||||

10.0 | 0.7 | 0.5 | 0.5 | 0.2 | 0.1 | 42.6 | |||||

18.7 | 0.4 | 0.3 | 0.1 | 0.2 | 0.5 | 58.5 | |||||

CD-373 | -49 | 056 | 53.3 | CWNE | NSI | ||||||

CD-371 | -56 | 060 | 62.7 | CWNE | NSI | ||||||

CD-370 | -57 | 041 | 105.4 | SCZ | |||||||

3.6 | 0.4 | 0.3 | 0.0 | 0.3 | 0.5 | 15.9 | |||||

3.8 | 1.4 | 0.9 | 0.1 | 0.9 | 1.5 | 34.1 | |||||

24.2 | 0.9 | 0.6 | 0.3 | 0.5 | 2.2 | 65.6 | |||||

Including | 3.9 | 2.3 | 1.6 | 0.3 | 1.3 | 8.0 | 85.9 | ||||

CD-369 | -52 | 058 | 148.0 | CWNE | |||||||

14.2 | 0.4 | 0.2 | 0.1 | 0.2 | 0.7 | 20.9 | |||||

15.7 | 1.6 | 1.1 | 0.4 | 0.8 | 3.0 | 82.6 | |||||

Including | 5.5 | 2.8 | 1.9 | 0.5 | 1.6 | 4.6 | 83.0 | ||||

12.5 | 0.7 | 0.5 | 0.2 | 0.4 | 1.6 | 104.9 | |||||

CD-367 | -50 | 056 | 120.2 | CWNE | |||||||

3.0 | 0.4 | 0.3 | 0.0 | 0.3 | 0.3 | 55.0 | |||||

4.3 | 0.3 | 0.2 | 0.0 | 0.2 | 0.2 | 68.7 | |||||

1.1 | 2.6 | 1.7 | 2.3 | 0.3 | 1.1 | 82.4 | |||||

7.8 | 0.6 | 0.4 | 0.2 | 0.3 | 1.2 | 93.2 | |||||

CD-366 | -50 | 057 | 82.5 | CWNE | |||||||

3.7 | 0.6 | 0.4 | 0.0 | 0.4 | 0.4 | 33.7 | |||||

CD-365 | -62 | 060 | 96.3 | CCZ | |||||||

50.5 | 1.0 | 0.7 | 0.7 | 0.3 | 1.1 | 19.8 | |||||

Including | 6.2 | 2.4 | 1.6 | 2.5 | 0.0 | 0.2 | 37.5 | ||||

Including | 7.1 | 2.8 | 1.9 | 1.3 | 1.0 | 5.6 | 67.9 | ||||

4.8 | 1.0 | 0.6 | 0.8 | 0.2 | 0.6 | 79.7 | |||||

CD-364 | -50 | 057 | 135.9 | CWNE | |||||||

20.1 | 0.7 | 0.5 | 0.1 | 0.5 | 0.8 | 13.2 | |||||

8.2 | 0.8 | 0.5 | 0.7 | 0.2 | 0.5 | 55.6 | |||||

Including | 3.8 | 1.4 | 0.9 | 1.2 | 0.2 | 0.7 | 56.2 | ||||

15.6 | 0.4 | 0.3 | 0.1 | 0.2 | 0.6 | 86.0 | |||||

11.9 | 1.3 | 0.9 | 0.2 | 0.7 | 4.0 | 110.5 | |||||

Including | 2.5 | 4.0 | 2.7 | 0.7 | 2.2 | 11.4 | 114.3 | ||||

CD-363 | -50 | 057 | 118.2 | CWNE | |||||||

26.2 | 0.5 | 0.3 | 0.1 | 0.3 | 0.5 | 44.3 | |||||

Including | 1.6 | 2.2 | 1.5 | 0.1 | 1.5 | 2.6 | 48.6 | ||||

13.7 | 0.5 | 0.3 | 0.2 | 0.2 | 0.6 | 86.4 | |||||

Including | 1.6 | 2.1 | 1.4 | 0.8 | 1.0 | 2.2 | 93.0 | ||||

Hole-ID | Dip | Azi | EOH (m) | Zone | Int (m) | AuEq (g/t) | CuEq (%) | Au (g/t) | Cu (%) | Ag (g/t) | From (m) |

CD-362 | -51 | 063 | 99.9 | CNWE | |||||||

1.1 | 0.5 | 0.3 | 0.4 | 0.1 | 0.4 | 46.3 | |||||

8.0 | 0.4 | 0.2 | 0.1 | 0.2 | 0.6 | 52.2 | |||||

CD-358 | -50 | 057 | 100.4 | CWNE | |||||||

8.5 | 0.4 | 0.3 | 0.0 | 0.3 | 0.2 | 42.1 | |||||

CD-357 | -49 | 057 | 105.4 | CWNE | |||||||

1.8 | 0.4 | 0.2 | 0.0 | 0.2 | 0.9 | 46.3 | |||||

CD-356 | -60 | 043 | 109.5 | SCZ | |||||||

2.2 | 0.4 | 0.3 | 0.1 | 0.3 | 1.1 | 46.4 | |||||

21.5 | 1.9 | 1.3 | 1.8 | 0.1 | 0.4 | 59.3 | |||||

Including | 7.0 | 4.7 | 3.1 | 4.6 | 0.1 | 0.5 | 59.3 | ||||

2.5 | 1.3 | 0.8 | 0.3 | 0.7 | 2.5 | 98.1 | |||||

CD-355 | -50 | 057 | 95.0 | CWNE | |||||||

12.0 | 0.3 | 0.2 | 0.0 | 0.2 | 0.2 | 37.0 | |||||

8.7 | 2.8 | 1.9 | 0.9 | 1.4 | 4.0 | 72.9 | |||||

Including | 3.7 | 5.2 | 3.5 | 1.5 | 2.5 | 7.7 | 72.9 | ||||

CD-354 | -57 | 042 | 104.6 | SCZ | |||||||

5.2 | 0.5 | 0.4 | 0.0 | 0.3 | 2.4 | 12.1 | |||||

38.3 | 0.6 | 0.4 | 0.3 | 0.2 | 0.9 | 52.3 |

SOURCE: Meridian Mining UK S

View the original press release on accesswire.com

FAQ

What is the latest development at the Santa Helena mine for Meridian Mining (TSX:MNO)?

What is the focus of the Cabaçal Project's work programs for Meridian Mining (TSX:MNO)?

What has been the impact of the drilling at Santa Helena on the VMS mine sequence?

What is the current focus of Meridian Mining (TSX:MNO) in South America?